Alphabet's Cloud Revenue Soars 34%, Outpacing Microsoft

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Dec 30 2025

0mins

Should l Buy GOOGL?

Source: Fool

- Cloud Growth: Alphabet's Google Cloud achieved a 34% revenue increase last quarter, driving an 84% surge in operating income, indicating that the company's strong performance in cloud computing will further solidify its market position.

- AI Technology Advantage: Alphabet's custom AI chips, known as TPUs, provide a significant cost advantage, placing it ahead in the competitive AI services landscape, especially with substantial orders from Anthropic enhancing its market competitiveness.

- Product Integration: By incorporating top-tier language models like Gemini into its products, Alphabet not only enhances product flexibility but also creates diversified revenue streams, which are expected to drive sustained growth in the future.

- Market Outlook: Although Alphabet's forward P/E ratio stands at 28, slightly lower than Microsoft's 30, its comprehensive AI tech stack and cloud growth potential position it for stronger stock performance in 2026, particularly if search revenue accelerates.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy GOOGL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on GOOGL

Wall Street analysts forecast GOOGL stock price to rise

33 Analyst Rating

26 Buy

7 Hold

0 Sell

Strong Buy

Current: 306.520

Low

305.00

Averages

374.25

High

400.00

Current: 306.520

Low

305.00

Averages

374.25

High

400.00

About GOOGL

Alphabet Inc. is a holding company. The Company's segments include Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment includes infrastructure and platform services, collaboration tools, and other services for enterprise customers. Its Other Bets segment is engaged in the sale of healthcare-related services and Internet services. Its Google Cloud provides enterprise-ready cloud services, including Google Cloud Platform and Google Workspace. Google Cloud Platform provides access to solutions such as artificial intelligence (AI) offerings, including its AI infrastructure, Vertex AI platform, and Gemini for Google Cloud; cybersecurity, and data and analytics. Google Workspace includes cloud-based communication and collaboration tools for enterprises, such as Calendar, Gmail, Docs, Drive, and Meet.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

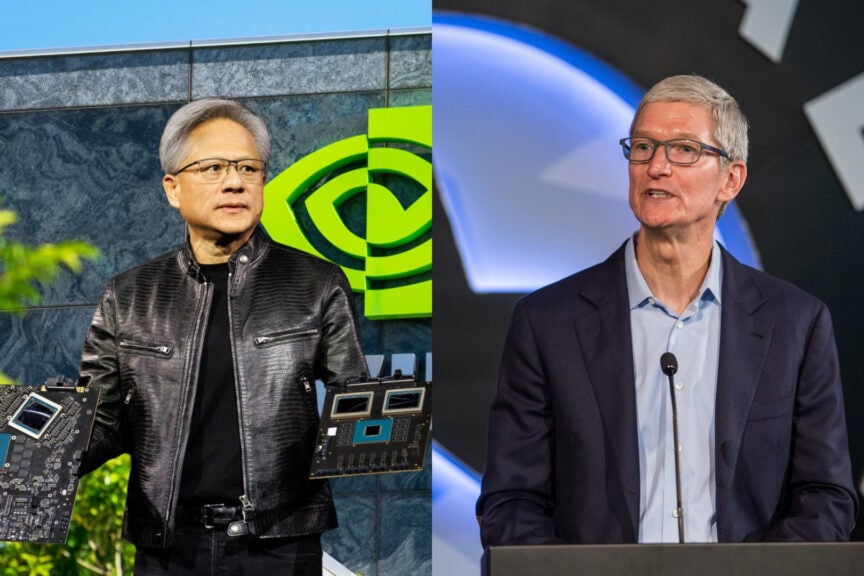

- Impressive Financials: Nvidia achieved a record $215.9 billion in revenue and $120.1 billion in net income for fiscal 2026, demonstrating strong performance in the data center segment, which is expected to continue driving stock growth over the next decade.

- Data Center Dominance: Data centers accounted for 89.7% of Nvidia's fiscal 2026 revenue, and while other segments like gaming and AI personal computing contribute less, there remains significant growth potential in these areas.

- New Product Architecture: The newly launched Rubin architecture features six new chips designed to support generative and agentic AI applications, which are expected to drive enterprise adoption of AI agents and expand market opportunities.

- Physical AI Market Potential: Nvidia's physical AI has already contributed over $6 billion in revenue for fiscal 2026, and although it currently serves niche markets, the expected proliferation of robotaxis and robotics could generate hundreds of billions in revenue over the next decade.

See More

Earnings Outlook: Broadcom's earnings are expected to be strong due to increased demand for artificial intelligence technologies.

Market Sentiment: Despite the positive earnings outlook, shareholders should brace for a potentially muted reaction in the stock market as overall sentiment remains uncertain.

See More

- Maritime Trade Assurance: Trump announced that the U.S. will provide insurance for 'ALL Maritime Trade' in the Middle East and may deploy the Navy to escort ships through the Strait of Hormuz if necessary, a move aimed at enhancing international shipping security and potentially increasing U.S. influence in global trade.

- Market Reaction: Following Trump's announcement, U.S. markets pared losses, with the Dow Jones Industrial Average ending down 403.51 points, or 0.83%, after dipping over 1,200 points at its lowest, indicating the market's sensitivity to geopolitical risks.

- Energy Price Risks: Analysts warn that European and Asian economies could be impacted by a surge in natural gas prices triggered by the ongoing war in the Middle East, as both regions are more exposed to potential gas price shocks compared to the U.S., which benefits from domestic shale and LNG production.

- Digital Service Outages: Outages in apps and digital services in the UAE have been reported following drone strikes on Amazon Web Services' data centers, which could disrupt business operations in the region and further exacerbate uncertainties stemming from geopolitical tensions.

See More

- Employee Safety Priority: Nvidia's CEO Jensen Huang confirmed that the safety of approximately 6,000 employees in Israel is secured despite the temporary closure of Dubai offices, emphasizing the company's commitment to employee welfare amid escalating regional tensions.

- Mass Flight Cancellations: Over 11,000 flights across the Middle East have been canceled since the U.S.-Israeli strikes on Iran, leaving many Google employees stranded in Dubai after a sales conference, highlighting the significant disruption to business operations caused by the conflict.

- Amazon Operational Adjustments: Amazon has instructed all corporate employees in the Middle East to work remotely and follow local government guidelines, demonstrating the company's prioritization of employee safety while also impacting its regional business operations amid ongoing instability.

- Data Center Damage: Two Amazon data centers in the UAE were directly struck by drones, resulting in structural damage and service outages, prompting AWS to advise customers to back up their data or consider migrating workloads, underscoring the direct threat the conflict poses to technological infrastructure.

See More

- Employee Safety Priority: Nvidia temporarily closed its Dubai office, with CEO Jensen Huang stating that the crisis management team is actively supporting around 6,000 employees and their families in the Middle East, highlighting the company's strong commitment to employee welfare during crises.

- Air Travel Disruption: The U.S.-Israeli strikes on Iran have led to over 11,000 flight cancellations in the Middle East, leaving many Google employees stranded in Dubai, which reflects the severe impact of the conflict on business operations and forces companies to reassess their strategies in the region.

- Amazon Remote Work: Amazon has instructed all corporate employees in the Middle East to work remotely and follow local government guidelines to ensure safety, indicating the company's flexible response measures to maintain business continuity amid the crisis.

- Data Center Damage: Two Amazon data centers in the UAE were directly struck by drones, causing structural damage and service disruptions, with AWS advising customers to back up data and consider migrating workloads, underscoring the direct threat the conflict poses to technological infrastructure.

See More

- Impressive Performance: Nvidia achieved a record $215.94 billion in revenue for fiscal 2026, with net income reaching $120.07 billion, demonstrating strong profitability and market demand, and is expected to continue leading the 'Magnificent Seven'.

- Robust Cash Flow: The company generated $96.58 billion in free cash flow, sufficient to cover $41.1 billion in stock repurchases and dividends, indicating a healthy financial position that supports future investments and growth.

- Increased R&D Investment: Nvidia launched the Blackwell architecture in March 2024 and unveiled the Rubin platform in January 2023, showcasing its ongoing innovation in AI aimed at eliminating workload bottlenecks and enhancing market competitiveness.

- Expanding Customer Base: By investing in Anthropic and OpenAI, Nvidia is broadening its customer base and is expected to benefit from the growing demand for AI, solidifying its leadership position in the data center market.

See More