Crude Oil Falls 1.5%; ON Semiconductor Shares Plunge After Q2 Results

U.S. Stock Market Performance: U.S. stocks rose significantly on Monday, with the S&P 500 gaining over 1%, while communication services saw a notable increase of 2.3%. However, energy stocks fell by 0.6%.

Company Earnings and Market Reactions: ON Semiconductor's shares dropped over 12% after reporting a revenue decline, while BT Brands and Verb Technology saw substantial gains due to strategic initiatives and private placements, respectively.

Trade with 70% Backtested Accuracy

Analyst Views on REPL

About REPL

About the author

- Earnings Beat: Replimune's Q3 GAAP EPS of -$0.77 exceeds expectations by $0.01, indicating a slight improvement in financial performance that could bolster investor confidence.

- Cash Position: As of December 31, 2025, the company's cash, cash equivalents, and short-term investments totaled $269.1 million, a significant decrease from $483.8 million at the end of fiscal year 2025, highlighting the urgency in cash utilization.

- Funding Outlook: Based on the current operating plan, the company believes that its existing cash and short-term investments will allow it to fund operations into late Q1 2027, demonstrating a strategic approach to cash management.

- Increased Market Attention: Replimune's presentation at the 44th Annual J.P. Morgan Healthcare Conference has drawn market attention, potentially paving the way for future financing and partnership opportunities.

- Shareholder Lawsuit Investigation: Johnson Fistel, PLLP is investigating shareholder claims against Alto Neuroscience (NYSE: ANRO) and others, alleging breaches of fiduciary duty that could lead to corporate governance reforms and return of funds.

- False Statements Allegations: Alto Neuroscience is accused of making false statements regarding the efficacy of its lead drug ALTO-100, resulting in investor losses when the truth was revealed, negatively impacting the company's reputation and stock price.

- Anticompetitive Pricing Practices: Atkore Inc. (NYSE: ATKR) faces a securities class action lawsuit alleging executives failed to disclose anticompetitive pricing practices related to PVC pipe products, which may lead to legal risks and diminished shareholder trust.

- Safety Risks Concealment: Fly-E Group (NASDAQ: FLYE) is accused of downplaying safety risks associated with its lithium battery technology in electric mobility products, leading to a stock price decline and harming investor interests, affecting the company's future growth prospects.

- Feature Launch: Replit's new mobile app feature allows users to create and publish apps using only natural language prompts, significantly reducing the time from concept to launch, enabling users to develop apps in minutes and submit them to the App Store in days.

- Monetization Integration: The feature's integration with Stripe allows users to easily monetize their apps, marking a significant advancement for Replit in the AI-powered coding space and enhancing market competitiveness for small businesses and creators.

- Increased Market Risks: As more vibe-coding products come online, software companies face intensified competition, with the iShares Expanded Tech-Software Sector ETF dropping 11% in the last three months, reflecting investor concerns about the risks posed by AI coding products.

- Security Concerns: A new study from Tenzai highlights critical security vulnerabilities in apps generated by AI coding agents like Replit and Claude Code, raising potential risks for cyberattacks, prompting users to carefully consider security before publishing.

- Replimune Options Activity: Replimune Group Inc experienced options trading volume of 6,830 contracts, representing approximately 50.6% of its average daily trading volume of 1.3 million shares over the past month, indicating heightened market interest in its future performance.

- High Demand for Puts: The $7 strike put option expiring on April 17, 2026, saw 2,313 contracts traded today, representing about 231,300 underlying shares, suggesting increased investor expectations for potential downside in the stock price.

- Upstart Options Surge: Upstart Holdings Inc recorded options trading volume of 22,484 contracts, approximately 48.1% of its average daily trading volume of 4.7 million shares over the past month, reflecting strong market interest in its stock.

- Bullish Call Options: The $50 strike call option expiring on January 16, 2026, had 1,226 contracts traded today, involving around 122,600 underlying shares, indicating investor optimism regarding Upstart's future price appreciation.

Reasons for Short Selling: Traders short stocks to either bet on a decline in value or to profit from potential short squeezes, where rising prices force short sellers to buy back shares, creating a feedback loop of increasing demand.

Characteristics of Heavily Shorted Stocks: Stocks become heavily shorted when experienced traders believe they are overvalued, indicating serious risks, while retail traders may see high short interest as an opportunity for quick gains.

Top Heavily Shorted Stocks: As of November 26, 2025, the most shorted stocks include The Wendy's Co. (WEN) at 55.36% short interest, followed by Cambium Networks Corp. (CMBM) and Lucid Group, Inc. (LCID).

Risks and Volatility: While short squeezes can lead to significant gains, they come with high risks and volatility, necessitating careful monitoring and due diligence by traders.

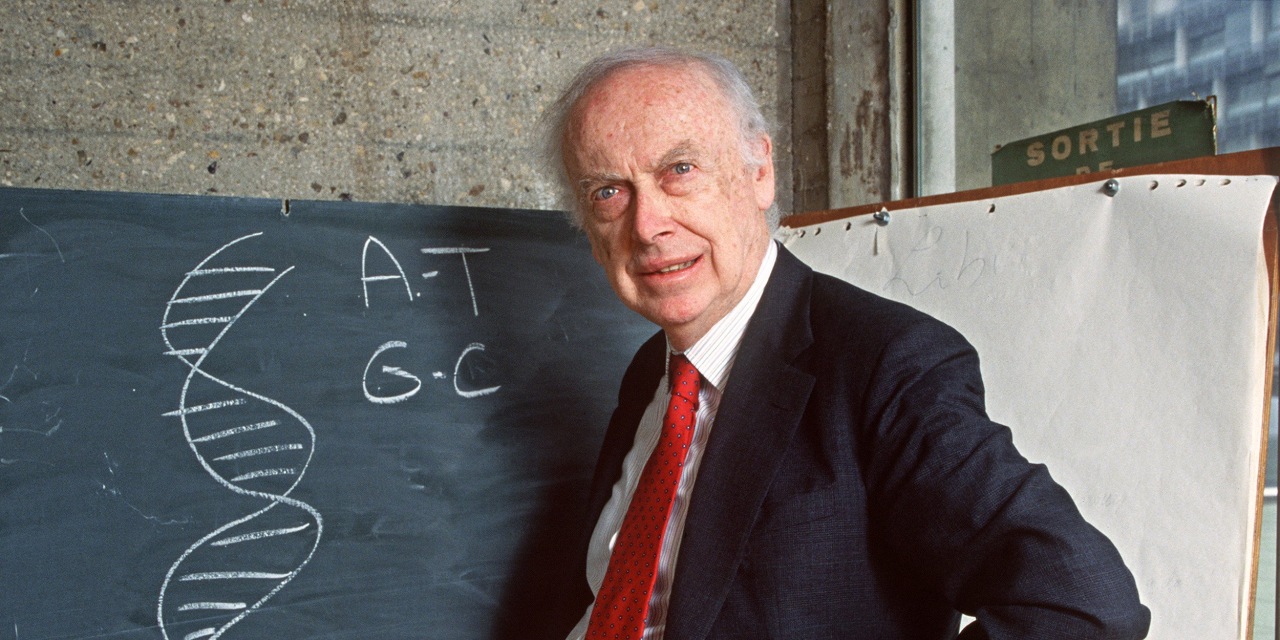

James Watson's Legacy: James Watson, the co-discoverer of DNA's double-helix structure, passed away at the age of 97, having expressed a desire to see a cure for cancer during his lifetime.

Advancements in Cancer Treatment: Significant progress has been made in cancer treatment, with previously terminal cancers now being curable, thanks to more targeted and precise therapies compared to traditional chemotherapy and radiation.