Key Takeaways

- Biotech stocks under $5 offer high growth potential but come with significant risks.

- Selecting the right stocks involves evaluating clinical pipelines, upcoming catalysts, and financial health.

- Intellectia.AI provides AI-driven tools to help investors identify and analyze promising biotech stocks.

- Five hot biotech stocks to watch: ORGO, DMAC, LXRX, CNTX, SGMO.

- Effective investment strategies include monitoring news, diversifying, and using technical analysis.

Introduction

Have you ever wondered how to find promising biotech stocks without spending a fortune? The biotech sector is buzzing with innovation, offering opportunities to invest in companies on the cusp of medical breakthroughs.

However, biotech stocks under $5, often called penny stocks, can be tricky due to their volatility and the complexities of drug development. That’s where Intellectia AI comes in. The platform uses advanced AI to analyze market trends, clinical data, and financial metrics to pinpoint the best biotech stocks under $5.

In this guide, you’ll learn what these stocks are, why they’re worth considering, and discover five top picks for 2025 that the AI tools highlight for their potential. Ready to dive into the world of biotech investing? Let’s get started.

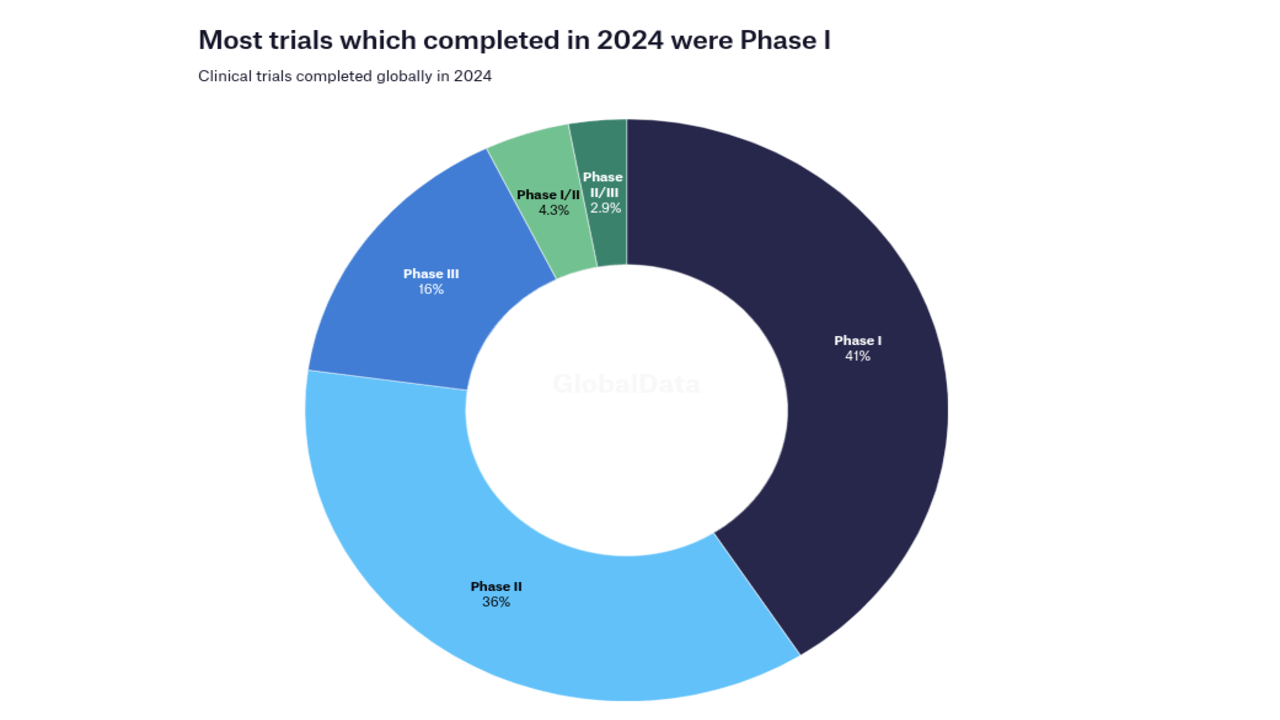

Source: clinicaltrialsarena.com

What Are Biotech Stocks Under $5?

Biotech stocks under $5 are shares of biotechnology companies trading at less than $5 per share. These firms, often small-cap with market capitalizations below $300 million, focus on developing drugs, therapies, or medical technologies using biological processes. Unlike larger pharmaceutical companies, which may have established products, these smaller biotechs are speculative, relying heavily on the success of clinical trials or regulatory approvals.

Their low price makes them accessible, but they’re volatile due to factors like trial outcomes, funding needs, or market sentiment. For example, a positive FDA decision can send a stock soaring, while a trial failure can cause a sharp drop. Understanding these dynamics is key to navigating this high-risk, high-reward space.

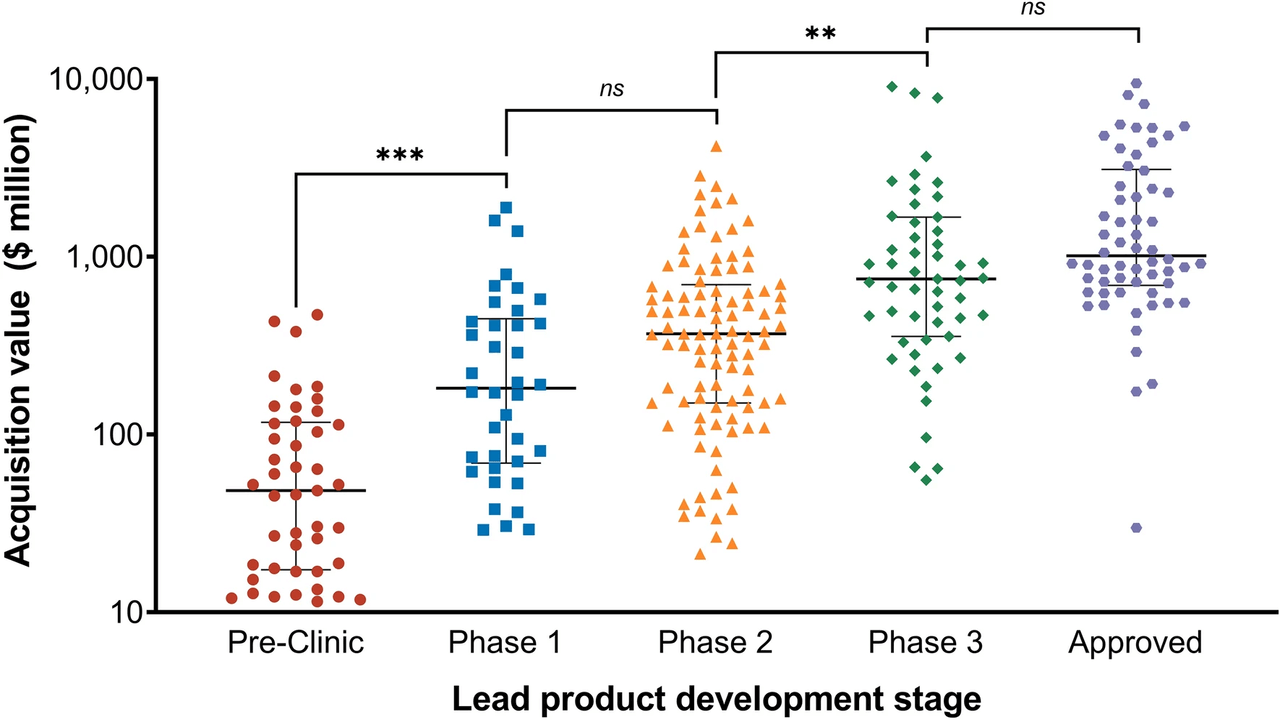

Source: springer.com

Why Invest in Biotech Stocks Under $5?

Investing in biotech stocks under $5 can be exciting for several reasons:

- High Growth Potential: A successful clinical trial or FDA approval can lead to massive stock price gains, offering outsized returns.

- Affordability: Low share prices allow retail investors to buy more shares with less capital, increasing potential profits.

- Early-Stage Opportunities: These stocks let you invest in innovative companies before they hit the mainstream, potentially reaping rewards from breakthroughs.

However, the risks are significant:

- Regulatory Challenges: Drug approvals are uncertain, with many candidates failing in late-stage trials.

- Volatility: Share prices can swing dramatically based on news or rumors.

- Financial Risks: Many small biotechs aren’t profitable and may need additional funding, which can dilute shareholder value.

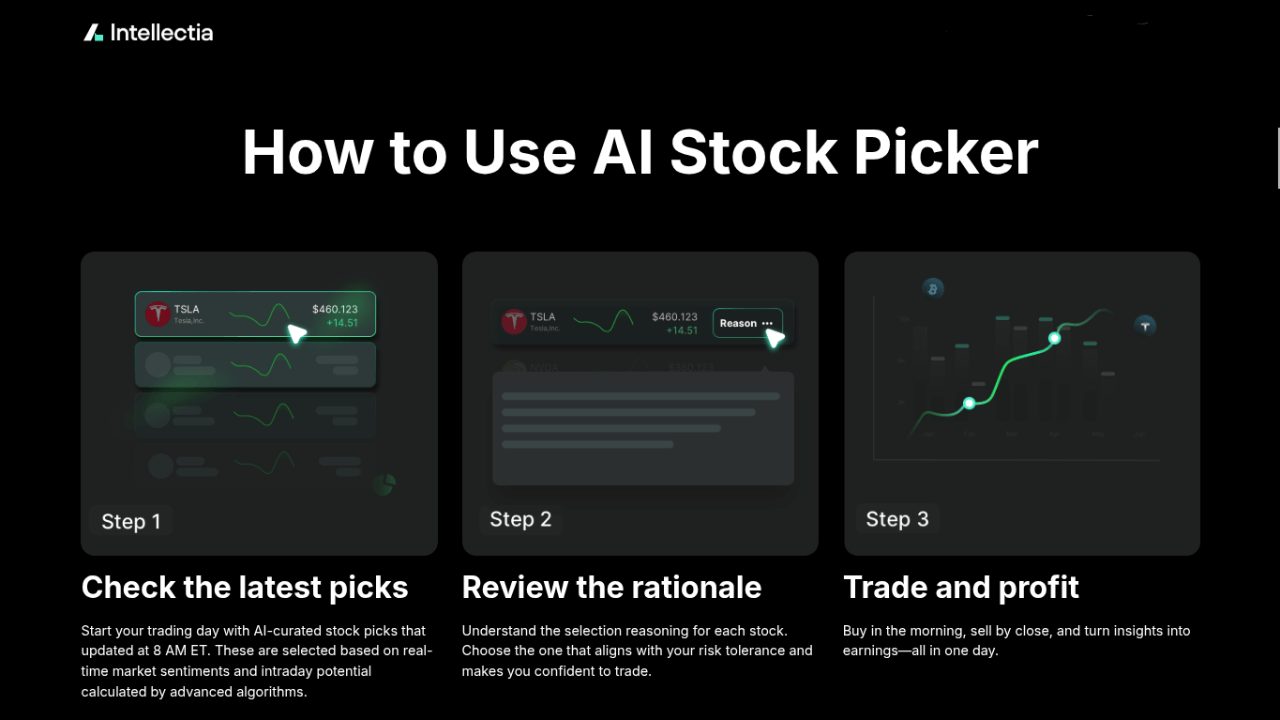

Balancing these risks and rewards requires careful research. Tools like Intellectia.AI’s AI stock picker can help you identify promising opportunities while managing risks.

Source: intellectia.ai

Criteria for Selecting Best Biotech Stocks Under $5

Choosing the right biotech stocks under $5 involves evaluating several factors:

- Strong Clinical Pipeline: Companies with multiple drug candidates in various development stages are less risky, as they’re not reliant on a single product.

- Upcoming Catalysts: Look for events like clinical trial results, FDA decisions, or partnerships that could boost the stock price.

- Financial Health: Check the company’s cash reserves and burn rate to ensure they can fund operations without excessive dilution.

- Experienced Management: A team with a proven track record in biotech increases the likelihood of navigating regulatory and development challenges.

- Intellectual Property: Strong patents protect innovations and provide a competitive edge.

- Market Opportunity: A large addressable market for the company’s products signals greater revenue potential.

Using these criteria, you can narrow down the field. Intellectia.AI’s AI screener lets you filter stocks based on these factors, making the process easier.

5 Hot Biotech Stocks Under $5

Here are five biotech stocks under $5 that show promise for 2025, based on analysis using Intellectia.AI’s tools.

| Company Name | Ticker | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| Organogenesis Holdings | ORGO | Regenerative Medicine | ~$465M | Strong product portfolio, insider buying |

| DiaMedica Therapeutics | DMAC | Neurology/Kidney Disease | ~$100M | Promising clinical trials for stroke |

| Lexicon Pharmaceuticals | LXRX | Biopharmaceuticals | ~$200M | Diverse pipeline for diabetes, heart failure |

| Context Therapeutics | CNTX | Oncology | ~$50M | Targeting hormone-driven cancers |

| Sangamo Therapeutics | SGMO | Genomic Medicine | ~$150M | Innovative gene-editing therapies |

Organogenesis Holdings Inc. (ORGO)

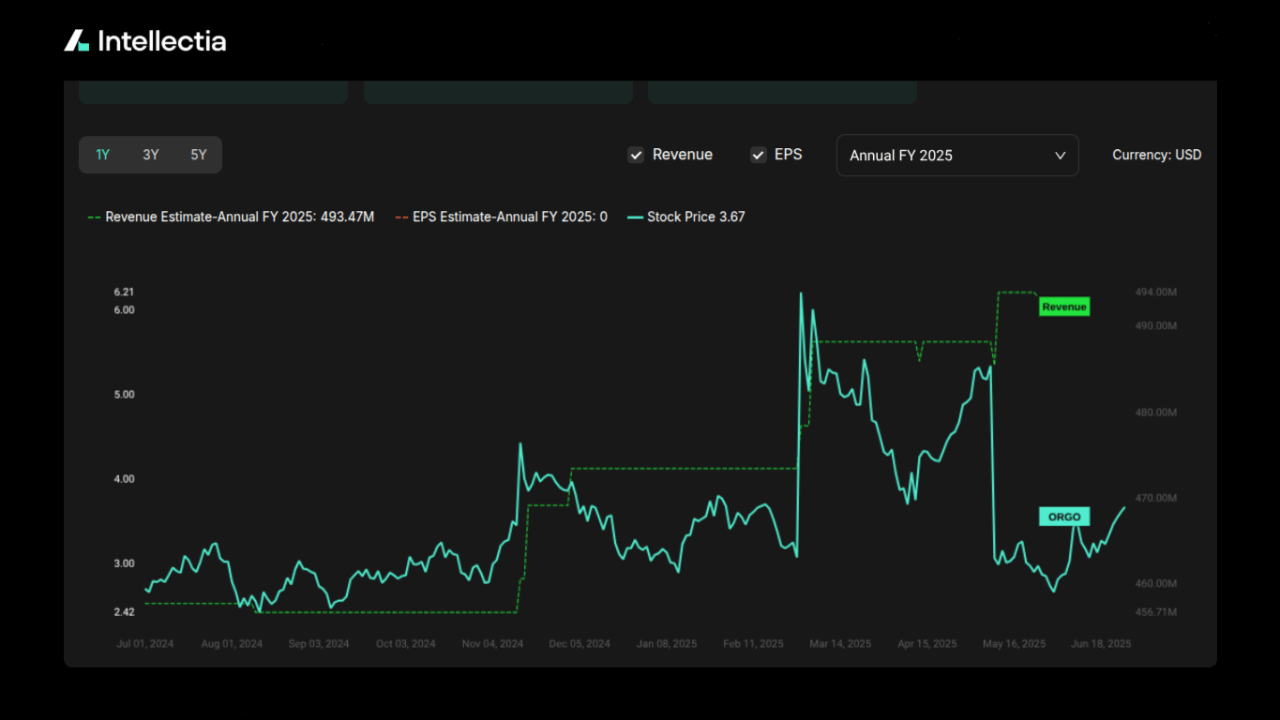

Organogenesis Holdings Inc. is a leading player in regenerative medicine, specializing in advanced wound care and surgical biologics. Their portfolio includes FDA-approved products like Apligraf and Dermagraft, used for chronic wound treatment, addressing a growing market driven by aging populations and rising diabetes rates.

Recent highlights include consistent revenue growth, with 2024 reports showing a 5% increase year-over-year, and significant insider buying, signaling confidence from management. Organogenesis differentiates itself with a diversified revenue stream, unlike many biotechs reliant on pipeline success. Its established market presence and strong distribution network make it less speculative than others on this list.

For investors seeking a relatively stable biotech stock under $5 with near-term growth potential, ORGO is a top pick due to its commercialized products and expanding market share in wound care.

Source: intellectia.ai

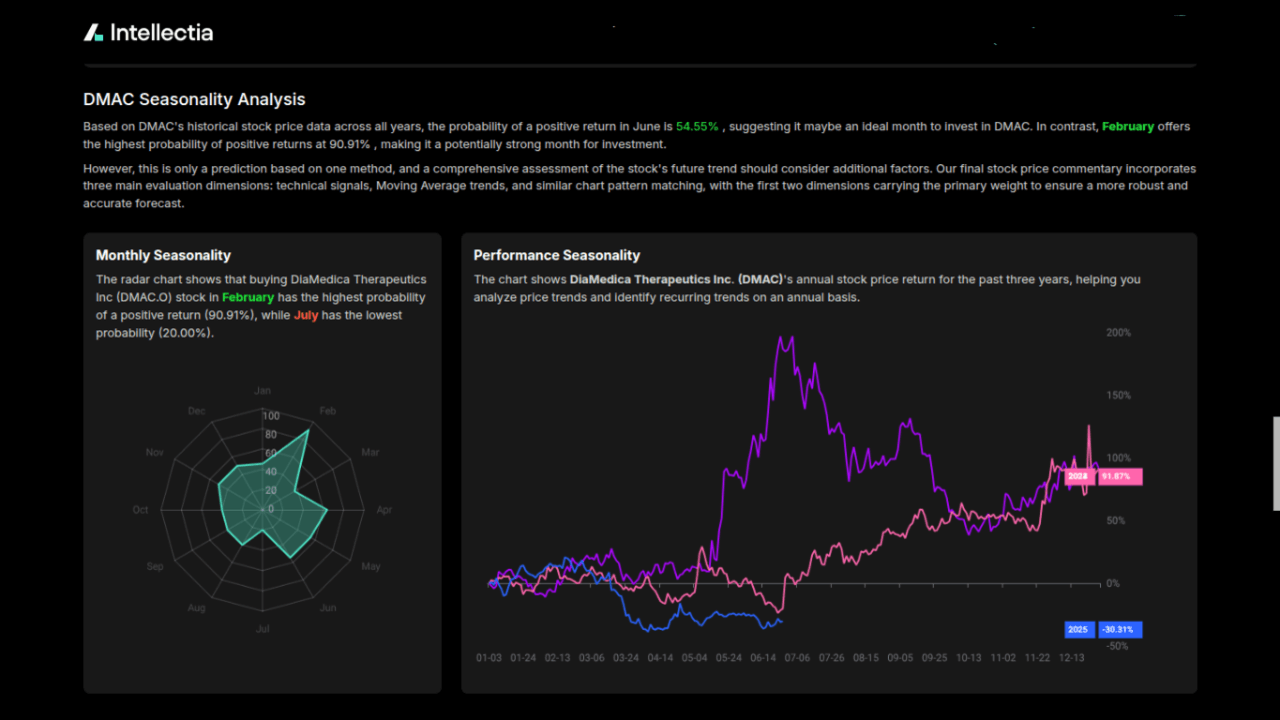

DiaMedica Therapeutics Inc. (DMAC)

DiaMedica Therapeutics focuses on developing treatments for neurological and kidney diseases, with its lead candidate, DM199, targeting acute ischemic stroke and chronic kidney disease.

In 2024, DiaMedica reported positive Phase 2 trial data for DM199, showing improved outcomes in stroke patients, which boosted investor interest. The company’s small market cap and focused pipeline make it a high-risk, high-reward option. Unlike ORGO’s commercial focus, DMAC’s value lies in its clinical-stage potential, with key data readouts expected in 2025.

Its differentiation comes from addressing underserved areas like stroke, where few effective treatments exist. For investors comfortable with volatility and seeking significant upside from clinical milestones, DMAC stands out.

Source: intellectia.ai

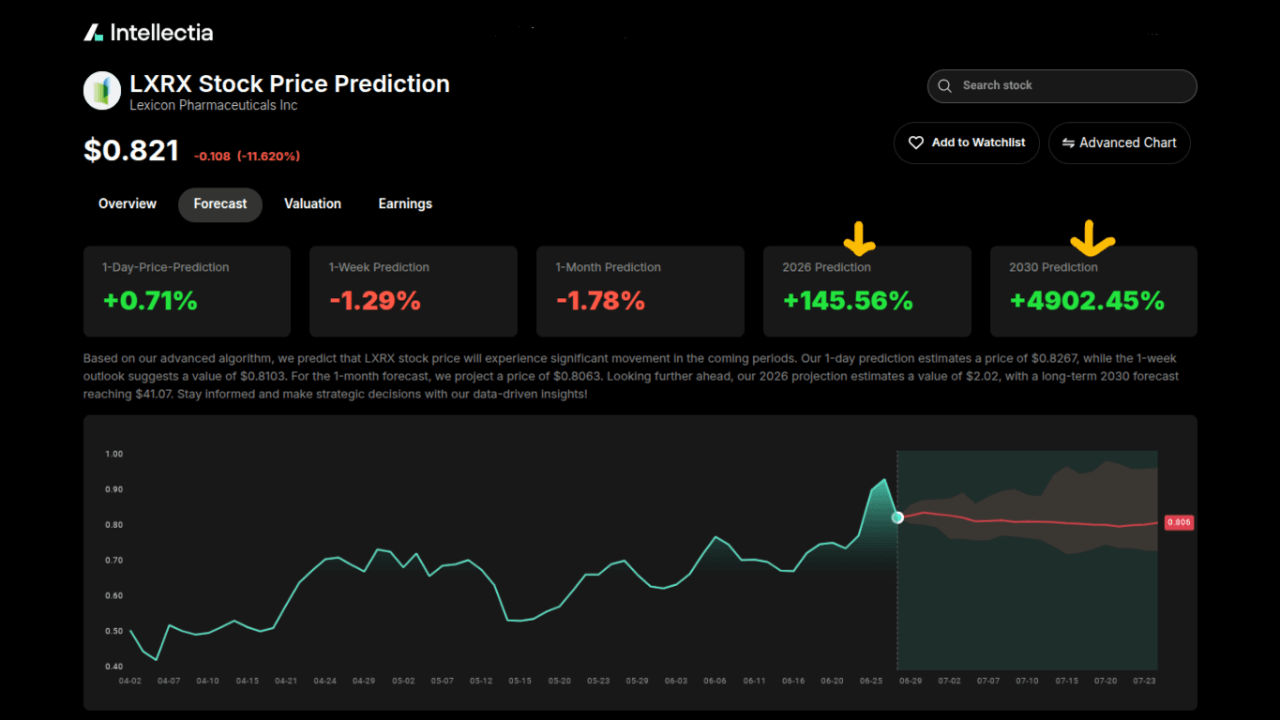

Lexicon Pharmaceuticals, Inc. (LXRX)

Lexicon Pharmaceuticals is a biopharmaceutical company developing therapies for diabetes, heart failure, and neuropathic pain. Its pipeline includes sotagliflozin, a drug for heart failure and type 1 diabetes, which received positive clinical data in 2024, positioning it for potential FDA submission.

Lexicon’s strength lies in its diverse pipeline, targeting large markets with high unmet needs, unlike the niche focus of some peers. Recent partnerships with major pharmaceutical firms enhance its financial stability and development capabilities.

LXRX is ideal for investors seeking exposure to both metabolic and cardiovascular markets, offering a balanced risk-reward profile. Its upcoming catalysts, including trial results and regulatory updates, make it a compelling choice for 2025.

Source: intellectia.ai

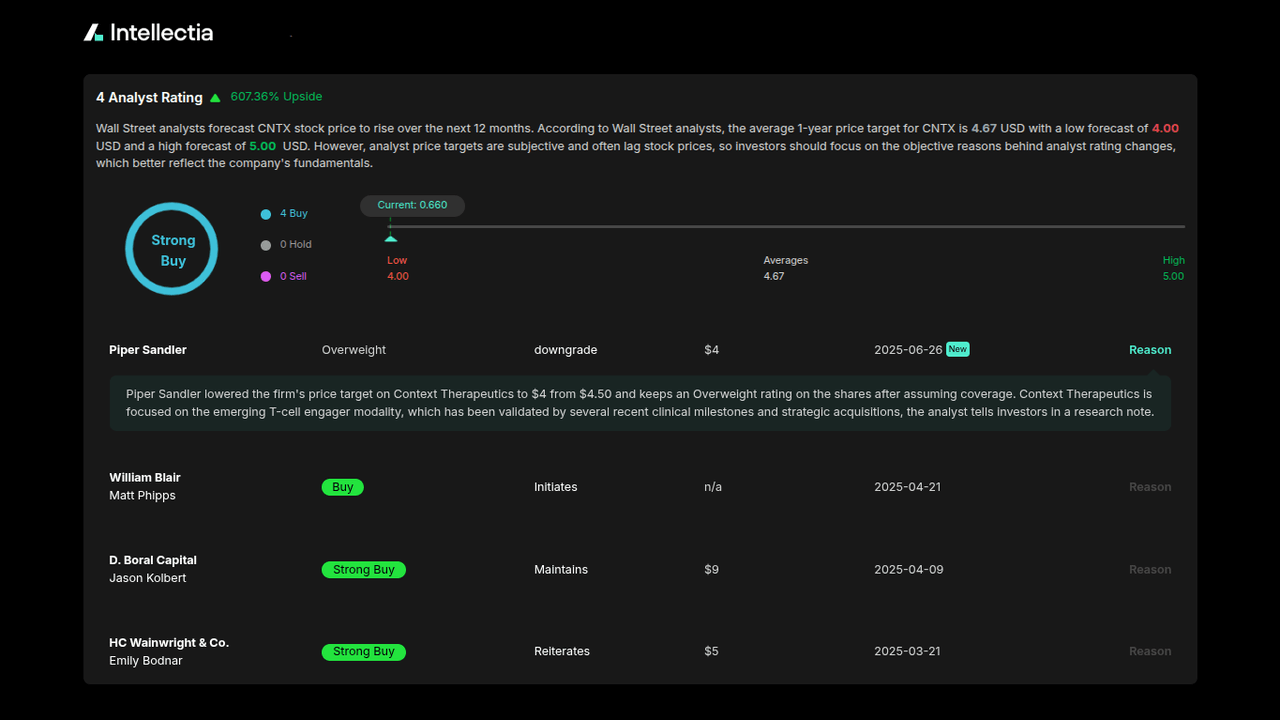

Context Therapeutics Inc. (CNTX)

Context Therapeutics is an oncology-focused biotech developing therapies for hormone-driven cancers, such as breast, ovarian, and endometrial cancers. Its lead candidate, Apristor, targets progesterone receptor-positive cancers, addressing a significant unmet need.

In 2024, CNTX announced promising preclinical data, with Phase 1/2 trials progressing, potentially leading to catalysts in 2025. Unlike broader biotechs like Lexicon, Context’s narrow focus on oncology offers high specificity, appealing to investors interested in cancer therapies.

Its small market cap and early-stage pipeline make it riskier but with substantial growth potential if trials succeed. For those prioritizing oncology innovation, CNTX is a standout.

Source: intellectia.ai

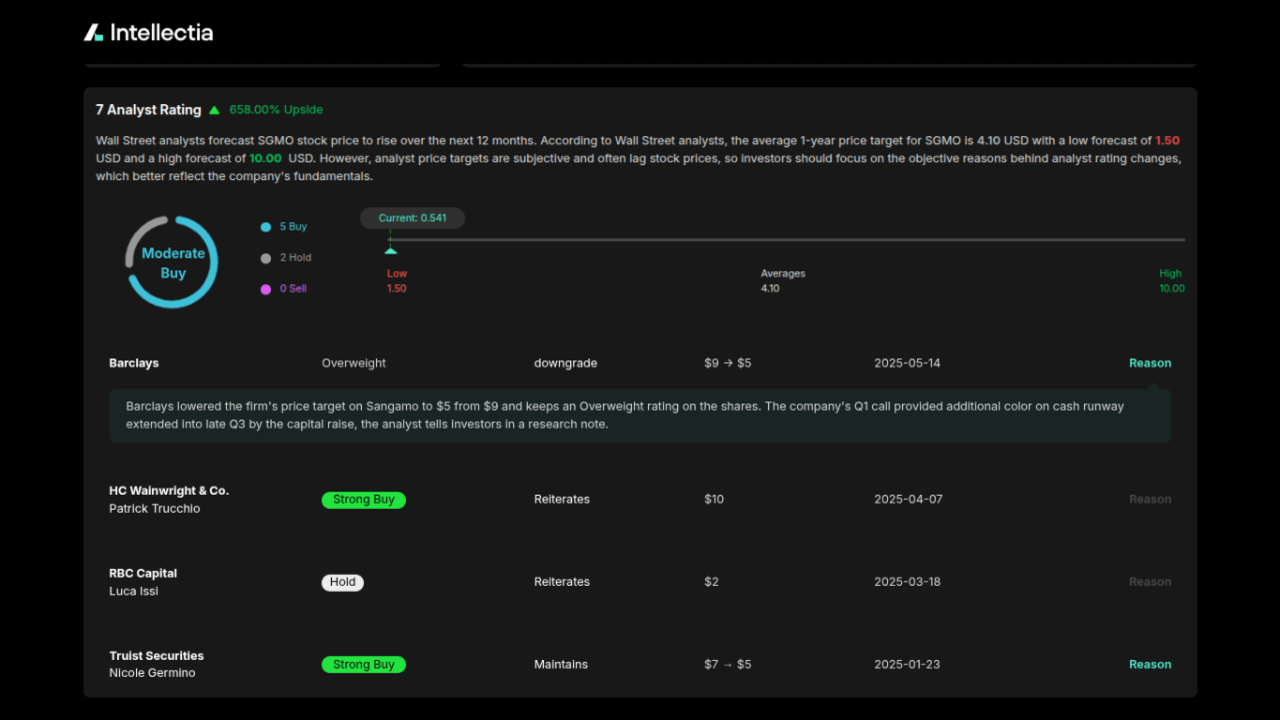

Sangamo Therapeutics, Inc. (SGMO)

Sangamo Therapeutics is a pioneer in genomic medicine, leveraging gene editing and gene therapy to treat diseases like hemophilia, Fabry disease, and neurological disorders. Its zinc finger nuclease technology sets it apart, offering precision in genetic modifications.

In 2024, Sangamo reported progress in its Fabry disease program, with Phase 1/2 data showing efficacy, and partnerships with companies like Pfizer bolster its credibility. Unlike ORGO’s commercial focus or CNTX’s oncology niche, Sangamo’s cutting-edge approach appeals to investors excited about transformative biotech.

Its diverse pipeline and strong IP portfolio enhance its growth potential, though clinical risks remain. SGMO is a top pick for those betting on gene-editing breakthroughs.

Source: intellectia.ai

Investment Strategies for Biotech Stocks Under $5

To succeed with biotech stocks under $5, consider these strategies:

- Monitor News and Catalysts: Stay updated on clinical trial results, FDA decisions, or partnerships. Intellectia.AI’s news alerts keep you informed in real-time.

- Diversify Your Portfolio: Spread investments across multiple biotech stocks to reduce risk. Use Intellectia.AI’s AI stock picker to build a balanced portfolio.

- Use Technical Analysis: Identify entry and exit points with tools like moving averages or RSI. Intellectia.AI’s technical analysis simplifies this process.

- Set Stop-Loss Orders: Protect your capital by setting automatic sell points if prices drop too low.

- Leverage AI Insights: Intellectia.AI’s trading signals provide data-driven buy and sell recommendations.

These strategies, combined with Intellectia.AI’s tools, can help you navigate the volatile biotech market with confidence.

Source: intellectia.ai

Conclusion

Biotech stocks under $5 offer a unique chance to invest in innovative companies with the potential for significant returns. While risks like regulatory hurdles and volatility exist, careful selection and strategic investing can lead to success. Stocks like ORGO, DMAC, LXRX, CNTX, and SGMO are worth watching in 2025 for their promising pipelines and catalysts.

With Intellectia.AI’s AI-driven tools, you can make informed decisions and stay ahead of market trends. Sign up today at Intellectia.AI to access daily stock picks, trading signals, and in-depth analysis to boost your biotech investments.