Option Profit Calculator

Options Type

Share Price

Option Price

Strike Price

Number of Contracts

Each contract is 100 shares.

Options Profit or Losses

# of Shares Shares = Contracts X 100

Share Price

X

# of Shares

Value

Strike Price

X

# of Shares

Execution

Options Price

X

# of Shares

Cost

Options profit is calculated by subtracting the strike price and option price from the current share price and multiplying by the number of contracts (100 shares).

3 Easy Steps to

Calculate Option Profit

Try 7 Days NowInterested in High Dividend Stocks?

Try These Prompts

Explore Intellectia's AI-powered prompts to uncover the most promising high-yield opportunities. Let advanced technology guide you to the best dividend stocks with strong potential for growth and returns.

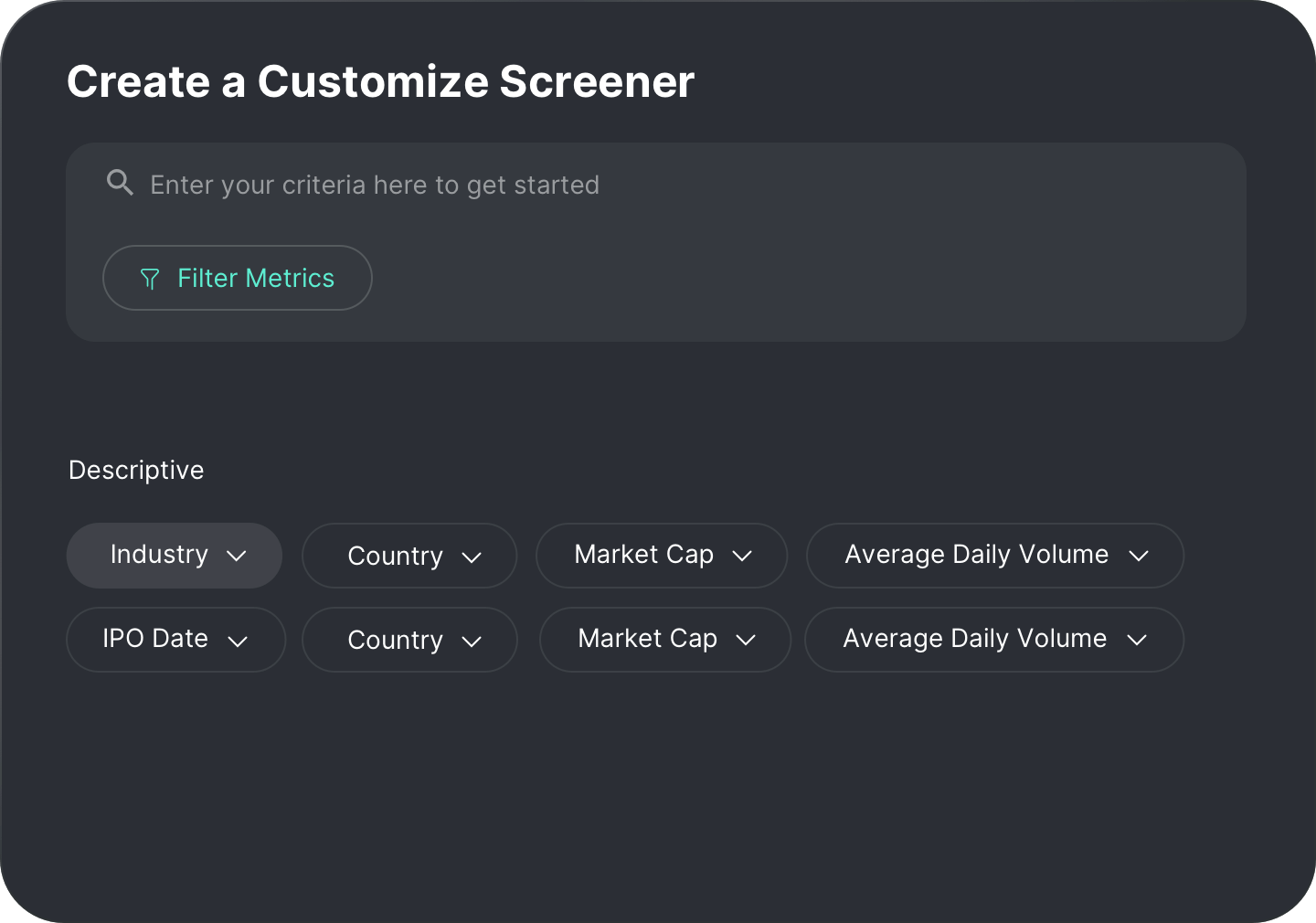

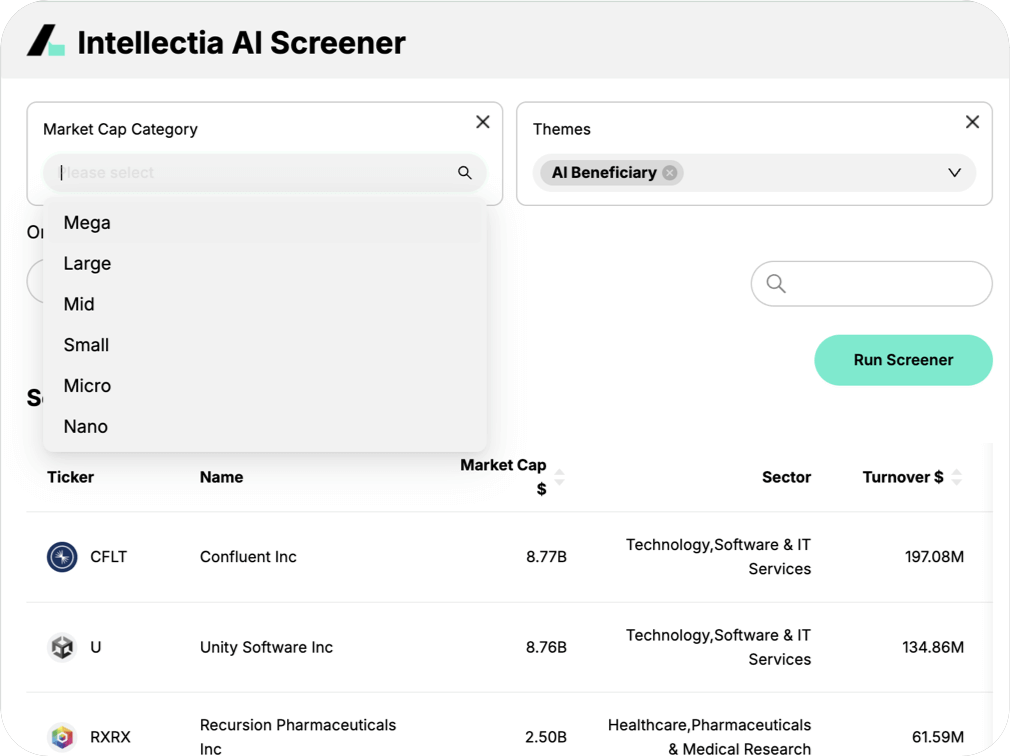

AI Dividend Stock Screener

Intellectia AI Stock Screener, featuring over 200 customizable screening criteria. Whether you're searching for high dividend yields, low valuations, or high-growth opportunities, our intelligent tool dynamically filters stocks based on your specific queries or manually selected preferences.