AXP Hits 20-Day Low Amid Market Shifts

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Apr 07 2025

0mins

Should l Buy AXP?

Source: Coinmarketcap

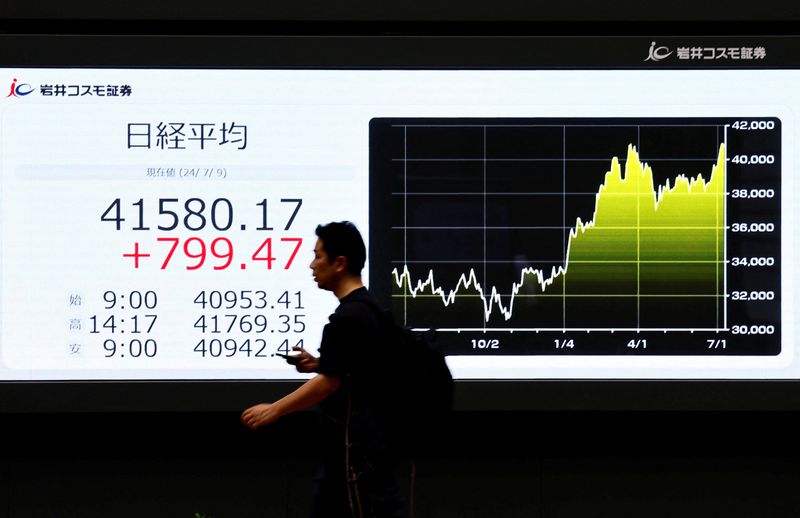

Shares of AXP.N declined sharply today, hitting a 20-day low as investors reacted to broader market trends. The stock's recent performance reflects increased bearish momentum, raising concerns among traders. This decline comes in the wake of Berkshire Hathaway's surprising $4.3 billion investment in Alphabet, which has shifted focus towards tech stocks, contrasting with Warren Buffett's traditional value investing approach. Despite Jim Cramer's positive outlook on American Express, noting its resilience in the current economy, the stock's current trajectory suggests a cautious sentiment among investors, particularly as they explore alternatives in the AI sector.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy AXP?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on AXP

Wall Street analysts forecast AXP stock price to rise

21 Analyst Rating

8 Buy

12 Hold

1 Sell

Moderate Buy

Current: 307.210

Low

280.00

Averages

379.06

High

425.00

Current: 307.210

Low

280.00

Averages

379.06

High

425.00

About AXP

American Express Company is a global payments and premium lifestyle brand powered by technology. Its card-issuing, merchant-acquiring and card network businesses offer products and services to a broad range of customers, including consumers, small businesses, mid-sized companies and large corporations around the world. Its range of products and services includes credit and charge cards and complementary products and services, including travel, dining, lifestyle and expense management products and services; banking and other payment and financing products and services, including deposits and non-card lending; merchant acquisition and processing, servicing and settlement, fraud prevention, and point-of-sale marketing and information products and services, and network services. These products and services are offered through various channels, including mobile and online applications, affiliate marketing, customer referral programs, third-party service providers, and business partners.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Significant Revenue Growth: American Express reported full-year revenue of $72.2 billion for 2025, reflecting a 10% increase, with earnings per share also rising by 10% to $15.38, showcasing the company's robust performance in the premium credit card market despite heightened concerns over AI disruption.

- Strong Q4 Performance: In Q4, revenue reached $19 billion, up 10% year-over-year, with earnings per share increasing by 16% to $3.53, indicating sustained consumer spending, particularly with card member spending rising by 9%, which supports future performance.

- Stable Credit Quality: Although the net write-off rate ticked up to 2.1% in Q4, the overall credit quality remains strong with a full-year net write-off rate of 2%, demonstrating effective risk management for a credit card issuer focused on high-spending customers.

- Aggressive Capital Return Program: American Express returned approximately $7.6 billion to shareholders in 2025, with $5.3 billion through share repurchases and $2.3 billion via dividends, alongside a 16% year-over-year dividend increase, enhancing earnings per share and bolstering investor confidence, even as the stock faces some downward pressure.

See More

- Stagnant User Growth: PayPal's active accounts grew from 426 million in 2021 to only 439 million by 2025, significantly below its original target of 750 million, indicating a troubling stagnation in user growth that adversely impacts revenue and market position amid fierce competition and macroeconomic challenges.

- Strategic Adjustments and Cost Cuts: To stabilize margins, PayPal is downsizing high-volume, low-value platforms like Braintree while aggressively repurchasing shares to boost EPS, although it still anticipates a mid-single-digit decline in EPS for 2026, reflecting struggles for its branded checkout platform to stand out in a crowded market.

- Comparative Analysis with Competitors: While PayPal's stock appears cheap at nine times this year's earnings, analysts suggest this discount valuation is justified, recommending investors consider more competitively positioned financial giants like American Express, which is expected to see a 15% CAGR in EPS from 2025 to 2028.

- Market Environment Impact: PayPal is grappling with revenue growth slowdowns due to the loss of eBay as a customer and challenging macroeconomic conditions, and despite efforts to drive transaction volume through platforms like Venmo and BNPL services, the intensifying market competition casts a shadow over its future prospects.

See More

- Portfolio Overview: New CEO Greg Abel's letter to shareholders provides a detailed overview of Berkshire Hathaway's approximately $318 billion equity portfolio, emphasizing the importance of four core stocks expected to compound over decades, showcasing the company's commitment to long-term investments.

- Apple Holdings: Abel highlighted that Apple constitutes 18.9% of Berkshire's portfolio, and despite a 75% reduction in holdings in recent years, its strong performance and ongoing stock buyback strategy keep it a vital part of the portfolio, reflecting a cautiously optimistic view on tech stocks.

- Stability of American Express: American Express, representing 14.7% of Berkshire's portfolio, is noted for its stability, with its closed-loop payment network and high-income customer base providing resilience during economic downturns, as Abel reiterated the importance of brand protection, indicating confidence in its long-term value.

- Defensive Nature of Coca-Cola: Coca-Cola, making up 10.2% of the portfolio, is highlighted as a

See More

- Stalled User Growth: PayPal's active accounts grew from 426 million in 2021 to only 439 million by 2025, significantly below its original target of 750 million, indicating severe stagnation in user growth amid intense competition and macroeconomic challenges, which could lead to continued revenue declines.

- Profitability Under Pressure: Despite efforts to stabilize margins through share buybacks and cost-cutting, PayPal expects its EPS to decline by mid-single digits in 2026, reflecting difficulties for its branded checkout platform to stand out in a crowded market, potentially impacting investor confidence.

- Intensifying Market Competition: American Express's

See More

- Portfolio Overview: New CEO Greg Abel's letter to shareholders outlines Berkshire Hathaway's substantial $318 billion equity portfolio, emphasizing the company's strategic direction and confidence in long-term growth prospects.

- Holding Strategy: Abel highlighted four key stocks, including Apple, American Express, Coca-Cola, and Moody's, which he expects to compound over decades, indicating a focus on businesses with strong leadership and deep understanding, despite limited activity in these holdings.

- Apple's Position: Despite Berkshire trimming its stake in Apple in recent years, Abel still regards it as a crucial asset, reflecting a cautious approach towards tech stocks while expressing confidence in Apple's future performance, particularly in the realm of artificial intelligence.

- Coca-Cola's Defensive Nature: Coca-Cola, held for over sixty years, is viewed as a defensive investment due to its stable dividends and market position; Abel emphasized its importance during economic uncertainties, showcasing Berkshire's long-term commitment to consumer staples.

See More

- Stock Buyback Resumption: Berkshire Hathaway has resumed its stock buyback program for the first time since May 2024, with CEO Abel stating that this move is intended to maintain transparency during the leadership transition, although specific repurchase numbers were not disclosed, reflecting confidence in the current market value.

- Personal Investment Commitment: Abel announced his commitment to use his entire after-tax salary to purchase Berkshire stock annually, with his first transaction being $15.3 million for 21 Class A shares, indicating a strong alignment with shareholder interests and boosting market confidence in the company's future.

- Kraft Heinz Investment Strategy: Abel supported Kraft Heinz's new CEO's decision to pause the split plan, arguing against breaking up the company amid challenges, which demonstrates Berkshire's long-term commitment to its investment, despite previous considerations to reduce its stake.

- Financial Performance and Market Reaction: Despite a 29% drop in operating income for the fourth quarter, Abel's stock buyback and personal investment commitment are viewed as positive signals, helping to bolster shareholder confidence, although overall financial challenges remain.

See More