Key Takeaways

- Cryptocurrency offers independence from traditional banking systems through decentralized blockchain technology.

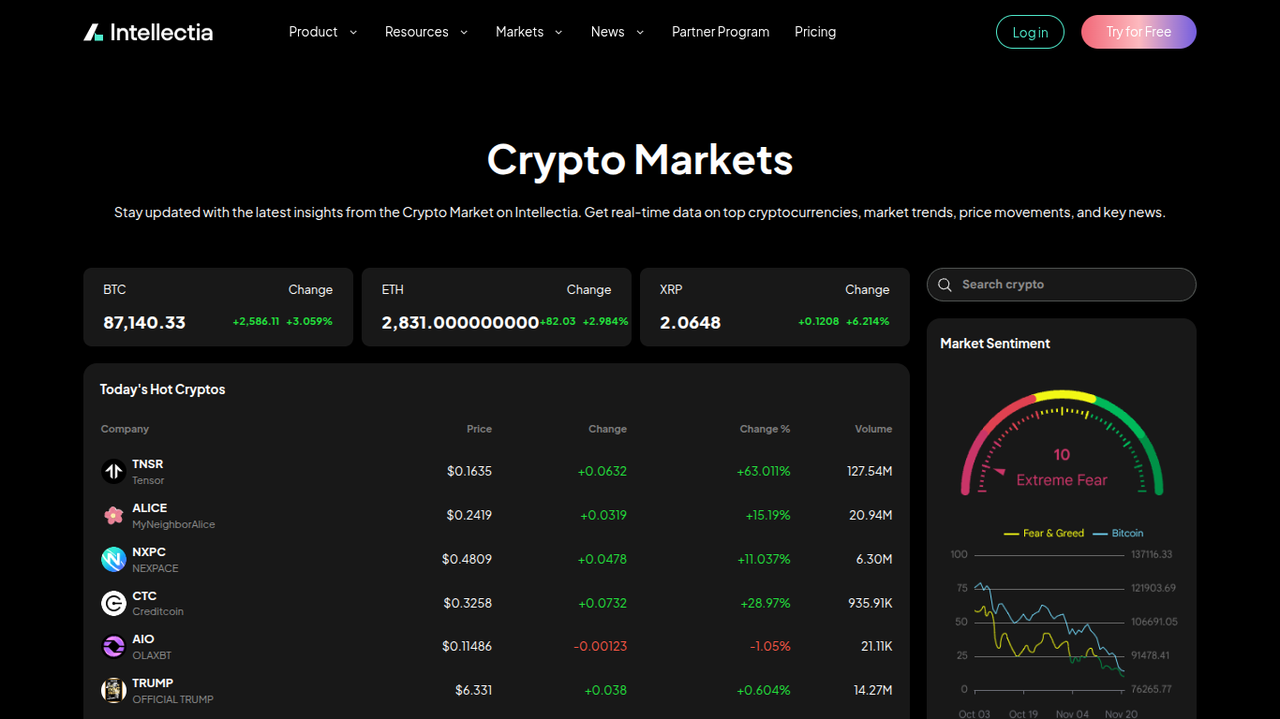

- Digital assets provide high liquidity and 24/7 market access, unlike traditional stock markets.

- Top picks for 2026 include innovative projects like BANANAS31, LIGHT, RESOLV, and AIO, spanning meme culture to AI integration.

- Utilizing AI tools for technical analysis and screeners significantly enhances your trading strategy and risk management.

Introduction

Have you ever felt that the traditional financial system is moving too slowly for your ambition? You aren't alone. Many traders face the problem of limited market hours, high barriers to entry, and a lack of transparency in conventional banking. This often leads to missed opportunities and frustration.

However, when you aggregate the potential of digital assets, a different picture emerges. By leveraging the expertise found in modern blockchain technology, you gain access to a global, borderless financial system that never sleeps. The solution lies in understanding the mechanics of this new economy and using advanced tools to navigate it.

For example, imagine identifying a breakout trend before the mainstream news catches it. By analyzing market sentiment and on-chain data, you can position yourself to profit from the unique volatility of crypto. This article will walk you through the major benefits of cryptocurrency trading and introduce you to the top assets to watch for 2026.

What are the benefits of cryptocurrency?

When you step into the world of digital assets, you quickly realize that the benefits of investing in cryptocurrency go far beyond simple price appreciation. It represents a fundamental shift in how value is transferred and stored.

Decentralization and independence from traditional banking

One of the most significant benefits of cryptocurrency is decentralization. Unlike fiat currency, which is controlled by central banks and governments, most cryptocurrencies operate on a distributed network of computers. This means you have full control over your assets without relying on an intermediary. You do not need permission from a bank to send or receive money, and your account cannot be frozen by a central authority arbitrarily. This level of financial sovereignty is appealing if you value privacy and autonomy over your wealth.

Global accessibility and borderless transactions

The traditional banking system often creates friction when you try to move money across borders. High fees, exchange rates, and multi-day processing times are common. Cryptocurrency solves this by being inherently global. Whether you are in New York or a remote village, as long as you have internet access, you can participate in the global economy. Transactions can be finalized in minutes, regardless of the physical distance between the sender and receiver. This borderless nature opens up investment opportunities in emerging markets that were previously inaccessible to the average retail investor.

Transparency and security through blockchain technology

Blockchain is the underlying technology that powers cryptocurrency, and it offers unparalleled transparency. Every transaction is recorded on a public ledger that is immutable, meaning it cannot be altered or deleted. This transparency reduces the risk of fraud and corruption. For you as an investor, this means you can verify the supply and movement of tokens without trusting a third party. Furthermore, the cryptographic nature of these assets makes them highly secure against hacking, provided you store your private keys safely.

High liquidity in major crypto assets

Liquidity refers to how easily you can convert an asset into cash without affecting its price. The benefits of cryptocurrency trading include high liquidity, especially for major assets like Bitcoin and Ethereum, as well as high-volume altcoins. Because the crypto market operates 24/7, 365 days a year, you can enter or exit a position at any time. This is a distinct advantage over the stock market, which has set trading hours and closes on weekends and holidays. This flexibility allows you to react instantly to breaking news or market shifts.

Criteria for selecting cryptocurrency

With thousands of digital assets available, how do you separate the gems from the junk? Selecting the right cryptocurrency requires a strategic approach rather than relying on hype.

First, you must evaluate the utility and use case. Does the project solve a real-world problem? For instance, does it improve transaction speeds (like Layer 2 solutions), offer decentralized finance (DeFi) services, or integrate with growing sectors like Artificial Intelligence? Projects with clear utility tend to have better long-term sustainability.

Second, analyze the tokenomics. This involves looking at the total supply, circulating supply, and inflation rate. A token with an unlimited supply may face inflationary pressure, suppressing its price over time. Conversely, a deflationary model can drive value up if demand remains constant.

Third, consider community and developer activity. A strong, active community often indicates a healthy ecosystem. You can check developer activity on platforms like GitHub to ensure the team is actively building and updating the protocol.

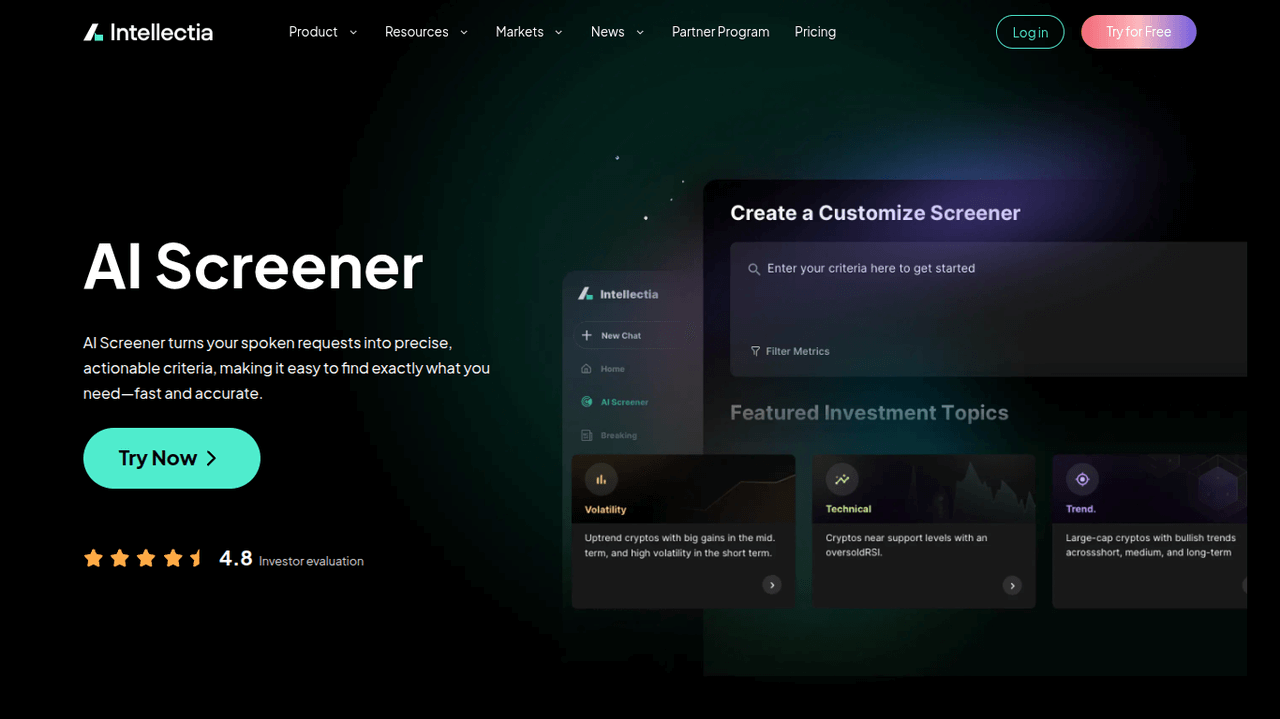

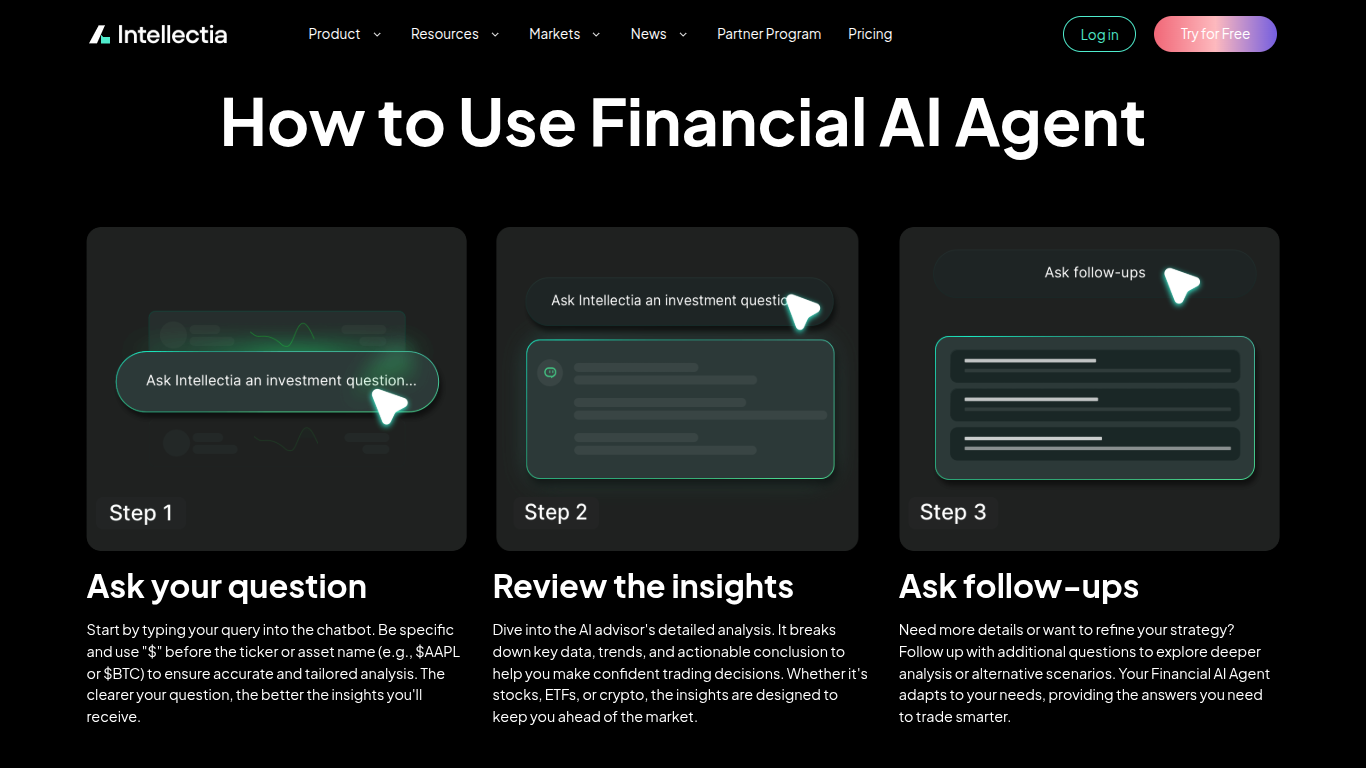

Finally, you need robust technical data. This is where tools like the Intellectia AI screener become invaluable. Instead of manually checking charts, you can filter assets based on technical indicators, volume, and volatility. For a deeper dive, utilizing crypto technical analysis features helps you identify support and resistance levels, ensuring you don't buy at the top of a cycle.

Top crypto to buy in 2026

As markets look toward 2026, the market is maturing. The projects likely to succeed are those that combine community engagement, technological innovation, and real-world integration. Below is a comparative overview of four standout candidates for your portfolio.

Comparative overview

| Token Name | Ticker | Sector | Key Strength | Risk Profile |

|---|---|---|---|---|

| Bananas31 | BANANAS31 | Meme/Community | High Virality & Community Driven | High |

| Light | LIGHT | Infrastructure/L2 | Speed & Low Transaction Costs | Medium |

| Resolv | RESOLV | DeFi/Stability | Stable Value Transfer | Low-Medium |

| Aio | AIO | AI & Big Data | AI Integration & Automation | Medium-High |

BANANAS31 (BANANAS31)

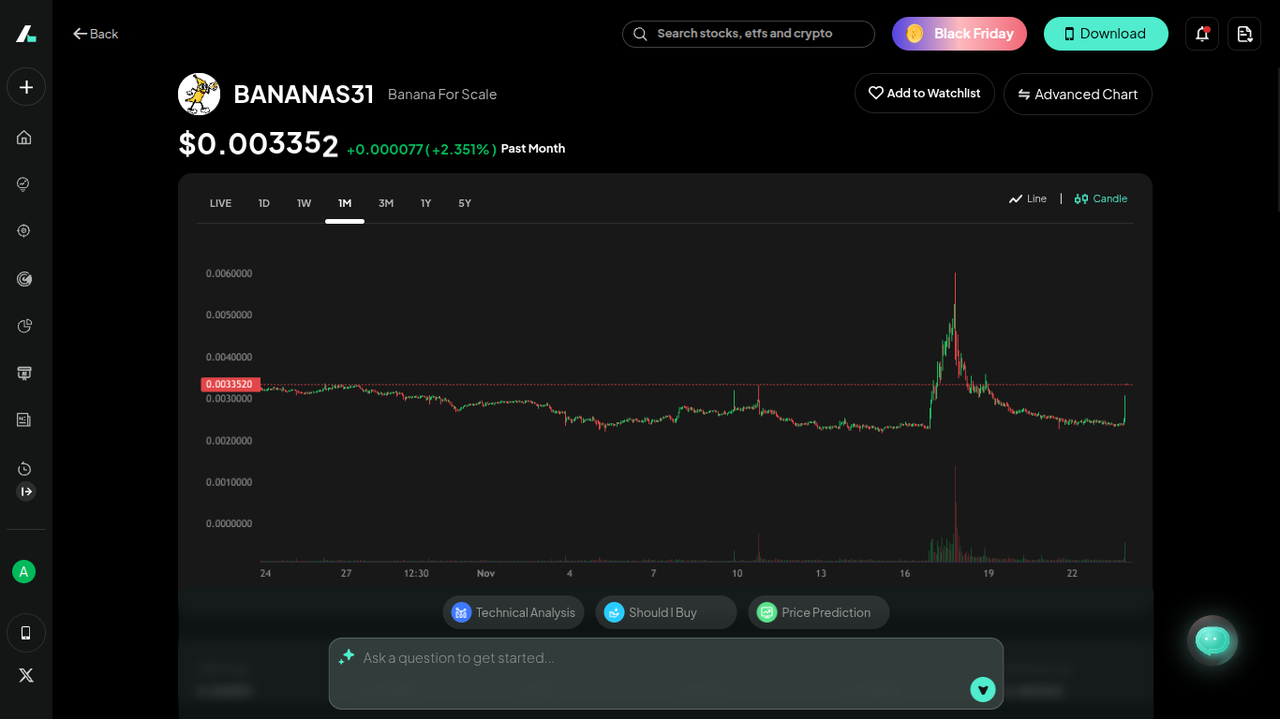

In the crypto world, community sentiment can drive massive value, often defying traditional fundamentals. BANANAS31 represents the evolution of the "meme coin" sector into a community-owned utility ecosystem. While it started with viral marketing, the roadmap suggests a pivot toward gaming integration and NFT rewards.

For 2026, the trend of "social finance" is expected to grow. BANANAS31 capitalizes on this by rewarding active community members. If you are looking for high-risk, high-reward plays, this asset fits the bill. The key differentiation here is its unique distribution model which prevents early "whales" from dumping on retail investors.

Meme coins often move in explosive cycles. By monitoring social volume and sentiment—something you can track via news analysis—you can time your entry. If the developers successfully launch their promised gaming platform, BANANAS31 could transition from a speculative asset to a utility token, potentially offering 10x returns in a bull market.

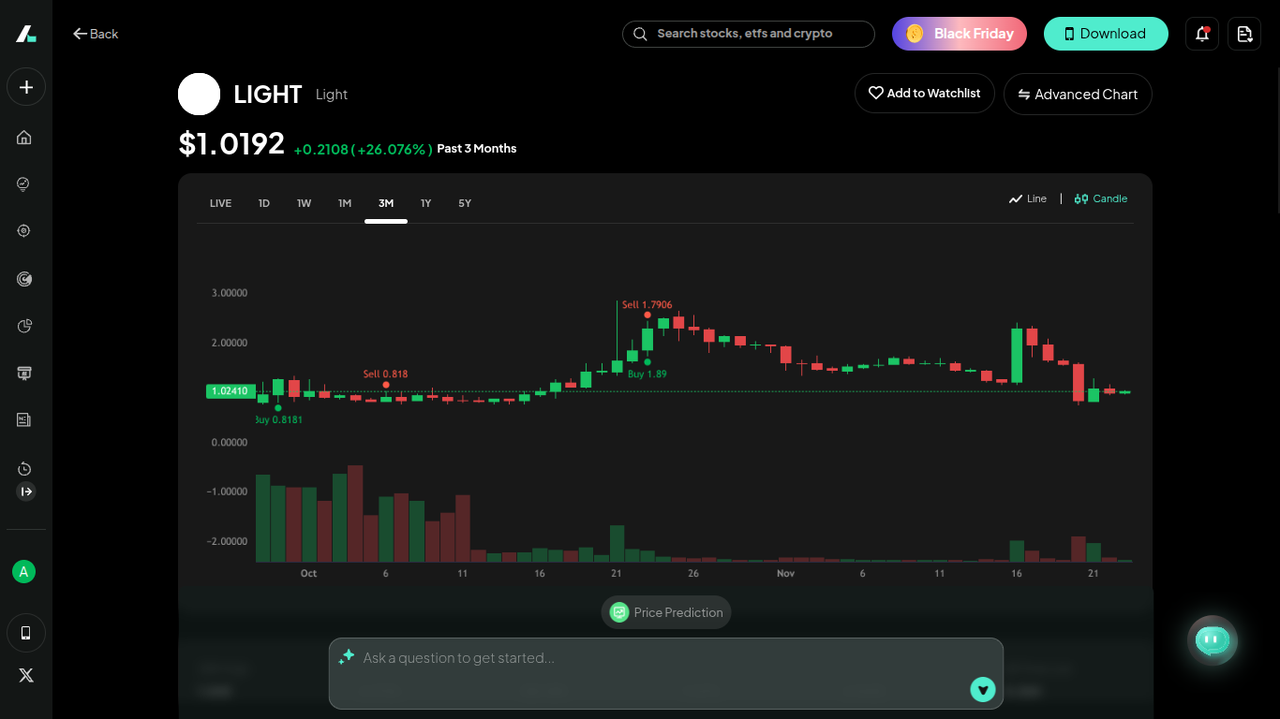

LIGHT (LIGHT)

LIGHT focuses on the infrastructure layer of blockchain. As the name suggests, it prioritizes speed and efficiency. One of the biggest hurdles for crypto adoption is the "gas fee" problem and slow confirmation times. LIGHT utilizes a novel consensus mechanism that allows for near-instant settlement at a fraction of a cent.

As global adoption increases, legacy blockchains may struggle with congestion. LIGHT is positioned as the "payment rail" for the future, suitable for micro-transactions and point-of-sale systems. This makes it a strong candidate for merchant adoption.

For 2026, infrastructure plays are considered safer bets than pure speculative tokens. If LIGHT secures partnerships with major payment processors or e-commerce platforms, its intrinsic value will skyrocket. You should watch for announcements regarding mainnet upgrades and enterprise partnerships.

RESOLV (RESOLV)

Volatility is the enemy of commerce. RESOLV aims to bridge the gap between DeFi yields and stable value transfer. It isn't just a stablecoin; it is a protocol that dynamically adjusts to market conditions to preserve purchasing power while offering staking rewards to holders.

In times of market uncertainty, investors flock to safety. RESOLV provides a hedge against the wild swings of Bitcoin or Ethereum without exiting the crypto ecosystem entirely. Its governance model allows holders to vote on risk parameters, making it a truly decentralized banking alternative.

The DeFi sector is projected to disrupt traditional banking by 2026. RESOLV’s potential lies in its Total Value Locked (TVL). As more users stake their assets in the RESOLV protocol to earn passive income, the scarcity of the governance token increases. This is an excellent pick for a conservative portion of your crypto portfolio, aimed at steady growth rather than moonshots.

AIO (OLAXBT)

The intersection of Artificial Intelligence and Blockchain is the hottest narrative for the coming decade. AIO is an infrastructure project that provides decentralized computing power for AI model training. Instead of relying on centralized giants like AWS or Google Cloud, AI developers can rent computing power from the AIO network.

AIO solves a massive bottleneck in the tech industry: the shortage of affordable GPU power. By tokenizing compute resources, AIO creates a marketplace where hardware owners can monetize their idle GPUs, and AI companies can access cheaper power.

With the exponential growth of AI agents and machine learning models, the demand for AIO's services is expected to surge. This token represents a "pick and shovel" play in the AI gold rush. You can track the correlation between AI sector growth and AIO’s price using AI trading strategies. If the project captures even a small percentage of the cloud computing market, the market cap could rival top 20 coins by 2026.

How to maximize the benefits of cryptocurrency trading

Knowing what to buy is only half the battle. To truly succeed, you need to understand what are the benefits of cryptocurrency trading strategies and how to execute them efficiently.

Choosing the right exchange

Your gateway to crypto is the exchange. You must prioritize security, fee structures, and available tools. A centralized exchange offers ease of use, while a decentralized exchange (DEX) offers better privacy. However, relying solely on the exchange's interface can be limiting. Integrating third-party analysis tools ensures you aren't trading blind.

Using on-chain analytics for smarter trades

Public blockchains allow you to see exactly what "smart money" is doing. Are whales accumulating or dumping? Is the hash rate increasing? Using on-chain analytics gives you an edge. For example, if you see a massive transfer of AIO tokens off exchanges and into cold wallets, it usually signals a supply shock and a potential price increase.

Diversifying across multiple crypto assets

Never put all your eggs in one basket. A balanced portfolio might look like 50% in established leaders (BTC/ETH), 30% in high-growth infrastructure (like LIGHT or AIO), and 20% in speculative plays (like BANANAS31). To manage this complexity, you can use a hedge fund tracker to see how institutional players are diversifying their holdings and mimic their allocation strategies.

Setting stop-loss & risk controls

The volatility that makes crypto profitable also makes it dangerous. You must set strict rules. A stop-loss order ensures you automatically sell if an asset drops by a certain percentage, protecting your capital.

This is where automation helps. Using the Intellectia AI agent or visiting the day trading center allows you to access AI trading signals that take the emotion out of the decision. AI can analyze chart patterns faster than any human, alerting you to swing trading opportunities or identifying when a trend is reversing.

For those interested in how external corporate performance affects crypto markets (especially for tokens linked to real-world assets), keeping an eye on earnings trading data is also beneficial, as macro-economic factors often correlate across stock and crypto markets.

Conclusion

The world of digital finance is moving fast, and the benefits of cryptocurrency trading—from decentralization to massive growth potential—are too significant to ignore. By focusing on high-utility projects like BANANAS31, LIGHT, RESOLV, and AIO, you position yourself for success in 2026.

However, success requires more than just luck; it requires the right tools. Don't trade alone in the dark. Sign up for Intellectia.AI today to subscribe for alerts on daily AI stock and crypto picks. Leverage its advanced pricing plans to unlock premium market analysis, AI trading signals, and strategies that give you the professional edge you need.