Widely Held Leveraged Funds Stun Investors with Significant Losses

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Oct 23 2025

0mins

Should l Buy MORN?

Source: WSJ

Booming Popularity: Risky leveraged exchange-traded funds (ETFs) are experiencing significant growth, attracting investors through easy access via brokerage accounts.

Mechanism of Operation: These funds utilize derivative contracts or borrowed money to enhance the returns of an underlying asset, with leveraged funds tracking stock indexes existing for over a decade.

Recent Developments: The approval of leveraged single-stock ETFs by U.S. regulators in 2022 marks a notable expansion in the types of leveraged funds available to investors.

Performance Concerns: The performance of these leveraged funds over the past year underscores their inherent risks and potential pitfalls for investors.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy MORN?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on MORN

Wall Street analysts forecast MORN stock price to rise

2 Analyst Rating

2 Buy

0 Hold

0 Sell

Moderate Buy

Current: 182.310

Low

250.00

Averages

285.00

High

320.00

Current: 182.310

Low

250.00

Averages

285.00

High

320.00

About MORN

Morningstar, Inc. is a provider of independent investment insights in North America, Europe, Australia, and Asia. Its segments include Morningstar Data and Analytics, PitchBook, Morningstar Wealth, Morningstar Credit, and Morningstar Retirement. The Morningstar Data and Analytics segment provides investors comprehensive data, research and insights, and investment analysis to empower investment decision-making. The PitchBook segment provides investors with access to a broad collection of data and research covering the private capital markets. Morningstar Wealth segment brings together its model portfolios and wealth platform; practice and portfolio management software for registered investment advisers; data aggregation and enrichment capabilities; and others. Morningstar Credit segment provides investors with credit ratings, research, data, and credit analytics solutions. The Morningstar Retirement segment offers products designed to help individuals reach their retirement goals.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- New Market Analysis Area: PitchBook has launched a Late-Stage Company Research initiative focusing on the world's most influential private companies, with the first report analyzing SpaceX, providing in-depth insights into its business model and market dynamics, thereby aiding investors in understanding performance and market impact.

- IPO Activity Resurgence: After years of delays, IPO activity is regaining momentum for the first time since 2021, shifting attention back to late-stage private companies, with PitchBook's research addressing the gap in consistent, timely analysis that investors demand for transparency.

- AI Giants Evaluation Framework: The report titled 'Ranking the AI Giants' introduces PitchBook's AIBQ framework, designed to evaluate companies like Anthropic, Databricks, and OpenAI on long-term value drivers, offering a consistent, data-driven approach to assessing business quality.

- Quarterly Tracking Reports: PitchBook will publish a quarterly Unicorn Tracker highlighting trends in valuation, fundraising, and exits within the late-stage ecosystem, enabling clients to apply consistent data analysis across workflows such as deal sourcing and strategic planning.

See More

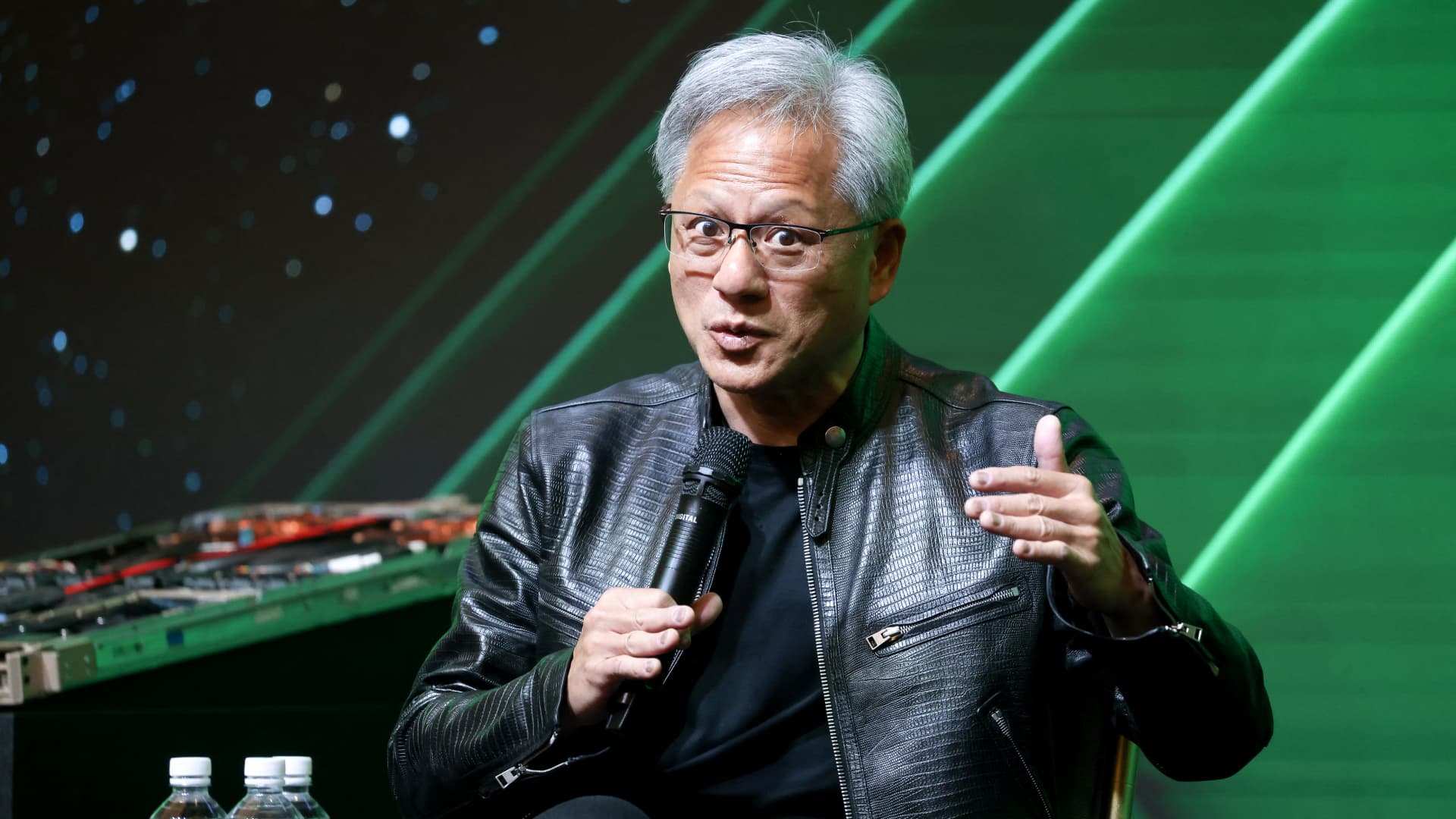

- Market Share Comparison: Nvidia commands an impressive 86% market share in AI data center revenue, compared to AMD's mere 7%, highlighting Nvidia's dominant position in the data center processor market, which is likely to attract more customers in the future.

- Major Deal Impact: AMD's agreement with Meta to supply up to 6 gigawatts of AI data center processing, valued at over $100 billion, represents a significant win for AMD; however, its high stock valuation raises concerns among investors.

- Financial Performance Divergence: Nvidia's recent Q4 fiscal 2026 results revealed a 65% increase in sales to nearly $216 billion, with adjusted earnings rising 60% to $4.77 per share, indicating strong growth momentum in the AI sector.

- Valuation Comparison: Nvidia's P/E ratio stands at 53, which, while above the tech sector average, is significantly lower than AMD's 101, making Nvidia a more attractive investment in the AI stock landscape given its robust financial performance.

See More

- Significant Inflows: In 2025, investors poured $152 billion into emerging market debt exchange-traded products, significantly surpassing the $103 billion that flowed into emerging market equities, indicating a strong preference for debt amid market turmoil.

- Yield Advantage: The attractive yields of emerging market debt are drawing investors, with the Morningstar Emerging Markets Composite Bond index showing a total return of nearly 9% over the past 12 months, compared to approximately 5.8% for the Morningstar U.S. Core Bond index, highlighting the rising appeal of emerging market debt.

- Impact of Dollar Weakness: The U.S. dollar index has fallen about 7% in the past year, which lowers the servicing costs of dollar-denominated emerging market sovereign and corporate bonds, thereby increasing investor interest in this asset class.

- Regional Investment Opportunities: Investors are focusing on countries like China, Korea, and India, where inflation and fiscal risks are perceived to be lower, particularly in the context of increasing competition in artificial intelligence, suggesting new investment potential in Asian emerging markets.

See More

- Investor Expectations: Investors in the Schwab U.S. Dividend Equity ETF are not anticipating significant growth this year.

- Current Performance: Despite low expectations, the ETF is experiencing notable performance this year.

See More

- Rising Demand for ESG Data: The Morningstar Sustainalytics survey reveals that 58% of the 145 financial market participants are increasingly seeking regulation-aligned datasets, highlighting a pressing need for high-quality, comparable data to support long-term value creation.

- Data Quality Challenges: The survey indicates that 41% of respondents face data quality issues, while 47% cite gaps in ESG data coverage, obstacles that could hinder effective investment decision-making and compel institutional investors to seek stronger data foundations.

- Demand for Forward-Looking Climate Metrics: 35% of respondents identify transition risk models as uniquely valuable datasets, with 73% and 68% considering ISSB disclosures and sustainable bond data essential, reflecting a growing need for predictive analytical tools.

- Challenges in Private Market Data: The survey highlights private markets as one of the most challenging areas for ESG and climate data, with 56% of participants emphasizing the need for greenhouse gas emissions data, indicating that investors require more comprehensive data integration in their sustainability pursuits.

See More

- Oil Price Surge: The escalation of the Middle East conflict has led West Texas Intermediate futures to rise over 5% and Brent crude by about 6%, indicating heightened market concerns over supply disruptions that could exacerbate overall inflationary pressures.

- Inflationary Pressures: January's Producer Price Index (PPI) rose 0.8% above expectations, with a 12-month rate of 3.6%, suggesting that while inflation has eased, underlying price pressures remain, potentially influencing the Federal Reserve's interest rate decisions.

- Uncertain Economic Impact: Economists note that the long-term effects of rising oil prices are unclear, especially given the U.S.'s increased energy self-sufficiency, leading to expectations that the near-term economic growth and inflation downside risks are limited.

- Stagflation Risks Reemerge: With signs of labor market softening and uncertain policy outlooks, economists warn of potential stagflation risks, particularly if Middle East tensions persist, which could pressure economic recovery.

See More