Key Takeaways

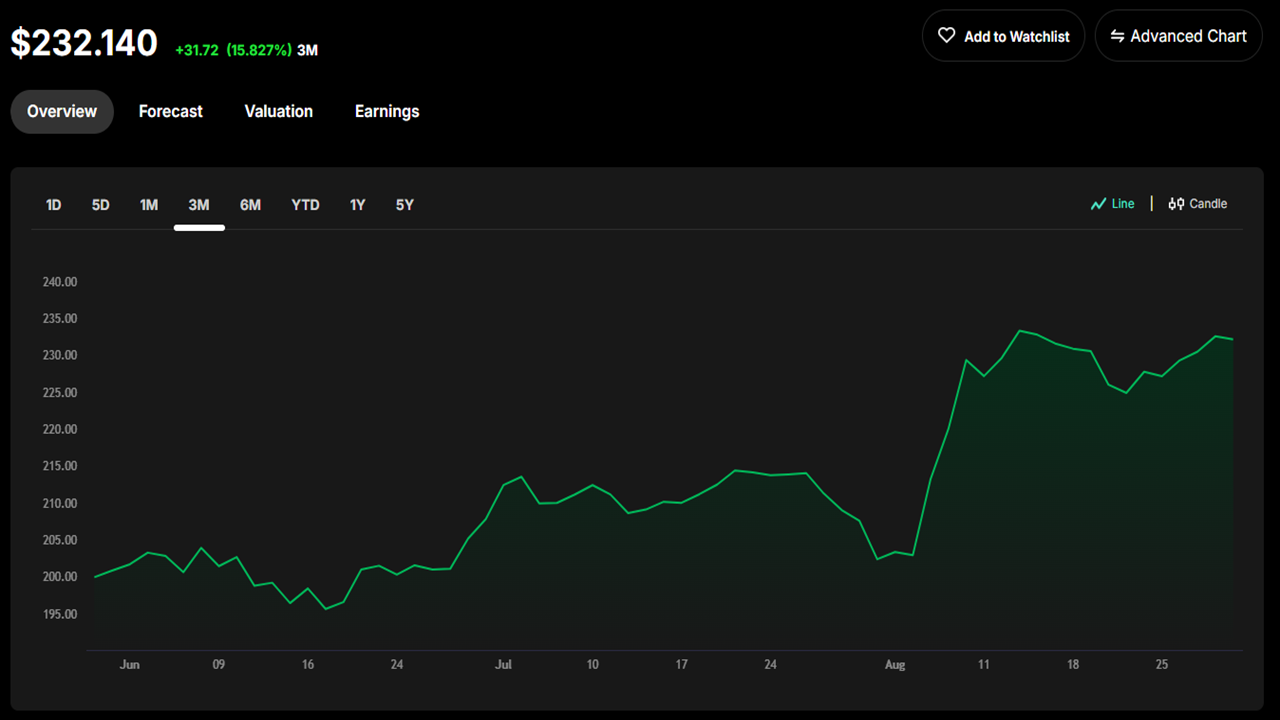

- Berkshire Hathaway announced its Q1 2025 report in May 2025, which covers the Quarter ended in March and generated revenue of $89.725 billion, slightly lower than the same period in 2024.

- The Warren Buffett portfolio includes companies such as Coca-Cola (KO), American Express (AXP), Apple (AAPL), and others.

- Mr. Buffet and his team recently reduced their stake in Bank of America Corp (BAC) and Apple Inc. (APPL).

- The Berkshire Hathaway portfolio recently added new stakes in companies across various sectors, including healthcare, food chains, metal and the housing industry.

Introduction

Investing in the financial market has become increasingly complex due to the market’s continued volatility, accompanied by considerable uncertainty and geopolitical tensions. Due to current conditions, it has become increasingly complex to determine which assets are promising for generating income and preserving capital for both short-term and long-term investors. It is a broader challenge for a significant number of individual investors, even professionals, to keep pace with the volatility.

Portfolios such as Berkshire Hathaway have garnered global attention as they represent the portfolio of investing legend Warren Buffett. The holding company manages over $700 billion, run by Warren Buffett. The company’s portfolio involves a diversified range of assets, including publicly traded equities, privately owned subsidiaries, and a substantial amount of cash. So, it’s no wonder that millions of traders around the globe review the portfolio of Berkshire Hathaway every quarter to inform their trade decisions and stay ahead of trends.

This article covers everything an investor needs to know about Warren Buffett's portfolio holdings 2025, including an overview of Berkshire Hathaway, the top five assets in the portfolio, and recent portfolio movements. However, platforms like intelectia.ai help investors gain more insight and utilise artificial intelligence to learn how to invest like Warren Buffett. In the following section, we will discuss how users can utilise the platform more effectively to explore investment opportunities.

Who Is Warren Buffett And Why Does His Portfolio Matter

Warren Edward Buffett is a legendary American investor often referred to as the “Oracle of Omaha,” reflecting his reputation in the investment sector. He is the CEO and chairman of Berkshire Hathaway, and he has amassed a remarkable fortune through his visionary investment decisions, disciplined approach, long-term mindset, and a unique ability to identify the most promising investment assets.

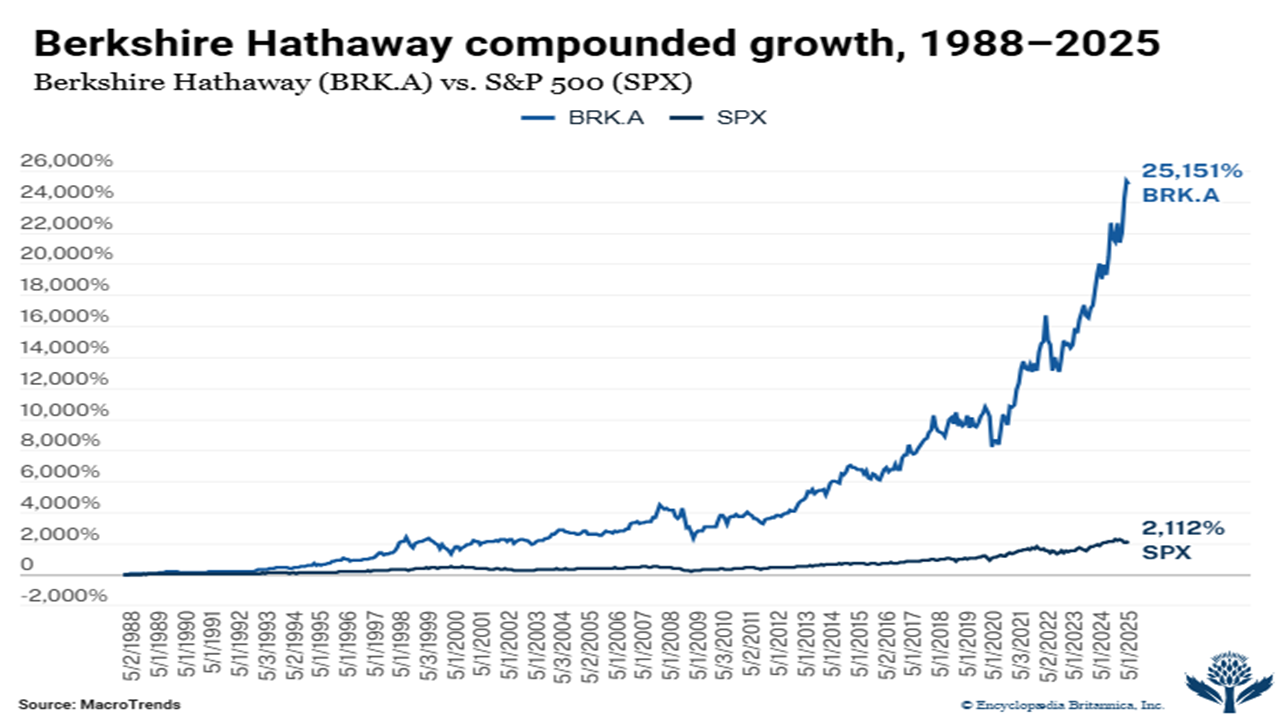

Warren Buffett's portfolio holdings 2025 have delivered remarkable positive results over the decades, and this consistency has transformed a tiny textile mill into a vast company with a capitalisation of over $1 trillion, making Warren Buffett the sixth richest billionaire, according to Forbes, with a net worth of more than $154 billion. So, it’s no wonder that traders, including individual investors, professional traders, or Wall Street analysts, closely monitor the portfolio of the investment legend to gain insight into how he allocates the best investment assets over a specific period.

After a more extended period, Warren Buffett proved himself to be a role model in investing and selecting the appropriate assets to outperform the market. So, his portfolio becomes attractive to investors or serves as a blueprint to recognise potential assets that can generate considerable profit over time.

Overview of Berkshire Hathaway’s Portfolio

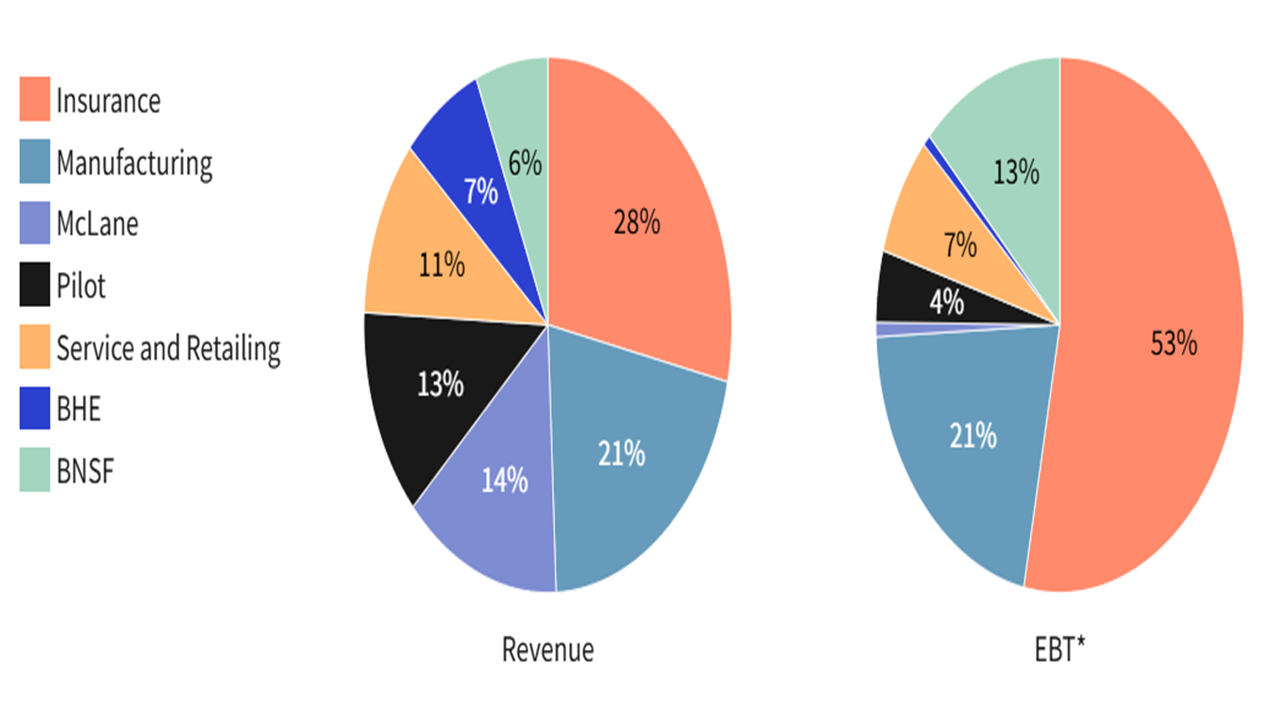

Berkshire Hathaway is an American holding company led by the legendary investor Warren Buffett. The company is based in Omaha, Nebraska. It operates within the financial sector and the reinsurance industry, owning dozens of businesses in various sectors, including equities, insurance, transportation, retail, and energy.

Berkshire Hathaway announced its Q1 2025 report in May 2025, which covers the Quarter ended in March and generated revenue of $89.725 billion, slightly lower than the same period in 2024. Meanwhile, earnings were $4.672 billion, which is considerably lower than in Q1 2024, when the figure was $12.702 billion.

Let’s check the Berkshire Hathaway stock investments in different sectors at a glance.

The report shows asset allocations for fiscal year 2024, which ended on December 31, 2024.

While the remarkable holding company has many assets and investments in various sectors. You can group all into three major components. Berkshire Hathaway stock investmentst is a list of publicly traded companies, including publicly traded stocks, wholly owned subsidiaries, and substantial cash reserves.

- Publicly Traded Companies: This portion of the portfolio captures the most attention from investors, impressively reflecting $277 billion in investments in various publicly traded companies. Buffett and his teams select the companies before making investments. It also shows their interests in companies over a considerable time, making it a must-check list for investors who follow the role model Warren Buffett. In this section, the portfolio includes companies such as Coca-Cola (KO), American Express (AXP), Apple (AAPL), and others.

- Wholly Owned Subsidiaries: The holding company holds investments in various sectors that generate income over an extended period, but these companies are privately owned and not publicly traded. This portion includes companies like BNSF Railway (freight rail transport), GEICO (auto insurance), and Berkshire Hathaway Energy (utility and energy generation).

- Massive Cash Reserve: The company has a substantial cash reserve, which reached $344 billion by mid-2025. Mr. Buffett doesn’t view cash as a static asset, but as a strategic tool, because it increases his purchasing power and unlocks opportunities, especially during turbulent periods.

Top 5 Stocks in Warren Buffett’s Portfolio

This section lists the top five stocks in the portfolio of Warren Buffett and short description to introduce. Let’s check at a glance:

| Company Name | Ticker | Sector | Portfolio Weight | Key Strength |

| Apple Inc. | AAPL | Technology | 21% | Iconic brand, increasing global demand |

| Bank of America Corp. | BAC | Financial | 10% | A leading U.S. bank, with consistent interest income growth and robust fundamentals |

| American Express Co. | AXP | Financial | 16.5% | Remarkable and leading brand in the global payment network and credit card sector |

| Coca-Cola Co | KO | Consumer Staples | 9.1% | Consistent dividend history, increasing demand |

| Constellation Brands Inc | STZ | Beverages | 0.7% | Premium beverage growth and expanding portfolio |

Apple Inc. (AAPL)

Apple Inc. holds a significant portion of the portfolio, approximately 21%, with a value of $64.9 billion. The robust ecosystem and sticky consumers around the globe attract Warren Buffett, as he once mentioned, “probably the best business” he knows, which reflects his reliability. The company has millions of customers worldwide, as its brand value is unmatched and its cash flow is recurring. These attributes make APPL an attractive investment asset to Mr. Buffett.

Bank of America Corp. (BAC)

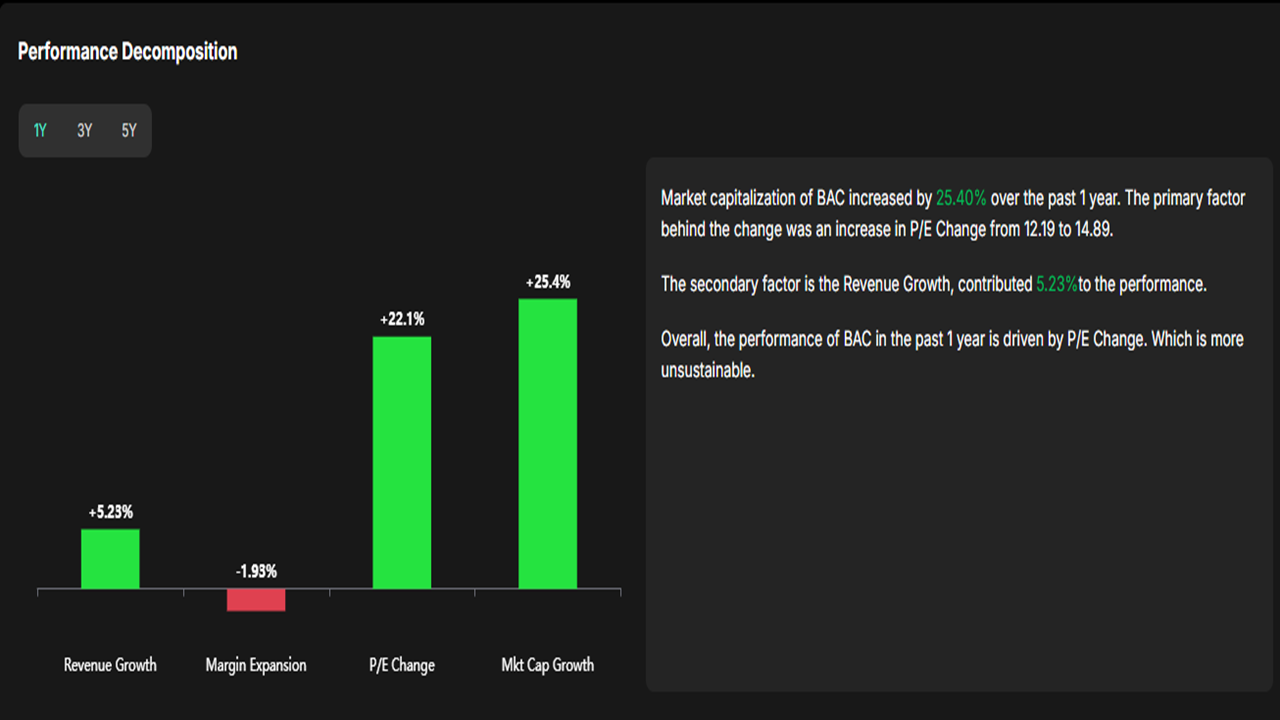

Bank of America Corp. (BAC) is another company holding approximately 10% of the portfolio. It reflects significant confidence in the leading American banking company. It remains one of the key holdings in the portfolio over long period, despite recent trimming by Mr. Buffett. Mr. Buffett appreciates the bank’s position, strong leadership, remarkable fundamentals, and consistent ability to generate income.

American Express Co.(AXP)

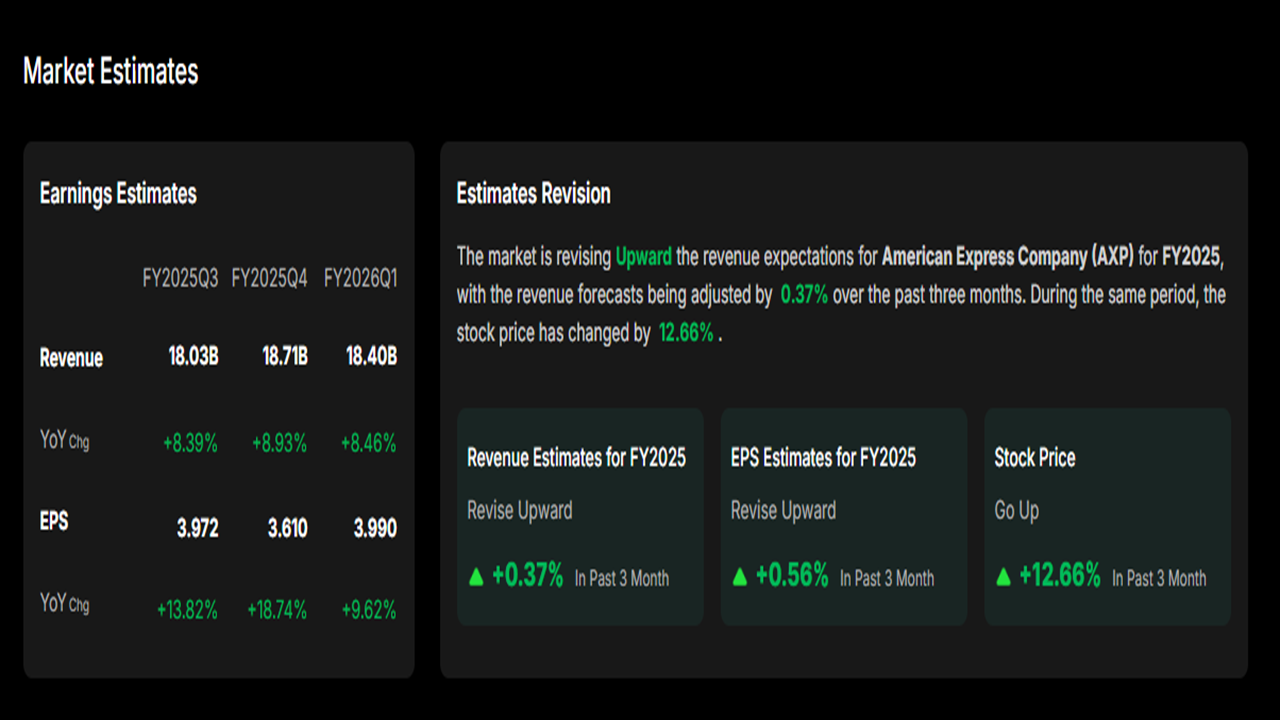

American Express Co. (AXP) is one of the top five holdings in the portfolio, accounting for approximately 16.5%. Mr. Buffett has owned shares of AXP shares for decades. This financial company operates as both a payment processor and a lender or financial services provider. Therefore, the company has a unique ability to generate income from a dual revenue stream.

These capabilities are crucial factors to consider when generate incomes and seeking long-term potential investments, making it an adequate investment asset.

Coca-Cola Co (KO)

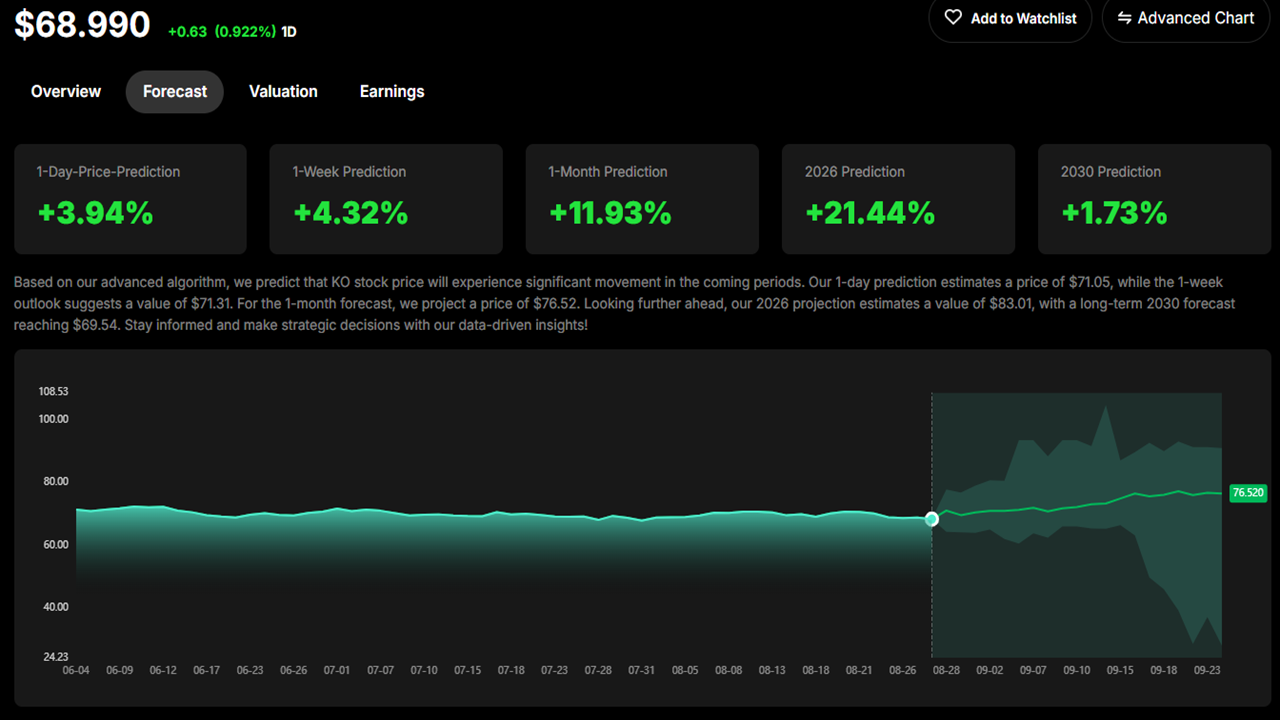

The Coca-Cola Company (KO) has remain one of Warren Buffett’s iconic holdings, represents 9.1% of the total portfolio. This consumer staple company has a record of recession-resistant nature due to stable demand. It is a globally famous brand that pays consistent dividends, making it an attractive investment. It is one of his “forever stock”.

Constellation Brands (STZ)

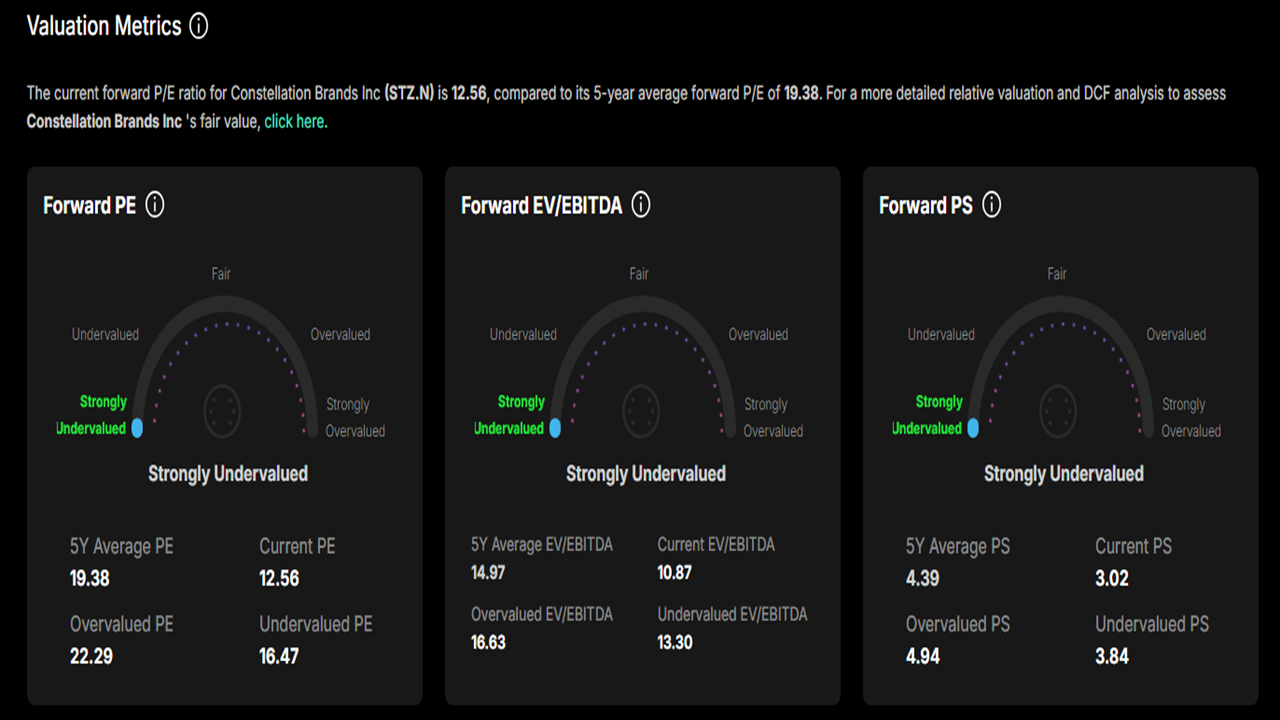

Constellation Brands (STZ) is not one of the top holdings, representing only 0.7% of the portfolio, but it is notable as it is a new addition to the portfolio. A company that includes famous brands like Corona and Modelo, making it attractive as the beverage trend is gaining more traction.

Recent Portfolio Moves

Warren Buffett has made recent adjustments in his portfolio, including trimming some holdings and adding strategic holdings. It reflects strategic movements that can occur for profit-taking, identifying new opportunities, or shifting trends. Mr. Buffet and his team recently reduced their stake in Bank of America Corp (BAC) and Apple Inc. (APPL).

Simultaneously, the portfolio recently added new stakes in companies across various sectors, including healthcare, food chain, metal and housing industry. For instance, Domino’s Pizza, most notably by taking a significant stake in UnitedHealth Group, Nucor (NUE), Lennar (LEN), and D.R. Horton (DHI). Domino’s Pizza has regained global recognition and remains a prominent player in the food industry. UnitedHealth Group’s share price skyrocketed while Mr. Buffet made an investment of $1.6 billion. He takes a stake worth $860 million in Nucor (NUE), which is a steel company, reflecting his interest in the metal sector. Again, his recent investments in Lennar (LEN) and D.R. Horton (DHI) reflect his confidence in the housing market.

Moreover, as of mid-2025, the portfolio holds a cash pile of $334 billion, which provides a strong indication that the legend and his team may be seeking undervalued assets that can generate moderate income over a specified period.

How to Analyse Buffett’s Portfolio with Intellectia.ai

Intellectia.ai is an attractive platform for investors, as it provides innovative insights into any stock. You can use the AI stock picker and AI stock screener features to allow investors to track the portfolio holdings of Warren Buffett. Any investor can do it using the same fundamental principle that the legend uses. The platform enables filtering using Mr. Buffett’s philosophy, such as,

- P/E Ratio: Seek companies that are trading at a price relative to their earnings.

- High ROE (Return on Equity): Select companies that generate profits efficiently and consistently utilise shareholders’ capital.

- Consistent Profitability: Identify businesses that consistently generate profits and increase earnings.

- Low Debt-to-Equity Ratios: Investors may seek companies with a stable balance sheet and minimal reliance on debt.

When applying these filters, investors can not only analyse stocks of Warren Buffett’s portfolio, but also many other companies with similar characteristics. Moreover, intellectia.ai provides fundamental updates that enable investors to make more efficient and data-driven investment decisions.

Unlocking Wealth with Warren Buffett’s Portfolio Insights

Warren Buffett has significant holdings in some famous companies in technology and financial setor, such as Apple Inc. and Bank of America. It shows the legend has a primary focus on undervalued, high-quality stocks with solid fundamental support. His approach is a disciplined, long-term mindset, which is notable for every investor.

Moreover, he has a recent cash pile of $344 billion, signalling his caution and hunting opportunities for potentially profitable investment assets, and possibly seeking opportunities to invest in stocks at an attractive price to generate a considerable return.

Investors can utilise AI-driven tools from intellectia.ai to analyse their portfolio holdings and determine stocks that may generate significant profits in the long term.

Conclusion

Finally, now you have the basic idea of Top stocks in Warren Buffett’s portfolio and his investment patterns. His portfolio demonstrates how to generate substantial profits through disciplined investing with a long-term mindset. The portfolio is an attractive list of investment assets, and millions of investors follow the list to generate investment ideas.

Platforms like intellectia.ai enable various AI-driven tools, including an AI screener and technical and fundamental analysis, that help investors make informed trade decisions. You can sign up today and subscribe to daily AI stock picks, AI trading signals & strategies, and market analysis from Intellectia.ai.