Tuesday's Major Stock Market Highlights: Morning News Summary!

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Sep 16 2025

0mins

Should l Buy GOOG?

Source: TipRanks

- Market Coverage: TipRanks provides updates on the latest stock market stories and trends for traders.

- Resource Availability: Additional stock market news can be found on the TipRanks platform.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy GOOG?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on GOOG

Wall Street analysts forecast GOOG stock price to rise

15 Analyst Rating

14 Buy

1 Hold

0 Sell

Strong Buy

Current: 306.360

Low

255.00

Averages

336.08

High

400.00

Current: 306.360

Low

255.00

Averages

336.08

High

400.00

About GOOG

Alphabet Inc. is a holding company. The Company's segments include Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment includes infrastructure and platform services, collaboration tools, and other services for enterprise customers. Its Other Bets segment is engaged in the sale of healthcare-related services and Internet services. Its Google Cloud provides enterprise-ready cloud services, including Google Cloud Platform and Google Workspace. Google Cloud Platform provides access to solutions such as artificial intelligence (AI) offerings, including its AI infrastructure, Vertex AI platform, and Gemini for Google Cloud; cybersecurity, and data and analytics. Google Workspace includes cloud-based communication and collaboration tools for enterprises, such as Calendar, Gmail, Docs, Drive, and Meet.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- AI Preference for Bitcoin: A report from the Bitcoin Policy Institute reveals that 22 out of 36 tested AI models favored Bitcoin as their top monetary choice, indicating Bitcoin's potential dominance in future economic activities.

- Innovative Experiment Design: Researchers treated 36 frontier models as independent economic agents, allowing them to freely choose monetary instruments across 28 scenarios, generating 9,072 responses that ensured objectivity and diversity in results.

- Developer Preference Variations: Significant differences in Bitcoin preference were observed among AI developers, with Anthropic models showing a preference rate of 68.0%, while OpenAI models only preferred Bitcoin 25.9% of the time, highlighting the influence of technical backgrounds on monetary choices.

- Cautious Market Predictions: Despite the consistent trends shown in the study, Zell cautions investors against interpreting these findings as market predictions, emphasizing that AI model preferences reflect training data patterns rather than real-world forecasts.

See More

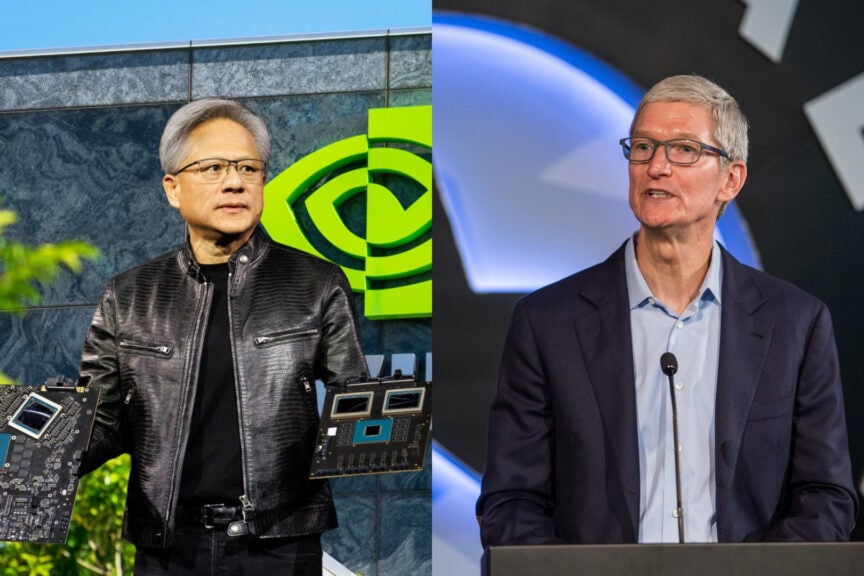

- Impressive Performance: Nvidia achieved a record $215.94 billion in revenue for fiscal 2026, with net income reaching $120.07 billion, demonstrating strong profitability and market demand, and is expected to continue leading the 'Magnificent Seven'.

- Robust Cash Flow: The company generated $96.58 billion in free cash flow, sufficient to cover $41.1 billion in stock repurchases and dividends, indicating a healthy financial position that supports future investments and growth.

- Increased R&D Investment: Nvidia launched the Blackwell architecture in March 2024 and unveiled the Rubin platform in January 2023, showcasing its ongoing innovation in AI aimed at eliminating workload bottlenecks and enhancing market competitiveness.

- Expanding Customer Base: By investing in Anthropic and OpenAI, Nvidia is broadening its customer base and is expected to benefit from the growing demand for AI, solidifying its leadership position in the data center market.

See More

- Strong Financial Performance: Nvidia achieved a record $215.94 billion in revenue for fiscal 2026, with net income reaching $120.07 billion, showcasing robust profitability and cash flow that solidifies its leadership in the semiconductor industry.

- Shareholder Return Strategy: The company allocated $41.1 billion for stock repurchases and dividends in fiscal 2026, indicating its strong cash flow capabilities and commitment to shareholders, which is expected to boost investor confidence.

- AI Market Potential: Nvidia is targeting $78 billion in revenue for Q1 fiscal 2027 with a gross margin of 75%, representing a significant 76.9% year-over-year increase, reflecting its market leadership amid surging AI compute demand.

- Strategic Investment Expansion: Nvidia announced a $10 billion investment in Anthropic and is close to investing $30 billion in OpenAI, demonstrating its strategic positioning in the AI sector and commitment to emerging technologies, further broadening its customer base.

See More

- Protests Escalate: Hundreds of Iraqi Shiites protested in Baghdad against U.S. and Israeli strikes on Iran, indicating a rise in regional tensions that could lead to larger conflicts and instability.

- Increased Cyberattack Risk: Cybersecurity experts warn that Iran may launch attacks on U.S. businesses and infrastructure at a high-risk moment, highlighting the rising potential for cyber threats against critical sectors.

- CISA Challenges: The Cybersecurity and Infrastructure Security Agency (CISA) faces significant challenges due to a partial government shutdown and management reshuffle, resulting in staff shortages and resource constraints that may weaken its ability to counteract cyber threats.

- Financial Sector Vigilance: JPMorgan Chase's CEO noted that banks could be targets for cyberattacks, anticipating an increase in global cyber or terrorist threats, which underscores the financial industry's heightened focus on cybersecurity.

See More

- Rising Cyberattack Risk: As Middle Eastern conflicts escalate, cybersecurity experts warn that Iran may launch cyberattacks against U.S. businesses and infrastructure during a high-risk moment, particularly as the Cybersecurity and Infrastructure Security Agency (CISA) faces a partial government shutdown and leadership turmoil, severely compromising national defense capabilities.

- CISA Turmoil: CISA has reportedly lost about a third of its workforce since Trump took office, and temporary director Madhu Gottumukkala was reassigned due to clashes with staff and mismanagement, resulting in a lack of agency involvement in critical areas that could lead to future security vulnerabilities.

- Threat to Banking Sector: JPMorgan Chase CEO Jamie Dimon stated that banks may be targets for cyberattacks, anticipating a rise in global cyber or terrorist threats, emphasizing that cybersecurity is one of the highest risks faced by banks.

- Insufficient Cyber Monitoring: Due to a lapse in federal funding, CISA's website has not been updated since February 17, leading to the cancellation of cybersecurity assessments and training, with lawmakers expressing concerns that the shutdown will weaken the ability to protect critical infrastructure.

See More

- Market Signal: The South Korean ETF (EWY) experienced an approximately 11% selloff overnight, indicating its role as a 'canary in the coal mine' for potential turbulence in the U.S. stock market.

- Profit Signal: Following a buy signal on April 9, 2025, the South Korean ETF (EWY) has shown a strong upward trend, with recent sell-offs prompting investors to consider taking partial profits.

- Memory Market Dynamics: Due to surging AI demand, major memory manufacturers like Samsung Electronics and SK Hynix are perceived as lower risk compared to other AI stocks, contributing to South Korea's market outperforming QQQ by 27.48%.

- Global Industrial Recovery: As a major exporter of industrial goods, South Korea benefits from a global uptick in industrial activity, further bolstering investor confidence in the market.

See More