Hedge Fund Tracker

Provide key insights into fund managers by analyzing detailed data on their portfolio holdings, trading activities, and performance metrics.

Backed By Leading Global Technology Powerhouses

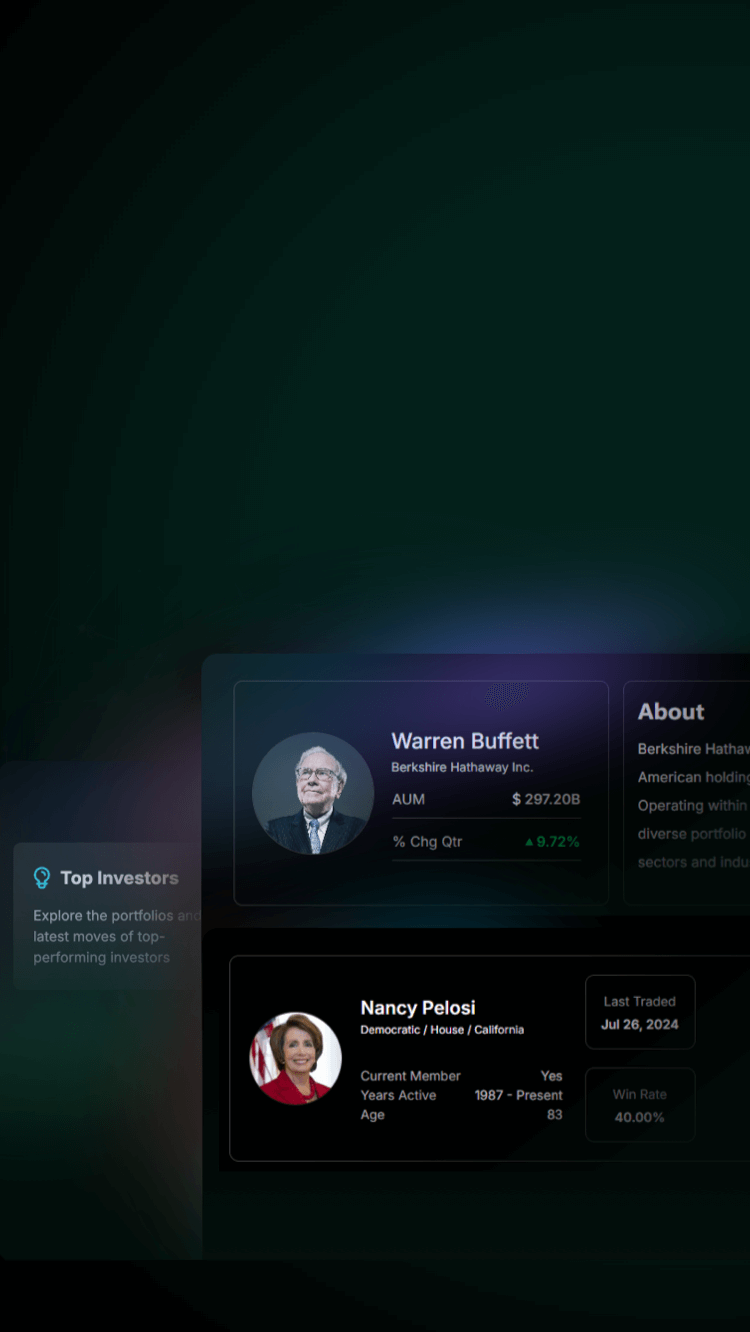

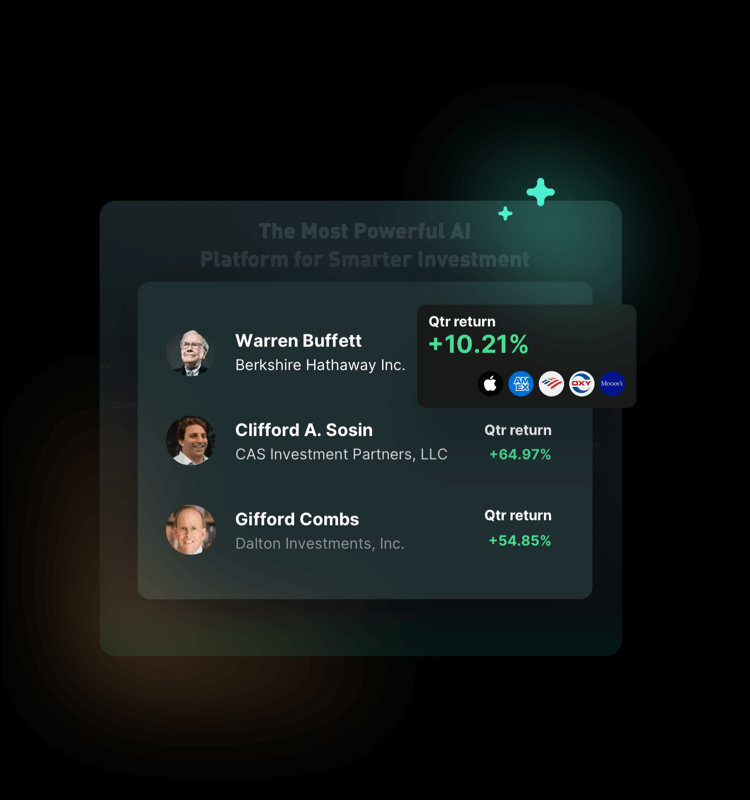

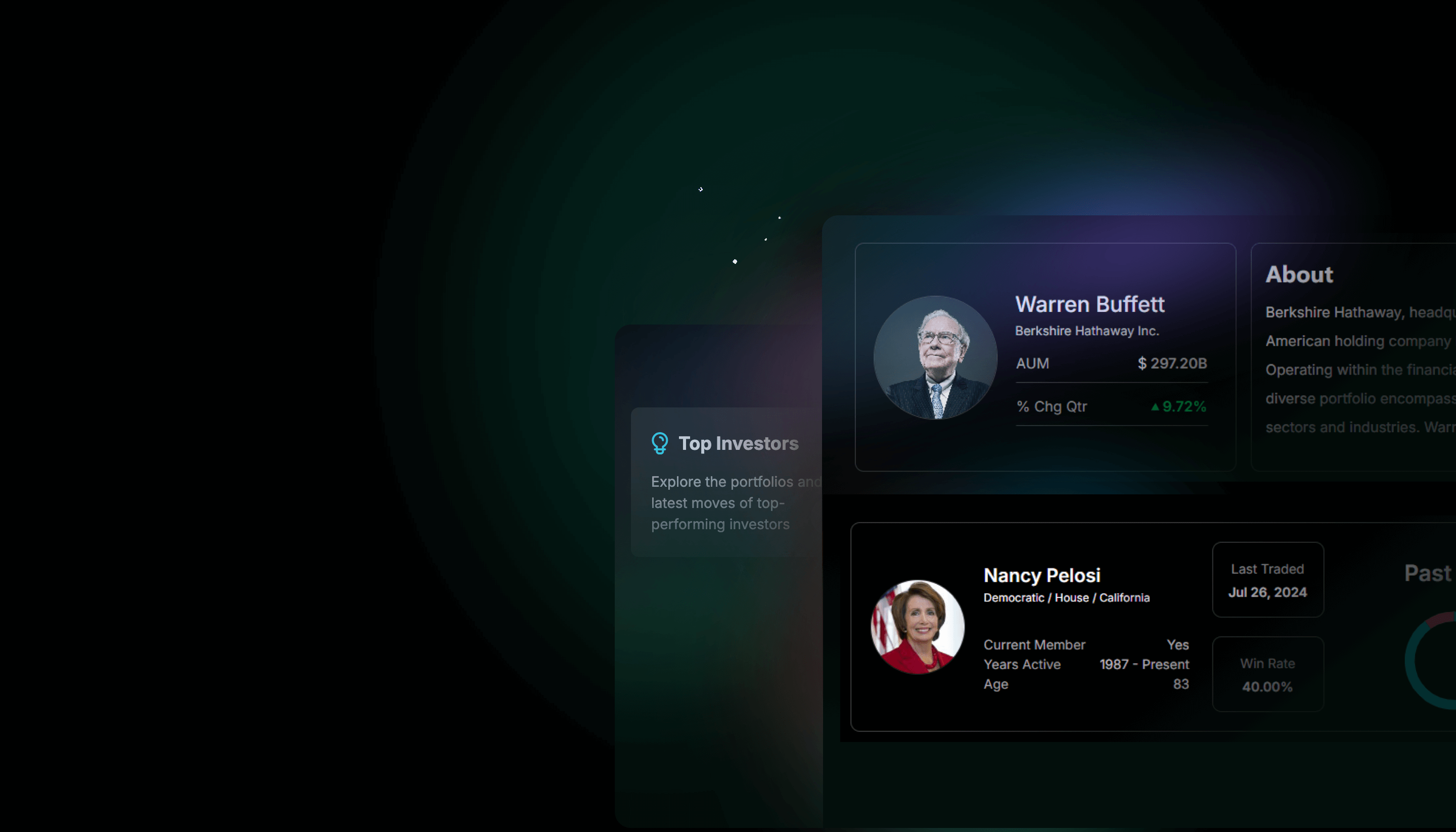

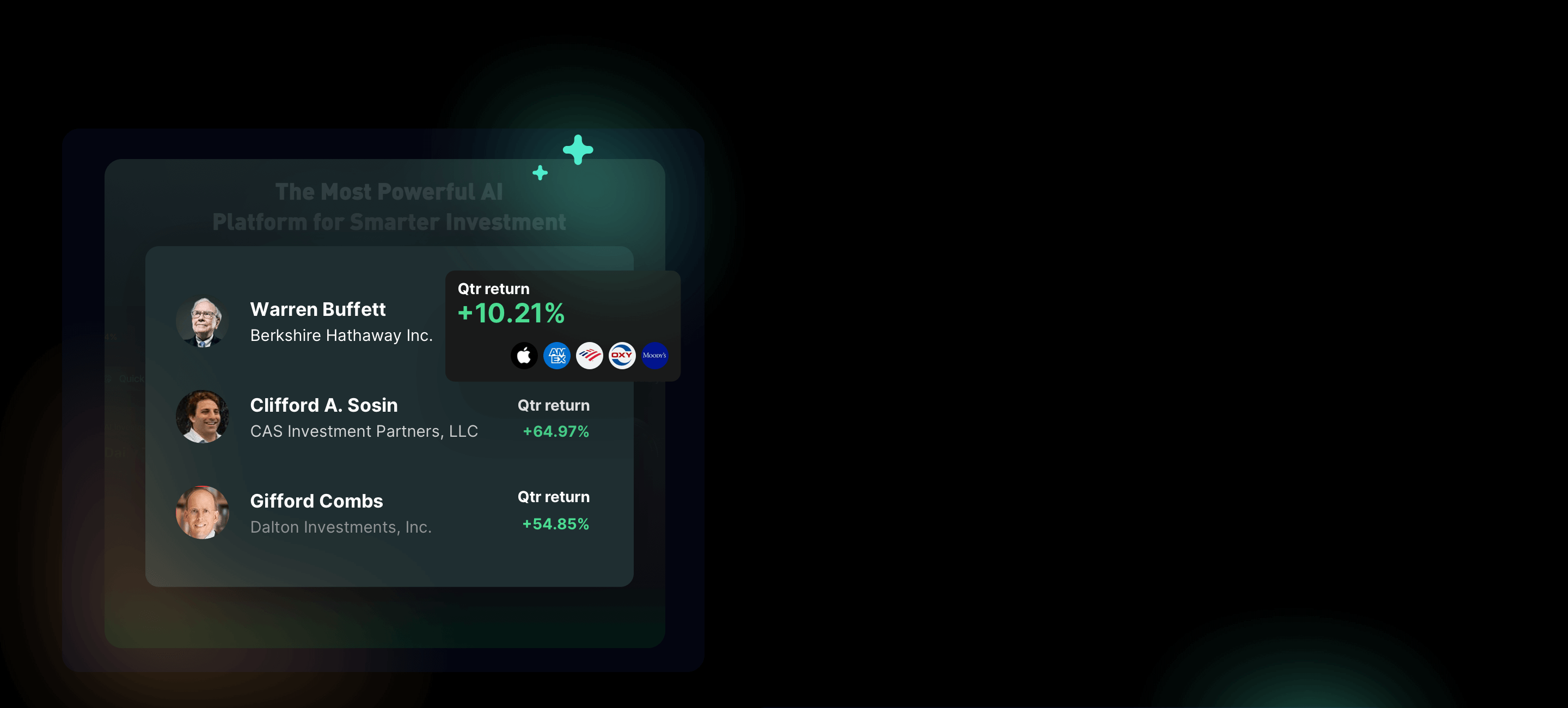

Unlock In-Depth Insights from Top Investors

Many investors struggle to understand the strategies behind the trades of top fund managers like Warren Buffett and George Soros. While their portfolio holdings are publicly available, most don't know how to sift through the data or extract valuable insights. This can lead to missed opportunities and poor decisions. Our product simplifies this process, providing easy access to key data and actionable insights, so investors can learn from the best and apply their strategies to their own portfolios.

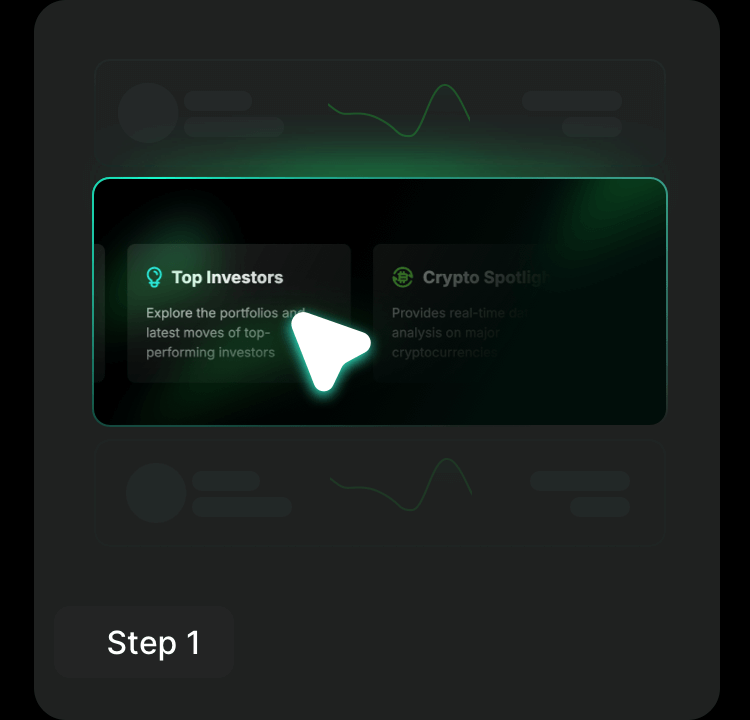

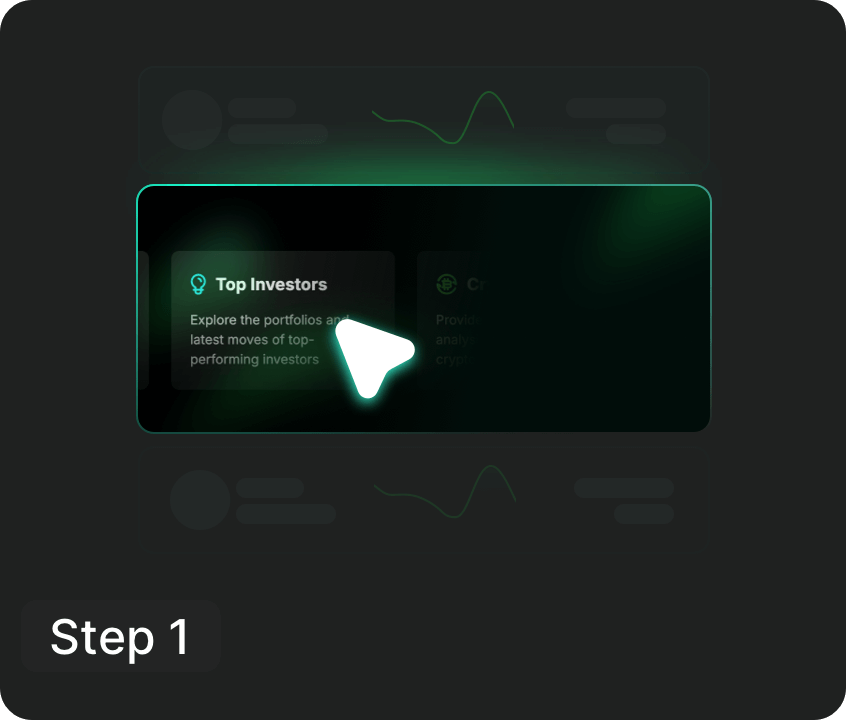

How to Use Stock Monitor

Check out the quarterly leaderboard

Click on the "Hedge Fund Tracker" feature to access the quarterly leaderboard and discover the top-performing fund managers of the quarter.

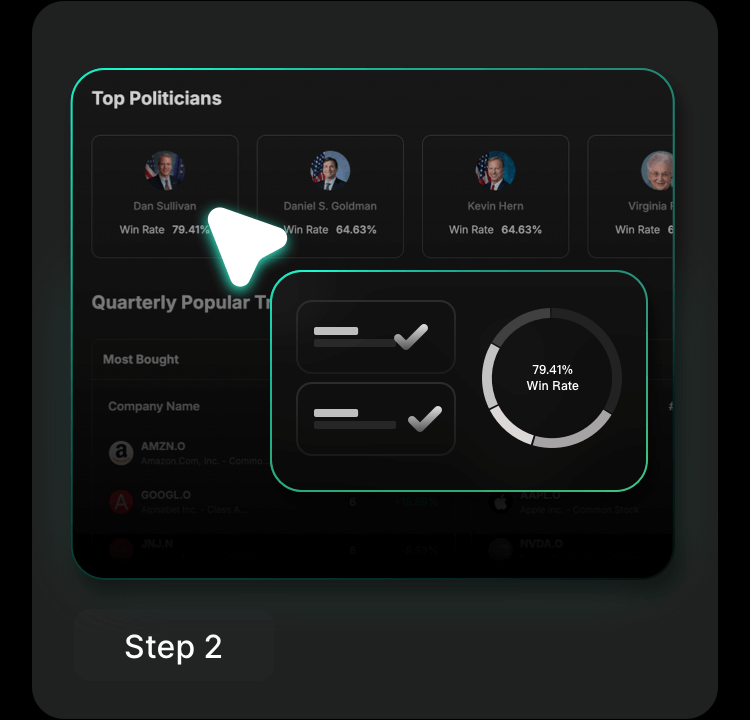

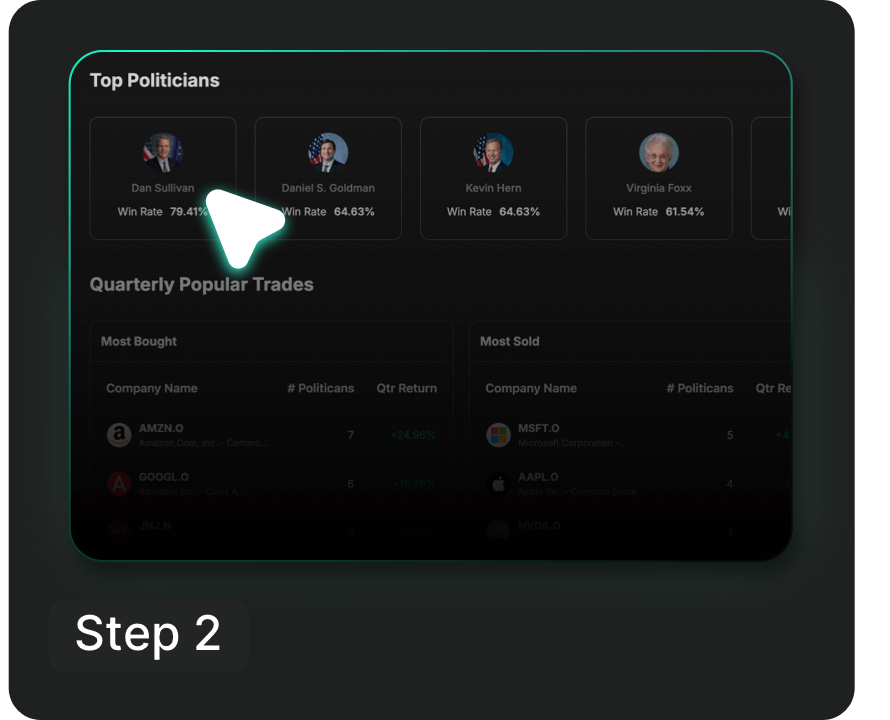

Dive into manager details

Click on any manager to explore their portfolio holdings and recent trades. Get a closer look at how they're positioning their investments.

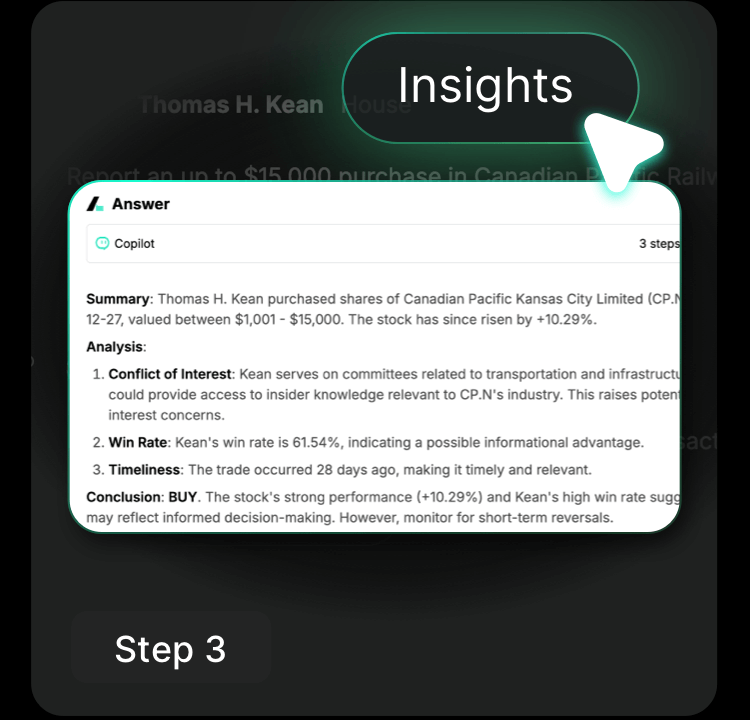

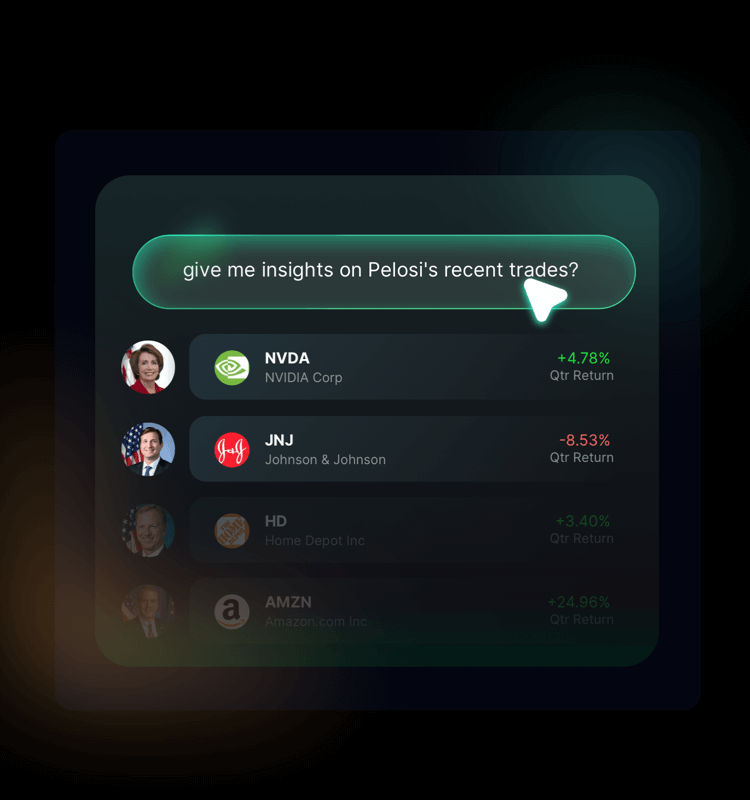

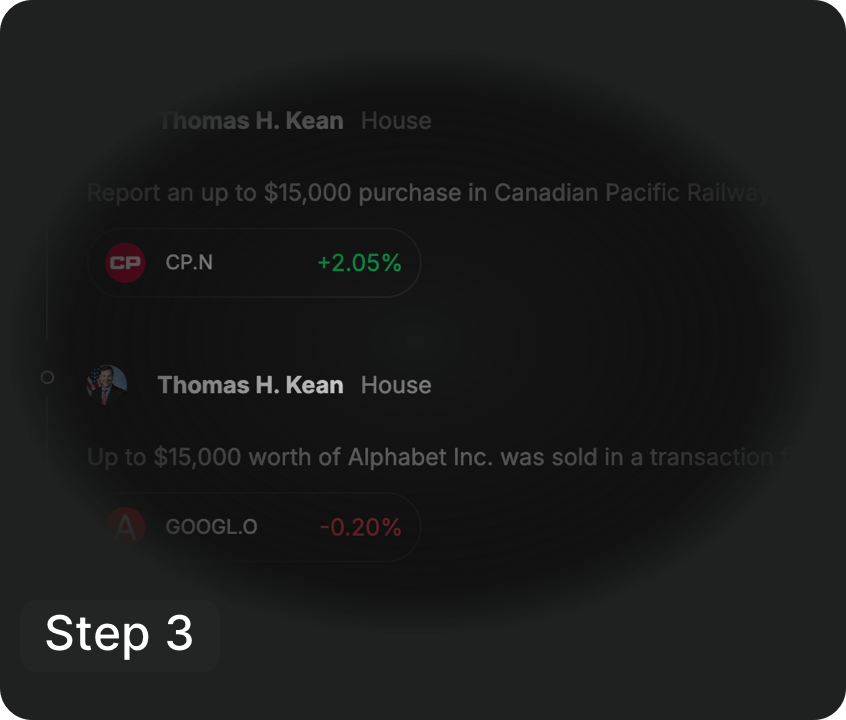

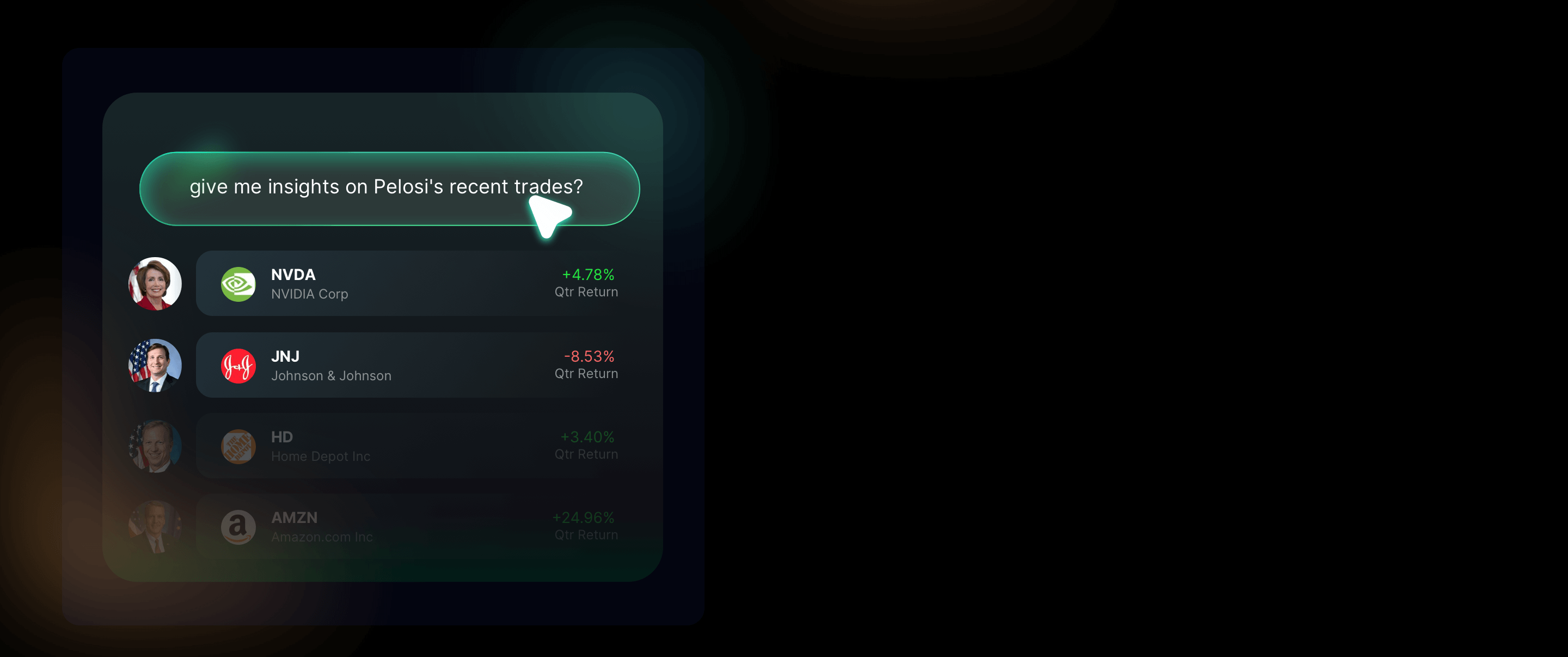

Ask for more insights

Need deeper analysis? Simply chat with our bot for more details on the manager's portfolio or specific stocks, and get the insights you need to make informed decisions.

Use Case

Value Investors

Evaluating undervalued stocks

Value investors leverage Stock Technical Analysis to spot undervalued stocks, using trend momentum and price patterns to assess potential market mispricings and long-term growth opportunities.

Growth Investors

Spotting high-potential stocks and emerging trends

Growth investors use the feature to track fast-growing companies, monitoring price momentum and key signals to identify the next big opportunity in tech and innovative sectors.

Contrarian Investors

Identifying market mispricings from leading managers

Contrarian investors use Hedge Fund Tracker to analyze top fund managers' trades, spotting opportunities where market sentiment may be wrong and positioning for long-term gains.

Why Hedge Fund Tracker Stands Out

Access to 1000+ Top Fund Managers

Hedge Fund Tracker gives you a front-row seat to over 1000 fund managers, including those with returns over 100% in a single quarter, so you can follow the strategies of the industry's best.

Try Now

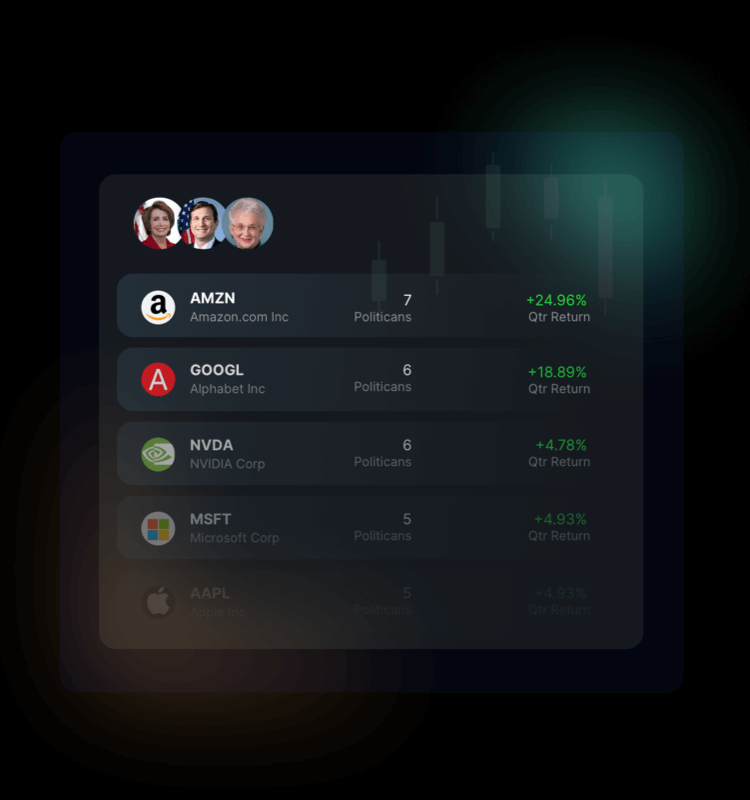

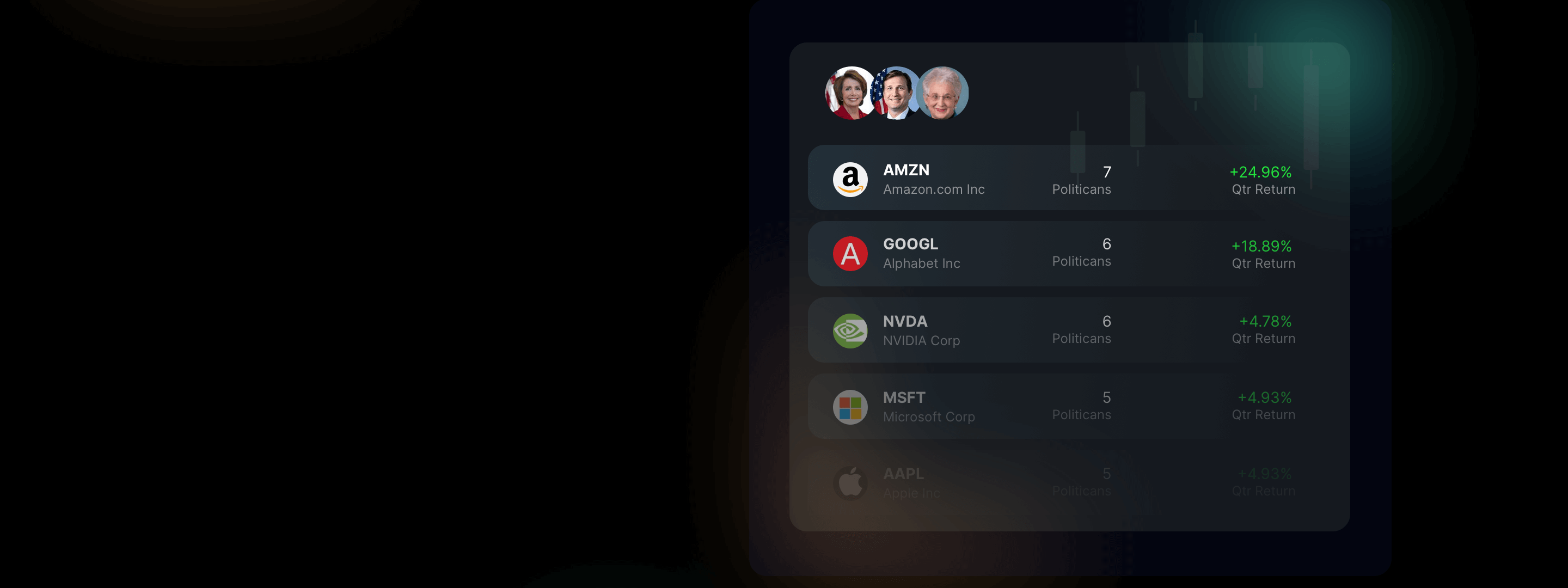

Try NowGet Ahead of Market Trends

Track the most popular stocks being bought and sold by these influential investors. By keeping an eye on their moves, you can spot market trends early and stay one step ahead.

Try Now

Try NowInstant Insights with Chatbot Assistance

Need a deeper dive? Just ask our chatbot for detailed analysis on any manager's portfolio or specific stocks. Get quick, data-driven insights to help you make smarter investment decisions.

Try Now

Try NowWhat Our Users Say

Why Choose Us

Frequently Asked Questions

What is the "Copy Top Investors Portfolio" feature?

The Copy Top Investors Portfolio feature provides insights into the top-performing politicians, managers, and funds by analyzing their recent trading activities, returns, and stock preferences.

Why should I track the trades of congress members or top managers?

Many high-profile investors, including Congress members and top managers, have access to unique insights and market conditions, which may influence their investment decisions. Tracking their moves can provide valuable indicators of potential market trends.

What is the quarterly trading moves by congress?

This section highlights the stocks most frequently bought and sold by politicians in the recent quarter, along with their returns, helping users spot trends and identify popular stocks among influential figures.

How are Top Investor Portfolios selected?

"Top Managers" are selected based on their quarterly returns, showcasing the performance of some of the most successful fund managers, which can serve as a reference for potential investments.

Discover top stock rankings and trends?

The Quarterly Leaderboard ranks funds by their performance, displaying both the best and worst performers, with details like AUM (Assets Under Management) and number of holdings, providing a comprehensive view of fund performance over the quarter.

Hedge Fund Tracker has become an essential tool for me. I love being able to see what top fund managers are buying and selling in real-time. It's given me an edge in identifying trends before they blow up. The detailed portfolio breakdowns and the ability to ask for further analysis via the chatbot have helped me make more informed, data-driven decisions.

John Mitchell

Investment Analyst