S&P 500 $1 Trillion Club Set to Expand to 18 Companies in Five Years

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 06 2026

0mins

Should l Buy AAPL?

Source: Fool

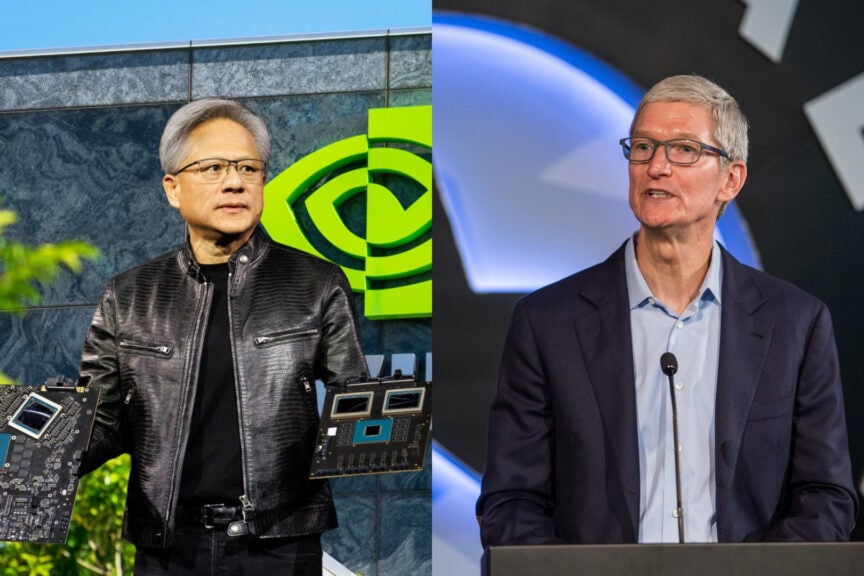

- Expansion of the Trillion Club: Since Apple became the first company to surpass a $1 trillion market cap in 2018, the S&P 500's trillion-dollar club has grown from one to nine members, with projections indicating it could expand to 18 companies in the next five years, highlighting the robust growth potential of tech stocks.

- Increased Market Concentration: Currently, about 20 companies account for 50% of the S&P 500 index, with Nvidia, Apple, Alphabet, and Microsoft collectively making up over 25%, indicating a deepening reliance on a few tech giants, which could impact portfolio risk management.

- Potential New Members: Companies like Eli Lilly, Walmart, and JPMorgan Chase are expected to join the trillion-dollar club by 2030, with Eli Lilly having briefly crossed the threshold, showcasing its strong market performance and growth potential.

- IPO Impact: The potential IPOs of high-profile private companies like SpaceX and OpenAI could significantly alter the composition of the S&P 500, further driving the expansion of the trillion-dollar club, prompting investors to focus on the future fundamentals of these companies.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy AAPL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on AAPL

Wall Street analysts forecast AAPL stock price to rise

27 Analyst Rating

17 Buy

9 Hold

1 Sell

Moderate Buy

Current: 264.720

Low

239.00

Averages

306.89

High

350.00

Current: 264.720

Low

239.00

Averages

306.89

High

350.00

About AAPL

Apple Inc. designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. Its product categories include iPhone, Mac, iPad, and Wearables, Home and Accessories. Its software platforms include iOS, iPadOS, macOS, watchOS, visionOS, and tvOS. Its services include advertising, AppleCare, cloud services, digital content and payment services. The Company operates various platforms, including the App Store, that allow customers to discover and download applications and digital content, such as books, music, video, games and podcasts. It also offers digital content through subscription-based services, including Apple Arcade, Apple Fitness+, Apple Music, Apple News+, and Apple TV+. Its products include iPhone 16 Pro, iPhone 16, iPhone 15, iPhone 14, iPhone SE, MacBook Air, MacBook Pro, iMac, Mac mini, Mac Studio, Mac Pro, iPad Pro, iPad Air, AirPods, AirPods Pro, AirPods Max, Apple TV, Apple Vision Pro and others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Significant Investment Returns: Over the past decade, an investment of $10,000 in Apple has grown to approximately $105,000, showcasing its strong growth potential, although future challenges may arise.

- Strong iPhone Sales: In the last three months of 2025, Apple reported a 23% increase in iPhone sales, reaching $85.3 billion, indicating that consumer anticipation for new AI features is driving sales.

- Insufficient Growth Drivers: Despite the surge in iPhone sales, Apple's overall revenue grew only 6% in the most recent fiscal year, indicating a lack of compelling catalysts that could sustain future growth and potentially impact stock performance.

- High Market Valuation: With a market cap of around $4 trillion and a current stock price of $260.76, trading at 33 times earnings, Apple's excellent financial performance may not translate into a doubling of stock value in the near future.

See More

- Beta Rollout: William Shatner shared updates on the X Money service's beta rollout, which offers a 6% annual percentage yield (APY), aiming to attract users while raising funds for his charity.

- Welcome Bonus: New users will receive a $25 welcome gift upon signing up for X Money, a strategy that not only enhances user registration appeal but may also promote long-term engagement.

- Feature Offerings: X Money will introduce a metal debit card with cashback features, allowing users to personalize it with their official X handle, and it will incur no foreign transaction fees, significantly enhancing user experience.

- X Chat App: The X team is launching a standalone X Chat app, with the first 1,000 users gaining access via TestFlight, marking a significant step towards achieving the goal of an

See More

- Impressive Performance: Nvidia achieved a record $215.94 billion in revenue for fiscal 2026, with net income reaching $120.07 billion, demonstrating strong profitability and market demand, and is expected to continue leading the 'Magnificent Seven'.

- Robust Cash Flow: The company generated $96.58 billion in free cash flow, sufficient to cover $41.1 billion in stock repurchases and dividends, indicating a healthy financial position that supports future investments and growth.

- Increased R&D Investment: Nvidia launched the Blackwell architecture in March 2024 and unveiled the Rubin platform in January 2023, showcasing its ongoing innovation in AI aimed at eliminating workload bottlenecks and enhancing market competitiveness.

- Expanding Customer Base: By investing in Anthropic and OpenAI, Nvidia is broadening its customer base and is expected to benefit from the growing demand for AI, solidifying its leadership position in the data center market.

See More

- Strong Product Launches: Apple has unveiled a range of new products over the past two days, including the iPhone 17e and M4-powered iPad Air, showcasing its robust positioning in both budget and high-end markets, which is expected to further drive sales growth.

- Significant Revenue Growth: In Q1 of fiscal 2026, Apple's revenue surged 16% year-over-year to a record $143.8 billion, with iPhone sales jumping 23% and accounting for 59% of total revenue, indicating strong market demand.

- Robust Cash Flow: Apple generated $53.9 billion in operating cash flow during Q1, enabling approximately $25 billion in share repurchases while also paying dividends and maintaining a low payout ratio of 13%, reflecting its strong financial health.

- Optimistic Outlook: Management anticipates revenue growth of 13% to 16% in Q2, and despite a price-to-earnings ratio of 33, Apple's high-quality business and strong brand loyalty make its stock attractive, even amid regulatory risks and uncertainties in U.S.-China trade relations.

See More

- Strong Financial Performance: Nvidia achieved a record $215.94 billion in revenue for fiscal 2026, with net income reaching $120.07 billion, showcasing robust profitability and cash flow that solidifies its leadership in the semiconductor industry.

- Shareholder Return Strategy: The company allocated $41.1 billion for stock repurchases and dividends in fiscal 2026, indicating its strong cash flow capabilities and commitment to shareholders, which is expected to boost investor confidence.

- AI Market Potential: Nvidia is targeting $78 billion in revenue for Q1 fiscal 2027 with a gross margin of 75%, representing a significant 76.9% year-over-year increase, reflecting its market leadership amid surging AI compute demand.

- Strategic Investment Expansion: Nvidia announced a $10 billion investment in Anthropic and is close to investing $30 billion in OpenAI, demonstrating its strategic positioning in the AI sector and commitment to emerging technologies, further broadening its customer base.

See More

- Product Refresh: Apple has introduced an updated Studio Display, retaining its 27-inch 5K Retina panel with 600 nits brightness while adding a 12MP Center Stage camera, enhancing user experience and expected to boost competitiveness in the high-end monitor market.

- Technical Specifications Upgrade: The new Studio Display XDR replaces the Pro Display XDR, featuring a 27-inch 5K Retina XDR panel with 2,304 local dimming zones and supporting up to 2,000 nits peak HDR brightness, significantly improving image quality to meet professional users' demands.

- Enhanced Connectivity: The updated Studio Display features Thunderbolt 3 connectivity, allowing daisy-chaining of up to four displays and providing up to 96W charging power, enhancing device flexibility and compatibility to suit various work environments.

- Market Pricing and Pre-order: The Studio Display starts at $1,599, while the Studio Display XDR starts at $3,299, with pre-orders beginning on March 4, expected to attract professional creators and users in the medical imaging field, further expanding Apple's share in the high-end monitor market.

See More