Key Takeaways

- AI is radically reducing the time and cost of drug discovery, creating a new sector of "Tech-Bio" companies with high growth potential.

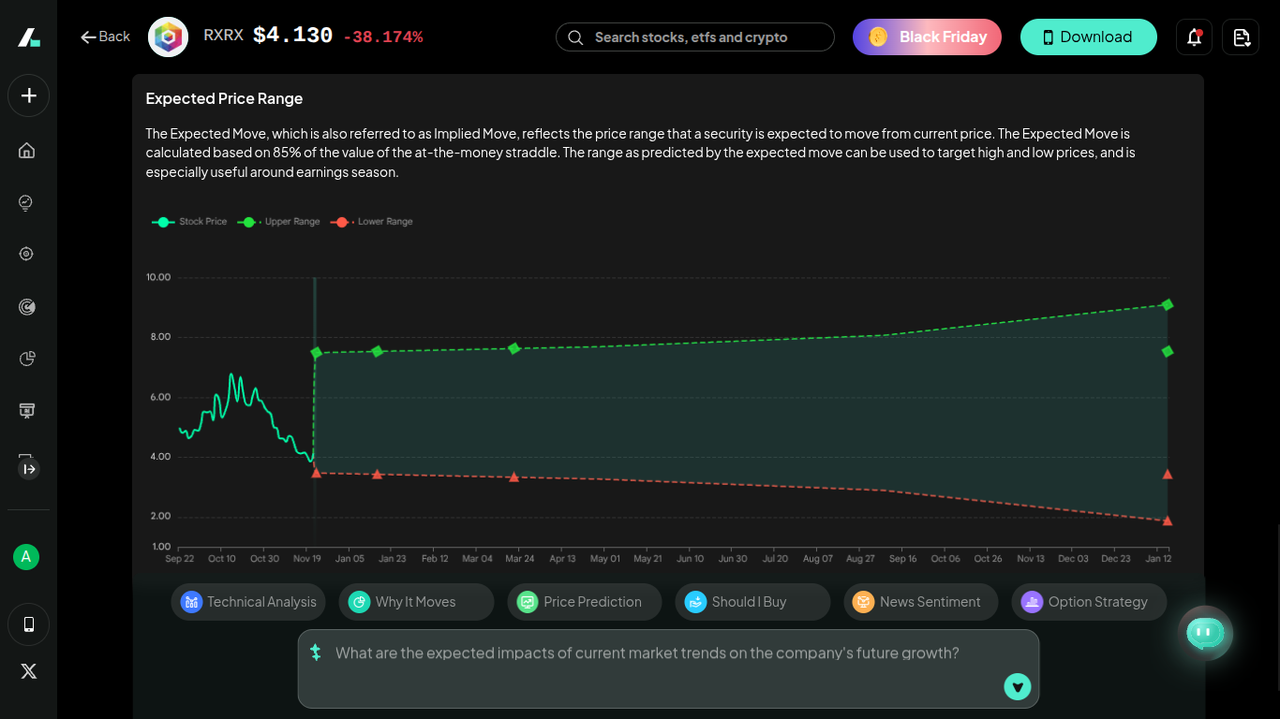

- Recursion Pharmaceuticals (RXRX) has secured a massive cash runway through 2027, positioning it as a leader in AI-driven biology.

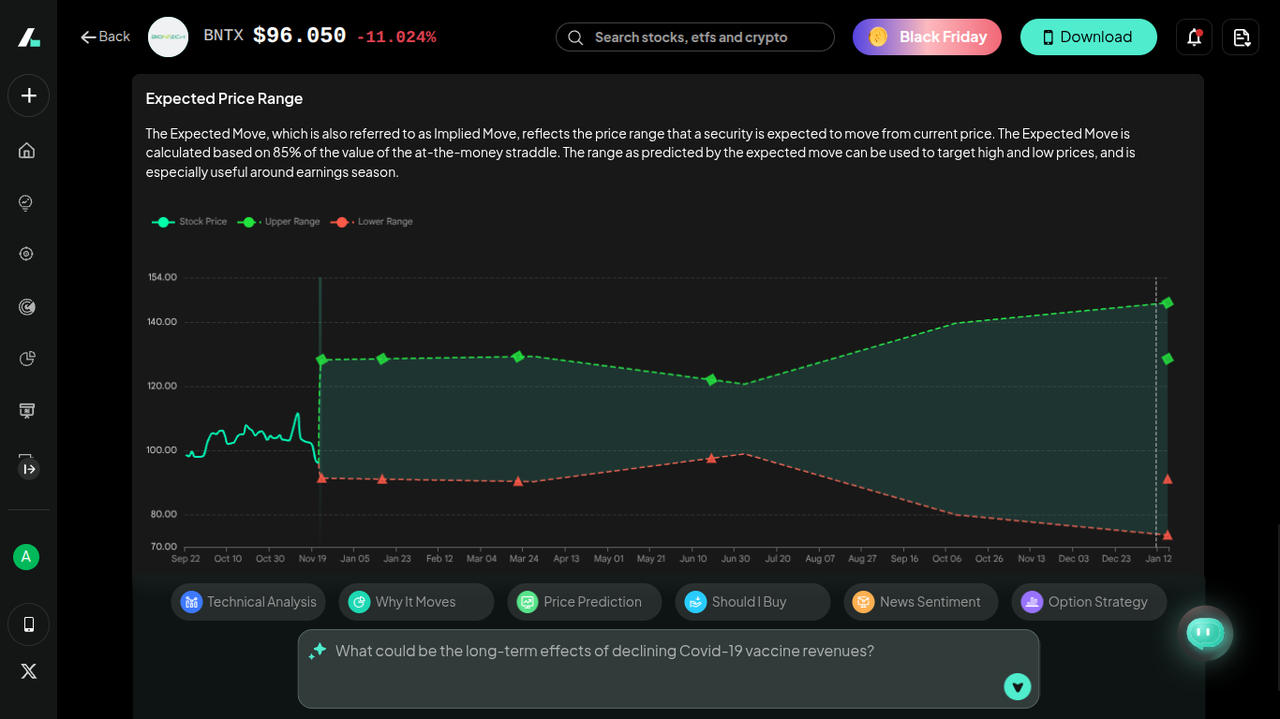

- BioNTech (BNTX) is pivoting its massive cash reserves into an AI-powered oncology pipeline, moving beyond its COVID-19 legacy.

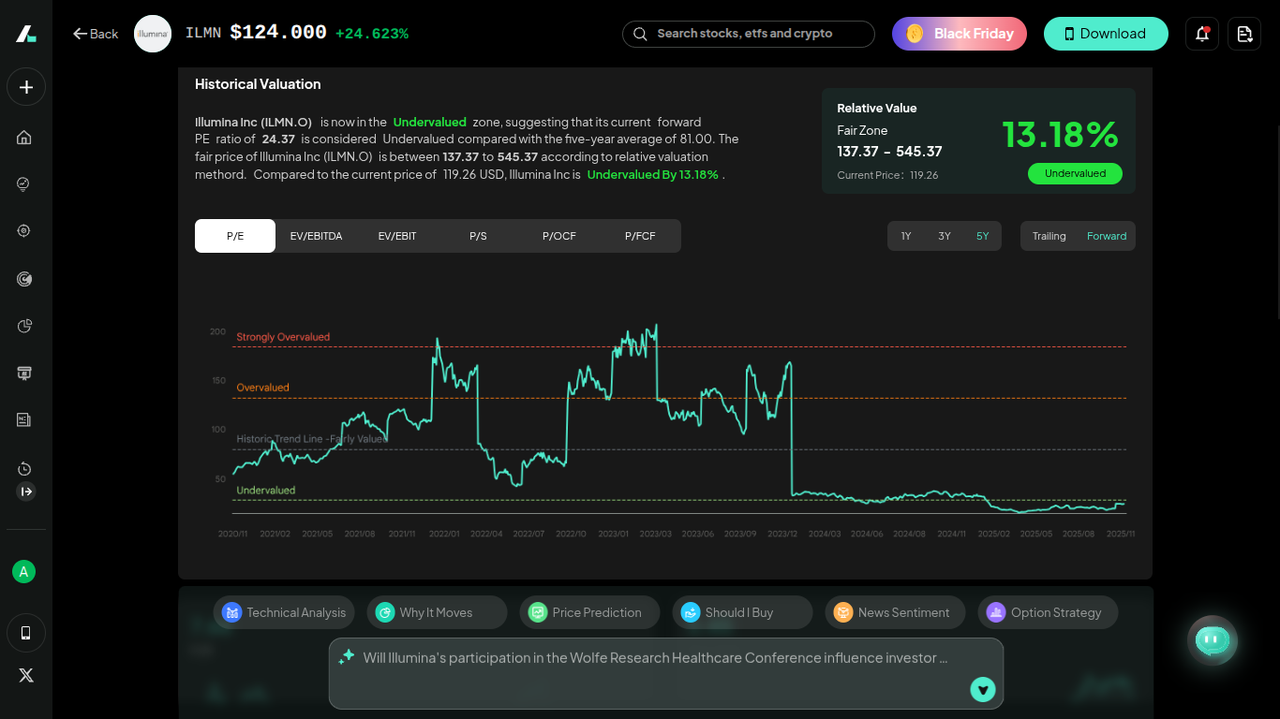

- Illumina (ILMN) is expanding beyond sequencing into AI data services with its new BioInsight business unit.

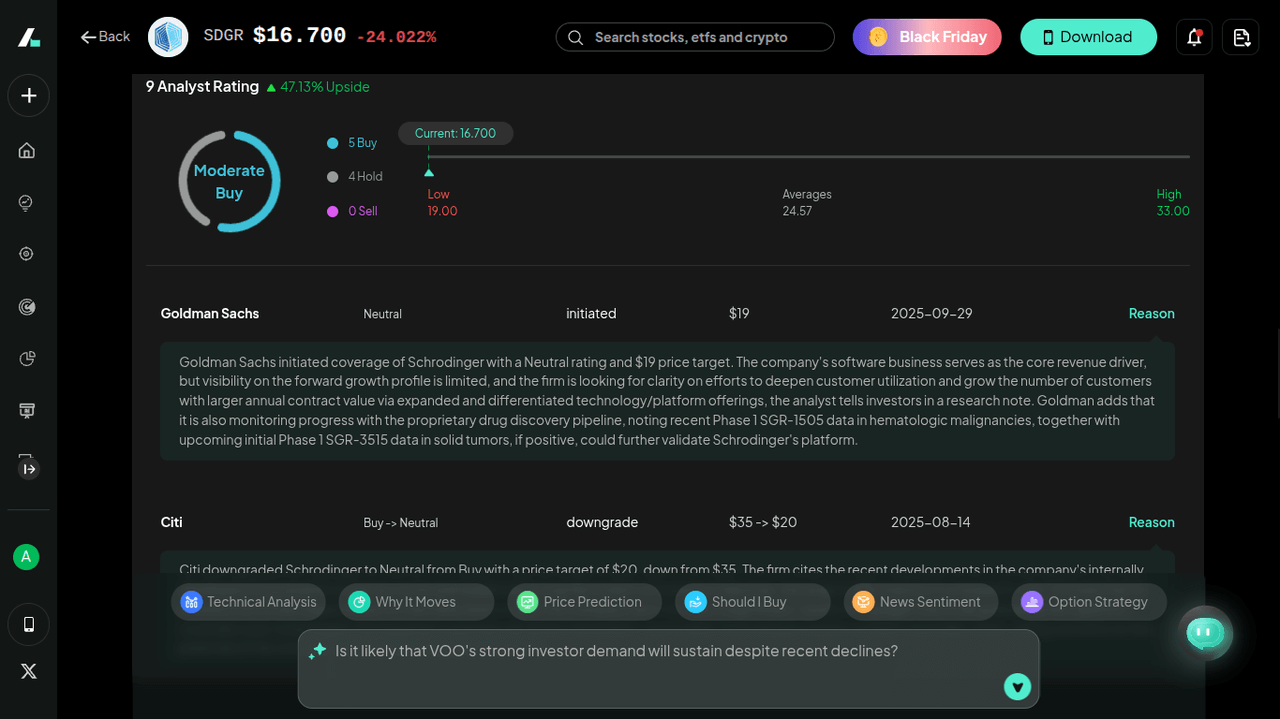

- Schrödinger (SDGR) is shifting its business model to focus on high-margin software and discovery partnerships, reducing clinical risk.

Introduction

Have you ever stared at a biotech stock plummeting 50% overnight because of a failed clinical trial and wondered how you could have predicted it? Or perhaps you’ve watched from the sidelines as a "Tech-Bio" company rallied because their AI algorithm identified a drug candidate in months rather than years?

The problem with traditional biotech investing is the binary nature of the industry—it is often a gamble on a single lab result. However, a revolution is happening. Artificial Intelligence is aggregating massive biological datasets to predict success before a physical trial even begins. This expertise, blending computer science with biology, is changing the risk profile of the sector.

The solution for your portfolio isn't just buying random pharma stocks; it's identifying the companies building the engines of discovery. In this article, you will explore the best AI biotech stocks that are leveraging machine learning to redefine medicine and potentially generate massive returns for your portfolio.

What Are AI Biotech Stocks?

AI biotech stocks represent companies that sit at the intersection of technology and biology. Unlike traditional pharmaceutical companies that rely on trial-and-error in a wet lab, these companies use advanced algorithms, machine learning, and massive computing power to simulate biological interactions.

Think of these companies not just as drug makers, but as data companies. They use generative AI to design novel protein sequences, predict how a molecule will bind to a target, and identify patients who are most likely to respond to a treatment.

By investing in AI biotech stocks, you are investing in platforms that can generate multiple assets, rather than a single drug. This sector includes companies that sell the AI software (the "picks and shovels"), companies that use AI to develop their own pipeline, and hybrids that do both.

As markets move into 2026, this distinction between "Tech" and "Bio" is blurring, creating some of the most exciting investment opportunities in the market.

Why Invest in AI Biotech Stocks?

Why should you allocate capital to biotech ai stocks now? The answer lies in efficiency and probability.

Speed and Cost Reduction

Traditional drug discovery takes over a decade and costs billions. AI can shorten the discovery phase from years to months. For example, companies like Recursion Pharmaceuticals are now using automated labs driven by AI to conduct millions of experiments weekly, drastically lowering the cost per discovery.

Higher Success Rates

The biggest risk in biotech is failure in Phase II or III clinical trials. AI models help filter out bad candidates earlier in the process. By simulating toxicity and efficacy virtually, companies can ensure that only the most promising molecules enter human trials.

The "Tech-Bio" Premium

AI-powered biotech stocks often command higher valuations because their platforms are scalable. Once an AI model is trained, it can be applied to hundreds of diseases. This scalability offers you a growth potential that traditional single-asset biotech firms cannot match.

Massive Industry Adoption

As seen in late 2025, major pharmaceutical giants are no longer just dipping their toes in the water; they are buying in. Companies like Roche, Sanofi, and Novartis are signing multi-billion dollar deals with AI biotech firms to access their technology. Investing now allows you to ride this wave of institutional adoption.

5 Best AI Biotech Stocks

Based on Q3 2025 performance, strategic pivots, and technological capabilities, here are the top contenders for your portfolio.

| Company Name | Ticker | Market Cap | Key Strength |

|---|---|---|---|

| Recursion Pharmaceuticals | RXRX | ~$2B | Massive proprietary dataset & "Recursion OS" |

| BioNTech SE | BNTX | ~$23.3B | Deep cash reserves & AI-driven Oncology |

| Illumina, Inc. | ILMN | ~$18.2B | Genomic sequencing leader entering AI data services |

| Schrödinger, Inc. | SDGR | ~$1.2B | Physics-based software standard for drug design |

| Moderna, Inc. | MRNA | ~$8.7B | mRNA platform leader with AI-designed vaccines |

Recursion Pharmaceuticals (RXRX)

Recursion Pharmaceuticals is arguably the purest play in the best ai biotech stocks list. They don't just use AI; they built their entire company around the "Recursion OS," an operating system for drug discovery.

Recursion recently announced a major leadership transition, with Najat Khan taking over as CEO to drive execution. Financially, they are in a fortress position, reporting nearly $800 million in cash, which provides a runway through the end of 2027. This is critical in a high-interest-rate environment.

They recently earned a $30 million milestone payment from Roche/Genentech for a "whole genome neuro map." This validates their platform's ability to map complex biology (specifically neuroscience). While they face risks—shares dipped on the CEO transition news—their massive dataset and partnership inflows make them a standout for long-term growth.

BioNTech SE (BNTX)

You likely know BioNTech for its COVID-19 vaccine, but its future is in AI-powered oncology. They define themselves as a "fully integrated AI-tech bio company."

Despite Pfizer selling down some of its stake (which caused short-term volatility), BioNTech reported strong Q3 revenues of €1.52 billion, beating expectations. They are aggressively pivoting to cancer treatments, utilizing AI to address inter-patient heterogeneity—essentially using AI to tailor cancer drugs to individual immune systems.

Cash is king in biotech, and BioNTech has over €16 billion on its balance sheet. This allows them to acquire AI technologies (like their InstaDeep acquisition) and fund massive Phase III trials for their assets like Pumitamig without diluting shareholders.

Illumina, Inc. (ILMN)

Illumina provides the data that fuels the AI revolution. You cannot have AI in biology without genomic data, and Illumina dominates the sequencing market.

Illumina is seeing an acceleration in its NovaSeq X transition, which drives higher data throughput. Crucially, they launched BioInsight, a new business unit focused on leveraging genomic data for drug discovery using AI. Additionally, the lifting of the export ban to China in late 2025 removes a significant regulatory overhang.

Illumina is a "pick and shovel" play. By launching BioInsight, they are moving up the value chain from just selling hardware to selling AI-enabled biological insights. With margins expanding and a return to growth, ILMN is a foundational holding for top ai biotech stocks 2026.

Schrödinger, Inc. (SDGR)

Schrödinger blends physics-based simulation with machine learning. Their software is the industry standard for molecular design.

In a major strategic shift, Schrödinger announced they will no longer advance internal discovery programs into the clinic independently. Instead, they will focus on software and discovery partnerships. This reduces their cash burn significantly (saving ~$70M annually). While they lowered software growth guidance slightly due to a pharma slowdown, their drug discovery revenue jumped to $13.5 million in Q3.

This pivot de-risks the stock significantly. By removing the high cost of clinical trials, Schrödinger becomes a higher-margin software and royalty business. For investors looking for ai-powered biotech stocks with less binary clinical risk, SDGR is a strong contender.

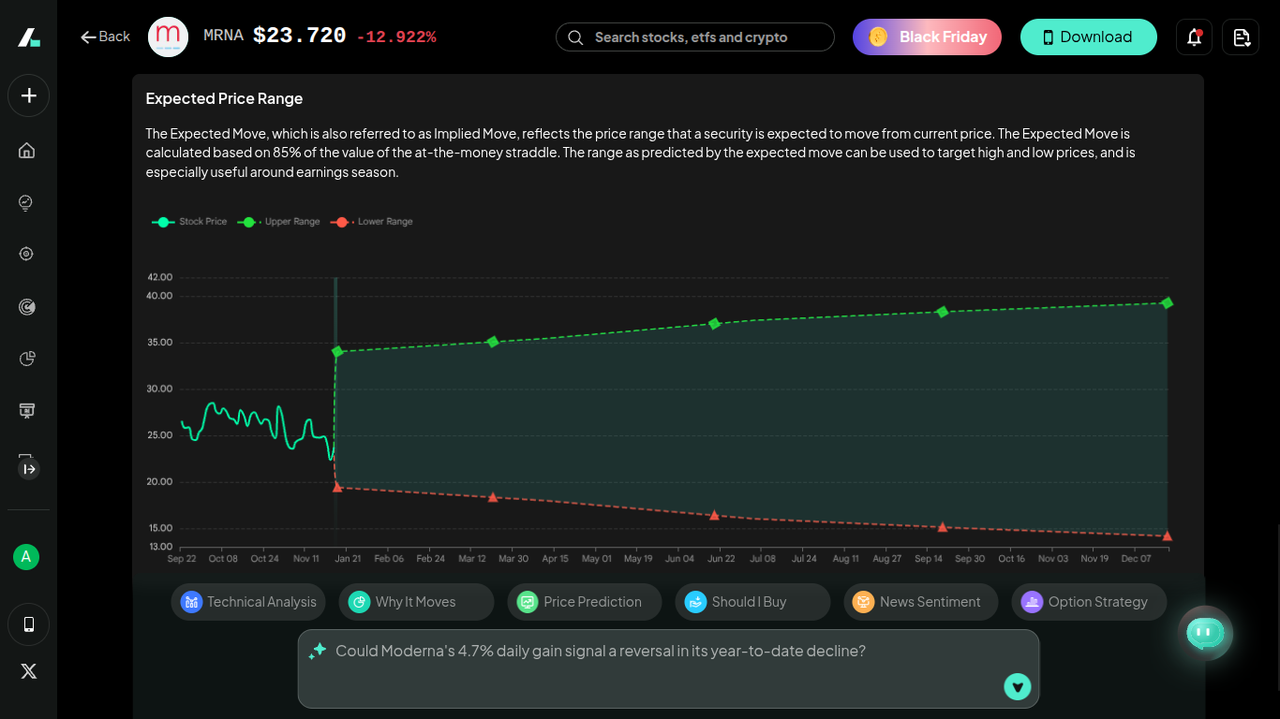

Moderna, Inc. (MRNA)

Moderna is the pioneer of mRNA technology, which is inherently programmable and digital.

Moderna is in a turnaround phase. They reported a Q3 revenue beat ($1 billion) but are facing challenges, including the discontinuation of their CMV vaccine program. However, they have aggressively cut costs, saving $900 million in 2025 expenses. Their pipeline remains robust with 10 late-stage programs, including cancer vaccines designed using AI algorithms to predict the best antigens.

Despite the headwinds, Moderna's technology platform is proven. Their ability to rapidly design mRNA sequences using digital tools places them firmly among top biotech ai stocks. With a reduced cost structure and a focus on cancer vaccines, the risk-reward ratio at current levels ($24 range) is compelling for contrarian investors.

Investment Strategies for AI Biotech Stocks

Investing in this sector requires a blend of traditional analysis and modern tools. Here is how you can approach it.

Diversify Your Stock Portfolio

Biotech is volatile. Even the best AI cannot guarantee a clinical trial win (as seen with Moderna’s CMV program). Do not put all your capital into one stock. A basket approach—owning a software provider like Schrödinger, a platform company like Recursion, and a commercial giant like BioNTech—balances your risk.

Long-term vs. Short-term Strategy

- Long-term: If you believe in the singularity of biology and tech, hold stocks like RXRX and ILMN through the volatility. Their moats are their datasets.

- Short-term: Trade around data readouts. Clinical trial results (like BioNTech’s oncology updates) cause massive price swings.

Use Technical Analysis and AI Signals

Because these stocks are news-sensitive, timing your entry is critical. You shouldn't just rely on fundamentals. Use technical analysis to identify support levels and breakout points.

For example, checking Intellectia.AI’s stock technical analysis can help you see if a stock like Moderna is oversold or if Illumina is breaking out of a consolidation pattern.

Utilize AI stock signals to catch momentum shifts before the broader market reacts to news like FDA approvals or partnership announcements.

Conclusion

The convergence of artificial intelligence and biotechnology is not just a buzzword; it is the only way the pharmaceutical industry can sustain itself moving forward. The best biotech ai stocks discussed here—RXRX, BNTX, ILMN, SDGR, and MRNA—are at the forefront of this shift.

Whether you are looking for the stability of an infrastructure provider like Illumina or the explosive potential of a platform like Recursion, the opportunities in 2026 are immense. However, navigating this volatility requires sharp tools.

To stay ahead of the market, Sign Up for Intellectia.AI today. You will get access to daily AI stock picks, real-time trading signals, and deep market analysis that will help you time your entries and exits in the fast-moving world of AI biotech. Don't guess—let AI help you invest in AI.