Video: AMD Shares Climb Following Analyst Day, IBM Sees Increase from Quantum Chip Progress

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Nov 12 2025

0mins

Should l Buy AMD?

- YouTube Launch: The Fly has expanded its stock market reporting by launching a YouTube channel.

- Market Insights: The channel provides insights on market openings, stock movements, and the reasons behind them.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy AMD?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on AMD

Wall Street analysts forecast AMD stock price to rise

33 Analyst Rating

25 Buy

8 Hold

0 Sell

Strong Buy

Current: 200.210

Low

210.00

Averages

289.13

High

377.00

Current: 200.210

Low

210.00

Averages

289.13

High

377.00

About AMD

Advanced Micro Devices, Inc. is a global semiconductor company. The Company is focused on high-performance computing, graphics and visualization technologies. Its segments include Data Center, Client and Gaming, and Embedded. Data Center segment includes artificial intelligence (AI) accelerators, microprocessors (CPUs) for servers, graphics processing units (GPUs), accelerated processing units (APUs), data processing units (DPUs), Field Programmable Gate Arrays (FPGAs), smart network interface Cards (SmartNICs) and Adaptive system-on-Chip (SoC) products for data centers. Client and Gaming segment includes CPUs, APUs, chipsets for desktops and notebooks, discrete GPUs, and semi-custom SoC products and development services. Embedded segment includes embedded CPUs, GPUs, APUs, FPGAs, system on modules (SOMs), and Adaptive SoC products. It markets and sells its products under the AMD trademark. Its products include AMD EPYC, AMD Ryzen, AMD Ryzen PRO, Virtex UltraScale+, and others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Holding Recommendation: Motley Fool analysts suggest current shareholders should continue holding Nvidia, citing its strong market position despite competitive pressures, with technological advantages and demand supporting stock price stability.

- AMD Investment Potential: Analysts believe AMD's current valuation is more attractive, with expectations of further market share expansion, particularly in high-performance computing and data centers, which could lead to significant revenue growth.

- Rising Intel Competitiveness: Despite past challenges, analysts note that Intel is emerging as a surprising competitor, potentially regaining market share through new products and technological innovations, impacting the industry landscape.

- Market Dynamics Analysis: The stock price data mentioned reflects market conditions as of February 27, 2026, highlighting performance differences between Nvidia and AMD, prompting investors to monitor these dynamics for informed decision-making.

See More

- Collaborative Manufacturing Opportunity: Flex has initiated U.S.-based production of AMD's Instinct MI355X GPU platforms at its Austin, Texas facility, with a volume ramp expected next quarter to meet the growing demand for AI in data centers.

- Technical Validation and Testing: The partnership involves assembling eight AMD Instinct GPUs and essential components into a high-density system design, which will undergo rigorous testing and validation, thereby reinforcing Flex's manufacturing position in advanced AI infrastructure.

- Market Performance Analysis: Flex shares are currently priced at $64.02, trading 4.5% below the 20-day simple moving average, indicating a bearish trend in the short term, yet the stock has increased approximately 25% over the past 12 months, suggesting long-term growth potential.

- Future Earnings Outlook: Flex is set to report earnings on May 6, 2026, with an estimated EPS of $0.83 and projected revenue of $6.93 billion, reflecting strong growth expectations in the AI sector.

See More

- Performance Issues: Anthropic's Claude Opus 4.6 model experienced 'elevated errors' on Monday, yet it maintained its position as the most popular free app on Apple's App Store, indicating strong user demand despite technical challenges.

- Fix in Progress: An update at 10:49 AM ET confirmed that the issues with Opus 4.6 were identified and a fix was underway, reflecting the company's commitment to user experience and responsiveness.

- Pentagon Contract Tensions: The $200 million contract with the Pentagon, effective since July, has faced strain as Anthropic refused to comply with government demands regarding the use of its AI models, potentially jeopardizing future business relations.

- Government Ban: President Trump ordered all U.S. government agencies to 'immediately cease' using Anthropic's technology, with the Defense Secretary labeling the company a 'supply-chain risk to national security', which could significantly impact Anthropic's market position and future growth prospects.

See More

- Brand Consolidation: Alibaba has unified its large model brand under 'Qwen', with the app serving as its flagship product, aiming to strengthen its competitive position in the rapidly growing AI market, despite a 2.57% drop in stock price.

- User Engagement: During the Lunar New Year, users placed nearly 200 million orders through the 'Qwen' app, demonstrating strong consumer appeal and further driving Alibaba's market share in the AI sector.

- Low-Cost AI Tools: Alibaba Cloud launched a new AI coding platform providing low-cost access to various leading Chinese AI models, with the basic version priced at 7.9 yuan for the first month, aimed at attracting more developers and boosting cloud service revenue.

- Chip Innovation: Alibaba's T-Head introduced the Zhenwu 810E chip, comparable in performance to Nvidia's H20, deployed in multiple 10,000-card clusters and utilized by over 400 customers, including State Grid, showcasing its robust capabilities in AI training and inference.

See More

- Processor Launch: AMD unveiled the Ryzen AI 400 Series and Ryzen AI PRO 400 Series desktop processors at Mobile World Congress 2026, aiming to provide broader options for AI-capable PCs and enabling on-device AI software execution, particularly for demanding engineering and design workloads.

- Transformation to Intelligent Assistants: Senior VP Jack Huynh stated that desktop PCs are evolving from mere tools to intelligent assistants, with the Ryzen AI 400 Series being touted as the world's first designed to support new Copilot+ experiences on desktops, highlighting AMD's commitment to enhancing on-device AI capabilities.

- Commercial Expansion and OEM Partnerships: The Ryzen AI PRO 400 Series will extend into mobile workstations, further promoting Copilot+ PC features beyond notebooks, with shipments expected to begin in Q2 2026 through OEM partners like HP and Lenovo, indicating AMD's proactive approach in the commercial market.

- Market Pressure and Stock Fluctuations: AMD's stock fell 2.43% to $195.35 in premarket trading on Monday, driven by investor reactions to Nvidia's earnings and ongoing concerns about AI profitability, reflecting market uncertainties regarding AI valuations and heavy capital expenditures.

See More

- 6G Development Collaboration: Nvidia is collaborating with telecom and technology organizations to advance 6G development, aiming to enhance future wireless systems through open, secure AI-native network designs to meet the demands of increasingly complex machine connectivity.

- AI-RAN Architecture: The company emphasizes that AI-RAN (Artificial Intelligence Radio Access Network) will enable networks to improve continuously through software updates and embedded intelligence, reflecting a necessary shift from traditional network designs to address security and trust challenges.

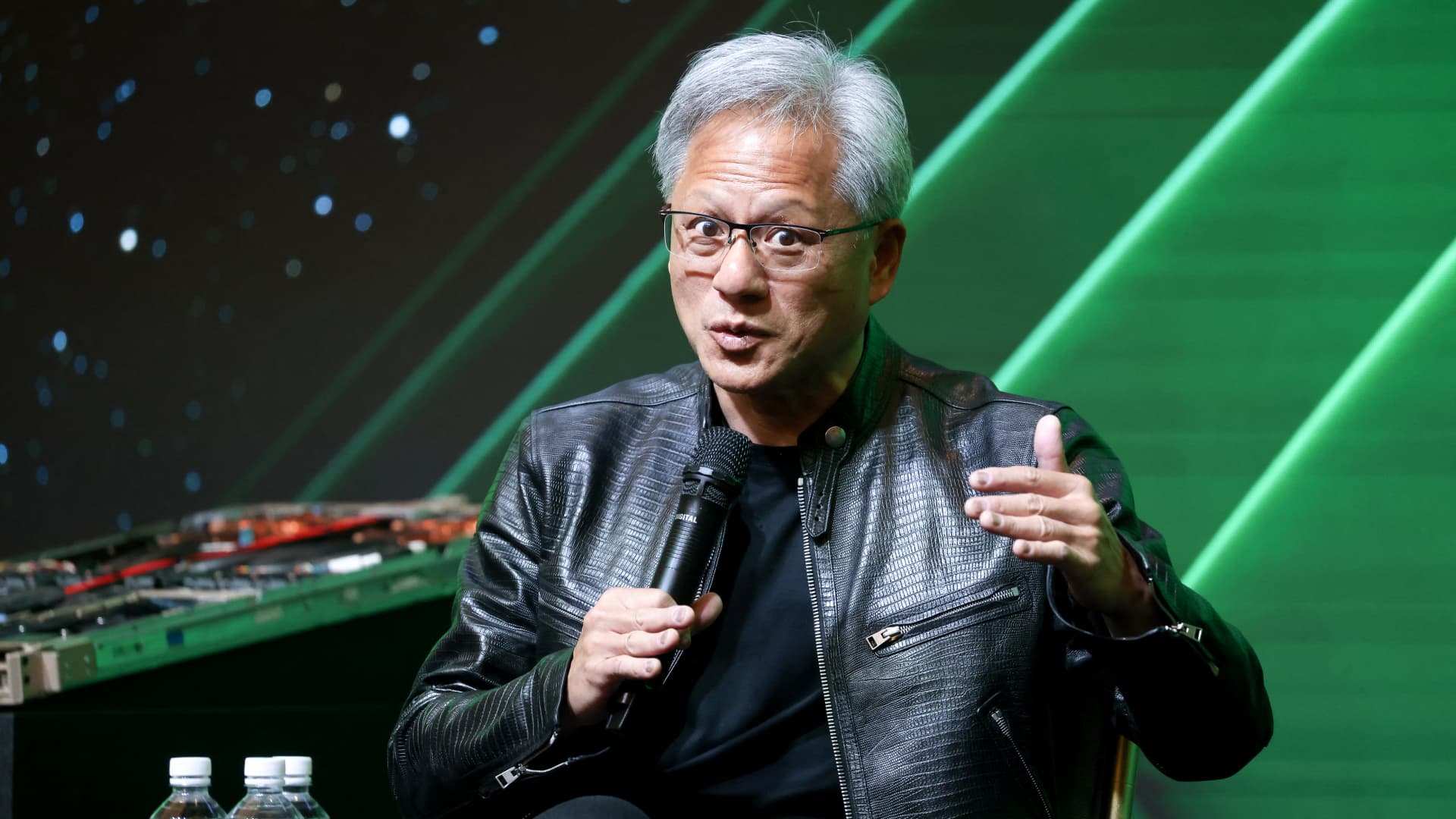

- Industry Leaders Coalition: Nvidia's founder and CEO Jensen Huang stated that AI is redefining computing and driving the largest infrastructure buildout in human history, with telecommunications being the next beneficiary, highlighting the company's pivotal role in transforming global telecom networks.

- Market Reaction: Despite Nvidia's earnings beating expectations, semiconductor and big tech stocks continued to slide on Monday due to lingering concerns about AI profitability and broader macro pressures, with Nvidia's stock down 1.24% to $175.00 in premarket trading.

See More