Health Care Select Sector SPDR: Key Turning Points

Pivot Points for Health Care Select Sector SPDR: The pivot high is set at $137.11 and the pivot low at $135.70, calculated using the DeMark method.

Market Sentiment Indicators: A breakout above the pivot high is considered bullish, while a breakdown below the pivot low is seen as bearish.

Technical Analysis Method: The DeMark method is used to determine significant price levels that can influence trading decisions.

Relevance of Data: The information is based on data available up to October 2023, indicating its timeliness in market analysis.

Trade with 70% Backtested Accuracy

Analyst Views on XLV

About the author

- Investment Strategy: Investors are encouraged to shift their focus towards defensive stocks for better stability in uncertain markets.

- Sector Shift: The recommended approach is to sell off consumer staples and invest in the healthcare sector.

Market Volatility: The U.S. stock market has experienced an unstable start to the year, with heightened volatility and investor pressure, particularly affecting sectors like technology and consumer staples.

Defensive Investment Strategies: Investors are increasingly seeking defensive strategies, focusing on sectors such as health care and consumer staples, which have historically performed well during market downturns.

Top Investment Options: Five stocks and ETFs are highlighted as potential investments for those looking to shield their portfolios from volatility, emphasizing the importance of resilience and income generation.

Consumer Staples Resilience: Companies in the consumer staples sector, like Coca-Cola and Johnson & Johnson, are noted for their consistent demand and dividend reliability, making them attractive options for income-focused investors.

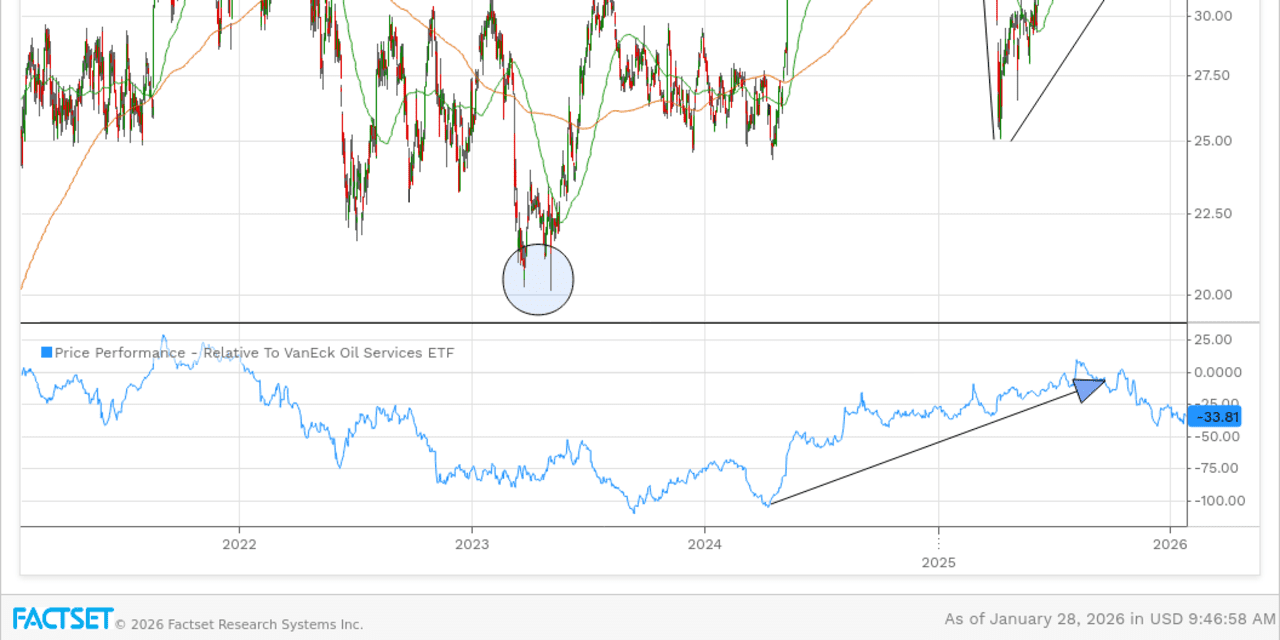

- Pharmaceutical Stocks Performance: Pharmaceutical stocks have recently reached new highs in the market.

- Earnings Potential: Upcoming earnings reports are expected to further boost the stock prices of pharmaceutical companies.

- Market Opportunities: Investors may find renewed opportunities in previously recommended stocks from healthcare, oil services, and consumer staples sectors.

- Signs of Momentum: These stocks are showing signs of renewed momentum, suggesting potential upside for investors.

- Sector Rotation: The leadership in these sectors has already rotated, indicating a shift in market dynamics.

- Investor Consideration: Investors are encouraged to take a fresh look at these stocks as they may present attractive investment options.

Impact of a Single Company: A single company's performance can significantly influence the price-weighted Dow Jones Industrial Average.

Price-Weighted Index: The Dow Jones Industrial Average is structured as a price-weighted index, meaning that companies with higher stock prices have a greater impact on the index's movements.

Impact of a Single Company: A single company's performance can significantly influence the price-weighted Dow Jones Industrial Average.

Price-Weighted Index Explanation: The Dow Jones Industrial Average is a price-weighted index, meaning that companies with higher stock prices have a greater impact on the index's overall movement.