Tesla's Sharp Drop Sends Shockwaves Through These ETFs

Tesla's Stock Decline: Tesla Inc.'s stock has dropped approximately 40% since late 2024, impacting various ETFs with significant Tesla exposure due to declining European sales and concerns over CEO Elon Musk's leadership. Leveraged ETFs have been particularly affected, with some losing over 80% since December.

Market Outlook for Tesla: Analysts predict limited catalysts for a turnaround in Tesla's performance, citing high stock valuation and increasing competition, particularly from China's BYD Co. Investors are cautious as options traders prepare for further declines amid the current market pressures.

Trade with 70% Backtested Accuracy

Analyst Views on XLY

About the author

Morgan Stanley's Price Target Update: Morgan Stanley raised its price target on Dutch Bros to $85 from $82, maintaining an overweight rating, while RBC Capital lowered its target to $75 from $80 but kept an outperform rating.

Strong Q4 Performance: Dutch Bros reported Q4 revenues of $443.6 million, exceeding expectations of $424.9 million, and demonstrated a 29.4% increase in revenue year-over-year.

Analyst Ratings and Market Sentiment: Analysts have varied ratings on Dutch Bros, with some maintaining buy ratings and others lowering price targets, reflecting a mix of optimism and caution in the market.

Future Projections: Dutch Bros announced plans for significant capital expenditures in 2026, projecting revenues between $2 billion and $2.03 billion, with same-store sales growth estimated at 3% to 5%.

Consumer Discretionary Performance: Consumer discretionary stocks have seen minimal growth, with only a 2% increase over the past year as indicated by the Consumer Discretionary Select Sector SPDR ETF.

Comparison with Other S&P Sectors: Among the 11 major S&P sectors, consumer discretionary stocks performed poorly, with only financials showing worse performance, remaining unchanged over the same period.

S&P 500 Growth: In contrast, the S&P 500 has experienced a more robust gain of 12% over the past year, highlighting the underperformance of consumer discretionary and financial sectors.

Market Trends: The overall market trends suggest a challenging environment for consumer discretionary stocks, reflecting broader economic conditions affecting consumer spending.

- Market Dynamics: The stock market is characterized by rapid changes, where previously popular stocks can quickly lose favor.

- Investor Strategy: Investors are increasingly looking back at former stock picks to identify potential opportunities for profit.

- Stock Price Prediction: Predicting stock prices is inherently challenging due to market volatility and numerous influencing factors.

- Weather Pattern Prediction: Forecasting weather patterns proves to be even more complex, highlighting the difficulties in making accurate predictions in both fields.

Market Dynamics: Stock markets are continuously changing, with past stock picks potentially becoming new investment opportunities as trends evolve.

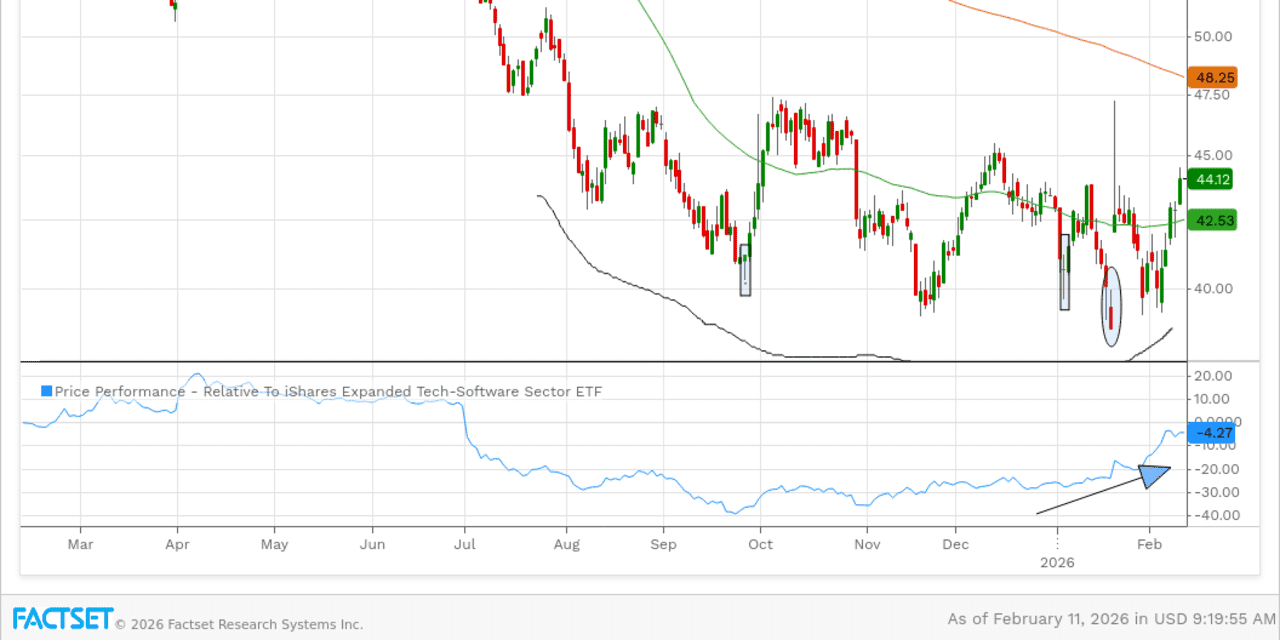

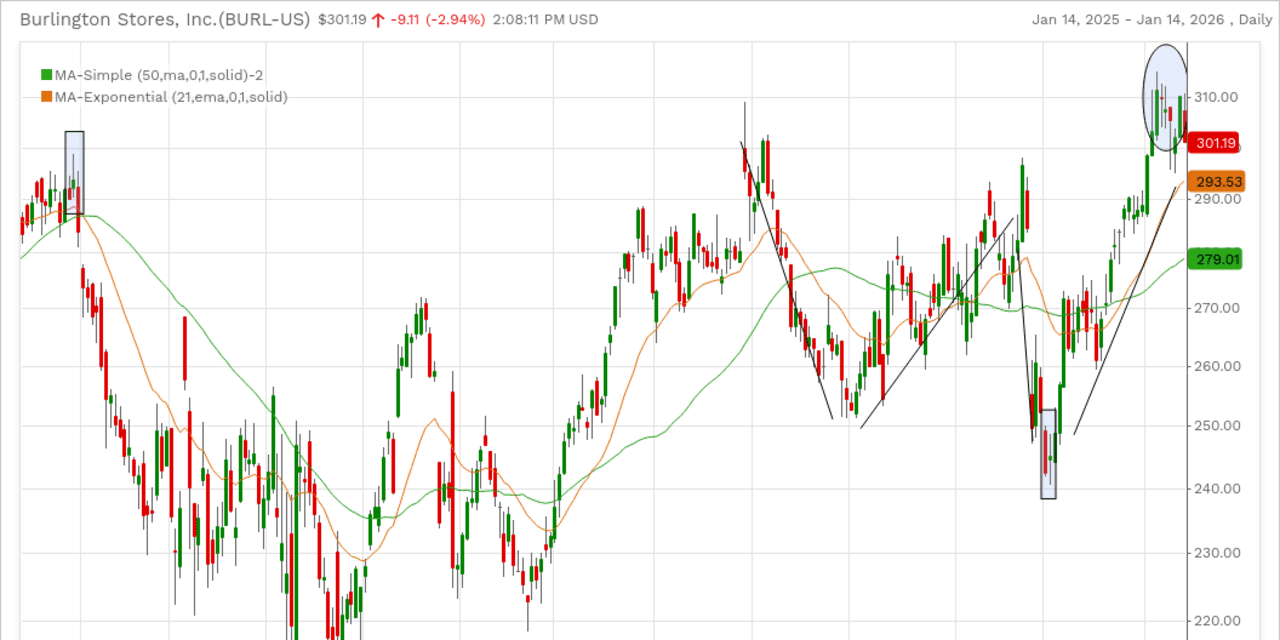

Technical Reset: Many previously strong stocks are undergoing technical resets after consolidations or pullbacks, indicating potential for renewed growth.

Investor Patience: Investors who are patient may find rewarding setups in stocks that are beginning to show signs of recovery.

Revisiting Stocks: It is beneficial to revisit earlier stock selections that may now present fresh opportunities due to recent market adjustments.