Key Takeaways

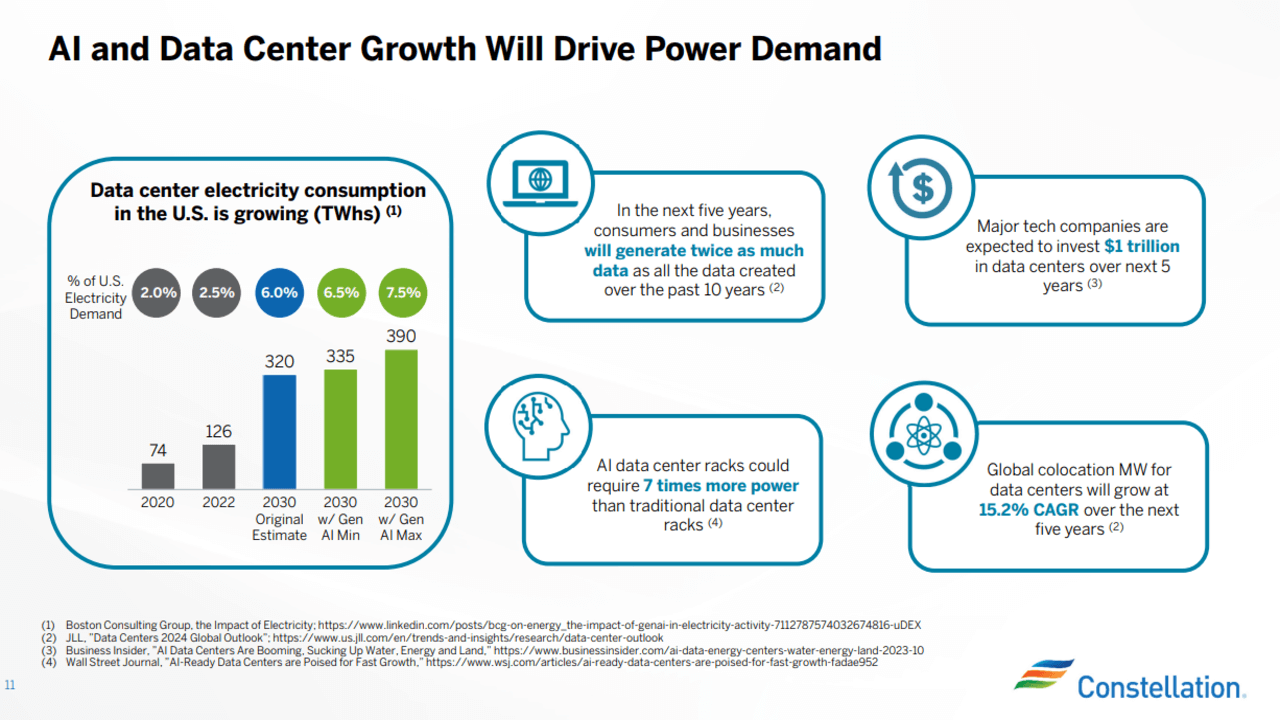

- Artificial Intelligence data centers require massive amounts of 24/7 baseload power that renewable energy sources alone cannot provide.

- Nuclear energy has emerged as the preferred solution for hyperscalers like Microsoft and Google due to its carbon-free reliability.

- Constellation Energy (CEG) leads the pack with direct deals to power data centers, while Cameco (CCJ) dominates the fuel supply chain.

- Small Modular Reactors (SMRs) represent high-growth potential, though they carry higher volatility compared to established utilities.

- Utilizing AI-driven technical analysis is crucial for timing your entries into these volatile energy stocks.

Introduction

Have you ever felt the frustration of identifying a massive market trend—like the explosion of Artificial Intelligence—only to feel like you missed the boat on the primary tech stocks like NVIDIA? It is a common pain point for investors; the obvious plays often get overcrowded and expensive very quickly.

However, the AI revolution has a secondary, less obvious bottleneck: energy. AI models consume voracious amounts of electricity, and the world's current grid cannot keep up. Through analyzing earnings reports and market shifts, you can identify that the next massive wave of capital isn't going into the chips, but into the power plants that keep them running.

The solution for smart investors lies in AI nuclear power stocks. These companies are uniquely positioned to solve the energy crisis facing big tech. By understanding the intersection of nuclear energy and AI demand, you can uncover high-potential investment opportunities before the rest of the market catches up.

What Are AI Nuclear Power Stocks?

When the sharp investors talk about AI nuclear power stocks, they are referring to a specific basket of companies within the energy and industrial sectors that are pivoting to service the booming data center economy. These aren't just your grandfather's utility companies; they are dynamic firms engaging in the construction, fueling, and operation of reactors specifically to power Artificial Intelligence infrastructure.

This sector includes three main categories:

Utility Operators: Companies like Constellation Energy that own existing reactors and are signing direct Power Purchase Agreements (PPAs) with tech giants.

Technology Developers: Firms like NuScale Power designing Small Modular Reactors (SMRs) to be placed directly on-site at data centers.

Fuel and Supply Chain: Companies like Cameco and BWX Technologies that provide the uranium, enrichment, and specialized components necessary to keep reactors running.

As AI data centers move from gigawatt to multi-gigawatt scale, they require "always-on" power. Solar and wind are intermittent, and batteries are currently too expensive for this scale. Nuclear is the only carbon-free energy source that runs 24/7, making these stocks the backbone of the AI future.

Why Invest in AI Nuclear Power Stocks?

You might be wondering, why look at nuclear now after years of stagnation? The answer lies in the convergence of policy support and desperate demand from "Big Tech."

The Energy Density Problem

A ChatGPT query uses nearly 10 times as much electricity as a standard Google search. As generative AI scales, power consumption is skyrocketing. Tech companies have Net Zero carbon goals, meaning they cannot simply burn coal or gas to power their servers. They are cornered, and nuclear power is their only escape route. This creates a seller's market for nuclear power producers.

Unprecedented Government Support

The regulatory environment has shifted drastically. As seen in recent earnings calls from companies like NuScale and Constellation, the U.S. government is actively loaning billions to restart dormant reactors and support new builds. For example, the Department of Energy (DoE) recently committed substantial loans to restart the Three Mile Island facility specifically to support Microsoft's data center needs.

Long-Term Cash Flow Visibility

Unlike standard utility contracts, deals with hyperscalers (like Amazon, Google, and Microsoft) are often long-term (20 years) and at premium pricing. Investing in nuclear power stocks for AI offers you exposure to these guaranteed revenue streams, providing a mix of defensive stability and growth potential.

5 Top AI Nuclear Power Stocks for 2026

To help you navigate this sector, Intellectia.ai AI tools have analyzed the latest financial data, earnings transcripts, and market moves to select the five best nuclear ai stocks positioned for 2026.

| Company Name | Ticker | Sector | Market Cap | Key Strength |

|---|---|---|---|---|

| Constellation Energy | CEG | Utilities | Large Cap | Largest US nuclear fleet; direct Microsoft deal. |

| Cameco Corp | CCJ | Energy (Uranium) | Large Cap | Dominant fuel supplier; Westinghouse ownership. |

| NuScale Power | SMR | Industrials | Mid Cap | First NRC-approved SMR design; high growth. |

| BWX Technologies | BWXT | Industrials | Mid Cap | Critical components & manufacturing; government backing. |

| Centrus Energy | LEU | Energy (Fuel) | Small Cap | Domestic uranium enrichment; HALEU production. |

Constellation Energy (CEG)

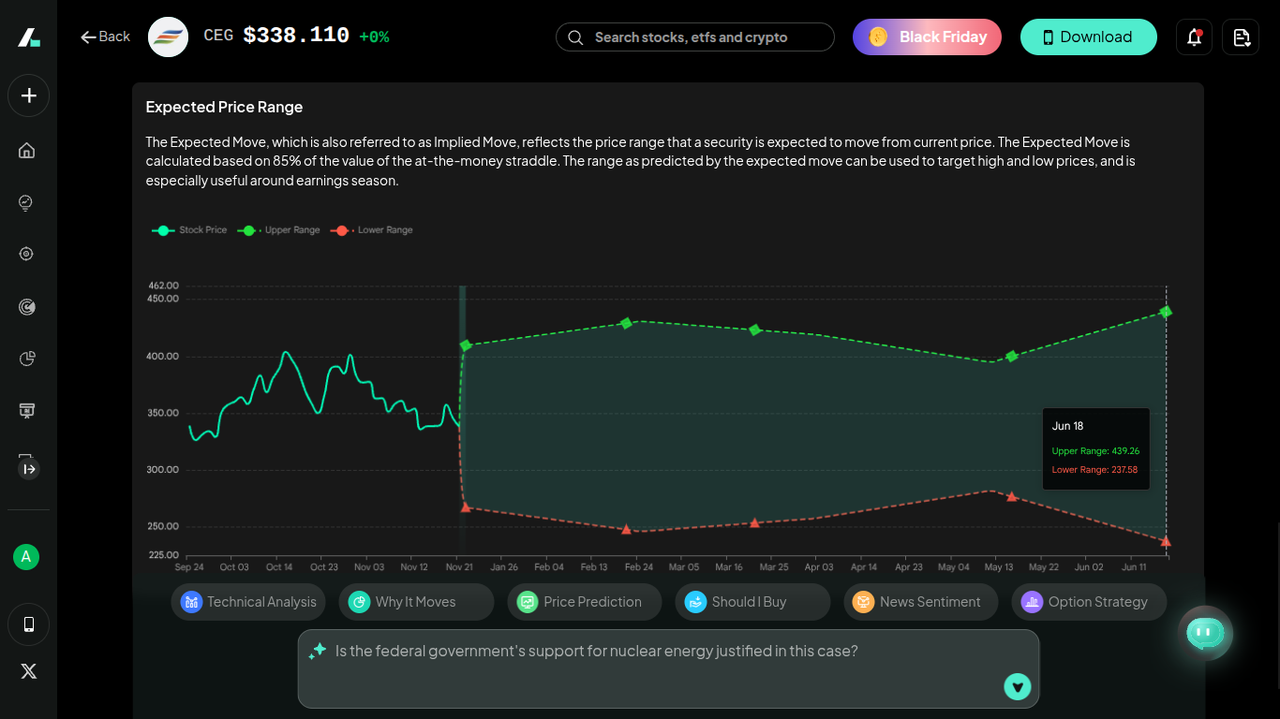

Constellation Energy is the United States' largest producer of carbon-free energy and operates the largest fleet of nuclear power plants in the nation. They are the prime beneficiary of the "nuclear renaissance."

In late 2025, Constellation solidified its status as a top AI nuclear energy stock by securing a $1 billion Department of Energy loan to restart a reactor at the Three Mile Island facility (renamed the Crane Clean Energy Center). This restart is underpinned by a massive deal with Microsoft to offset their data center electricity use.

According to their Q3 2025 earnings, Constellation is seeing a market that is "hotter than ever." They reported strong earnings with a 2025 EPS guidance range of $9.05–$9.45. Why is this a top pick for you? Because they own the land and the licenses. As CEO Joe Dominguez noted, "The path to new nuclear in many places is going to walk through Constellation." They offer the perfect blend of stability and explosive AI-driven growth.

Cameco Corporation (CCJ)

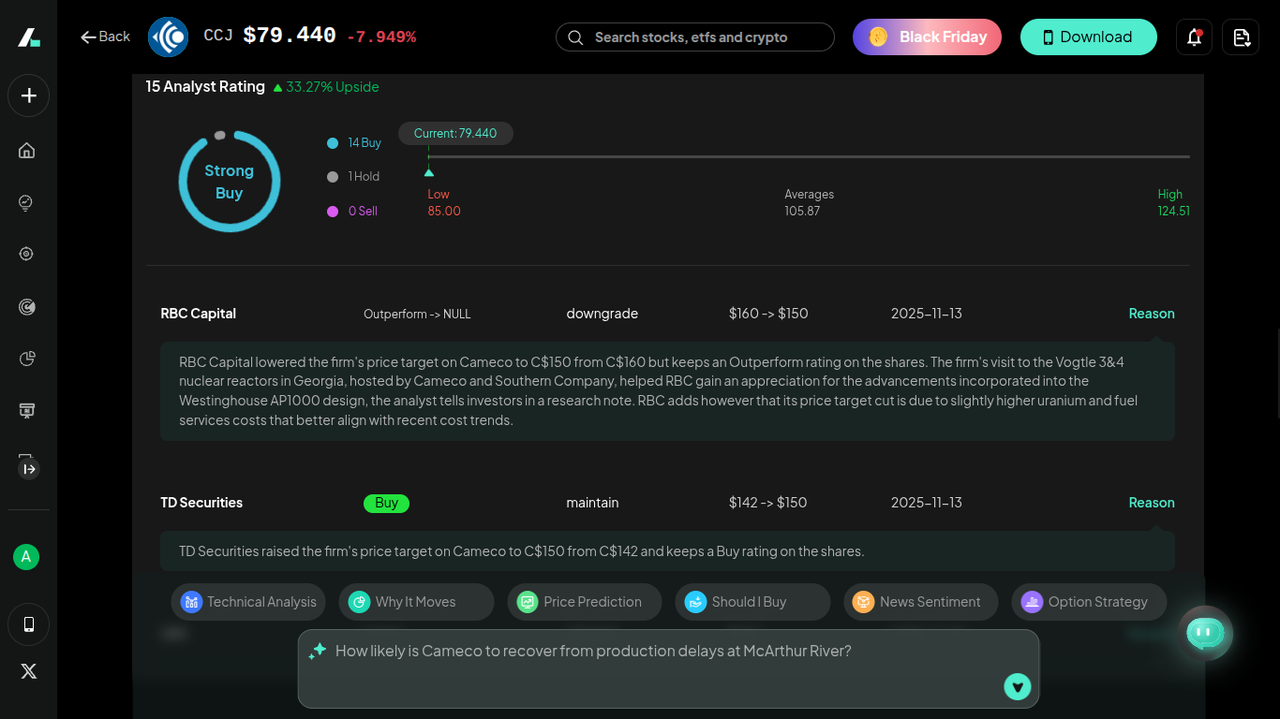

Cameco is one of the world's largest providers of uranium fuel. Beyond mining, they have a significant stake in Westinghouse Electric Company, a premier nuclear reactor builder.

Cameco is not just a mining play; it is a technology play. In Q3 2025, it was revealed that the U.S. government entered a partnership with Cameco and Brookfield to facilitate over $80 billion in investments for Westinghouse reactors. This confirms that the government views Cameco’s technology as central to the U.S. energy strategy.

While they faced some production delays at McArthur River, their long-term contracting strategy ensures they are selling uranium at higher prices as demand tightens. For you, investing in CCJ is a way to bet on the entire nuclear ecosystem—from the fuel in the ground to the reactor technology itself.

NuScale Power (SMR)

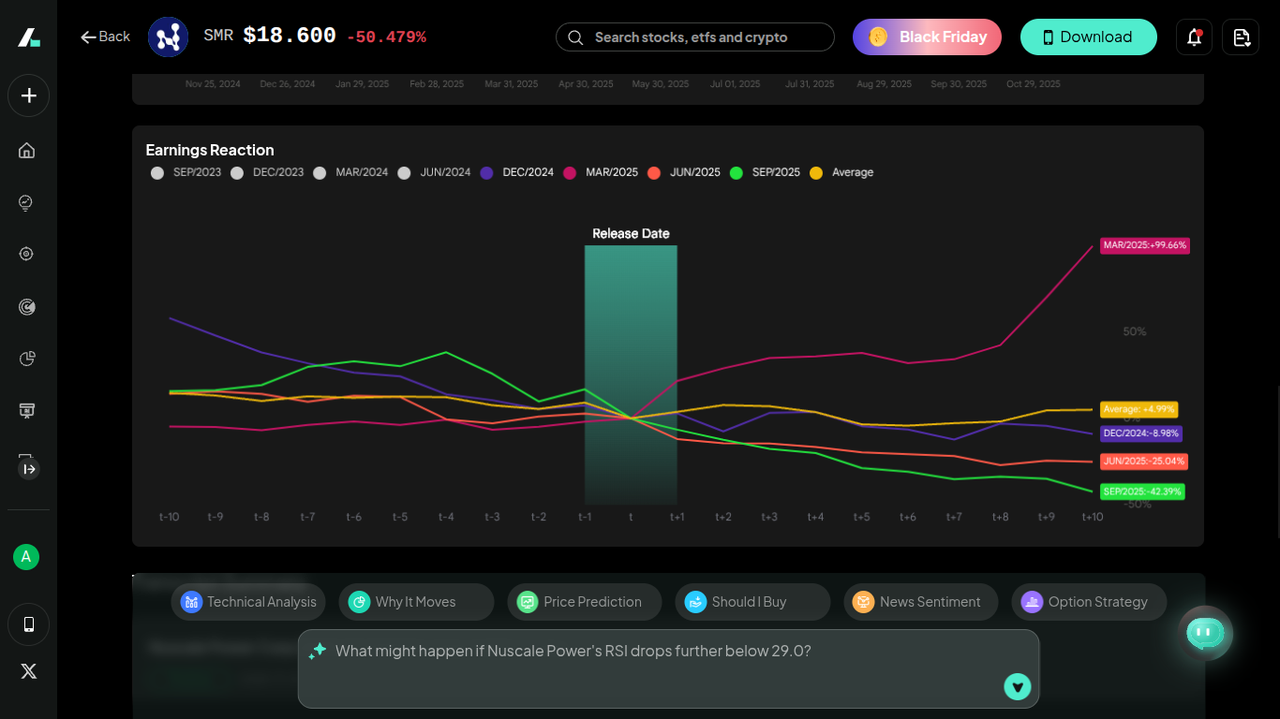

NuScale Power is the leading developer of Small Modular Reactors (SMRs). Unlike massive traditional plants, SMRs can be factory-built and deployed closer to data centers.

NuScale is the "high risk, high reward" play among nuclear AI stocks. In late 2025, they announced a landmark agreement with ENTRA1 and the Tennessee Valley Authority (TVA) to deploy up to 6 gigawatts of capacity—the largest SMR deployment program in history. Furthermore, they were the only developers included in a recent U.S.-Japan framework for AI energy development.

Financially, they are still burning cash (EPS of -$1.85 in Q3 2025), but their backlog and regulatory approval put them years ahead of competitors. If you have a higher risk tolerance and want exposure to the next generation of nuclear tech, SMR is the ticker to watch.

BWX Technologies (BWXT)

BWXT manufactures nuclear components for the U.S. government (submarines and carriers) and is rapidly expanding into commercial SMR components and microreactors.

Think of BWXT as the "picks and shovels" of the nuclear industry. In Q3 2025, they reported a record backlog of $7.4 billion, up 119% year-over-year. They recently signed a contract with Rolls-Royce to design steam generators for SMRs, proving their commercial viability.

With mid-teens government revenue growth projected for 2026, BWXT offers you a safety net through defense contracts while giving you upside exposure to the commercial AI nuclear build-out. It is one of the best nuclear energy stocks for AI if you prefer steady, compounded growth.

Centrus Energy Corp. (LEU)

Centrus is a supplier of nuclear fuel and services, specifically focusing on uranium enrichment. They are critical for the production of HALEU (High-Assay Low-Enriched Uranium), which is required for many next-gen advanced reactors.

Centrus is currently targeting a massive expansion, signaling a $1 billion capital raise in late 2025 to build out domestic enrichment capacity. With spot SWU (Separative Work Unit) prices surging to $220, the demand for non-Russian enrichment is at an all-time high.

CEO Amir Vexler highlighted the demand for U.S.-owned enrichment has "never been stronger." While the stock can be volatile due to government funding cycles and capital raises, LEU is essential for national security and the fueling of the SMRs that will power AI.

intellectia.ai-stocks-LEU-Earnings-Reaction

Investment Strategies for Nuclear Power Stocks for AI

Investing in this sector requires more than just picking a ticker; it requires a strategy. Here is how you can approach it:

Diversify Your Portfolio

Don't put all your capital into a speculative developer like NuScale. A balanced nuclear power stocks for AI portfolio should include a stable operator like Constellation (CEG), a fuel supplier like Cameco (CCJ), and a growth play like NuScale (SMR). This balances the steady cash flow of utilities with the explosive potential of tech developers.

Long-term vs. Short-term

Understand your timeline. The "Nuclear Renaissance" is a decade-long trend. Building reactors takes time. Stocks like CEG and BWXT are great for long-term holding. However, news-driven stocks like LEU and SMR can offer lucrative short-term swing trading opportunities based on regulatory announcements or contract wins.

Use Technical Analysis for Entry Points

Nuclear stocks can be volatile. A stock might have great fundamentals but be technically overbought. You should use technical analysis to identify support and resistance levels. This is where Intellectia.ai becomes invaluable. Intellectia.ai AI Stock Technical Analysis features can help you visualize the best entry points, ensuring you don't buy at the top of a hype cycle.

Monitor Institutional Flows

Hedge funds are aggressively entering this space. Using tools like a Hedge Fund Tracker can give you an edge by showing you where the "smart money" is positioning itself within the nuclear sector.

intellectia.ai-features-ai-Hedge-Fund-Tracker

Conclusion

The convergence of Artificial Intelligence and nuclear energy creates one of the most compelling investment themes for 2026. As tech giants scramble to secure reliable power, the companies controlling the nuclear supply chain—from Constellation Energy to BWX Technologies—stand to gain immense value.

You have the opportunity to position your portfolio ahead of this energy transition. However, navigating the volatility of AI nuclear power stocks requires the right data and timing.

Don't trade in the dark. Sign up for Intellectia.ai today to get access to real-time AI stock picks, advanced technical analysis, and institutional tracking tools. Equip yourself with the best AI trading signals and market analysis to maximize your returns in the nuclear energy boom.