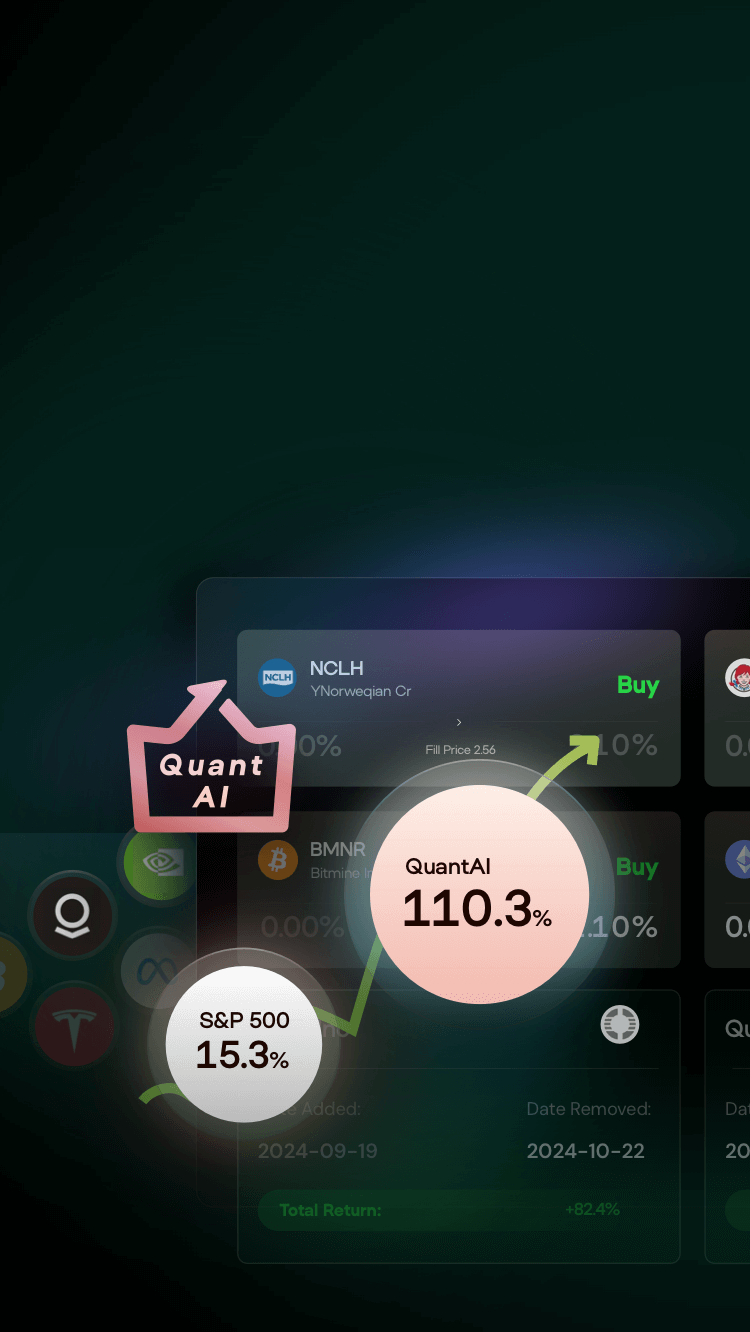

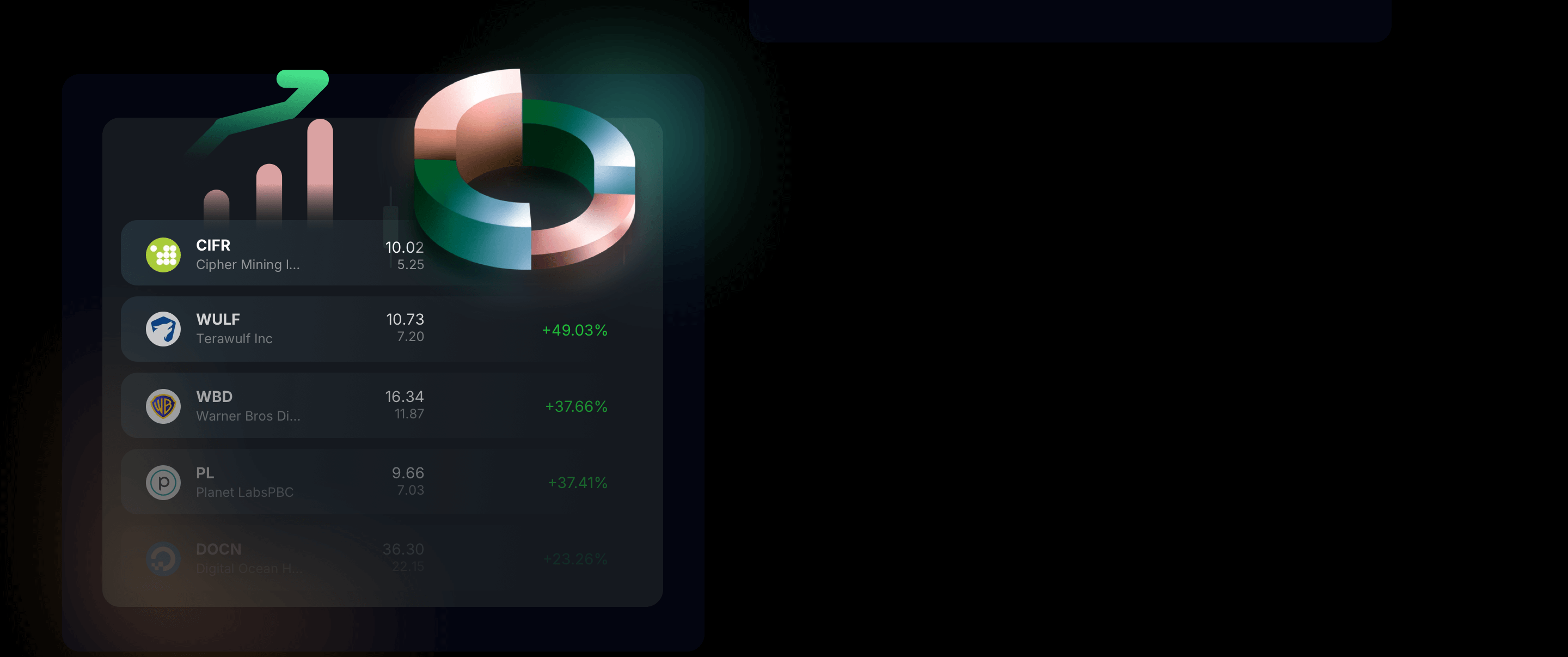

Quant AI Alpha Pick

Build Wealth with AI-Driven, Mid-Term Precision Investing. Activate AutoTrade to seamlessly mirror institutional-grade Alpha picks with automated position sizing and risk management.

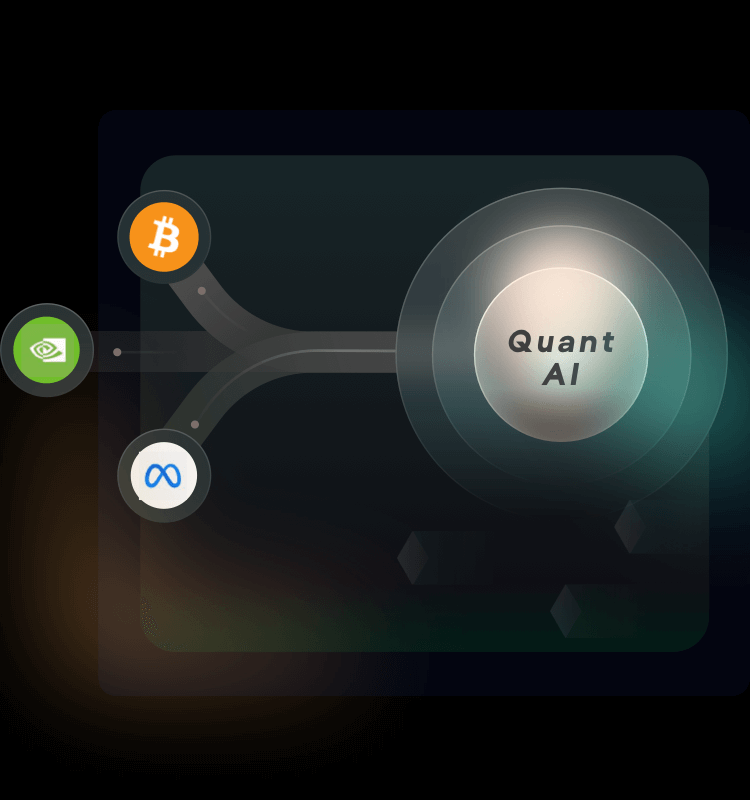

Backed By Leading Global Technology Powerhouses

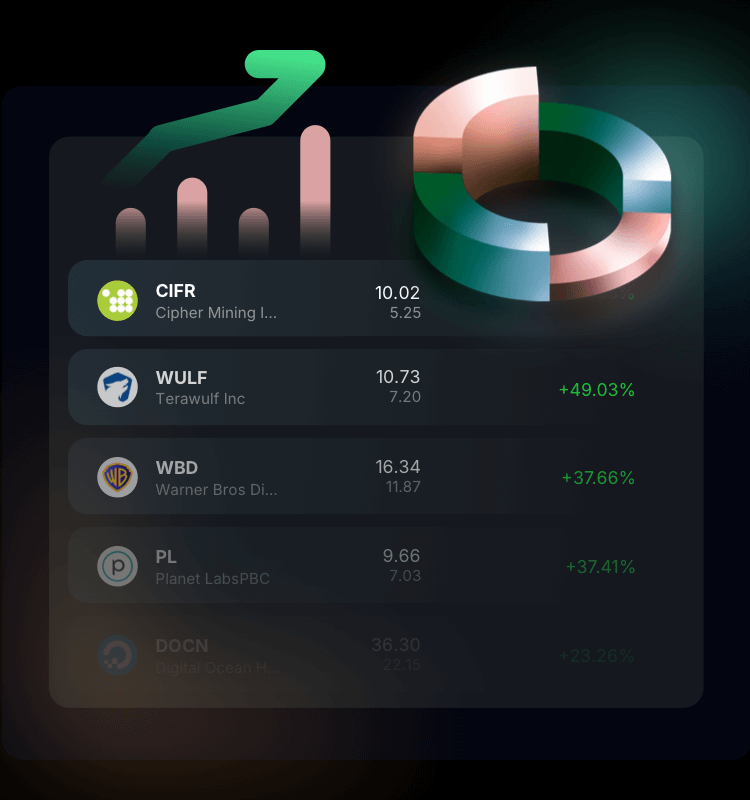

Maximize Your Wealth Creation with QuantAI Portfolio

For investors seeking stable, high returns over the medium term, constructing a diversified portfolio that balances risk and reward can be daunting. Traditional approaches often rely on static models or emotional decisions, leading to inconsistent results. QuantAI Portfolio revolutionizes investing by delivering a dynamic, AI-driven portfolio of 30–50 stocks, optimized for mid-term holding (approximately one month) with low turnover. Designed for investors with substantial capital (recommended $10,000+), this solution leverages advanced machine learning and quantitative modeling to ensure steady returns with robust risk management. Invest smarter, scale confidently, and achieve consistent growth.

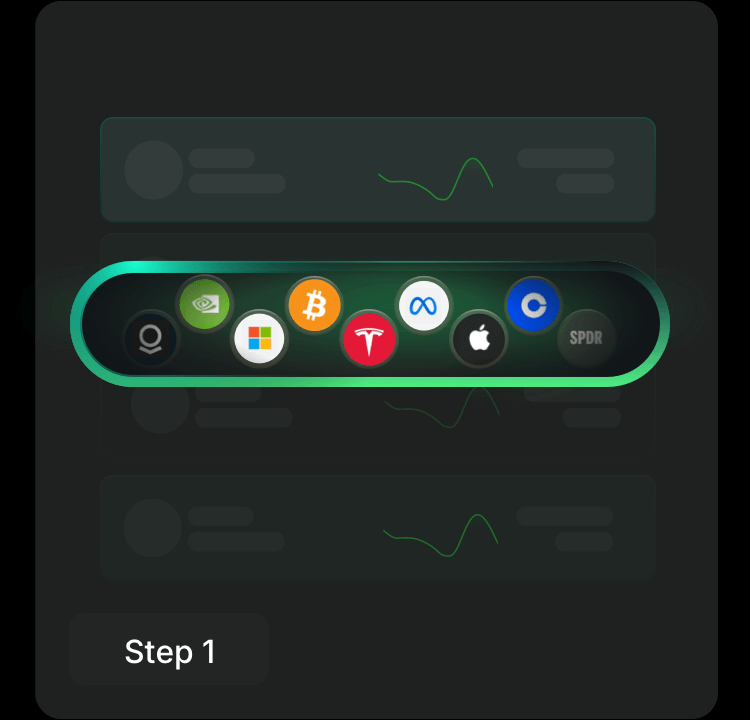

How to Use QuantAI Portfolio

Check The Latest Trade

Monitor recent trading activity to stay informed about the portfolio's performance.Navigate to the "Latest Trades", and review details like trade type, asset, price, and date. This helps you assess market trends and align your strategy with real-time data.

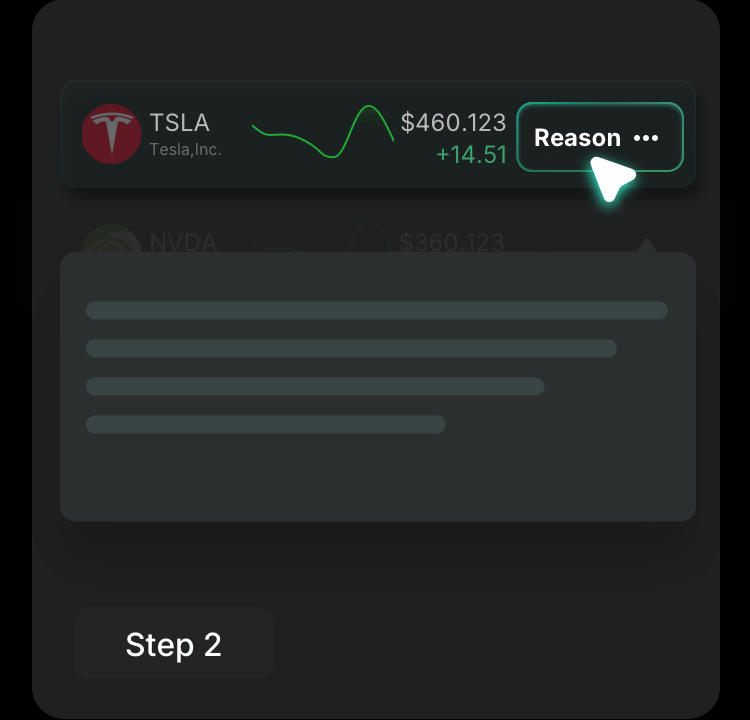

Review The Holdings

Dive into the transparent rationale behind each stock selection, powered by AI-optimized factors like price momentum, fundamental strength, market sentiment, and proprietary risk signals.

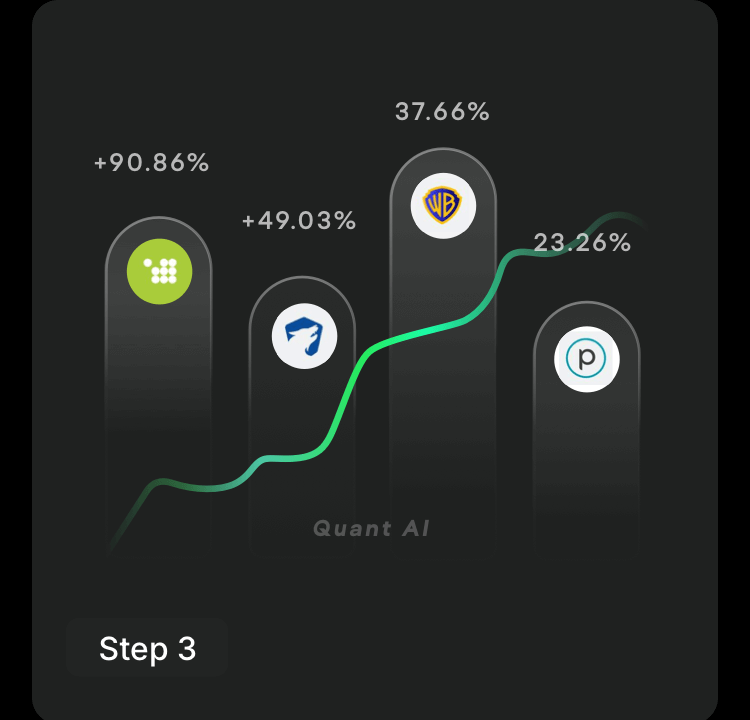

Invest and Grow

Deploy your capital into a high-capacity, diversified portfolio with automated rebalancing and intelligent risk controls. Watch your wealth grow steadily with a strategy built for consistent returns.

Use Case

Earnings Traders

Ride the earnings wave with precision

Earnings traders use AI Earnings Prediction to anticipate stock price jumps or drops post-earnings, enabling confident trades with options or equities based on data-driven Beat or Miss forecasts.

Long-Term Investors

Get actionable insights for future-proof investments

Long-term investors use the Financial AI Agent to assess long-term growth potential, track market trends, and identify stable investment opportunities for a diversified portfolio.

Hedge Fund Analysts

Enhance analysis with AI precision

Analysts use AI Earnings Prediction to complement their research, quickly identifying key drivers and probabilities to refine strategies for earnings-driven trades.

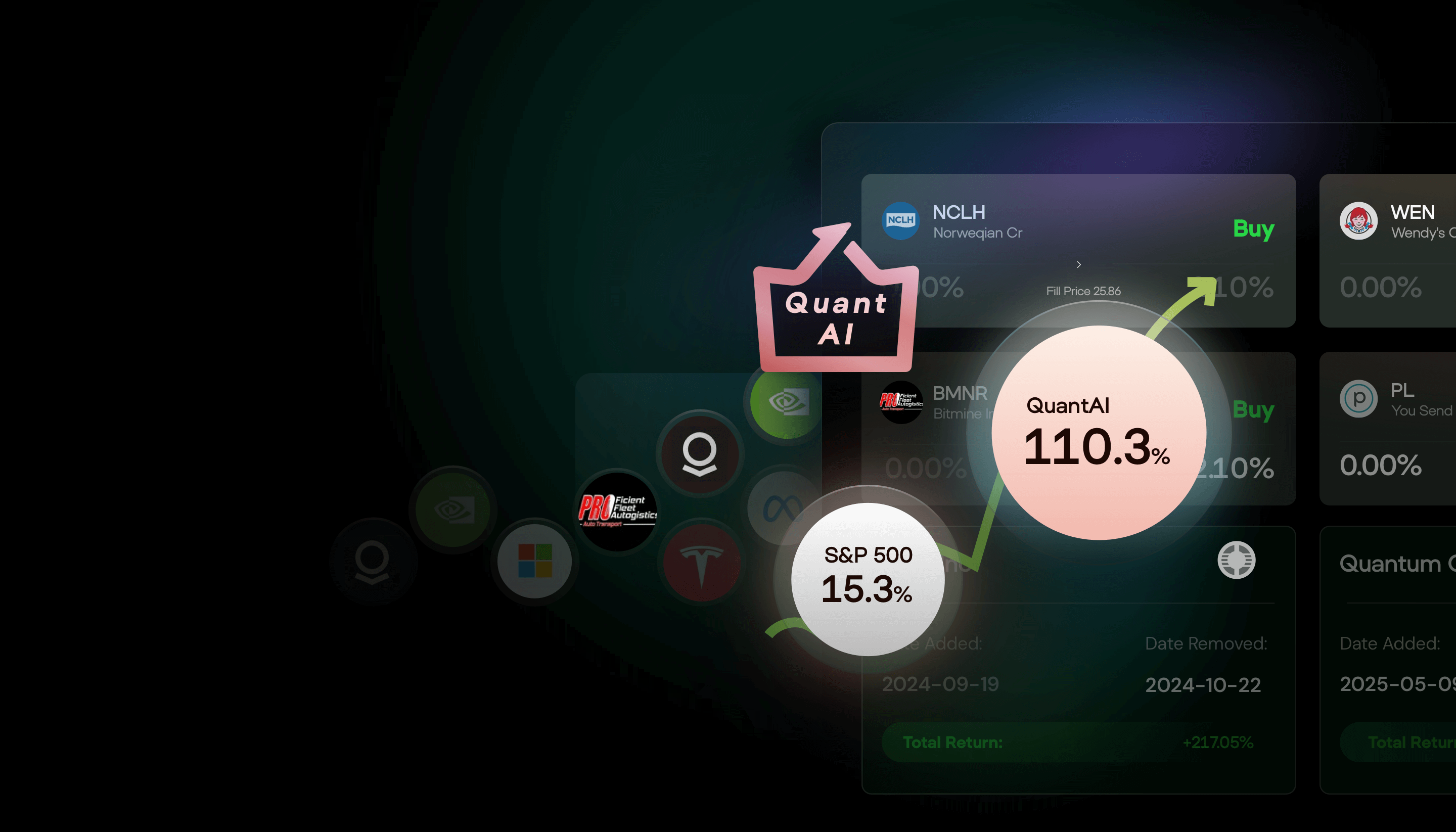

Why QuantAI Portfolio Stands Out

The Hands-Free Path to Alpha

Quant AI Alpha Pick uses institutional modeling to find mid-term winners with surgical precision. By syncing with AutoTrade, you transform these high-conviction insights into a hands-free growth engine. We handle the complex math and re-weighting, while you enjoy the results of systematic, AI-powered wealth building.

Try Now

Try NowRobust Risk Management

QuantAI Portfolio's AI-powered risk system analyzes market signals and sentiment, automatically adjusting exposure or shifting to cash during volatile periods to safeguard your capital from significant drawdowns.

Try Now

Try NowBuilt for Scale

Designed for investors with $10,000+ in capital, QuantAI Portfolio's diversified holdings (30–50 stocks) ensure high capacity and liquidity, delivering steady returns with reduced volatility through broad diversification.

Try Now

Try NowCutting-Edge AI Technology

Powered by intellectia's proprietary blend of reinforcement learning, generative adversarial networks, and quantum-inspired optimization, QuantAI Portfolio continuously refines its models to identify high-potential stocks while adapting to evolving market conditions.

Try Now

Try NowWhat Our Users Say

Why Choose Us

Frequently Asked Questions

Is the QuantAI Alpha Pick feature included in my current plan (Basic, Pro, Max, or Expert)?

No, the QuantAI Alpha Pick feature is not part of our standard Basic, Pro, Max, or Expert subscription plans. It is exclusively available as a premium add-on through the separate QuantAI Bundle. This allows users of any plan tier to purchase this advanced feature according to their specific needs.

What is QuantAI Portfolio, and how does it work?

QuantAI Portfolio is an AI-driven investment solution that curates a diversified portfolio of 30–50 stocks, optimized for mid-term holding (approximately one month) with low turnover. Using advanced machine learning and quantitative modeling, it dynamically selects and rebalances stocks based on multi-dimensional scoring, including price momentum, fundamental strength, and market sentiment, to maximize returns while managing risk.

Who is QuantAI Portfolio designed for?

QuantAI Portfolio is ideal for investors with at least $10,000 in capital, seeking steady, mid-term growth with low turnover. It suits both automated trading enthusiasts who prefer a hands-off approach and manual copy traders who want transparent, AI-driven stock picks to follow confidently.

Why is a minimum of $10,000 recommended?

The portfolio holds 30–50 stocks to ensure diversification and stability, with each position weighted at 2%–3%. A minimum of $10,000 is recommended to effectively allocate capital across this number of holdings, enabling proper diversification and risk management.

How does QuantAI Portfolio manage risk?

QuantAI Portfolio uses an AI-powered risk management system that analyzes market signals and sentiment. During periods of high volatility or anticipated market corrections, it can automatically shift to a full cash position to protect your capital from significant drawdowns.

How often is the portfolio rebalanced?

The portfolio is dynamically rebalanced as needed, based on AI-driven scoring and market conditions. However, its low-turnover strategy ensures minimal churn, with stocks typically held for around one month to maintain stability and reduce trading costs.

Can I use QuantAI Portfolio for manual trading?

Yes, QuantAI Portfolio is perfect for manual copy trading. It provides transparent insights into the rationale behind each stock selection, empowering you to make informed decisions while following the AI's diversified, low-turnover strategy.

QuantAI Portfolio has transformed my approach to mid-term investing. The diversified portfolio of 30–50 stocks gives me confidence in its stability, and the low turnover saves me from constant rebalancing. With my $15,000 portfolio, I've seen consistent returns without the stress of high-frequency trading. The AI-driven insights are clear and make it easy to understand why each stock is chosen. Highly recommend for anyone with a decent capital base looking for steady growth!

Michael Chen

Mid-Term Investor