What Are Wall Street Analysts' Target Price for Charles Schwab Stock?

Company Overview: The Charles Schwab Corporation, based in Westlake, Texas, is a financial services firm with a market cap of $151.2 billion, offering wealth management, brokerage, banking, and asset management services. The company has shown strong performance in 2025, with an 11.9% year-to-date stock increase, despite slightly lagging behind the broader market over the past year.

Financial Performance and Analyst Ratings: Following impressive Q1 results, where net revenues surged 18.1% year-over-year, SCHW received a "Moderate Buy" consensus rating from analysts, with Goldman Sachs upgrading its rating to "Buy" and setting a price target of $100. The stock's mean price target suggests potential upside, indicating positive sentiment among analysts.

Trade with 70% Backtested Accuracy

Analyst Views on GS

About GS

About the author

- Generac Strong Demand: Generac's backup power solutions are experiencing surging demand from data centers, with a backlog for large diesel generators reaching $400 million, most of which is expected to ship this year, indicating the company's strong position in the rapidly growing energy market.

- Quanta Services Growth Outlook: Quanta Services' backlog has grown 27% year-over-year to $44 billion, with projected revenue guidance of $33.5 billion at the midpoint for this year, showcasing strong demand and market share expansion in the power infrastructure sector.

- RTX Stable Growth: RTX's backlog has reached $268 billion, with adjusted EPS guidance of $6.70 representing a 6.5% year-over-year growth, reflecting sustained demand and profitability in the aerospace and defense markets.

- Industry Trends: As artificial intelligence and electricity demand surge, industrial companies like Generac and Quanta Services benefit from market transformations, which are expected to drive stable growth in the coming years, attracting investor interest.

- Generac's Market Expansion: Generac is capitalizing on strong demand for backup power solutions, particularly in data centers, with a total addressable market for large diesel generators projected at $15 billion annually and a backlog of $400 million, indicating robust market potential.

- Quanta Services' Growth Outlook: Quanta Services has seen its backlog grow by 27% year-over-year to $44 billion, with a revenue guidance midpoint of $33.5 billion for this year, reflecting strong demand in power infrastructure and renewable energy, particularly from data centers and domestic manufacturing reshoring.

- RTX's Stable Revenue: RTX's backlog has reached $268 billion, with projected adjusted EPS of $6.70 representing a 6.5% year-over-year growth, supported by its diversified revenue streams and high-margin aftermarket services, providing long-term stability and growth potential.

- Overall Industry Stability: These industrial companies play a crucial role in modern energy infrastructure, and as electricity demand rises and technology advances, they not only provide stable support for the economy but also demonstrate long-term growth potential, attracting investor interest.

- Debt Financing Scale: Amazon is exploring a debt issuance that could raise at least $37 billion and potentially up to $42 billion, providing crucial funding for its investments in artificial intelligence and infrastructure.

- Diverse Issuance Structure: The debt offering may include as many as 11 different tranches, with maturities ranging from 2 to 50 years, demonstrating Amazon's flexibility and diversity in its financing strategy.

- Market Expectations: It is anticipated that U.S. bonds will dominate the issuance, raising about $25 billion to $30 billion, while another $10 billion may be raised through euro-denominated bonds issued across 8 tranches, further broadening its financing channels.

- Strong Underwriting Team: Major Wall Street banks, including Goldman Sachs, J.P. Morgan, and Citigroup, are expected to manage the debt issuance, indicating market confidence and support for Amazon's financing plans.

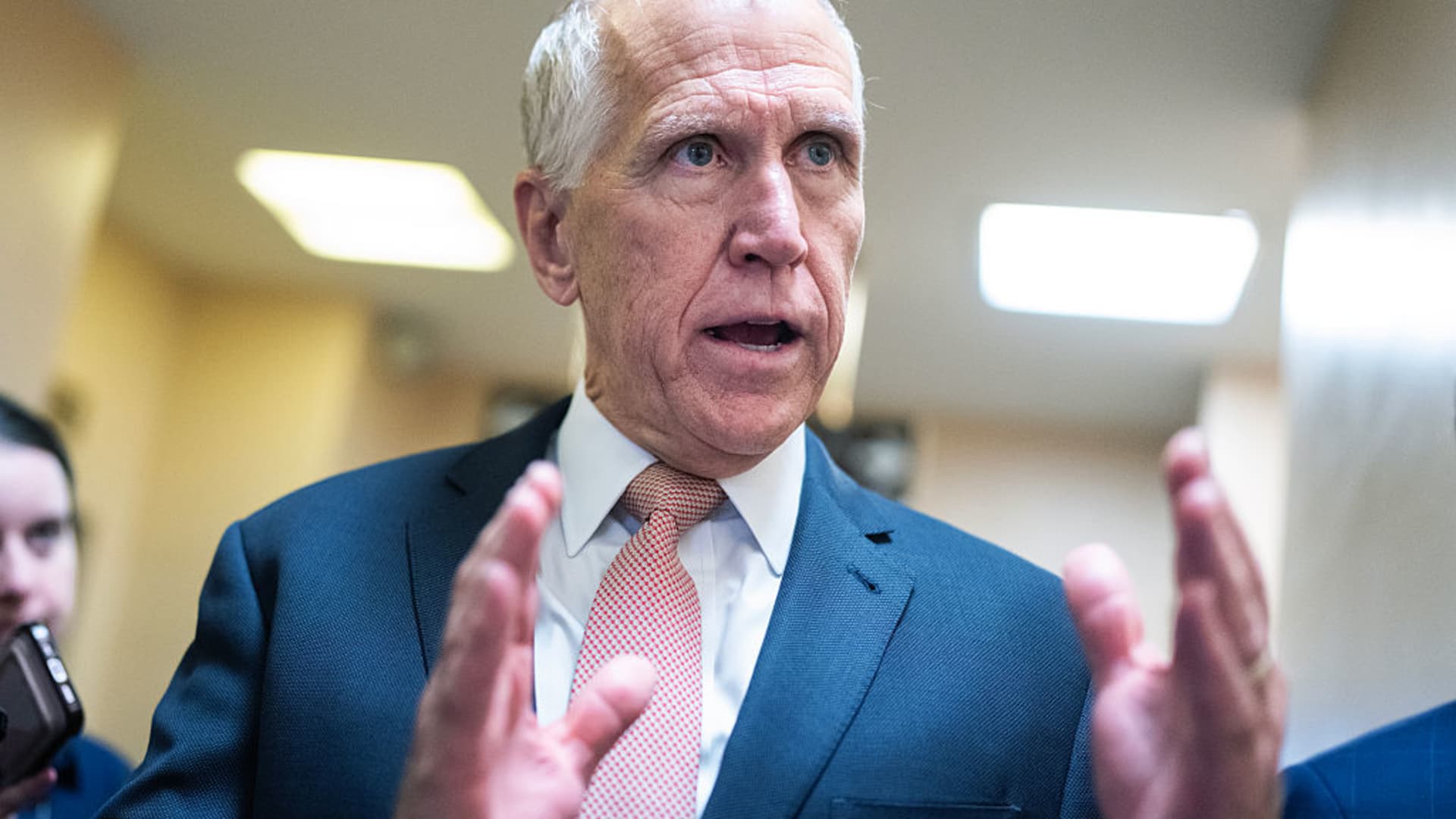

- Confirmation Block: Senator Thom Tillis from North Carolina stated that he will not vote for any Fed nominees, including Kevin Warsh, until the criminal investigation into Fed Chair Jerome Powell is resolved, indicating strong dissatisfaction with the Fed nomination process.

- Political Context: Tillis believes that the investigation into Powell is politically motivated, particularly due to Powell's refusal to cut interest rates as quickly as demanded by President Trump, complicating the confirmation of Fed nominees.

- Evaluation of Warsh: Despite expressing admiration for Warsh's skills, stating he is 'already impressed' with his work, Tillis remains firm on not voting, reflecting a lack of trust in the current Fed leadership.

- Process Over Personal: Tillis emphasized that this is not about personal issues but rather about procedural integrity, indicating that he prioritizes the completeness and transparency of the nomination process, which could impact future Fed nominations and policy directions.

Oil Futures Decline: U.S. and Brent crude oil prices fell by $1.2 a barrel, extending losses in the market.

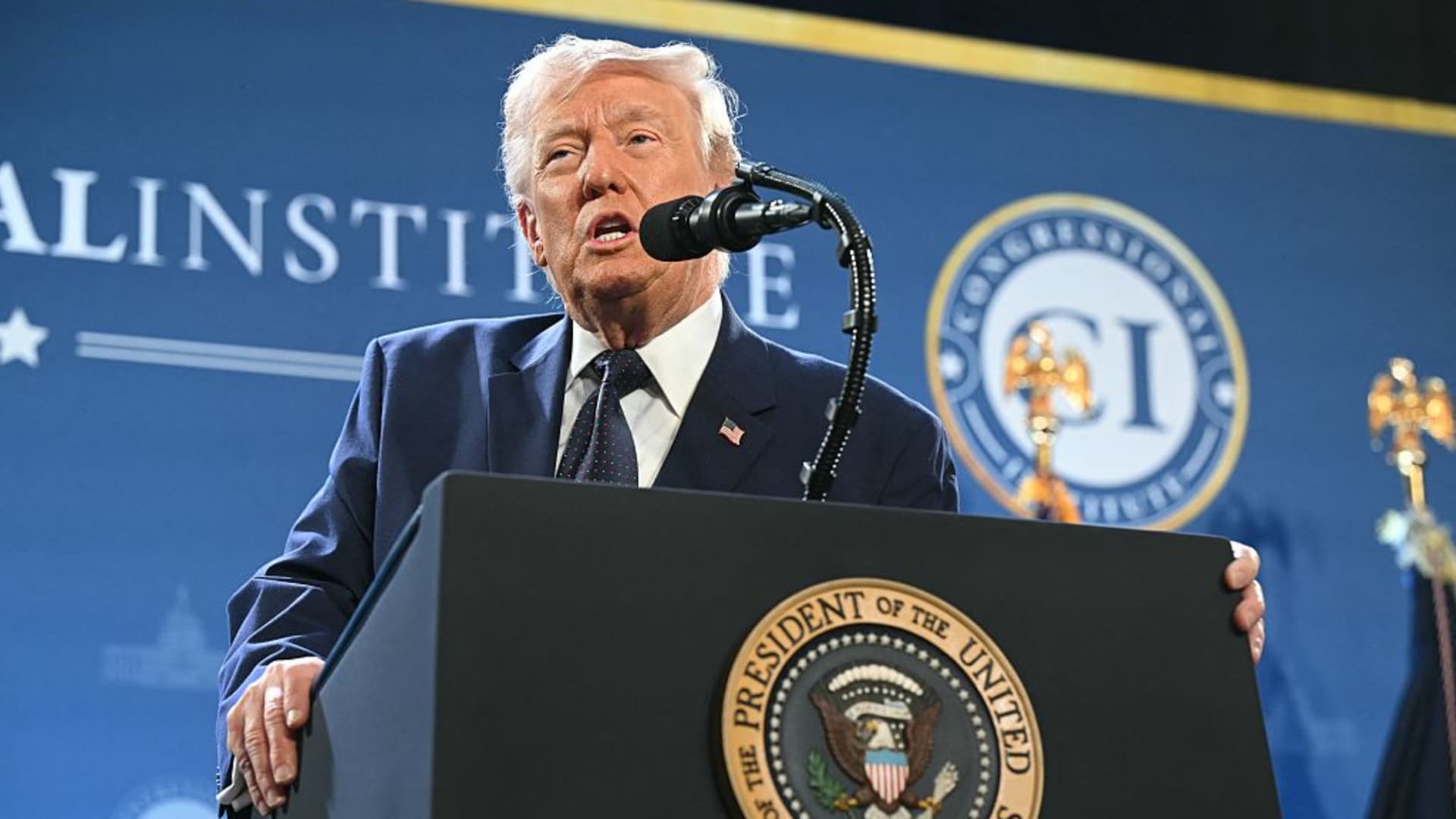

Trump's Prediction: Former President Donald Trump suggested that the ongoing war with Iran could come to an end soon.

- Oil Price Fluctuations: U.S. benchmark WTI crude prices have fallen below $90 a barrel, despite being up over 50% year-to-date, indicating market optimism regarding improved U.S.-Iran relations, yet geopolitical risks continue to loom over oil prices.

- Tech Stock Rating Changes: Intuit was upgraded to buy from hold by Rothschild & Co Redburn, with its stock rising over 30% since late February, although it remains down 28.5% for the year, reflecting a recovery in market confidence in its software products.

- Cybersecurity Stock Bounce: Morgan Stanley upgraded CrowdStrike from hold to buy, with its stock up over 20% from last month's low, highlighting the positive impact of AI technology on the cybersecurity sector and indicating optimistic market expectations for future growth.

- Hewlett Packard Enterprise's Positive Outlook: Despite memory cost pressures, the company raised its full-year earnings outlook, with reported quarterly revenues slightly below expectations but gross margins and adjusted EPS exceeding forecasts, demonstrating strong demand in the data center buildout.