Trump Threatens Tariffs on Countries Opposing Greenland Sale

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 20 2026

0mins

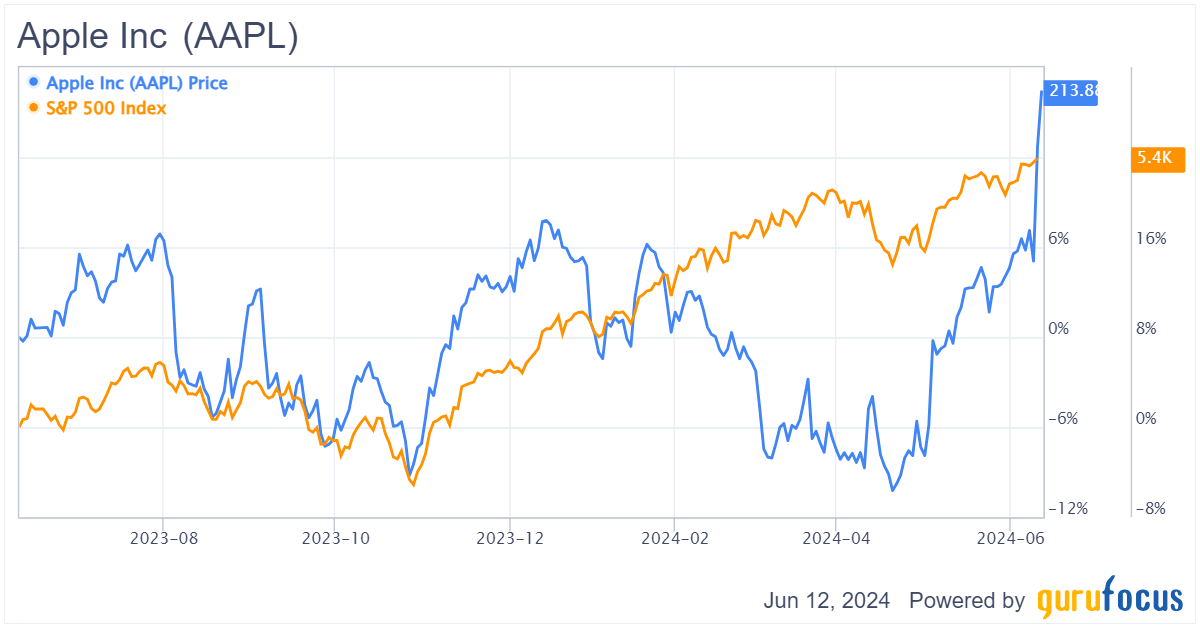

Should l Buy AAPL?

Source: CNBC

- Market Reaction: Trump's threat to impose tariffs on countries opposing the U.S. purchase of Greenland led to a significant lower open for stocks, raising investor concerns about future trade policies and potentially impacting market confidence.

- Gold Price Surge: The gold price jumped 3% amid rising trade tensions, reflecting increased demand for safe-haven assets and indicating market worries about economic prospects.

- Tech Stock Analysis: Analysts express concerns over the profitability of Software-as-a-Service (SaaS) companies, suggesting their high product prices could lead to market share losses and affect future earnings growth.

- Apple Price Target Downgrade: Citi lowered Apple's price target from $330 to $315 while maintaining a buy rating, but analysts warned that rising memory chip costs could pose pricing risks, impacting the company's profitability.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy AAPL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on AAPL

Wall Street analysts forecast AAPL stock price to rise

27 Analyst Rating

17 Buy

9 Hold

1 Sell

Moderate Buy

Current: 263.750

Low

239.00

Averages

306.89

High

350.00

Current: 263.750

Low

239.00

Averages

306.89

High

350.00

About AAPL

Apple Inc. designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. Its product categories include iPhone, Mac, iPad, and Wearables, Home and Accessories. Its software platforms include iOS, iPadOS, macOS, watchOS, visionOS, and tvOS. Its services include advertising, AppleCare, cloud services, digital content and payment services. The Company operates various platforms, including the App Store, that allow customers to discover and download applications and digital content, such as books, music, video, games and podcasts. It also offers digital content through subscription-based services, including Apple Arcade, Apple Fitness+, Apple Music, Apple News+, and Apple TV+. Its products include iPhone 16 Pro, iPhone 16, iPhone 15, iPhone 14, iPhone SE, MacBook Air, MacBook Pro, iMac, Mac mini, Mac Studio, Mac Pro, iPad Pro, iPad Air, AirPods, AirPods Pro, AirPods Max, Apple TV, Apple Vision Pro and others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Market Share Battle: In 2025, the iPhone became the top-selling smartphone, capturing 20% of the market share, and despite facing competitive pressures, Apple maintained high profits, demonstrating its strong competitive edge in the premium market.

- New Product Launch: At the spring event, Apple introduced the iPhone 17e with a starting price of $599, maintaining this price despite rising memory and storage chip costs, thereby attracting more consumers and enhancing market competitiveness.

- Supply Chain Advantage: Apple's strategy of securing multi-year agreements with suppliers allows it to manage price fluctuations effectively, ensuring production capacity and maintaining stable product pricing in a high-cost environment, further solidifying its market position.

- Long-term Shareholder Benefits: The pricing strategy of the iPhone 17e will enhance Apple's competitiveness in price-sensitive markets, likely attracting more users into the Apple ecosystem, which will promote sales of subsequent products and services, ultimately benefiting shareholders in the long run.

See More

- Long-Term Investment Philosophy: Over 60 years, Buffett achieved a compounded annual growth rate exceeding 19%, significantly outpacing the S&P 500's 10%, indicating the effectiveness of his investment strategy and its appeal to investors seeking inspiration.

- Apple Holdings: Buffett has held Apple shares since 2016, and despite selling some recently to lock in gains, it remains the largest holding in his portfolio, reflecting his ongoing confidence in the company and its strong brand moat.

- Coca-Cola's Steady Performance: Buffett has held Coca-Cola shares since the late 1980s, making it the fourth-largest holding in his portfolio; its status as a

See More

- Apple's Stock Holding: Buffett has held Apple shares since 2016, witnessing an approximately 800% increase, and despite selling some shares last year, it remains the largest holding in his portfolio, indicating his ongoing confidence in the company.

- Coca-Cola's Long-Term Investment: Buffett has owned Coca-Cola stock since the late 1980s, making it the fourth-largest holding in his portfolio; its strong brand and global distribution network ensure steady earnings growth, complemented by over 50 years of dividend increases, showcasing its reliability.

- American Express's Robust Performance: Buffett's investment in American Express dates back to the 1960s, and it is now the second-largest holding in his portfolio, with 2023 revenues exceeding $72 billion, demonstrating resilience during economic fluctuations and making it a solid long-term investment choice.

- Buffett's Investment Wisdom: Buffett emphasizes long-term investing and selecting quality companies, with Apple, Coca-Cola, and American Express exemplifying this principle, allowing investors to adopt his strategy of choosing firms with competitive advantages for steady growth.

See More

- Industry Response: The Information Technology Industry Council (ITI) sent a letter to Defense Secretary Pete Hegseth expressing concerns over his designation of a U.S. company as a supply chain risk, indirectly referencing Anthropic, which could jeopardize its future government contracts.

- Contract Dispute: ITI emphasized that contract disputes should be resolved through ongoing negotiations or by selecting alternative suppliers via established procurement channels rather than through emergency measures like supply chain risk designations, which are typically reserved for entities identified as foreign adversaries, reflecting strong opposition to government actions.

- Procedural Protections: The letter referenced the Federal Acquisition Supply Chain Security Act of 2018 and the Federal Acquisition Security Council (FASCSA), highlighting the importance of due process for private companies, including notice and response opportunities before any risk designation is made, underscoring ITI's commitment to procedural fairness.

- Anthropic's Position: Anthropic expressed deep sadness over the decision in a statement, arguing that labeling it as a supply chain risk is unprecedented and historically reserved for U.S. adversaries, which could severely impact its relationship with the Defense Department and the broader tech industry.

See More

- New CEO Transition: With Warren Buffett retiring on December 31, Greg Abel officially took over the day-to-day operations and the $319 billion investment portfolio of Berkshire Hathaway on January 1, marking a significant governance shift, as Abel vows to uphold Buffett's investment philosophy.

- Expansion of 'Forever' Holdings: In his first letter to shareholders, Abel announced the inclusion of Moody's and Apple into Berkshire's 'forever' holdings, with Moody's being the third-longest-held stock since 2000, boasting a 41% annual yield, showcasing its resilience in economic fluctuations.

- Valuation Considerations for Apple: While Abel considers Apple a long-term investment, the decision raises eyebrows given Buffett's sale of 75% of Berkshire's Apple shares prior to retirement, especially with Apple's current P/E ratio at 33.4, reflecting a commitment to value investing.

- Impact of Share Buybacks: Since 2013, Apple has repurchased over $841 billion in shares, reducing its outstanding shares by 44%, a strategy that has significantly boosted earnings per share, indicating that Abel's decisions may influence Berkshire's stake in Apple, reflecting sensitivity to market dynamics.

See More

- iPhone 17e Pricing Strategy: Apple introduced the iPhone 17e at a starting price of $599 during its spring event, maintaining last year's price despite rising component costs, aiming to capture market share through price stability.

- Increased Storage Capacity: The new iPhone 17e features double the starting storage at 256GB, and despite higher costs, Apple opted not to raise prices, showcasing its supply chain management prowess that could attract more consumers.

- Competitive Market Advantage: This pricing strategy enhances Apple's competitiveness in price-sensitive markets like China, where it faces lower-priced rivals such as Vivo, Huawei, and Xiaomi, potentially aiding in regaining market share.

- Long-Term Shareholder Benefits: The iPhone serves as a starting point for customer relationships with Apple, likely driving sales of other products and services in the future, and while the stock has struggled recently, this strategy offers long-term growth potential for shareholders.

See More