xAI Loses Two Co-Founders in Two Days

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1h ago

0mins

Should l Buy TSLA?

Source: seekingalpha

- Co-Founder Departures: Prominent AI researcher Jimmy Ba announced his resignation from xAI on Tuesday, expressing gratitude to Elon Musk for the opportunity to co-found the company.

- Internal Tensions: Ba's exit follows the departure of fellow co-founder Tony Wu, highlighting internal tensions within the technical team over demands to enhance AI model performance.

- Merger with SpaceX: xAI merged with Musk's aerospace company SpaceX earlier this month, yet the frequent executive turnover may impact the company's stability and strategic direction.

- Increased Competitive Pressure: Musk faces mounting pressure from rivals like OpenAI and Anthropic to accelerate improvements in AI model performance, but internal turmoil could hinder achieving these objectives.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy TSLA?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on TSLA

Wall Street analysts forecast TSLA stock price to fall over the next 12 months. According to Wall Street analysts, the average 1-year price target for TSLA is 401.93 USD with a low forecast of 25.28 USD and a high forecast of 600.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

30 Analyst Rating

12 Buy

11 Hold

7 Sell

Hold

Current: 417.320

Low

25.28

Averages

401.93

High

600.00

Current: 417.320

Low

25.28

Averages

401.93

High

600.00

About TSLA

Tesla, Inc. designs, develops, manufactures, sells and leases high-performance fully electric vehicles and energy generation and storage systems, and offers services related to its products. Its segments include automotive, and energy generation and storage. The automotive segment includes the design, development, manufacturing, sales and leasing of high-performance fully electric vehicles, and sales of automotive regulatory credits. It also includes sales of used vehicles, non-warranty maintenance services and collisions, part sales, paid supercharging, insurance services revenue and retail merchandise sales. The energy generation and storage segment include the design, manufacture, installation, sales and leasing of solar energy generation and energy storage products and related services and sales of solar energy systems incentives. Its consumer vehicles include the Model 3, Y, S, X and Cybertruck. Its lithium-ion battery energy storage products include Powerwall and Megapack.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Value Potential Assessment: Morgan Stanley preliminarily estimates that Tesla Solar, at full capacity, could add $20 billion to $50 billion in equity value to Tesla's Energy business, translating to $6 to $14 per share, indicating significant growth potential despite limited standalone impact on Tesla's overall valuation.

- Strategic Investment Justification: The firm emphasizes that Tesla's capital allocation to solar manufacturing is rooted in a long-term strategic outlook regarding geopolitics and data center demand, warning that without this investment, Tesla risks facing energy bottlenecks that could hinder broader business objectives.

- Manufacturing Capacity Goals: CEO Elon Musk reiterated at the World Economic Forum that Tesla aims to achieve 100 gigawatts of annual solar manufacturing within three years, highlighting the integration of the entire supply chain from raw materials to finished solar panels as a key focus.

- Market Sentiment Shift: Over the past 24 hours, retail sentiment on Stocktwits regarding TSLA stock shifted from 'bearish' to 'neutral', with message volume remaining at normal levels, while TSLA stock has gained 21% over the past 12 months.

See More

- Merger Scale: Musk's SpaceX and xAI have merged to form a new entity valued at $1.25 trillion, making SpaceX the largest single holding in the ARK fund at 11.23%, while xAI stands at 6.31%, together representing a significant 17.54% of the portfolio, enhancing the fund's market position.

- Market Impact: This merger breaks the global M&A record, with SpaceX acquiring xAI for approximately $1 trillion and xAI valued at around $250 billion, surpassing Vodafone's $203 billion acquisition of Mannesmann in 2000, marking Musk's strategic integration in space and AI.

- Portfolio Dominance: The combined entity dominates the ARK fund, significantly exceeding other holdings like Figure AI (4.24%) and Databricks (3.55%), providing investors with a stronger concentrated investment opportunity in the AI and aerospace sectors.

- Future IPO Outlook: SpaceX is reportedly preparing for a potential IPO later this year that could see its valuation exceed $1.5 trillion, and this merger consolidates high-conviction exposure for ARK investors, further solidifying its leadership in emerging markets.

See More

- Robotaxi Milestone: Investor Gary Black believes that if Tesla operates 'hundreds' of unsupervised Robotaxis in Austin and beyond, the stock could reach $500, demonstrating Tesla's ability to scale autonomous technology globally.

- Significance of Autonomy: This milestone not only highlights Tesla's technological advancements in autonomy but could also attract more investor interest, potentially driving up stock prices and enhancing market confidence.

- Competitive Challenges: In contrast to Waymo's recent Robotaxi accidents, successful operation of Tesla's Robotaxis could significantly improve its competitive edge, particularly in terms of safety and reliability.

- Positive Market Reaction: Tesla's stock rose 1.89% to $425.21 at market close on Tuesday, with an additional 0.16% increase in after-hours trading, reflecting investor optimism regarding the future of Robotaxi operations.

See More

- Co-Founder Departures: Prominent AI researcher Jimmy Ba announced his resignation from xAI on Tuesday, expressing gratitude to Elon Musk for the opportunity to co-found the company.

- Internal Tensions: Ba's exit follows the departure of fellow co-founder Tony Wu, highlighting internal tensions within the technical team over demands to enhance AI model performance.

- Merger with SpaceX: xAI merged with Musk's aerospace company SpaceX earlier this month, yet the frequent executive turnover may impact the company's stability and strategic direction.

- Increased Competitive Pressure: Musk faces mounting pressure from rivals like OpenAI and Anthropic to accelerate improvements in AI model performance, but internal turmoil could hinder achieving these objectives.

See More

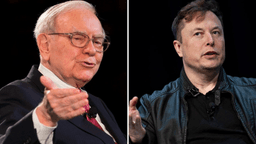

- Wealth Comparison: In 2026, Musk's wealth reaches $676 billion, adding $57 billion year-to-date, making him the richest person globally, significantly ahead of second-richest Larry Page at $278 billion, showcasing his dominance in the wealth rankings.

- Merger Impact: The merger of SpaceX and xAI values the company at $1.25 trillion, with Musk's nearly 42% ownership further boosting his wealth, highlighting his substantial influence in the tech sector.

- Stock Volatility: Despite Tesla shares declining 5.45% year-to-date, Musk's wealth continues to grow, reflecting the resilience of his diversified investment portfolio and the potential future value from upcoming IPOs.

- Buffett's Wealth Decline: Buffett's wealth has fallen to $120 billion due to ongoing philanthropic efforts, dropping him to 12th place, indicating a widening gap between him and Musk, and suggesting a shift in the future wealth landscape.

See More

- Robotaxi Service Launch: Tesla has launched robotaxis without safety monitors in Austin, currently operating about 500 Model Y vehicles across the Bay Area and Austin, but the cautious scaling may impact the company's future market performance.

- Stock Price Outlook: Analyst Randy Kirk stated that the only way for Tesla's stock to breach the $500 mark is through scaling its robotaxi fleet, as neither the merger with SpaceX nor the volume production of the Tesla Semi will drive the stock price higher.

- Market Sentiment: Retail sentiment on Stocktwits regarding TSLA stock has remained in the 'bearish' territory over the past 24 hours, despite the stock rising 21% over the past 12 months, indicating cautious market expectations for future performance.

- Full Self-Driving Technology: Tesla is advancing its unsupervised full self-driving technology execution, although some vehicles will still retain safety monitors, and future expansion will depend on the maturity of the technology and market acceptance.

See More