Key Takeaways

- The cannabis sector is shifting from speculation to fundamental profitability in 2026, with companies like Tilray Brands achieving net income profitability.

- Regulatory changes, including potential rescheduling and international expansion in Germany, remain the biggest catalysts for cannabis stocks that will explode.

- Ancillary companies like Turning Point Brands (Zig-Zag) and Quest Diagnostics offer stable, "pick-and-shovel" ways to invest in the sector.

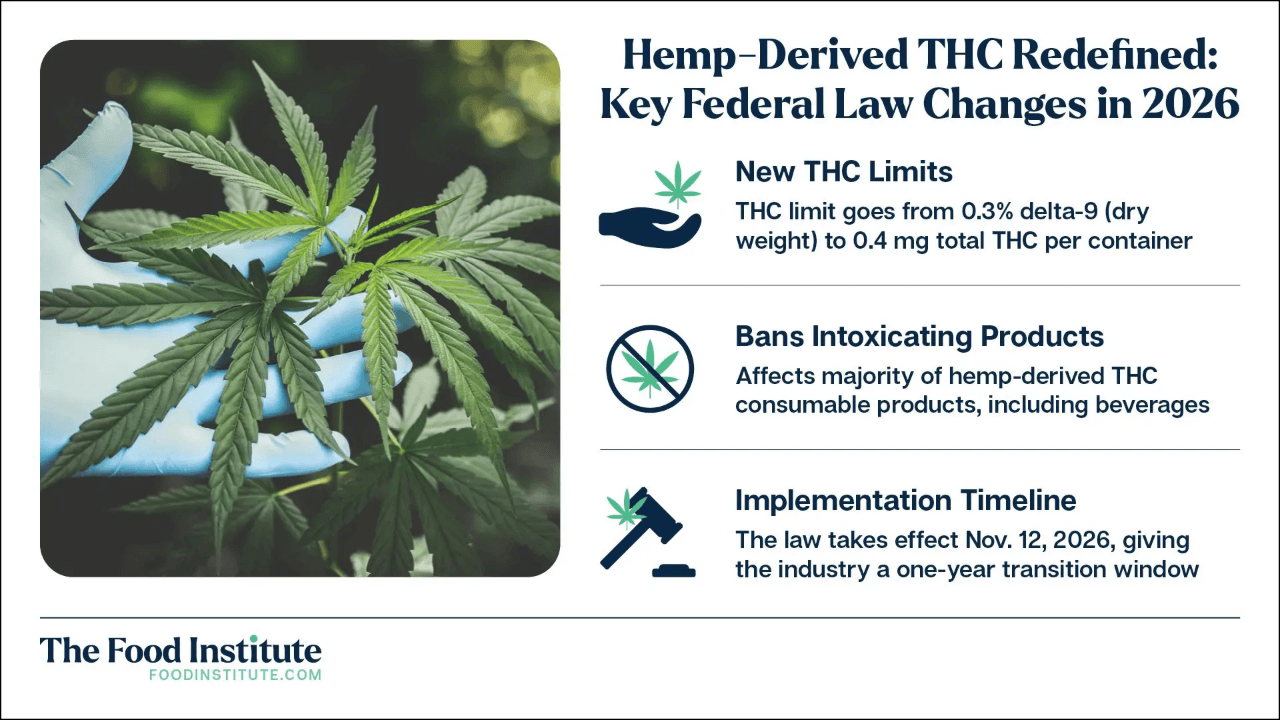

- Investors must remain vigilant regarding U.S. legislative risks, specifically recent moves to recriminalize certain hemp-derived THC products.

Introduction

Have you ever watched a sector explode with potential, only to see it hampered by regulatory gridlock and volatility? The cannabis industry has taken investors on a rollercoaster ride over the last decade. Many traders have experienced the frustration of buying into the hype, only to watch valuations crumble when legislative promises fall through.

However, by analyzing recent earnings data and market sentiment, you can see a distinct shift occurring as the markets head into 2026. The market is maturing. It is no longer just about who can grow the most plants; it is about who can generate cash flow, navigate international laws, and survive consolidation.

Here, you will discover the top marijuana stocks poised for growth in 2026. The article will move beyond the hype and look at the hard numbers—revenue, EBITDA, and strategic positioning—to help you make informed decisions. Whether you are looking for pure-play cannabis growers or stable ancillary businesses, understanding the current landscape is the solution to building a resilient portfolio.

What Are Marijuana Stocks?

Before diving into specific tickers, you need to understand the landscape. "Marijuana stocks" is a catch-all term that actually covers several distinct sub-sectors. Understanding these distinctions is vital because regulatory changes—like the 2018 Farm Bill or rescheduling efforts—affect each group differently.

The Core Segments

Cannabis Growers and Retailers (Plant-Touching)

These are companies that cultivate, harvest, process, and sell cannabis. They operate in medical and adult-use markets. They are most sensitive to state and federal laws. Companies in this bucket are often considered the "pure plays." When you look for top cannabis stocks, you are usually looking at these operators. They offer the highest reward potential but come with the highest risk due to tax burdens (like 280E in the U.S.) and interstate commerce restrictions.

Hemp and CBD Stocks

Hemp is a variety of the Cannabis sativa plant containing very low levels of THC (less than 0.3%). Top hemp stocks focus on industrial uses (fibers, building materials) or the extraction of cannabinoids like CBD for wellness products. Recently, this segment has expanded into "hemp-derived THC" beverages, though this specific niche faces significant legislative headwinds in the U.S. going into 2026.

Ancillary Companies (Pick-and-Shovel)

These companies do not touch the plant. Instead, they provide essential services or products to the industry. This includes companies that make rolling papers, hydroponic equipment, packaging, or provide drug testing and real estate. These are often safer bets because they can list on major U.S. exchanges (NASDAQ/NYSE) regardless of federal marijuana prohibition.

Pharmaceutical/Biotech

These companies use cannabinoids to create FDA-approved drugs. They operate strictly within the federal legal framework and are viewed more as biotech plays than traditional marijuana stocks.

By diversifying across these segments—perhaps through marijuana ETFs—you can mitigate the risks associated with a single company or regulatory ruling.

Why Invest in Marijuana Stocks?

Why should you consider allocating capital to this sector now? Despite the volatility, the long-term thesis for cannabis remains compelling.

The Global Expansion Story

While the U.S. market often grabs the headlines, the international story is heating up. Countries like Germany have significantly reformed their medical and recreational cannabis laws. As of late 2025, distribution of medical cannabis in Germany is expanding rapidly. Companies with a foothold in Europe are seeing their total addressable market grow exponentially. If you are looking for cannabis stocks that will explode, look for those with international export licenses and GMP-certified facilities.

The Shift to Profitability

For years, cannabis companies burned cash to fund expansion. In fiscal 2025 and 2026, the narrative has shifted. Major players are now reporting positive net income and free cash flow. The industry is consolidating, and the survivors are leaner and more efficient. Investing now means you are buying into real businesses, not just speculative concepts.

Ancillary Stability

Investing in cbd stocks or ancillary providers allows you to tap into the growth of the industry without the direct risk of crop failure or interstate trafficking laws. Companies that sell accessories or compliance services often pay dividends and have steady cash flows, providing a hedge against the volatility of pure growers.

Potential Regulatory Catalysts

Although delays are common, the potential for U.S. federal rescheduling (moving cannabis from Schedule I to Schedule III) remains a massive potential catalyst. Such a move would alleviate tax burdens for U.S. operators and likely spark a significant rally across the sector.

Top Marijuana Stocks to Watch in 2026

Here are four companies representing different angles of the industry—global cultivation, U.S. expansion, consumer accessories, and healthcare services.

| Company Name | Ticker | Sector | Market Cap | Key Strength |

|---|---|---|---|---|

| Tilray Brands | TLRY | Cannabis & Alcohol | Mid-Cap | Diversified global footprint & profitability |

| Canopy Growth | CGC | Cannabis | Small/Mid-Cap | Canopy USA strategy & Storz & Bickel |

| Turning Point Brands | TPB | Accessories/Nicotine | Small-Cap | Strong cash flow from Zig-Zag & Stoker's |

| Quest Diagnostics | DGX | Healthcare/Testing | Large-Cap | Stability & Employer Drug Testing |

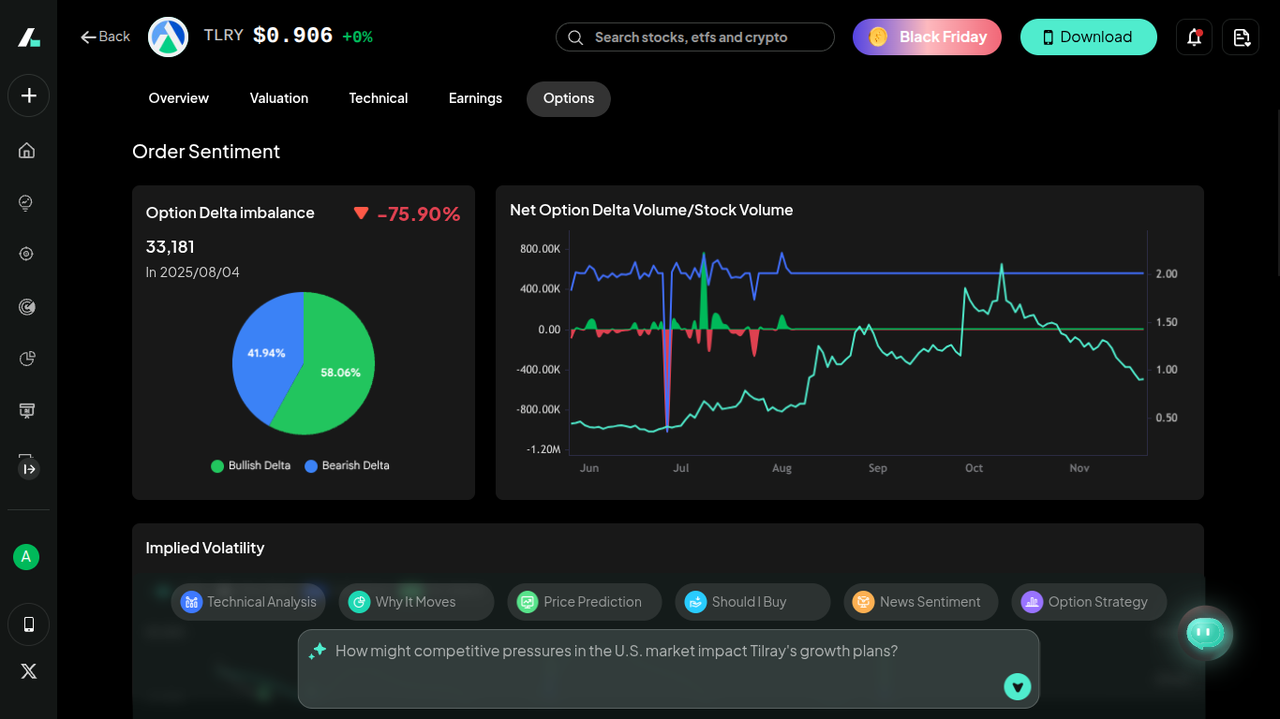

Tilray Brands, Inc. (TLRY)

Tilray is a global lifestyle and consumer packaged goods company. It is currently the 1 Canadian cannabis operator by revenue and has a significant alcohol division.

In its Q1 2026 earnings, Tilray reported record net revenue of $210 million, a 5% increase year-over-year. Most importantly, the company achieved net income of $1.5 million, signaling a turn toward sustainable profitability. Their adjusted EBITDA guidance for 2026 remains strong at $62 million to $72 million.

Tilray isn't just a pot stock; it's a craft beer giant (SweetWater, Montauk). This beverage revenue stabilizes the ship when cannabis markets are volatile. With medical cannabis distribution in Germany expected to triple in fiscal 2026, Tilray is perfectly positioned to dominate the European market.

Tilray has aggressively entered the hemp-derived Delta-9 beverage market in the U.S. However, you must watch this closely, as recent political moves to recriminalize hemp-derived THC could impact this specific revenue stream.

Tilray is arguably the safest bet among the pure-play cultivators due to its diversified revenue streams and strong balance sheet ($265 million in cash).

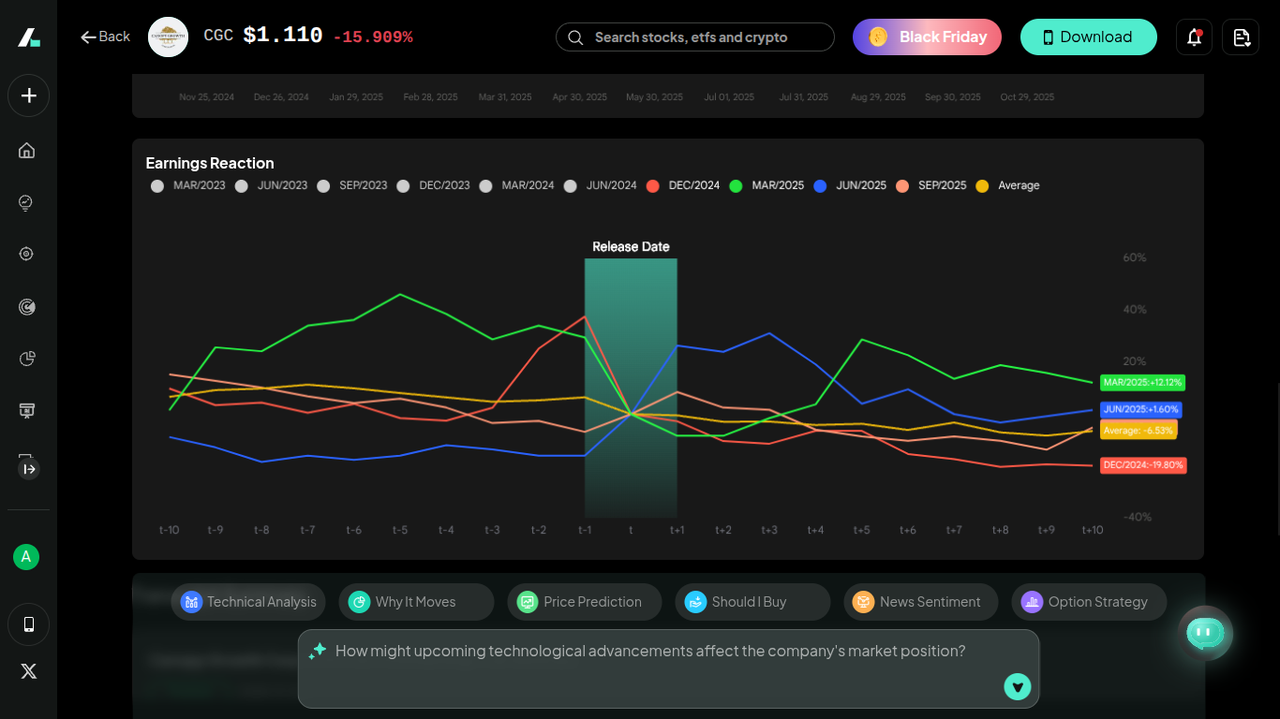

Canopy Growth Corporation (CGC)

Canopy Growth has long been a favorite among retail investors. After a period of restructuring, the company is emerging leaner and more focused.

In Q2 fiscal 2026, Canopy resolved "going concern" doubts, a massive psychological win for investors. They hold $298 million in cash, exceeding their debt balances. While international sales dipped due to supply chain issues, their Canadian adult-use revenue surged 30% year-over-year, driven by new product launches like Claybourne infused pre-rolls.

Canopy USA is a unique structure that allows Canopy to trigger the acquisition of U.S. assets (like Wana Brands and Jetty) once federal laws permit, giving it a "fast lane" into the American market. Storz & Bickel subsidiary manufactures high-end vaporizers (like the Volcano). It provides high-margin hardware revenue, though it faces some pressure from U.S. tariffs.

Also, management has delivered over $21 million in annualized SG&A savings, proving they can cut costs and improve margins. Canopy represents a higher-risk, higher-reward play focused on the eventual opening of the U.S. market. If you believe in U.S. legalization, Canopy is a primary vehicle for that thesis.

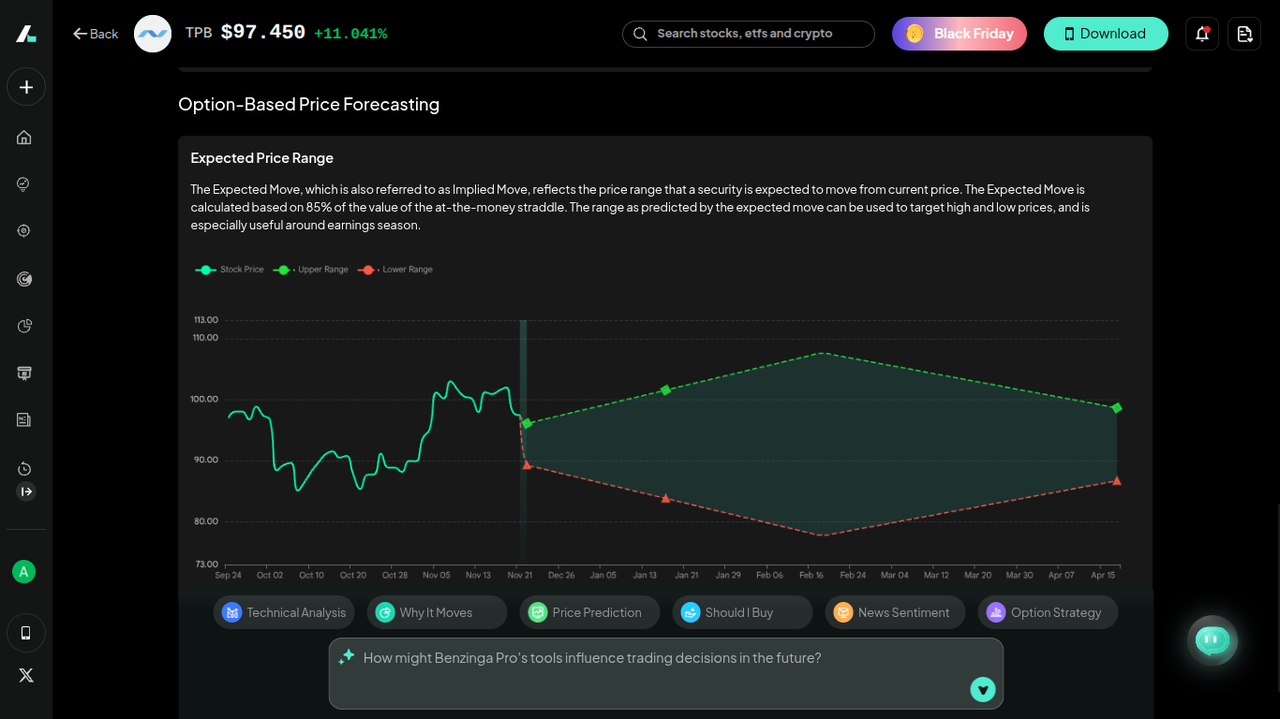

Turning Point Brands, Inc. (TPB)

Turning Point Brands is not a grower, but it owns Zig-Zag, the iconic rolling paper brand essential to cannabis culture.

TPB is a cash flow machine. In Q3 2025, they reported $119 million in revenue (up 31% YoY) and raised their full-year EBITDA guidance to $115-$120 million. Their "Modern Oral" segment (nicotine pouches) grew a staggering 628%, driving massive upside.

It is a "Pick and Shovel" play. Regardless of which grower wins, people need rolling papers and cones. Zig-Zag sales provide a steady baseline revenue that cannabis growers struggle to match.

The company is aggressively rolling out its "ALP" nicotine pouch brand. While not cannabis, this segment is driving the stock price higher, effectively subsidizing the stable Zig-Zag business.

Unlike most cannabis stocks, TPB has a history of returning capital to shareholders. If you want exposure to the cannabis demographic without the regulatory headaches of plant-touching operations, TPB is a robust choice.

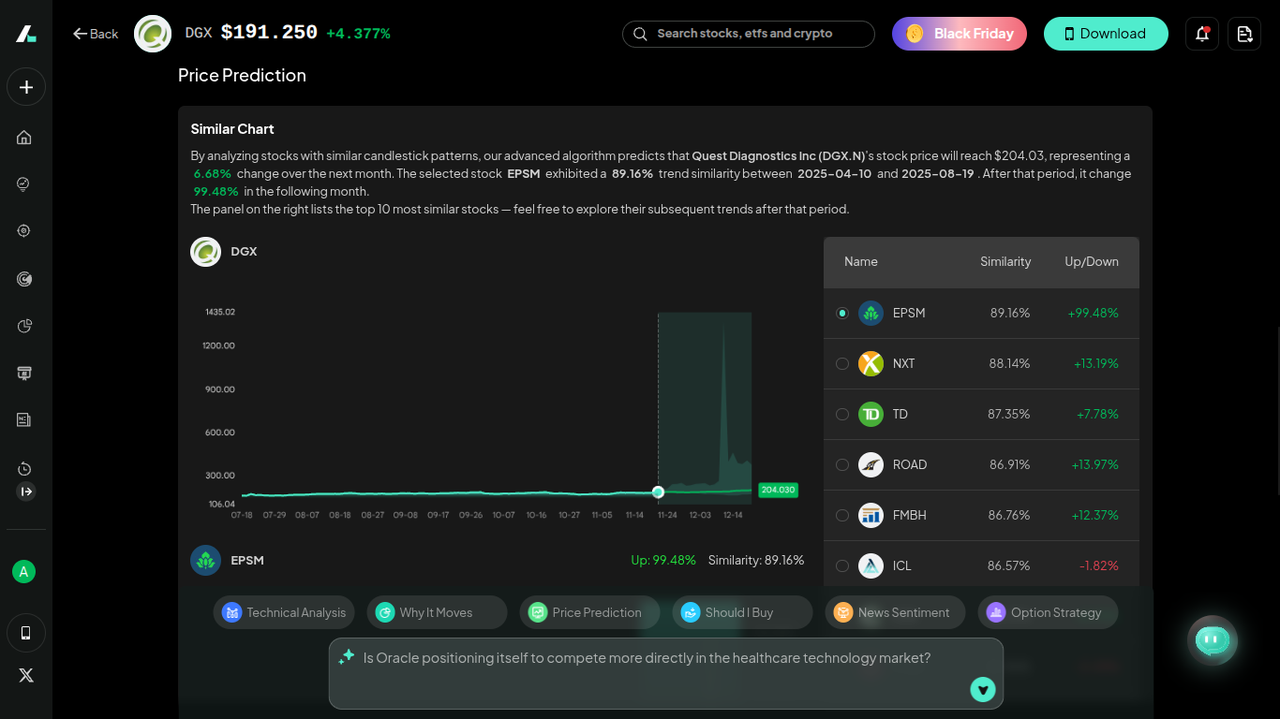

Quest Diagnostics (DGX)

Quest is a healthcare giant, not a marijuana company. However, it plays a critical role in the ecosystem through workforce drug testing.

Quest is a large-cap fortress. In Q3 2025, they reported $2.82 billion in revenue and raised their full-year guidance. They generate massive operating cash flow ($1.42 billion year-to-date).

As cannabis laws change, Quest is at the forefront of helping employers navigate complex drug testing requirements. If the cannabis sector crashes, Quest will likely remain unaffected due to its core clinical diagnostics business. It is a defensive play for your portfolio. Its consumer health segment (testing for brands like WHOOP) is growing, showing they are modernizing rapidly.

Include DGX in your watchlist if you are a conservative investor who wants only tangential exposure to the societal shifts regarding drug use, backed by a blue-chip balance sheet.

Investment Strategies for Marijuana Stocks

Investing in this sector requires more than just picking a ticker. You need a strategy to manage the extreme volatility.

Focus on Fundamentals over Hype

In 2018, investors bought stocks based on cultivation capacity. In 2026, you must buy based on cash flow. Look at Tilray’s turn to net income profitability or TPB’s gross margins. Use tools like the Intellectia.AI Stock Screener to filter for cannabis companies that have positive EBITDA and manageable debt loads. Avoid companies that are diluting shareholders just to keep the lights on.

Monitor the Regulatory Landscape

Politics drive cannabis stock prices.

The Farm Bill: Watch for updates on the "spending bill" provisions mentioned in recent news. If hemp-derived THC is banned federally, companies relying heavily on that revenue stream (like certain beverage segments) could suffer.

Rescheduling: Keep an eye on the DEA. Moving cannabis to Schedule III would remove the 280E tax burden, instantly boosting the bottom line of U.S. operators.

Technical Analysis for Entry Points

Because these stocks are volatile, entry price matters. Do not chase rallies blindly. Use Stock Technical Analysis to identify support levels. For example, if Canopy Growth jumps 20% on news, wait for a consolidation period before entering.

Diversify with ETFs

If picking individual winners feels too risky, consider marijuana ETFs like MSOS or MJ. These funds hold a basket of top cannabis stocks, spreading your risk across growers, real estate, and ancillary providers.

Conclusion

The cannabis industry in 2026 is vastly different from the "Green Rush" of the past decade. It is maturing into a sector driven by fundamentals, international distribution, and brand loyalty. Companies like Tilray Brands and Canopy Growth have weathered the storm and are now optimizing for profitability, while Turning Point Brands continues to offer a reliable, cash-generating alternative for investors.

However, risks remain. Regulatory flip-flops in the U.S. regarding hemp and rescheduling can change the outlook overnight. You must remain vigilant and data-dependent.

To stay ahead of these rapid market changes, you need the best tools available. Sign up for Intellectia.AI today to accessdaily AI stock picks, real-time market analysis, and advanced trading signals that can help you navigate the volatile world of marijuana stocks with confidence. Don't just guess—invest with intelligence.