Is It a Good Idea to Invest in Klarna Stock Before Year-End?

Klarna's Growth and Popularity: The Klarna Card has gained significant traction since its U.S. launch, achieving over 4 million sign-ups within four months and contributing to a 51% increase in U.S. revenue for the company.

Market Performance and Investor Outlook: Despite a decline in stock value since its IPO, Klarna is viewed as a promising growth stock, with expectations to exceed $1 billion in fourth-quarter revenue due to its expanding user base and merchant partnerships.

Sustainability Concerns in BNPL: Critics argue that the buy now, pay later (BNPL) model may lead to financial strain for consumers, but Klarna reports a 99% repayment rate, suggesting that the model is currently sustainable.

Future Growth Potential: With 114 million global active users and a growing number of merchants accepting Klarna, the company is well-positioned for continued growth, especially as it aims to attract more customers in the coming years.

Trade with 70% Backtested Accuracy

Analyst Views on SEZL

About SEZL

About the author

- Robinhood Financial Growth: In Q3 2025, Robinhood's total revenue doubled year-over-year, with transaction revenue soaring by 129%, reflecting strong market demand and profitability, particularly driven by cryptocurrencies, positioning the company for sustained future growth.

- New Opportunity in Prediction Markets: The prediction market launched by Robinhood in March 2025 saw significant revenue growth in Q3, especially with the introduction of professional and college football contracts, leading to October's revenue surpassing that of the entire third quarter, showcasing robust market potential.

- Sezzle's Strong Growth: Sezzle reported a 67% year-over-year revenue increase and a 72.7% rise in net income in Q3 2025, solidifying its leadership in the buy now, pay later sector, despite its stock price being down over 60% from its all-time high, its strong financial performance continues to attract customers.

- Customer Base Expansion: Sezzle ended Q3 2025 with 2.97 million customers, an 11.4% year-over-year increase, indicating a sustained demand for installment payments amid economic pressures, which may allow it to continue outperforming the S&P 500.

- Analyst Rating Changes: Top Wall Street analysts have adjusted their ratings on several stocks, including upgrades, downgrades, and initiations, reflecting varying market perspectives on these companies.

- Market Impact: While specific stocks are not detailed, such rating changes typically influence investor decisions, thereby directly impacting the stock prices of the companies involved.

- Source of Updates: A complete view of all analyst rating changes can be found on our analyst ratings page, offering a comprehensive understanding of market dynamics.

- Lack of Investment Advice: Although the report provides information on rating changes, it does not offer specific investment advice, leaving investors to make their own judgments.

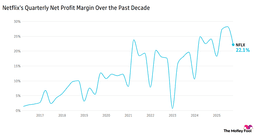

- Acquisition Dynamics: Netflix is reportedly considering an all-cash bid for Warner Bros. Discovery, although the board's resistance to Paramount's offer complicates negotiations, potentially impacting Netflix's market position.

- Market Reaction: Warner Bros. Discovery's spin-off, Versant, has a market cap of $4.8 billion post-IPO, with shares dropping from $45 to $33, indicating market concerns about its future value, which may influence Netflix's acquisition strategy.

- Financial Risks: Netflix's acquisition approach could involve up to $60 billion in debt, and while it generates $7-8 billion in free cash flow annually, high leverage may restrict future investment flexibility and affect shareholder confidence.

- Competitive Pressure: Amid intensifying competition in the streaming industry, Netflix faces threats from platforms like YouTube; if the acquisition fails, it could weaken its market share and growth potential.

- Acquisition Dynamics: Netflix is considering switching its bid for Warner Bros to an all-cash offer, a strategy that could expedite the deal but also increases financial leverage risks, impacting future investment flexibility.

- Market Reaction: Versant's market cap has dropped to $4.8 billion, with shares falling from $45 to $33, indicating market concerns about its future value, which may influence Netflix's acquisition decisions.

- Competitive Pressure: Paramount is attempting to outbid for Warner Bros, but Netflix, as a more established competitor, may gain the board's favor due to its stable financial position, despite execution risks.

- Industry Outlook: Analysts suggest that Netflix's acquisition could be a defensive move to counter emerging competitors like YouTube, although this may lead to short-term financial strain.

- Market Leader: Crypto investment firm Galaxy Digital (GLXY) surged 38% in the week ending January 16, 2026, becoming the top gainer among financial stocks with a market cap over $2 billion, indicating strong market interest and a recovery in investor confidence in crypto assets.

- Earnings Expectations: Figure Technology Solutions (FIGR) jumped 27% after posting preliminary Q4 numbers this week, reflecting positive market expectations for its performance, which could drive future growth and investment appeal for the company.

- Bitcoin Impact: With Bitcoin (BTC-USD) logging a solid weekly rise, both IREN (IREN) and Riot Platforms (RIOT) gained 26%, suggesting that the rebound in the cryptocurrency market positively influenced the stock prices of related companies, potentially attracting more investor attention.

- Market Volatility: In this week's market, Sezzle (SEZL) slid 11% and Slide Insurance Holdings (SLDE) fell 10%, highlighting the volatility within the financial sector, prompting investors to exercise caution in response to potential risks.

- Acquisition Intent Upgrade: Netflix is considering transforming its acquisition proposal for Warner Bros into an all-cash offer, reflecting its proactive stance in the acquisition market, especially after Warner rejected a hostile bid from Paramount.

- Strong Financing Capability: With a robust financial position, Netflix has secured $59 billion in loans, indicating ample funding support for large-scale acquisitions, thereby enhancing its competitive edge in the market.

- Market Reaction: Since Warner indicated openness to bids last October, Netflix's stock has dropped 25%, reflecting market concerns about its acquisition capabilities, which may also impact future shareholder confidence.

- Legal Challenges Intensify: Paramount's CEO has launched a lawsuit against Warner's rejection, complicating acquisition negotiations and potentially exposing Netflix to additional legal and market challenges during the acquisition process.