AI Giants or Small-Cap Recovery? ETFs to Monitor as Morgan Stanley Targets S&P 500 at 7,800

Morgan Stanley's Forecast: Morgan Stanley has raised its year-end 2026 forecast for the S&P 500 to 7,800, citing stronger earnings and productivity gains from AI adoption, while UBS expects the index to reach 7,500 by the end of 2025.

Market Dynamics: The bank predicts a two-speed market rally, with mega-cap tech stocks leading the AI boom and small caps potentially outperforming as the Fed cuts rates and business confidence improves.

ETF Opportunities: Key ETFs like the Technology Select Sector SPDR Fund (XLK) and iShares Russell 2000 ETF (IWM) are positioned to benefit from the expected surge in capital expenditures and small-cap growth.

Equal-Weight Strategies: Equal-weight ETFs, such as Invesco S&P 500 Equal Weight ETF (RSP), may provide balanced exposure and reduce concentration risk, appealing to investors looking to capitalize on both tech leadership and small-cap recovery.

Trade with 70% Backtested Accuracy

Analyst Views on AAPL

About AAPL

About the author

- Market Share Battle: In 2025, the iPhone became the top-selling smartphone, capturing 20% of the market share, and despite facing competitive pressures, Apple maintained high profits, demonstrating its strong competitive edge in the premium market.

- New Product Launch: At the spring event, Apple introduced the iPhone 17e with a starting price of $599, maintaining this price despite rising memory and storage chip costs, thereby attracting more consumers and enhancing market competitiveness.

- Supply Chain Advantage: Apple's strategy of securing multi-year agreements with suppliers allows it to manage price fluctuations effectively, ensuring production capacity and maintaining stable product pricing in a high-cost environment, further solidifying its market position.

- Long-term Shareholder Benefits: The pricing strategy of the iPhone 17e will enhance Apple's competitiveness in price-sensitive markets, likely attracting more users into the Apple ecosystem, which will promote sales of subsequent products and services, ultimately benefiting shareholders in the long run.

- Industry Response: The Information Technology Industry Council (ITI) sent a letter to Defense Secretary Pete Hegseth expressing concerns over his designation of a U.S. company as a supply chain risk, indirectly referencing Anthropic, which could jeopardize its future government contracts.

- Contract Dispute: ITI emphasized that contract disputes should be resolved through ongoing negotiations or by selecting alternative suppliers via established procurement channels rather than through emergency measures like supply chain risk designations, which are typically reserved for entities identified as foreign adversaries, reflecting strong opposition to government actions.

- Procedural Protections: The letter referenced the Federal Acquisition Supply Chain Security Act of 2018 and the Federal Acquisition Security Council (FASCSA), highlighting the importance of due process for private companies, including notice and response opportunities before any risk designation is made, underscoring ITI's commitment to procedural fairness.

- Anthropic's Position: Anthropic expressed deep sadness over the decision in a statement, arguing that labeling it as a supply chain risk is unprecedented and historically reserved for U.S. adversaries, which could severely impact its relationship with the Defense Department and the broader tech industry.

- New CEO Transition: With Warren Buffett retiring on December 31, Greg Abel officially took over the day-to-day operations and the $319 billion investment portfolio of Berkshire Hathaway on January 1, marking a significant governance shift, as Abel vows to uphold Buffett's investment philosophy.

- Expansion of 'Forever' Holdings: In his first letter to shareholders, Abel announced the inclusion of Moody's and Apple into Berkshire's 'forever' holdings, with Moody's being the third-longest-held stock since 2000, boasting a 41% annual yield, showcasing its resilience in economic fluctuations.

- Valuation Considerations for Apple: While Abel considers Apple a long-term investment, the decision raises eyebrows given Buffett's sale of 75% of Berkshire's Apple shares prior to retirement, especially with Apple's current P/E ratio at 33.4, reflecting a commitment to value investing.

- Impact of Share Buybacks: Since 2013, Apple has repurchased over $841 billion in shares, reducing its outstanding shares by 44%, a strategy that has significantly boosted earnings per share, indicating that Abel's decisions may influence Berkshire's stake in Apple, reflecting sensitivity to market dynamics.

- iPhone 17e Pricing Strategy: Apple introduced the iPhone 17e at a starting price of $599 during its spring event, maintaining last year's price despite rising component costs, aiming to capture market share through price stability.

- Increased Storage Capacity: The new iPhone 17e features double the starting storage at 256GB, and despite higher costs, Apple opted not to raise prices, showcasing its supply chain management prowess that could attract more consumers.

- Competitive Market Advantage: This pricing strategy enhances Apple's competitiveness in price-sensitive markets like China, where it faces lower-priced rivals such as Vivo, Huawei, and Xiaomi, potentially aiding in regaining market share.

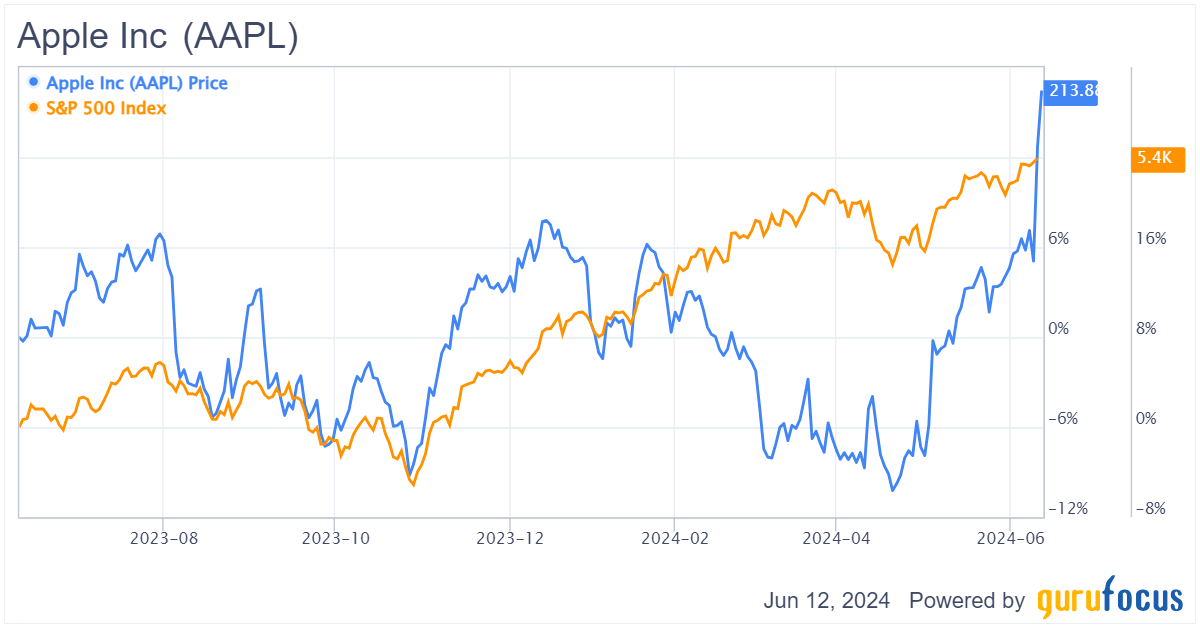

- Long-Term Shareholder Benefits: The iPhone serves as a starting point for customer relationships with Apple, likely driving sales of other products and services in the future, and while the stock has struggled recently, this strategy offers long-term growth potential for shareholders.

- Market Crash: The KOSPI Index plummeted over 12% on Wednesday, marking its worst single-day decline in history, reflecting a strong market reaction to the Middle East conflict, resulting in an 18% drop this week, the largest weekly loss since 2008, severely impacting investor confidence.

- High Concentration: More than one-third of the KOSPI Index is comprised of Samsung Electronics and SK Hynix, indicating a high level of market concentration, with these two stocks having surged 216% and 356% over the past year, respectively, but their recent sharp declines have significantly increased market risk.

- Retail Investor Exodus: The iShares MSCI South Korea ETF (EWY) experienced a record net outflow of $266 million in just one month, indicating a pessimistic outlook among retail investors, leading to the fund's highest trading volume ever on Tuesday, reflecting heightened market panic.

- Significant Economic Impact: As the 14th largest economy globally, South Korea's heavy reliance on fossil fuel imports from the Middle East means that the current market turmoil could have profound implications for its economic recovery and future growth prospects, especially amid increasing global economic uncertainty.

- Supply Chain Risk Warning: On March 2, Defense Secretary Pete Hegseth announced the designation of AI company Anthropic as a supply chain risk to national security, prompting strong opposition from the tech industry, particularly from ITI members including Nvidia and Google.

- Contract Dispute Resolution: The Information Technology Industry Council (ITI) stated in their letter that contract disputes should be resolved through negotiations or by the Department selecting alternative providers, rather than imposing supply chain risk designations, which could adversely affect U.S. companies.

- Historic Decision: Anthropic, awarded a $200 million DoD contract in July, had its request to ensure its technology wouldn't be used for autonomous weapons or mass surveillance rejected by the Pentagon, leading to this unprecedented risk designation, which ITI argues has never been applied to an American company before.

- Industry Reaction: OpenAI CEO Sam Altman remarked that enforcing the SCR designation on Anthropic would have detrimental effects on the industry and the country, highlighting the tech sector's significant concern and unease regarding government policies.