Carlyle Group to Acquire 45% Stake in Edelweiss's Nido Home Finance

Carlyle Group Inc's stock fell 3.25% and hit a 20-day low amid a broader market decline, with the Nasdaq-100 down 1.74% and the S&P 500 down 1.10%.

The company announced its plan to acquire a 45% stake in Edelweiss Financial's Nido Home Finance for approximately $232 million, marking a significant entry into India's housing finance market. This strategic acquisition is expected to enhance Edelweiss's capital base and drive innovation and business expansion, reflecting Carlyle's long-term commitment to the Indian market.

This acquisition not only positions Carlyle for growth in a rapidly expanding sector but also indicates a proactive approach to diversifying its investment portfolio, potentially mitigating risks associated with current market volatility.

Trade with 70% Backtested Accuracy

Analyst Views on CG

About CG

About the author

- Deal Overview: Carlyle Group has agreed to sell SierraCol Energy, Colombia's largest independent oil and gas exploration and production company, to Prime Infrastructure Capital, although the financial terms remain undisclosed, indicating a strategic shift for Carlyle in the energy sector.

- Investment Returns: Since investing nearly $1 billion in SierraCol through Carlyle International Energy Partners in 2020, Carlyle has successfully increased reserves by over 100 million barrels of oil equivalent, achieving a reserves replacement ratio of approximately 135%, demonstrating the effectiveness of its investment.

- Market Impact: SierraCol currently accounts for about 10% of Colombia's total oil production, and its ongoing production capacity not only supports the local economy but also enhances Carlyle's influence in the Latin American energy market.

- Future Outlook: This transaction will enable Prime Infrastructure Capital to further expand its assets in energy supply and clean water management, aligning with its long-term strategic goals and is expected to drive investments in renewable energy.

- Project Background: Carlyle Group is utilizing structured financing to create a new flagship fund known as 'Project Potomac,' aiming to raise funds and repay investors from older funds amid slower deal activity.

- Financing Structure: The initiative will resemble a collateralized fund obligation and is expected to be the largest of its kind, combining senior debt, preferred shares, and common equity, with Carlyle holding a significant minority stake in the common equity.

- Investor Transition: Investors from previous funds will transfer their holdings into a newly established special purpose vehicle in exchange for equity and cash, which will be invested in the new buyout fund.

- Future Goals: Carlyle aims to raise over $200 billion by 2028, indicating a proactive financing strategy and confidence in future growth despite current market conditions.

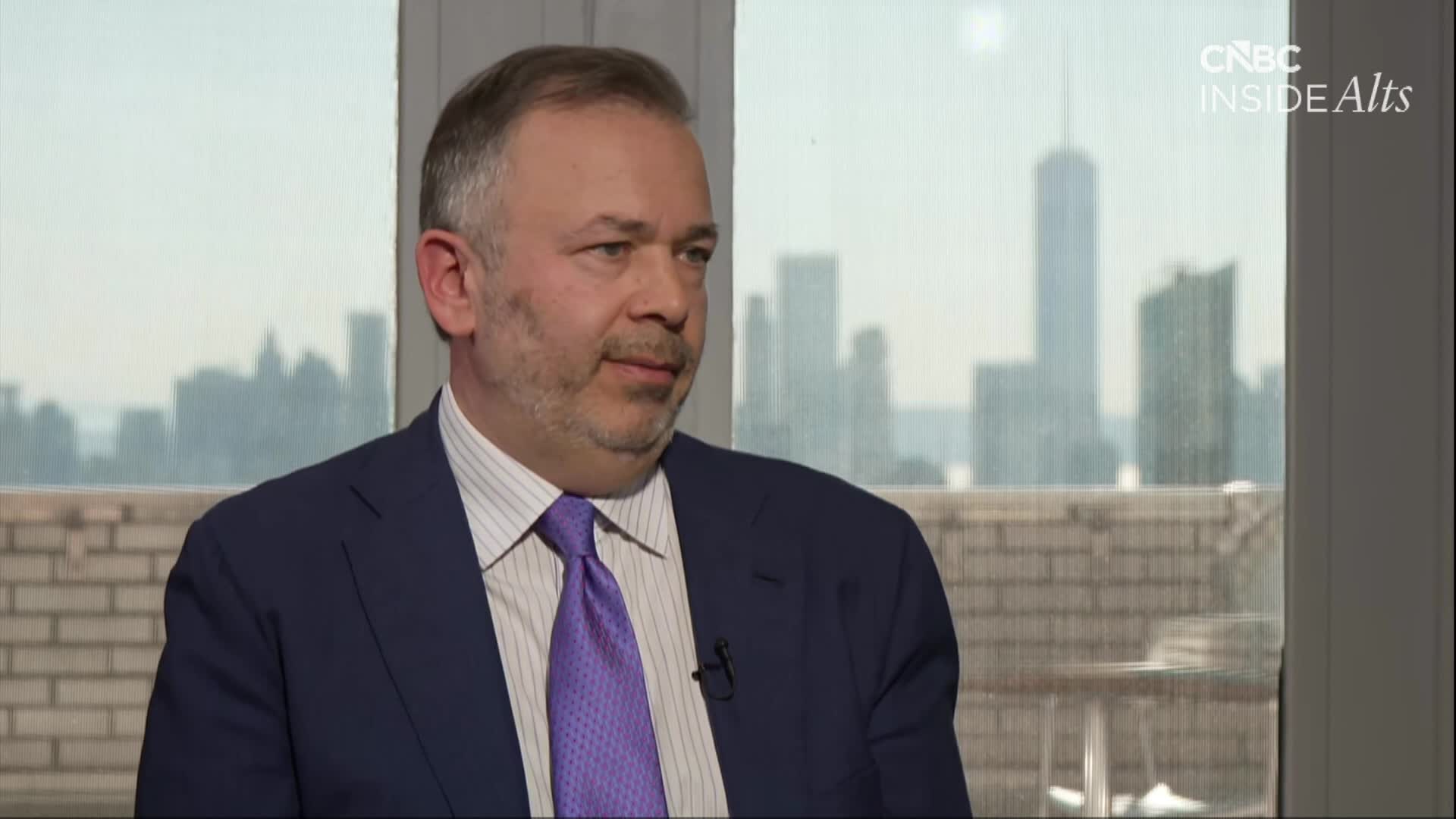

- Liquidity Issues Escalate: Boaz Weinstein of Saba Capital highlights that liquidity problems in private credit are worsening during the bull market, leading to dividend cuts for investors and increasing market focus on redemption requests, reflecting potential risks and uncertainties within the industry.

- Surge in Redemption Requests: Blue Owl Capital Corp. II halted quarterly redemptions and sold $1.4 billion in direct lending investments to provide liquidity, becoming one of the first non-traded private credit funds affected by redemption requests, indicating urgent market demand for liquidity.

- Investment Opportunities Arise: Despite market challenges, Weinstein remains optimistic about major private credit managers like Ares, Apollo, and Blackstone, believing these firms will emerge as winners after market fluctuations, demonstrating confidence in the industry's future.

- Cliffwater Monitoring: Weinstein is closely watching Cliffwater's redemption rate, expected to be between 10% and 20%, indicating potential difficulties in meeting redemption requests, further reflecting the fragility of the private credit market.

- Oil Price Fluctuations: U.S. benchmark WTI crude prices have fallen below $90 a barrel, despite being up over 50% year-to-date, indicating market optimism regarding improved U.S.-Iran relations, yet geopolitical risks continue to loom over oil prices.

- Tech Stock Rating Changes: Intuit was upgraded to buy from hold by Rothschild & Co Redburn, with its stock rising over 30% since late February, although it remains down 28.5% for the year, reflecting a recovery in market confidence in its software products.

- Cybersecurity Stock Bounce: Morgan Stanley upgraded CrowdStrike from hold to buy, with its stock up over 20% from last month's low, highlighting the positive impact of AI technology on the cybersecurity sector and indicating optimistic market expectations for future growth.

- Hewlett Packard Enterprise's Positive Outlook: Despite memory cost pressures, the company raised its full-year earnings outlook, with reported quarterly revenues slightly below expectations but gross margins and adjusted EPS exceeding forecasts, demonstrating strong demand in the data center buildout.

- Surge in Redemption Requests: Blackstone's BCRED private credit fund is experiencing record redemption requests, with investors seeking to withdraw approximately $3.8 billion, or 7.9% of total assets, posing a significant challenge to the firm's liquidity management.

- Liquidity Structure Scrutiny: The expansion of private credit into retail investors has intensified scrutiny over its liquidity structures, with Moody's warning that balancing high returns with retail-like liquidity will continue to be tested as the sector evolves.

- Asset Management Strategy Adjustment: Blackstone plans to increase its share buyback to 7% to meet redemption requests, demonstrating its response strategy under liquidity pressure while also reflecting a commitment to maintaining market confidence.

- Market Risk Intensification: Concerns over loan quality and AI-related risks have led to declines in stock prices for Blackstone and other alternative asset managers, indicating a weakening market confidence in the private credit industry.

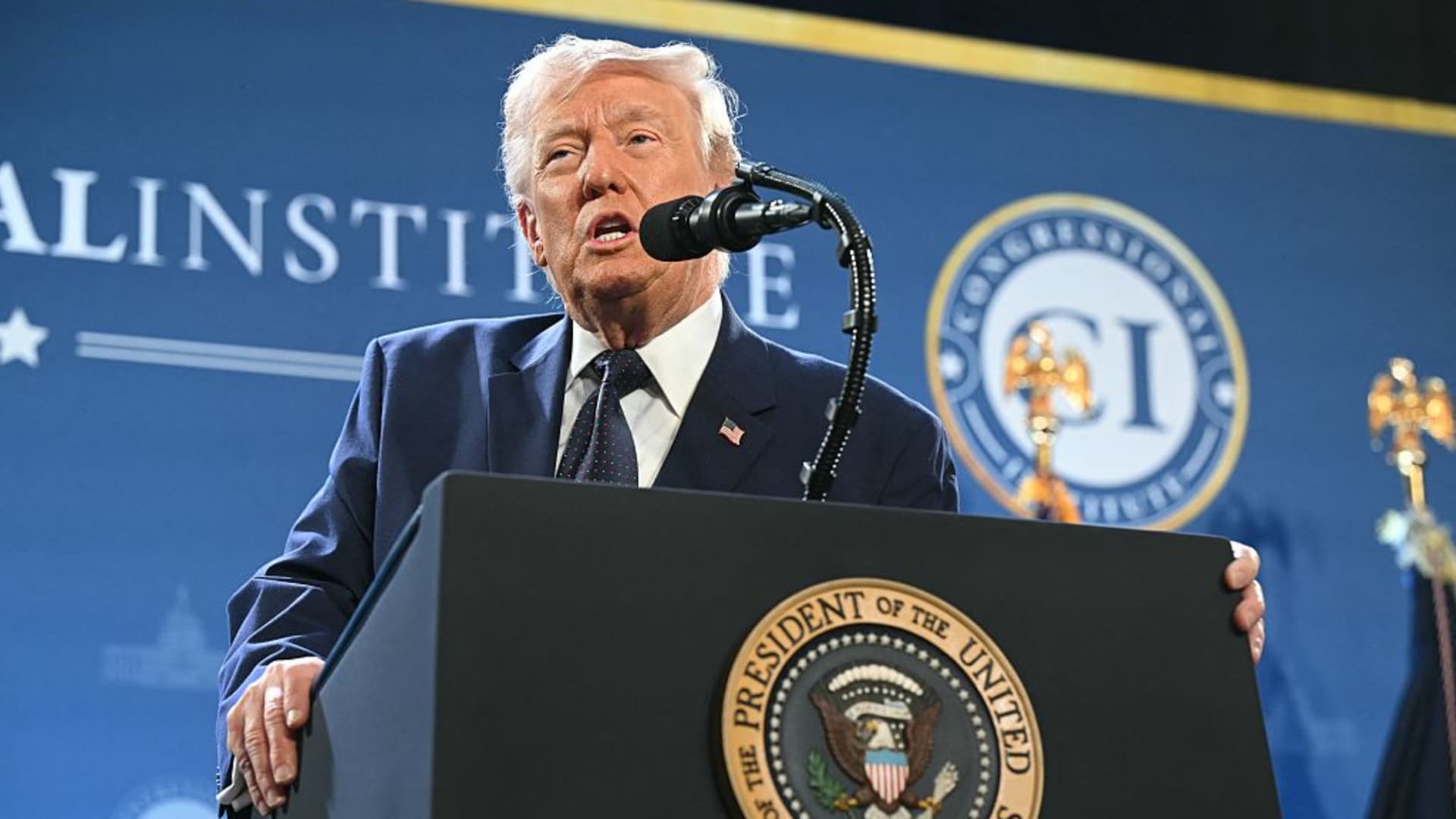

- Market Rebound: Trump's announcement that the U.S. will insure Gulf shipping and escort tankers through the Strait of Hormuz led to a market rebound after significant losses, with the S&P 500 closing down about 1%, well off its session lows of roughly 2.5%, indicating market sensitivity to geopolitical risks.

- Oil Price Impact: The assurances regarding oil trade not only boosted stock prices but also eased crude oil price pressures, highlighting that fluctuations in the oil market could have broader macroeconomic implications that investors need to monitor closely.

- Private Credit Concerns: Blackstone's Jon Gray defended the quality of loans from its main private credit fund, despite allowing investors to withdraw nearly 8% of their investments, which caused Blackstone shares to fall nearly 4%, reflecting growing market concerns about the health of the private credit sector.

- Congressional Hearing Pressure: Commerce Secretary Howard Lutnick voluntarily agreed to testify before the House Oversight Committee regarding his ties to sex offender Jeffrey Epstein, which has drawn bipartisan scrutiny, although he has not been accused of wrongdoing, potentially impacting his political future.