Thanksgiving Market Rally: Robinhood, Dell, Deere Moves

Updated: 27 Nov 25

0mins

Ahead of Thanksgiving, U.S. markets rallied with the Dow, S&P 500, and Nasdaq seeing nearly 1% gains. Robinhood shares surged 10% following its LedgerX acquisition, while Dell jumped 7% on strong AI demand. Conversely, Deere dropped 5% due to weak forecasts, and HP fell 2% amid layoffs and cost-cutting measures.

Market Overview and Gains Before Thanksgiving

Major U.S. stock indices advanced on Wednesday as investors looked forward to a potential Federal Reserve rate cut, fueling optimism in the markets. The Dow Jones Industrial Average, S&P 500, and Nasdaq all posted gains close to 1%, continuing a trend of strong performance leading into the Thanksgiving holiday. The rally reflects a combination of easing labor market pressures and positive sentiment around corporate earnings. Fresh data showing initial jobless claims at 216,000, below the expected 225,000, bolstered confidence, suggesting that the economy remains resilient despite tightening monetary policies.

Among sectors, technology and consumer staples led the gains. Tech stocks were buoyed by strong demand for artificial intelligence-related products, while consumer staples benefited from higher retail activity ahead of the holiday season. The CBOE Volatility Index, a measure of market uncertainty, fell for a fourth consecutive session, signaling reduced investor concerns about near-term risks.

Key Stock Performers: Robinhood and Dell Surge

Robinhood Markets (HOOD) emerged as one of the day's top performers, surging nearly 10% after the online trading platform announced its acquisition of LedgerX. This move, in partnership with Susquehanna International Group, signals Robinhood’s strategic entry into prediction markets and futures derivatives trading, marking a significant expansion of its product offerings. The rally brought Robinhood's year-to-date gains to over 230%, underscoring investor confidence in its growth strategy.

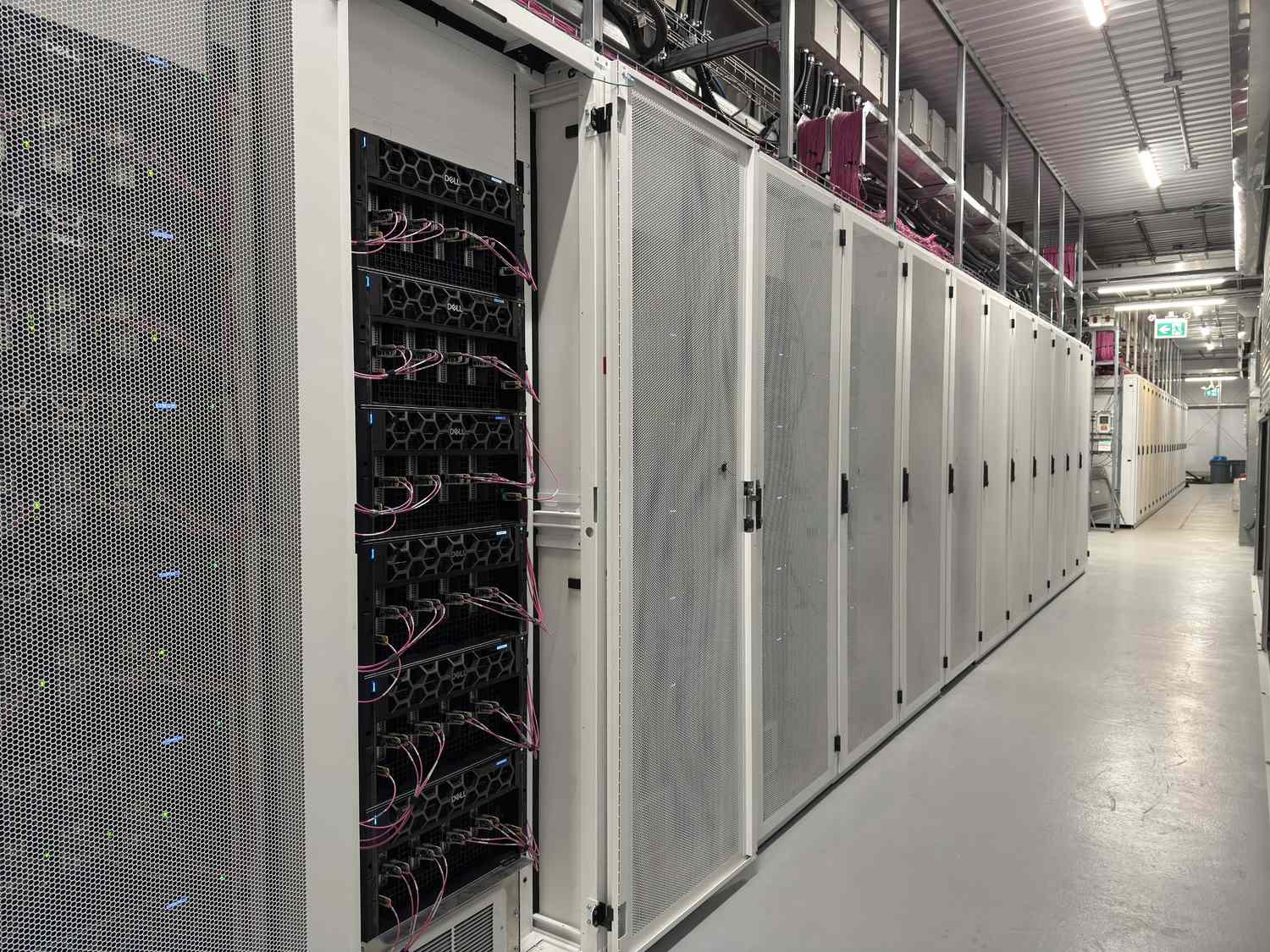

Dell Technologies (DELL) also stood out, climbing 7% after the company raised its financial guidance and highlighted robust demand for its artificial intelligence-driven server products. The surge in AI product demand has positioned Dell to capitalize on the expanding enterprise tech market, particularly as businesses accelerate their investments in AI infrastructure.

Declining Stocks: Deere and HP Struggle

Shares of Deere & Company (DE) dropped 5% following the release of a weaker-than-expected financial outlook. The agricultural equipment manufacturer cited challenging global market conditions, including softening demand in the farm and construction sectors, as key factors behind its cautious guidance. The decline marks a setback for the company amid broader industry headwinds.

HP Inc. (HPQ) also faced pressure, with shares slipping 2% after the company announced a cost-cutting initiative involving layoffs of 4,000 to 6,000 employees. The restructuring plan aims to offset rising costs, including those tied to U.S. tariffs. Despite these efforts, HP’s muted revenue outlook for the coming fiscal year failed to reassure investors, reflecting the competitive and cost-sensitive environment in the personal computing market.

Sources

Sources- Stock Movers Now: Robinhood, Dell, Deere, HP,

yahoo

yahoo - Stocks Surge Ahead Thanksgiving, Robinhood Rallies 10% - Deere (NYSE:DE)

benzinga

benzinga - Stock market today: Dow, S&P 500, Nasdaq jump Wall Street eyes 4th straight win Thanksgiving

yahoo

yahoo

- Stock Movers Now: Robinhood, Dell, Deere, HP,

yahoo

yahoo - Stocks Surge Ahead Thanksgiving, Robinhood Rallies 10% - Deere (NYSE:DE)

benzinga

benzinga - Stock market today: Dow, S&P 500, Nasdaq jump Wall Street eyes 4th straight win Thanksgiving

yahoo

yahoo

About the author

Preview

John R. Smitmithson

With over 15 years of experience in global financial markets, John R. Smitmithson holds a Master’s degree in Finance from the London School of Economics. A former investment strategist at Goldman Sachs, he specializes in macroeconomic trends and equity analysis, contributing authoritative insights to Intellectia’s market overviews.