Copper Stocks On Shaky Ground, JPMorgan Analysts Say: Tariffs, DeepSeek Cloud Outlook

Copper Market Challenges: JPMorgan analysts indicate that copper-exposed stocks are under pressure due to trade tariffs, geopolitical risks, and fears of AI disruption, maintaining an Underweight rating on Antofagasta PLC and Boliden AB while keeping Anglo American PLC at Neutral with a Negative Catalyst Watch.

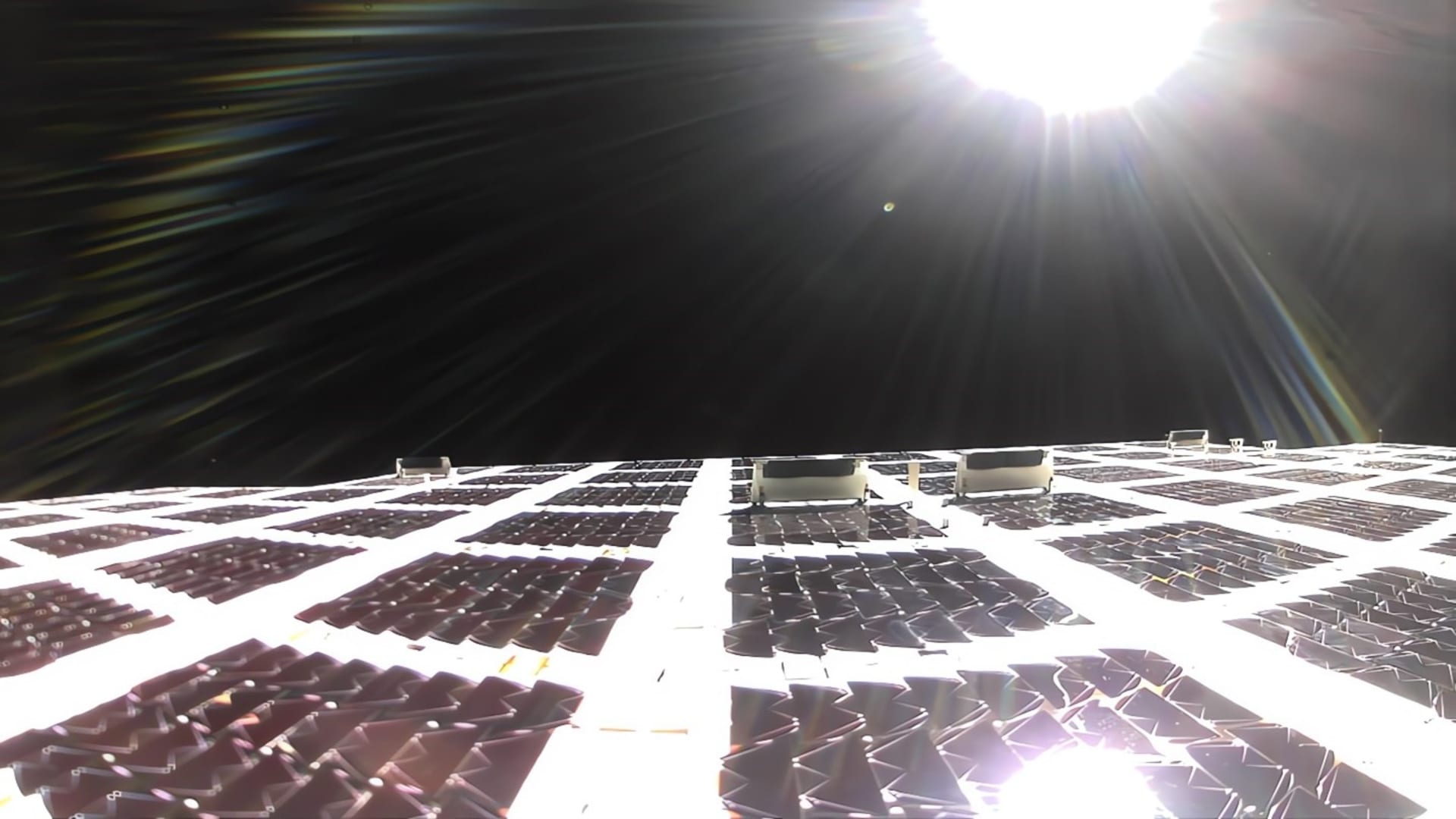

Future Outlook for Copper Demand: Despite concerns over AI impacting copper demand, JPMorgan projects growth in demand from data centers, while instability in the Democratic Republic of the Congo poses additional risks to global supply, suggesting that copper investors may face a prolonged wait for market recovery.

Trade with 70% Backtested Accuracy

Analyst Views on AU

About AU

About the author

- Market Decline: The S&P 500 index fell by 0.94%, reaching a 3.25-month low, reflecting investor concerns over escalating tensions in Iran, which may impact future investment decisions and market stability.

- Surge in Oil Prices: WTI crude oil prices rose over 4% to an 8.5-month high due to threats from Iran to close the Strait of Hormuz, intensifying fears of energy supply disruptions and potential inflationary pressures in the economy.

- Natural Gas Price Spike: European natural gas prices surged more than 22% to a three-year high after Qatar's Ras Laffan plant was targeted by an Iranian drone attack, posing significant risks to global liquefied natural gas supply and market stability.

- Economic Data Expectations: This week, the ADP employment change is expected to increase by 50,000, while the ISM services index is projected to slip slightly, with markets closely monitoring these indicators to assess economic health and potential implications for Federal Reserve monetary policy decisions.

- Oil Price Surge: The escalating conflict between the U.S., Israel, and Iran has driven West Texas Intermediate crude oil prices up by 6.4% to $75.8 per barrel, marking the largest two-day rally since March 2022, indicating heightened market concerns over energy supply disruptions.

- Market Panic Intensifies: The CBOE Volatility Index surged by 6% to 22.74, reflecting increased investor fear regarding short-term market volatility, with all 11 S&P 500 sectors trading in the red, showcasing widespread market pressure.

- Fed Policy Expectations Shift: Amid rising inflation fears, the 10-year Treasury yield climbed from 3.97% last Friday to approximately 4.06%, leading traders to reprice expectations for Fed rate cuts, now anticipating fewer chances of cuts in 2026.

- Strong Dollar Impact: The U.S. dollar index is on track for its largest two-day gain since February 2023, resulting in significant declines in gold and silver prices, with spot gold falling 4.6% to around $5,080 per ounce and silver plummeting 7.8% to $82 per ounce, highlighting the dollar's pressure on commodity markets.

Market Concerns: The markets are experiencing a downturn due to escalating fears of a prolonged conflict in Iran.

Oil Price Impact: Investors are worried that rising oil prices could negatively affect the global economy and reignite inflation fears.

AI Trade Vulnerability: The situation poses particular challenges for the previously thriving artificial intelligence sector.

Investment Climate: Overall, it is becoming increasingly difficult for investors to find safe investment opportunities amid these uncertainties.

- Stock Market Decline: The S&P 500 index fell by 2.18%, reaching a 3.25-month low, indicating market concerns over the Iran conflict that may lead to decreased investor confidence and increased volatility.

- Surge in Oil Prices: WTI crude oil prices rose over 8% to an 8.5-month high due to Iran's threats to close the Strait of Hormuz, potentially causing long-term disruptions in global energy markets and raising inflation expectations.

- Rising Bond Yields: The 10-year German bund yield climbed to a 2.5-week high of 2.814%, reflecting market worries about future inflation, which may prompt investors to shift towards bonds for safety.

- Economic Data Focus: This week, the market will focus on U.S. employment data and economic indicators, with the ADP employment change expected to rise by 40,000 and the ISM services index anticipated to slip slightly, indicating potential economic slowdown.

- Market Uptrend: South Africa's stock market has been trending steadily higher for nearly two years, brushing aside volatility in the U.S. and elsewhere, primarily driven by strong gold prices, indicating a significant reliance on gold in the market.

- ETF Momentum Recovery: The iShares MSCI South Africa ETF (EZA) has reestablished short-term momentum after a brief shakeout, with a bullish crossover in the daily MACD serving as a positive technical catalyst, suggesting a rebound in investor confidence.

- Technical Indicators Support: EZA is supported by three rising and diverging moving averages on the weekly chart, while a rising MACD histogram on the monthly chart reinforces the long-term uptrend, indicating that the intermediate- and long-term momentum behind South African equities remains healthy.

- Relative Strength Continuation: Since the start of 2025, South Africa's equity market has consistently outperformed the U.S. market, with the ratio of EZA to the S&P 500 trending higher, suggesting that South African equities could extend their relative strength through 2026, warranting investor attention on this trend.

- Deteriorating Market Sentiment: Wall Street opened under heavy pressure as concerns over AI-related credit intensified, with the S&P 500 down over 1%, the Nasdaq 100 falling 1.3%, and the Dow Jones Industrial Average slumping 1.5%, indicating a pessimistic outlook among investors.

- Poor Financial Sector Performance: The Financial Select Sector SPDR Fund (NYSE:XLF) experienced its worst day since April 2025, reflecting growing concerns about financial stability that could impact future investment decisions.

- Tech Stocks Remain Under Pressure: The iShares Expanded Tech-Software Sector ETF (BATS:IGV) fell 5%, hitting its lowest level since August 2024, as software companies continued their recent downturn, suggesting ongoing challenges in the tech sector.

- Trade Policy Uncertainty: Trump's plan to raise global tariffs to 15% to replace duties ruled illegal by the Supreme Court has injected fresh uncertainty into trade policy, raising questions about whether businesses that paid the invalidated levies will receive refunds.