AI-Driven Shopping Surge Influences Black Friday — These Tech ETFs Could Gain Advantage

AI's Role in Retail: Artificial intelligence has become a crucial intermediary in retail, significantly influencing consumer behavior during Black Friday shopping, with AI-driven traffic to retail websites increasing by over 800%.

Impact on Spending: U.S. online spending reached $11.8 billion on Black Friday, a 9.1% increase from the previous year, while e-commerce growth outpaced in-store sales, highlighting the effectiveness of AI in product discovery and deal-hunting.

ETFs Benefiting from AI: Technology-focused ETFs, such as the iShares U.S. Technology ETF and Global X Artificial Intelligence & Technology ETF, are positioned to benefit from the growing reliance on AI in retail, as they include major companies like Apple, Amazon, and Microsoft.

Consumer Behavior Trends: Despite increased spending, consumers purchased fewer items per order due to higher prices and inflation concerns, indicating a cautious approach to holiday shopping, with expectations for Cyber Monday to set new records.

Trade with 70% Backtested Accuracy

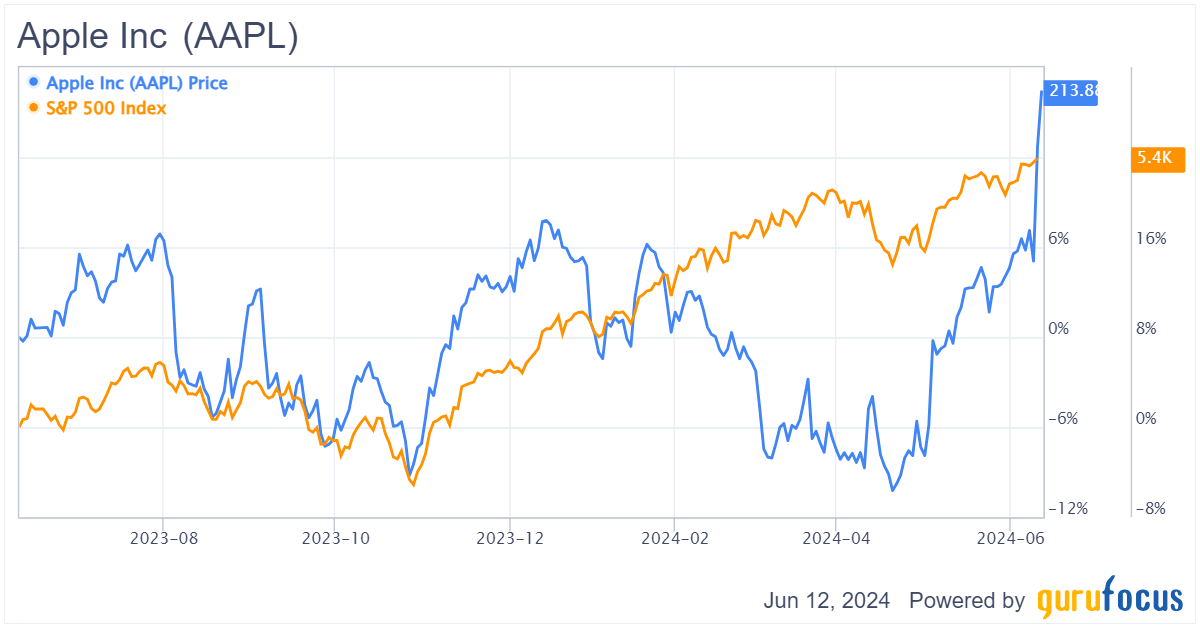

Analyst Views on AAPL

About AAPL

About the author

- Market Share Battle: In 2025, the iPhone became the top-selling smartphone, capturing 20% of the market share, and despite facing competitive pressures, Apple maintained high profits, demonstrating its strong competitive edge in the premium market.

- New Product Launch: At the spring event, Apple introduced the iPhone 17e with a starting price of $599, maintaining this price despite rising memory and storage chip costs, thereby attracting more consumers and enhancing market competitiveness.

- Supply Chain Advantage: Apple's strategy of securing multi-year agreements with suppliers allows it to manage price fluctuations effectively, ensuring production capacity and maintaining stable product pricing in a high-cost environment, further solidifying its market position.

- Long-term Shareholder Benefits: The pricing strategy of the iPhone 17e will enhance Apple's competitiveness in price-sensitive markets, likely attracting more users into the Apple ecosystem, which will promote sales of subsequent products and services, ultimately benefiting shareholders in the long run.

- Broadcom's Market Strategy: Broadcom is enhancing its competitive edge in the AI chip market by collaborating with Alphabet to develop Tensor Processing Units (TPUs) and signing a $21 billion deal with Anthropic to supply nearly 1 million AI chips, positioning itself as a key player in AI infrastructure.

- Lam Research's Growth Potential: Lam Research reported fourth-quarter revenue of $5.34 billion in 2025, a 22.3% increase year-over-year, with net income of $1.59 billion, indicating strong performance in semiconductor manufacturing equipment and expected benefits from the acceleration of AI technology.

- TSMC's Technological Advantage: TSMC achieved net revenue of $122.4 billion in 2025, a 35.9% increase, with 60% of its revenue coming from 3-nanometer and 5-nm chips, reinforcing its leadership position in the high-end chip market and driving profitability.

- Value of a Diversified Portfolio: By investing in Broadcom, Lam Research, and TSMC, investors can achieve diversification in the AI sector, leveraging the specialized capabilities of these companies to collectively drive stable growth in their investment portfolios.

- Capacity Expansion Plan: TSMC's new 15.46-hectare facility in the Southern Taiwan Science Park has passed environmental impact assessment, with completion targeted for 2028, focusing on industrial efficiency with 8 hectares dedicated to production equipment to enhance overall capacity to meet global AI hardware demand.

- Job Creation: The new fab is expected to generate 1,400 direct jobs and 500 supply-chain roles, further solidifying TSMC's leadership in semiconductor manufacturing while injecting vitality into the local economy.

- Strong Market Performance: Driven by AI hardware demand, Taiwan's January exports surged 70%, the fastest pace in 16 years, while TSMC reported a 37% revenue increase for the same period, indicating robust market demand and economic momentum.

- GDP Growth Forecast Upgraded: The Taiwanese government has revised its annual GDP growth forecast upward to 8.68% due to strong export performance and TSMC's impressive results, reflecting the positive impact of the semiconductor industry on the economy.

- Valuation Challenges: Wall Street analysts face difficulties in accurately valuing Tesla stock, similar to the challenges in understanding the design choices of the Tesla Cybertruck.

- Complexity of Analysis: The complexity involved in analyzing Tesla's stock reflects broader uncertainties in the market and the unique characteristics of the company's products.

- Significant Market Potential: With a market cap of $1.6 trillion, Meta could see an 81% potential return if it joins the $3 trillion club, indicating strong growth prospects in the coming years.

- Ad Impression Growth: Meta reported an 18% increase in ad impressions in Q4, driven by AI-enhanced user engagement, showcasing the company's strengthening position in the digital advertising market.

- Revenue Continues to Rise: Meta is expected to generate $251 billion in revenue by 2026, a 22% increase from 2025, further solidifying its global market position, particularly with significant expansion potential in international markets.

- Increased Capital Expenditure: Meta plans to raise capital expenditures to $125 billion in 2026, a 73% increase from last year, reflecting the company's commitment to AI technology and its strategic importance for future growth.

- Iran Withdrawal Resolution Fails: The U.S. Senate's failure to pass a resolution demanding President Trump withdraw from military actions in Iran highlights significant congressional divisions over current military policy, despite the resolution's largely symbolic nature.

- Major Update to French Nuclear Policy: French President Macron's announcement to increase the number of nuclear warheads and enhance cooperation with European allies is viewed as the most significant update to France's nuclear deterrence policy in 30 years, potentially reshaping the European security landscape.

- Impact on Indian Remittance Flows: A Citi report indicates that the Indian diaspora in Gulf countries contributes nearly 38% of total remittance inflows, with a total of $135.4 billion in FY 2025, of which $51.4 billion comes from Gulf nations, suggesting that prolonged Middle Eastern conflict could negatively impact India's economy.

- China Sets Record Low GDP Growth Target: The Chinese government has set its GDP growth target for 2026 at 4.5% to 5%, marking the lowest target on record since the early 1990s, reflecting the challenges Beijing faces amid persistent deflationary pressures and trade tensions with the U.S.