2026 Video Game Market Set for Boom with Delayed GTA VI Release

- Market Trend Analysis: Michael Pachter from Wedbush Securities forecasts a significant increase in video game sales for 2026, with expectations to surpass levels from 2016 to 2025, primarily driven by the delayed release of Grand Theft Auto VI to fall 2026, despite unreliable overall sales data.

- Rise of Subscription Models: Microsoft's push for Game Pass is expected to lead to a year-over-year decline in Call of Duty sales, yet it simultaneously provides new momentum for software sales growth, particularly in the spring of 2026.

- Changing Competitive Landscape: Netflix is actively positioning itself in the gaming market, and while its success remains uncertain, its financial resources and strategic initiatives could give it a competitive edge in the evolving gaming industry.

- Industry Expectations: 2026 is anticipated to be the strongest year in the past decade, although it may not exceed the peak of 2011, it is projected to significantly outperform the average levels from 2016 to 2025, reflecting strong consumer demand for new games.

Trade with 70% Backtested Accuracy

Analyst Views on WBD

About WBD

About the author

- Acquisition Price Increase: Paramount Skydance is set to acquire Warner Bros. Discovery at $31 per share, which is a significant increase from Netflix's previous offer of $27.75, indicating a reassessment of Warner's asset value and potentially enhancing Paramount's competitive position in the market.

- Increased Uncertainty: While Paramount's higher bid suggests confidence, the deal still faces regulatory scrutiny, particularly given Paramount's smaller market share, which may influence the future competitive landscape and the deal's likelihood of closing.

- Cash Flow Assurance: The acquisition includes a daily ticking fee of $0.25 per share and a $7 billion regulatory termination fee, adding complexity to the transaction but also providing cash flow assurances that enhance the deal's attractiveness to investors.

- Changing Competitive Landscape: The merger between Paramount and Warner Bros. could create a new formidable competitor in the market, which may lead to increased debt for Warner Bros. but also prompt Netflix and others to adjust their content acquisition strategies and market approaches.

Market Volatility: Rising oil prices and negative job reports have led to a decline in major stock indexes, causing uncertainty among investors, although U.S. stocks have shown resilience overall.

Upcoming Economic Indicators: Investors are anticipating three different readings on inflation, including the Consumer Price Index (CPI) and Producer Price Index (PPI), which are expected to influence market movements.

Company Earnings Reports: Several companies, including AmpX and IONQ, reported strong earnings, while others like Amazon and Wendy's faced challenges, impacting their stock performance and investor sentiment.

Investment Strategies: Analysts are highlighting the importance of cash-rich stocks and defensive utilities, as well as the potential for opportunities in the AI sector, amidst ongoing market fluctuations and uncertainties.

- Investment Portfolio Revealed: Trump purchased bonds from Netflix and Warner Bros. in December 2022 and January 2023, totaling between $600,000 and $1.25 million, coinciding with his public discussions about Netflix's bid for Warner Bros., indicating a potential conflict of interest.

- Debt Risk Mitigated: With Netflix backing out of the Warner Bros. acquisition, the risk associated with Trump's investments decreased, making Netflix's bonds relatively safer, reflecting Trump's indirect benefit from this transaction despite claims of independent portfolio management.

- Positive Market Reaction: Netflix's stock has risen 8% year-to-date and 19.5% over the past month following the cancellation of the merger, indicating increased market confidence in Netflix's future, which could positively impact Trump's investments.

- Political and Business Interplay: Although Trump initially stated he would be involved in the decision regarding Netflix's acquisition of Warner, he ultimately deferred to the Justice Department, highlighting the complex relationship between politics and business, with Netflix's CEO asserting that the deal is a business matter, not a political one.

- Price Forecast Adjustment: Despite Bank of America lowering Netflix's price target from $149 to $125, analyst Jessica Reif Ehrlich maintains a Buy rating, indicating ongoing confidence in the company's long-term growth potential and reflecting market sentiment.

- Strategic Focus Shift: By walking away from the Warner Bros. deal, Netflix reaffirms its commitment to an organic growth strategy, continuing to invest in content to enhance user engagement and expand its advertising business, thereby strengthening its competitive position.

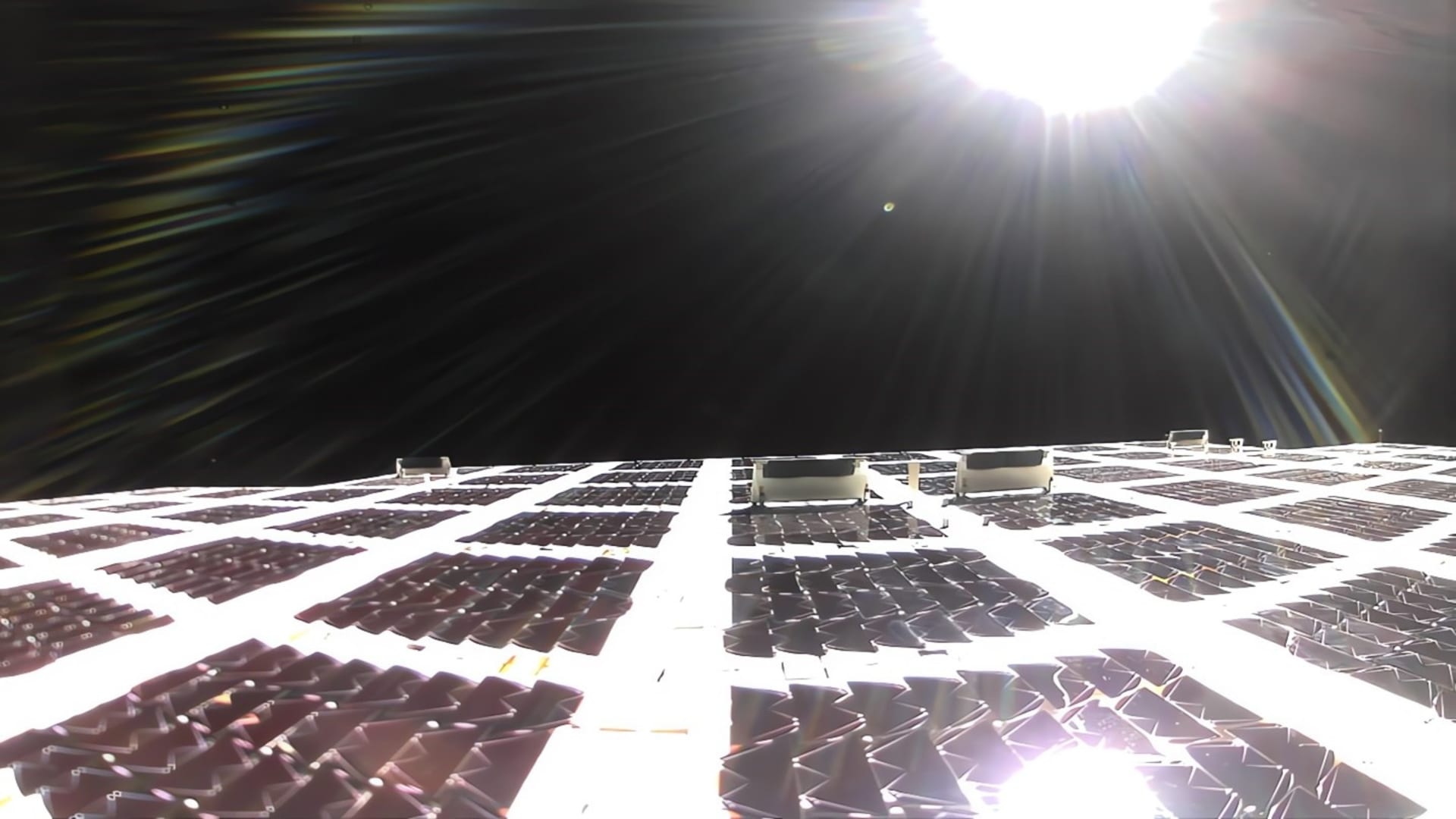

- Growth Drivers: The analyst highlights live events, sports programming, and international markets as key growth drivers for Netflix, while emerging initiatives in podcasting, mobile content, vertical video, and gaming are expected to provide additional growth opportunities.

- Long-Term Growth Outlook: Netflix is projected to achieve $51.3 billion in revenue by 2026, representing a 13% year-over-year growth, with operating margins at 31.5%, earnings per share of $3.19, and free cash flow of $11.3 billion, showcasing its expansion potential in both mature and emerging markets.

- Price Range Analysis: The XLC ETF has a 52-week low of $84.02 and a high of $120.405, with the latest trade at $116.89, indicating stability near its high and aiding investors in assessing market performance.

- Technical Analysis Tool: Comparing the latest share price to the 200-day moving average provides investors with deeper insights into market trends and potential buying opportunities, enhancing their trading strategies.

- ETF Trading Mechanism: ETFs trade like stocks, where investors buy and sell 'units' that can be created or destroyed based on demand, offering flexibility that makes ETFs effective for portfolio management.

- Liquidity Monitoring: Weekly monitoring of changes in shares outstanding helps identify significant inflows or outflows, where inflows necessitate purchasing underlying assets, while outflows may lead to selling, impacting the performance of individual components within the ETF.

- Strategic Shift: Netflix has refocused on organic growth after withdrawing from the bidding process, indicating a renewed emphasis on internal development and user growth aimed at enhancing long-term profitability.

- Market Reaction: This strategic change may impact investor confidence in Netflix, particularly as competition intensifies in the streaming market, where the company's market share and user growth will be focal points.

- Future Outlook: By concentrating on organic growth, Netflix may increase investments in original content to attract and retain users, thereby achieving more sustainable revenue growth in the future.

- Competitive Landscape: Against the backdrop of escalating competition in the streaming industry, Netflix's move may prompt other companies to reassess their growth strategies to adapt to market changes.