Trump, 'Inflation President' Of The Free World—Investors Run For Cover

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jul 30 2025

0mins

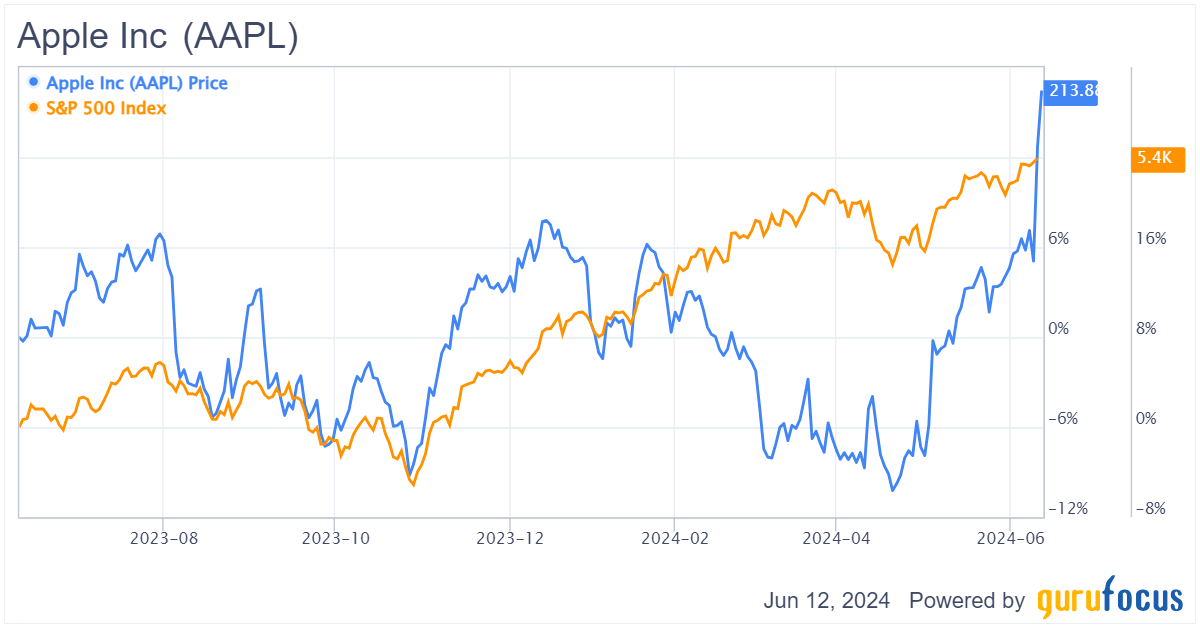

Should l Buy AAPL?

Source: Benzinga

Trump's Economic Policies and Inflation: Peter Schiff labels President Trump as the "Inflation President," highlighting his return to inflationary policies such as tariffs, deficit spending, and pressure on the Federal Reserve to cut rates, which are now occurring amid rising inflation.

Market Reactions and Investment Shifts: Investors are adjusting their portfolios in response to potential inflation driven by Trump's policies, with increased interest in TIPS, gold, energy, and commodities, while companies reliant on Chinese manufacturing may face supply chain risks due to escalating tariffs.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy AAPL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on AAPL

Wall Street analysts forecast AAPL stock price to rise

27 Analyst Rating

17 Buy

9 Hold

1 Sell

Moderate Buy

Current: 263.750

Low

239.00

Averages

306.89

High

350.00

Current: 263.750

Low

239.00

Averages

306.89

High

350.00

About AAPL

Apple Inc. designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. Its product categories include iPhone, Mac, iPad, and Wearables, Home and Accessories. Its software platforms include iOS, iPadOS, macOS, watchOS, visionOS, and tvOS. Its services include advertising, AppleCare, cloud services, digital content and payment services. The Company operates various platforms, including the App Store, that allow customers to discover and download applications and digital content, such as books, music, video, games and podcasts. It also offers digital content through subscription-based services, including Apple Arcade, Apple Fitness+, Apple Music, Apple News+, and Apple TV+. Its products include iPhone 16 Pro, iPhone 16, iPhone 15, iPhone 14, iPhone SE, MacBook Air, MacBook Pro, iMac, Mac mini, Mac Studio, Mac Pro, iPad Pro, iPad Air, AirPods, AirPods Pro, AirPods Max, Apple TV, Apple Vision Pro and others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Market Share Battle: In 2025, the iPhone became the top-selling smartphone, capturing 20% of the market share, and despite facing competitive pressures, Apple maintained high profits, demonstrating its strong competitive edge in the premium market.

- New Product Launch: At the spring event, Apple introduced the iPhone 17e with a starting price of $599, maintaining this price despite rising memory and storage chip costs, thereby attracting more consumers and enhancing market competitiveness.

- Supply Chain Advantage: Apple's strategy of securing multi-year agreements with suppliers allows it to manage price fluctuations effectively, ensuring production capacity and maintaining stable product pricing in a high-cost environment, further solidifying its market position.

- Long-term Shareholder Benefits: The pricing strategy of the iPhone 17e will enhance Apple's competitiveness in price-sensitive markets, likely attracting more users into the Apple ecosystem, which will promote sales of subsequent products and services, ultimately benefiting shareholders in the long run.

See More

- Product Launch Highlights: Apple's three-day product launch featured the $599 entry-level MacBook Neo, which, while affordable, underscores a broader artificial intelligence strategy that signals the company's commitment to hardware transformation.

- AI Performance Boost: The new MacBook Pro, powered by M5 Pro and M5 Max architectures, boasts up to four times the AI performance of the previous generation and up to eight times that of M1 models, enabling professionals to run large language models on-device, thus enhancing productivity.

- Sales Growth Driver: Apple's fiscal 2026 first-quarter revenue surged 16% year-over-year to $143.8 billion, with iPhone revenue spiking 23% to $85.3 billion, indicating strong market demand that will likely accelerate sales growth further with the new product launches.

- Upgrade Cycle Potential: With over 2.5 billion active devices, Apple's new AI-ready hardware could trigger a larger-than-usual upgrade cycle, significantly impacting its financials, especially as its services segment, which typically enjoys a gross margin around 75%, benefits from increased device sales.

See More

- Accelerated Revenue Growth: Apple reported a 16% year-over-year revenue increase in Q1 FY2026, reaching a record $143.8 billion, significantly up from 8% growth in Q4 FY2025, indicating strong market demand and product appeal.

- New Product Launch: The introduction of the new MacBook Pro lineup, powered by M5 Pro and M5 Max chips, enhances AI performance up to four times compared to previous generations, enabling professionals to run large language models and solidifying Apple's leadership in the premium market.

- Hardware Upgrade Cycle: With over 2.5 billion active devices, Apple is poised for a significant hardware upgrade cycle that could drive sales growth, particularly as consumer and business demand for new devices rises in an AI-driven technological landscape.

- Service Revenue Potential: The sales of new devices not only boost hardware revenue but also enhance Apple's services segment, which typically commands a gross margin around 75%, indicating that the long-term value of these devices far exceeds their sale price.

See More

- Strong Earnings Report: Broadcom's fiscal Q1 2026 revenue reached $19.31 billion, surpassing the $19.18 billion consensus forecast with a 29% year-over-year increase, indicating robust growth potential in the AI chip sector.

- Improved Profitability: Adjusted earnings per share (EPS) rose 28% to $2.05, exceeding expectations of $2.03, while adjusted EBITDA grew 30% to $13.13 billion, further boosting investor confidence.

- Optimistic Future Outlook: Broadcom projects AI chip revenue to exceed $100 billion by 2027, having secured the necessary supply chain, reflecting strong confidence in future demand, particularly with a positive relationship with OpenAI.

- Shareholder Return Plan: The company announced a newly authorized $10 billion share repurchase program, which, combined with strong financial performance and an optimistic outlook, enhances market confidence in Broadcom's stock.

See More

- Surge in AI Revenue: Broadcom reported a more than 100% year-over-year increase in AI revenue for Q1, reaching $8.4 billion, demonstrating the company's robust performance amid the AI boom, which is expected to drive sustained future growth.

- Strong Earnings Guidance: The company achieved a 29% increase in total sales to $19.3 billion in Q1, surpassing analyst expectations, with CEO Hock Tan projecting AI semiconductor revenue of $10.2 billion for the current quarter, further solidifying its market leadership.

- Rising Customer Demand: As large customers increasingly require custom silicon, Broadcom has secured the supply chain necessary to meet its 2027 sales targets, indicating strategic readiness to fulfill market demands.

- Key Customer Collaborations: Broadcom is assisting six major clients, including Google, Meta, Anthropic, and OpenAI, in chip design, which is expected to accelerate the next phase of custom AI deployment and further drive company growth.

See More

- GDP Growth Target: China has set its GDP growth target for 2026 at 4.5% to 5%, marking the lowest target on record since the early 1990s, indicating significant challenges for economic recovery amid persistent deflationary pressures and trade tensions with the U.S.

- Defense Spending Increase: Defense spending is projected to rise by 7%, the slowest increase since 2021, although analysts believe the official figures may be understated, which could impact national security and military modernization efforts.

- Data Center Attack: Amazon's data center in Bahrain was targeted by Iran for supporting the U.S. military, with damage reported from a drone strike, potentially affecting Amazon's cloud computing operations in the Middle East in the short term.

- Global Tariff Increase: U.S. Treasury Secretary announced that global tariffs will rise from 10% to 15%, with expectations that tariff rates will return to pre-Supreme Court ruling levels by August, which will have profound implications for international trade and the cost structures of U.S. businesses.

See More