BP Maintains Outlook, Hikes Dividend And Rolls Out $750 Million Share Buyback

Earnings Report: BP reported adjusted earnings of 90 cents per share for Q2 2025, exceeding expectations, but total revenue fell to $46.63 billion, below analyst projections. The company also reversed a loss from the previous year with a GAAP profit of $1.63 billion.

Future Outlook and Shareholder Returns: BP anticipates a slight decline in upstream production for Q3, while customer volumes are expected to rise. The company announced a quarterly dividend increase and a $750 million share buyback program, committing to return 30% to 40% of operating cash flow to shareholders.

Trade with 70% Backtested Accuracy

Analyst Views on XOM

About XOM

About the author

Company Overview: Presidio Production Company has recently gone public and is not expected to attract investors through major oil discoveries.

Investment Appeal: The company may gain investor interest primarily due to its dividend offerings.

- Oil Price Surge: West Texas Intermediate crude oil prices have surged past $80 per barrel, reaching their highest level since July 2024, primarily due to concerns over supply disruptions and ongoing conflict, which could lead to increased living costs for consumers.

- Inflationary Pressures: The rise in oil prices, coupled with higher benchmark 10-year Treasury yields, creates a negative impact on the stock market, undermining investor confidence in future economic growth and potentially leading to increased market volatility.

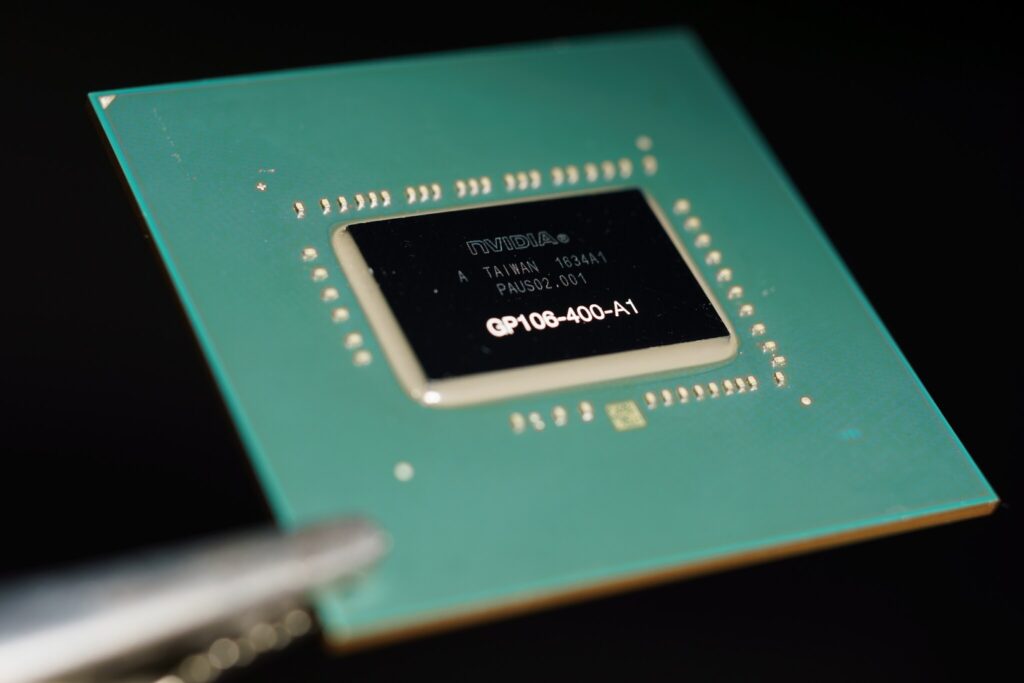

- Trump Administration Intervention: The Trump administration is drafting a plan that may tighten control over AI chip exports; while this does not constitute an export ban, it could still affect companies like Nvidia, adding uncertainty to the industry.

- Job Data Expectations: Economic data will be in focus, with economists forecasting a 55,000 increase in non-farm payrolls for February, a 3.7% rise in average hourly earnings, and an unemployment rate steady at 4.3%, which will significantly influence market sentiment.

- Oil and Gas Price Dominance: Oil and natural gas prices are the primary drivers of performance in the energy sector, with recent geopolitical events highlighting significant volatility, indicating that while tariffs are a factor, they are not the most critical one.

- Differential Company Impact: Companies face varying levels of tariff exposure; for instance, Devon Energy is less affected by tariffs compared to ExxonMobil, which operates globally, although ExxonMobil's diversified operations help mitigate the impacts of tariffs and commodity price fluctuations.

- Midstream Stability: Midstream companies like Enterprise Products Partners can avoid commodity price risks by charging fees for transportation, and while tariffs may alter oil and gas transportation methods, demand typically remains robust even when prices are low.

- Global Energy Importance: Oil and gas are essential to the global economy, and while tariffs may have peripheral effects, they are unlikely to fundamentally alter the industry's long-term operations, as historical trends show that even during wars, oil markets tend to normalize relatively quickly.

- Tariff Policy Changes: The U.S. Supreme Court ruled some of Trump's tariffs unconstitutional, prompting him to impose a new global 15% tariff, while other tariffs remain in effect, forcing energy companies operating internationally to navigate ongoing tariff challenges.

- Market Impact: While tariffs are a factor, the energy sector's performance is primarily driven by volatile oil and gas prices, with recent geopolitical events highlighting rapid price fluctuations, indicating that tariffs may have limited long-term effects on the industry.

- Differential Company Impact: For instance, Devon Energy, as a large U.S. energy firm, faces less impact from tariffs compared to ExxonMobil, which operates globally; however, ExxonMobil's diversified operations can mitigate the effects of tariffs and price volatility, necessitating attention to potential operational impacts.

- Midstream Company Advantage: Investors might consider midstream firms like Enterprise Products Partners, which earns fees from transporting oil and gas; while tariffs could affect commodity flow, demand remains strong even when prices are low, showcasing resilience in uncertain environments.

- Market Decline: On Thursday, the Dow Jones Industrial Average plummeted over 800 points, primarily due to rising oil prices, with U.S. crude briefly exceeding $79 per barrel, marking the highest level since June 2025, indicating the market's sensitivity to geopolitical tensions.

- Oil Price Volatility: Iran's missile strike on an oil tanker and subsequent closure of the Strait of Hormuz, along with threats to attack vessels in the area, have heightened market anxiety, prompting investors to navigate this volatile environment with caution.

- Costco Membership Concerns: Costco shares fell nearly 2.5% ahead of its earnings report, despite strong same-store sales momentum; however, declining membership renewal rates, particularly among online sign-ups, pose a challenge to the company's long-term growth prospects.

- Salesforce Stock Recovery: Salesforce shares rose nearly 5.5%, potentially signaling a rotation back into software stocks; while its core business faces pressure, Jim Cramer emphasized the positive outlook for Agentforce in the AI sector, suggesting a glass-half-full perspective on the company's future.

- Sector Recovery: In 2026, the Energy Select Sector SPDR ETF (NYSE:XLE) has surged over 20% year-to-date, indicating a strong rebound in the energy sector following the outbreak of war in Iran, with expectations for this momentum to continue reflecting sustained energy demand growth.

- Cheniere Expansion: Cheniere Energy Inc. is set to complete three expansion projects in 2026, 2028, and 2029, with LNG exports expected to nearly double by 2030, and most contracts spanning 20 years ensure sustainable revenue growth, although the stock has entered overbought territory.

- ExxonMobil Shareholder Returns: ExxonMobil has announced its 38th consecutive annual dividend increase and repurchases about $20 billion in shares annually; despite trading below the industry average, shares surged over 20% at the start of 2026, breaking out to a new all-time high since 2024, indicating strong technical support.

- EOG Resources Breakout: EOG Resources Inc. broke above the 50-day and 200-day moving averages in early 2026, with the MACD confirming a momentum shift and the RSI showing strong upward momentum, potentially breaking its streak of not reaching an all-time high since 2022.