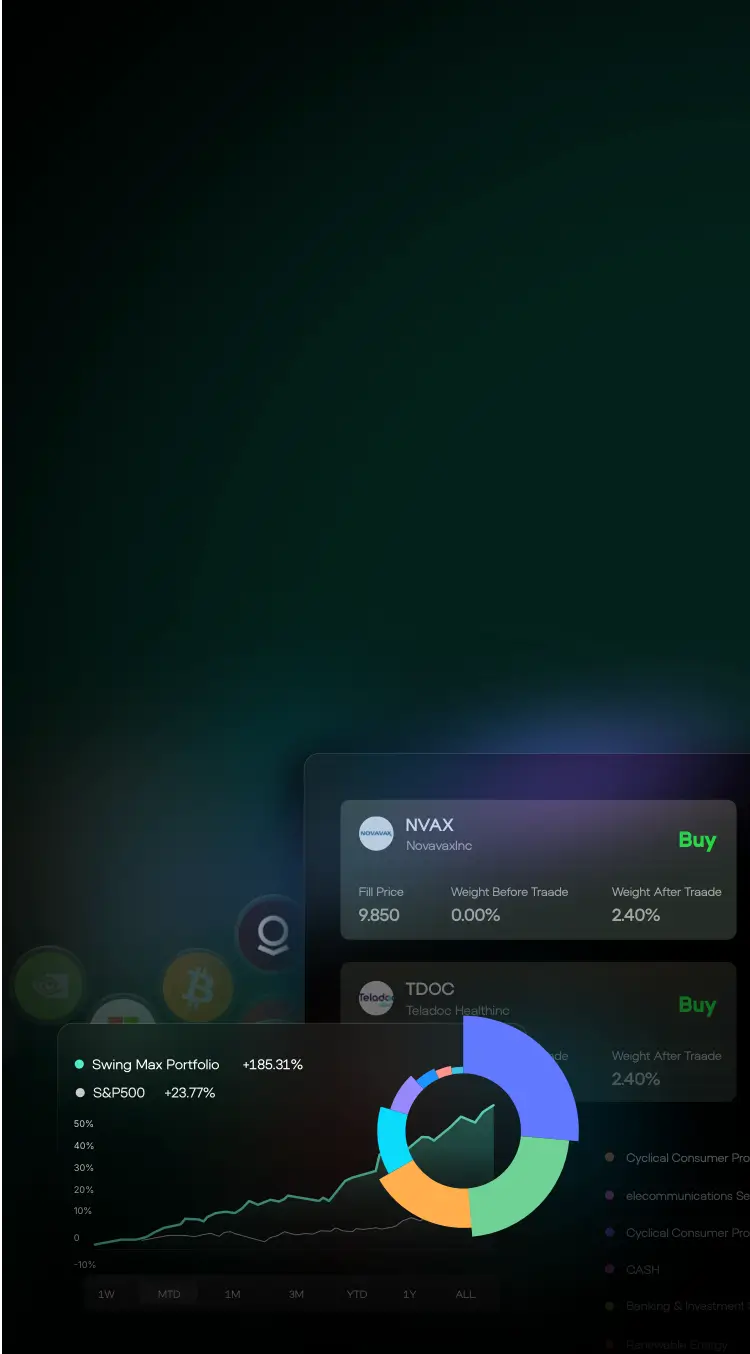

SwingMax Portfolio Copy Trade

Automatically mirror our top-performing AI swing portfolio with one click. We curate high-win-rate signals into a diversified, risk-managed bucket to capture steady mid-term growth with zero manual effort.

Backed By Leading Global Technology Powerhouses

Too many signals. Too many decisions

SwingMax Signal generates dozens of swing trading signals every trading day. While this depth gives traders flexibility, it often creates friction for beginner and intermediate investors. Faced with too many valid setups at once, users struggle to decide which signals truly matter, spread capital across too many positions, and end up overtrading without a clear sense of priority. SwingMax Portfolio is designed to remove this complexity by transforming signal abundance into a structured portfolio, allowing investors to focus on execution rather than constant decision making.

How to Use SwingMax Portfolio Copy

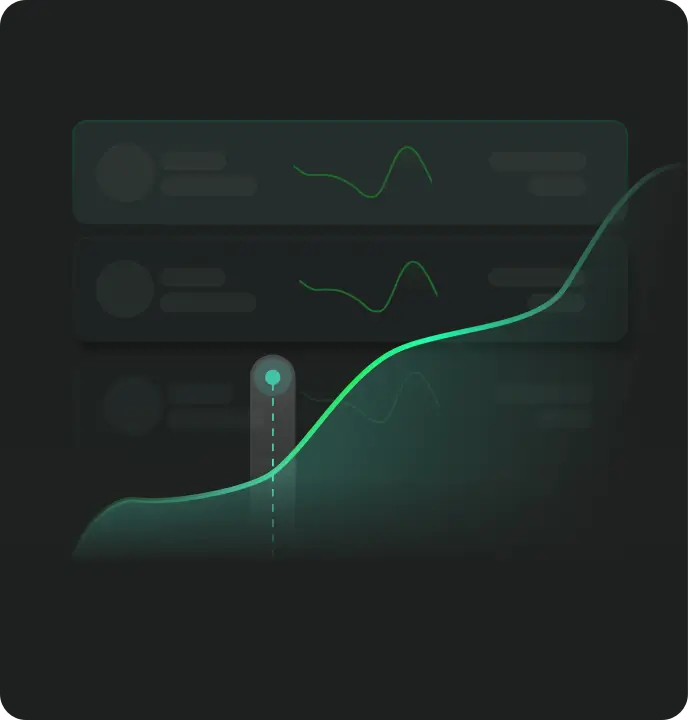

AI Curates the Portfolio

SwingMax Portfolio begins with the full universe of daily SwingMax signals. AI agents evaluate each signal across technical strength, fundamental stability, and portfolio fit, selecting only the highest conviction opportunities.

Clear, Unambiguous Actions

The portfolio maintains up to five active positions. When a stock enters the portfolio, it represents a clear buy decision. When it exits, the action is equally explicit, removing any manual hesitation or need for signal comparison.

Activate Portfolio Auto-Trade

Toggle the "Auto-Trade" switch to mirror the entire curated portfolio in your own account. The AI handles position sizing, risk management, and rebalancing automatically, keeping your capital focused on the top 5 high-conviction trades.

Use Case

Beginner Swing Traders

Start swing trading without signal overload

Beginner swing traders use SwingMax Portfolio to avoid choosing from dozens of daily signals. The portfolio condenses high quality opportunities into a small, easy to follow set of positions with clear buy and sell actions.

Structured Investors

Trade with discipline instead of constant decisions

Structured investors rely on SwingMax Portfolio to enforce focus through position limits and portfolio level selection. With up to five holdings at a time, the system reduces overtrading and helps maintain consistent execution.

Consistency Seekers

Follow a repeatable process, not every setup

Consistency focused investors use SwingMax Portfolio to prioritize signal quality over activity. By filtering signals through AI driven due diligence and portfolio rules, the portfolio supports steady, repeatable decision making across market conditions.

Why SwingMax Portfolio Stands Out

Institutional Discipline, Fully Automated

Managing a multi-signal portfolio manually is a full-time job. SwingMax Portfolio does the heavy lifting by filtering daily noise into a high-conviction strategy, and AutoTrade brings it to life.

Try Now

Try NowData Backed Signal Filtering

Every position in SwingMax Portfolio passes multiple AI driven checks, including fundamental due diligence, liquidity screening, and historical validation. Only signals with proven performance characteristics are eligible for inclusion.

Try Now

Try NowFocused Portfolio Design

SwingMax Portfolio maintains a maximum of five active positions to keep capital concentrated and decisions simple. Historical backtests show over 70% cumulative returns with 75%+ win rate under simulated conditions.

Try Now

Try NowWhat Our Users Say

Why Choose Us

Frequently Asked Questions

How is SwingMax Portfolio different from manually following SwingMax signals?

SwingMax signals focus on identifying individual trade opportunities, while SwingMax Portfolio focuses on decision reduction at the portfolio level.

Instead of asking users to evaluate dozens of signals, the portfolio applies additional AI filtering, prioritization, and position limits to create a single, coherent set of trades. The goal is not more activity, but better selection and consistency.

How does the portfolio decide which signals are excluded?

Signals are excluded when they fail to meet portfolio-level criteria, even if they are technically valid on their own. These criteria include:

- Relative signal strength versus other candidates on the same day

- Fundamental risk factors that increase downside asymmetry

- Liquidity constraints that could affect real execution

- Overlap with existing portfolio exposure

This means some valid signals are intentionally ignored to protect overall portfolio quality.

Why is the portfolio limited to five positions?

The position cap is a design choice, not a technical limitation.

Backtesting shows that beyond a small number of positions, incremental diversification often reduces clarity without meaningfully improving outcomes for swing trading timeframes. Limiting holdings helps users stay focused, manage capital more effectively, and avoid signal dilution.

Does SwingMax Portfolio rebalance or rotate positions automatically?

Yes, but only when signal conditions materially change.

Positions are added or removed based on signal status updates rather than fixed schedules. This avoids unnecessary turnover and keeps the portfolio aligned with current market conditions.

Can I use SwingMax Portfolio alongside my own discretionary trades?

Yes, but it works best when followed as a standalone system.

Mixing discretionary trades with portfolio positions can dilute performance tracking and reintroduce emotional decision making. Many users choose to allocate a specific portion of capital exclusively to SwingMax Portfolio for clarity.

I used to scroll through SwingMax signals and freeze. Too many options. The portfolio solved that for me. Now I just follow what’s inside and ignore the rest. My trades feel calmer and more consistent.

Daniel Roberts

Retail Swing Trader