"Regional Banks' Quality Scores Drop After Jamie Dimon's Warning: Are Cockroaches in the Vault?"

Deterioration of Regional Banks: Three regional banks—Old National Bancorp, Atlantic Union Bankshares, and Community Financial System—have seen their quality rankings plummet into the bottom decile, indicating a significant decline in their operational efficiency and financial health.

Jamie Dimon's Warning: JPMorgan Chase CEO Jamie Dimon highlighted potential issues in the banking sector, referring to "cockroaches" in U.S. credit markets, which coincided with a sell-off in regional banks and concerns over contagion risks.

Stock Performance Trends: All three banks are experiencing negative stock performance, with declines in year-to-date and annual metrics, despite maintaining some growth rankings according to Benzinga’s Edge Stock Rankings.

Market Reactions: The broader market showed mixed futures for major indices, with the S&P 500, Dow Jones, and Nasdaq 100 experiencing slight gains, while regional banking stocks faced downward pressure amid ongoing concerns.

Trade with 70% Backtested Accuracy

Analyst Views on JPM

About JPM

About the author

- Current Market Outlook: Bank stocks are currently perceived as undervalued and present a good investment opportunity.

- Impact of AI: The banking sector is leveraging artificial intelligence to enhance operations and profitability rather than facing challenges from it.

- Debt Financing Scale: Amazon is exploring a debt issuance that could raise at least $37 billion and potentially up to $42 billion, providing crucial funding for its investments in artificial intelligence and infrastructure.

- Diverse Issuance Structure: The debt offering may include as many as 11 different tranches, with maturities ranging from 2 to 50 years, demonstrating Amazon's flexibility and diversity in its financing strategy.

- Market Expectations: It is anticipated that U.S. bonds will dominate the issuance, raising about $25 billion to $30 billion, while another $10 billion may be raised through euro-denominated bonds issued across 8 tranches, further broadening its financing channels.

- Strong Underwriting Team: Major Wall Street banks, including Goldman Sachs, J.P. Morgan, and Citigroup, are expected to manage the debt issuance, indicating market confidence and support for Amazon's financing plans.

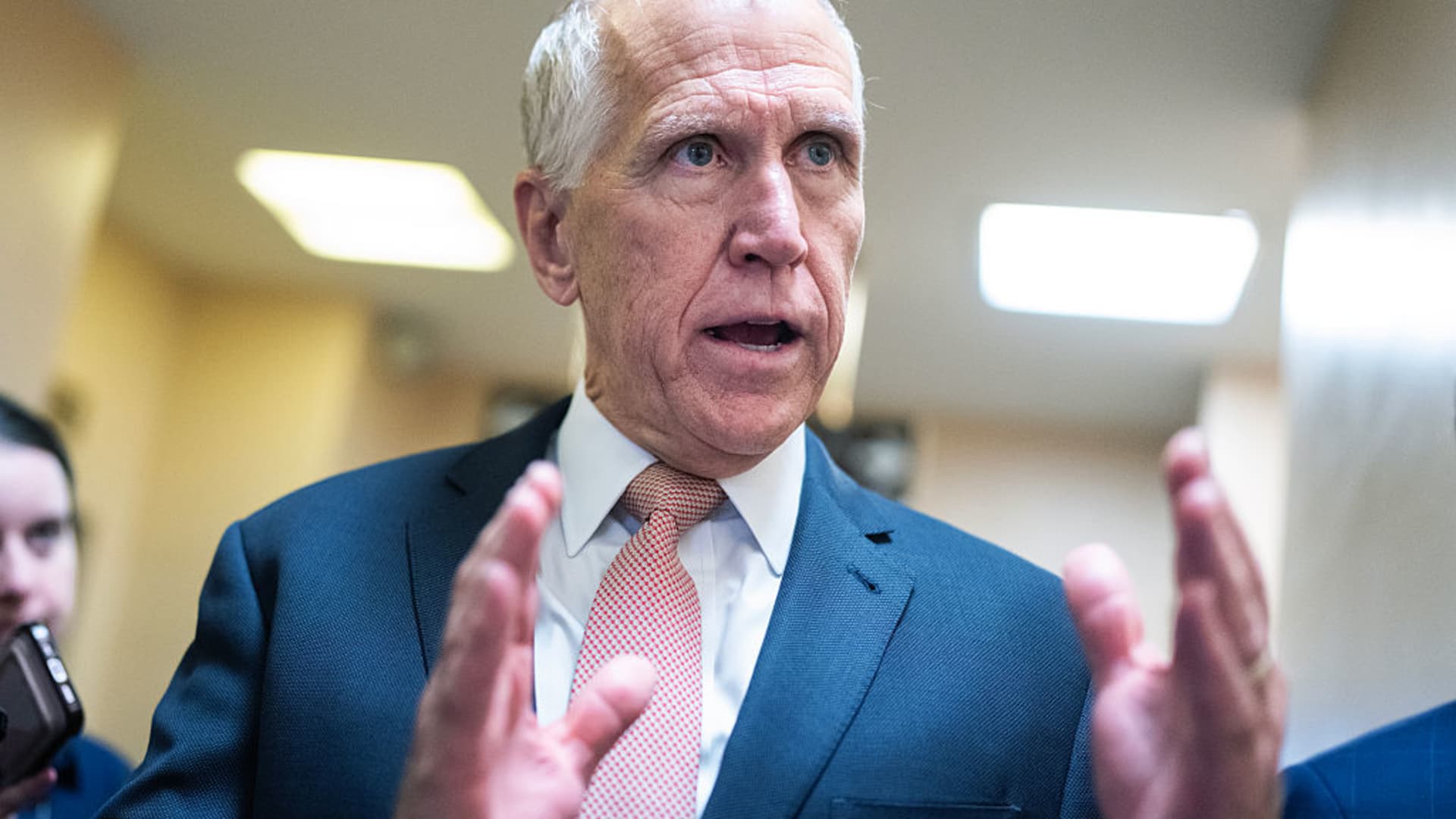

- Confirmation Block: Senator Thom Tillis from North Carolina stated that he will not vote for any Fed nominees, including Kevin Warsh, until the criminal investigation into Fed Chair Jerome Powell is resolved, indicating strong dissatisfaction with the Fed nomination process.

- Political Context: Tillis believes that the investigation into Powell is politically motivated, particularly due to Powell's refusal to cut interest rates as quickly as demanded by President Trump, complicating the confirmation of Fed nominees.

- Evaluation of Warsh: Despite expressing admiration for Warsh's skills, stating he is 'already impressed' with his work, Tillis remains firm on not voting, reflecting a lack of trust in the current Fed leadership.

- Process Over Personal: Tillis emphasized that this is not about personal issues but rather about procedural integrity, indicating that he prioritizes the completeness and transparency of the nomination process, which could impact future Fed nominations and policy directions.

Career Transition: Mollie Colavita transitioned from Merrill Private Wealth Management, where she spent over 25 years, to JPMorgan Chase in 2021.

Leadership Role: In 2025, she was appointed CEO of J.P. Morgan Advisors, succeeding Phil Sieg, who is set to retire.

- Leadership Change: Cresset, a wealth management firm based in Chicago, is promoting Susie Cranston to CEO, effective April 15.

- Continued Involvement: Co-founders Avy Stein and Eric Becker will remain involved as executive co-chairmen of the firm.

- Announcement of Cash Distributions: JPMorgan has announced cash distributions for its Exchange-Traded Funds (ETFs).

- Impact on Investors: This move is expected to benefit investors by providing them with immediate cash returns from their investments in the ETFs.