The Magnificent Seven Remain Relevant—Yet 2026 Tells More Than Just Their Tale

Market Dominance of Mega-Caps: The U.S. stock market has been heavily influenced by a small group of mega-cap technology companies, known as the Magnificent Seven, which have driven significant returns and earnings growth, accounting for nearly half of the S&P 500's projected earnings growth in 2026.

Shift in Earnings Growth: While the Magnificent Seven will still play a crucial role in market performance, Goldman Sachs indicates that earnings growth is expected to broaden, with other S&P 500 stocks contributing more significantly to overall growth, reflecting a shift in market dynamics.

Economic Factors Supporting Growth: Economic growth is a key driver of earnings, with cyclical sectors like Industrials and Consumer Discretionary anticipated to see faster earnings growth as macro conditions improve, supported by labor market dynamics and productivity gains.

AI's Gradual Impact: Although artificial intelligence is expected to enhance earnings potential over time, its current impact is limited, with adoption still in early stages among large firms, suggesting that it will not be the primary driver of growth in 2026.

Trade with 70% Backtested Accuracy

Analyst Views on META

About META

About the author

- Massive Market Potential: With a current market cap of approximately $1.6 trillion, Meta could join the $3 trillion club with an 81% stock price increase, highlighting its strong growth potential in the social media sector.

- Ad Revenue Growth: Meta reported an 18% increase in ad impressions in Q4, driven by AI-enhanced user engagement, which not only boosted ad revenue but also increased the amount charged per ad, reflecting the effectiveness of its business model.

- International Market Expansion: Meta's revenue growth in Europe and Asia-Pacific continues, with these markets still trailing the U.S., indicating significant future growth opportunities and further solidifying its global market position.

- Capital Expenditure Plans: Meta plans to increase capital expenditures to $125 billion by 2026, a 73% increase from last year, demonstrating the company's commitment to AI technology and confidence in future revenue growth.

- Broadcom's Strong Earnings: Broadcom reported record revenue of $19.3 billion for Q1 2026, a 29% year-over-year increase, surpassing analyst expectations of $19.14 billion, highlighting robust demand for AI hardware and reinforcing its market position.

- Surge in AI Revenue: The company's AI-related revenue soared 106% year-over-year to $8.4 billion, marking the 12th consecutive quarter of AI growth, indicating a significant share in the rapidly expanding AI market.

- Optimistic Future Outlook: Broadcom anticipates Q2 revenue of $22 billion, a 47% increase year-over-year, well above Wall Street's forecast of $20.4 billion, reflecting strong confidence in future AI chip demand.

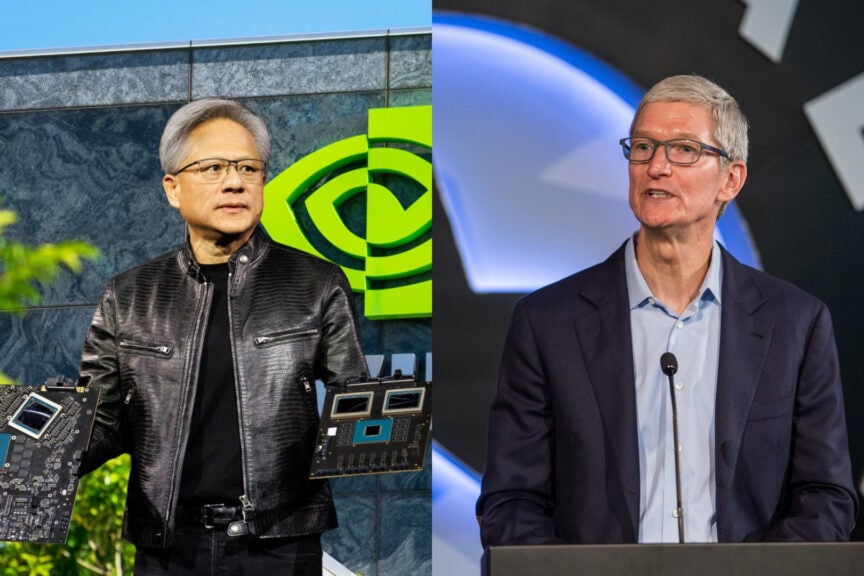

- Bright Prospects for Nvidia: Nvidia controls 92% of the data center GPU market, and as AI adoption expands downstream, demand for its GPUs is expected to rise, presenting a favorable entry point for investors despite market uncertainties.

- Ratepayer Protection Commitment: The Trump administration has signed a voluntary agreement with major tech companies to build or purchase the electricity needed for rapidly expanding data centers, covering the infrastructure costs to connect to the grid, thereby alleviating consumer electricity burdens.

- Surge in Electricity Demand: The U.S. brought online a record 10 gigawatts of new data center capacity in 2025, with electricity demand increasing by 2.8% year-over-year, marking the fastest growth rate in nearly 20 years, highlighting the significant impact of AI infrastructure expansion on the power market.

- Lack of Enforcement Power: Despite the agreement, experts indicate that the pledge lacks legal force, as state regulators ultimately decide on electricity pricing structures, meaning the White House cannot enforce new policies.

- Positive Industry Response: Companies like Amazon and Microsoft have indicated they will cover the costs of their expanding electricity needs, reflecting the industry's recognition of public concerns regarding potential increases in household electricity costs due to AI infrastructure.

- Finality of a Situation: The phrase "stick a fork in it" suggests that something is finished or no longer viable.

- Closure and Departure: Expressions like "turn out the lights" and "hasta la vista" indicate a sense of closure and farewell.

Financial Boost: Marvell Technology's fourth-quarter financials are expected to improve due to ongoing demand for hardware that supports artificial intelligence.

Customer Demand: The increasing need for AI-related technology is driving customer purchases, positively impacting Marvell's revenue.

- Custom Silicon Strategy: Meta plans to expand its custom silicon applications from simple recommendation algorithms to complex AI model training, aiming to enhance performance and efficiency while reducing reliance on third-party suppliers like Nvidia and AMD.

- Personalized Workloads: CFO Susan Li noted that some of Meta's workloads are highly customized, particularly those related to AI models and personalized recommendations, indicating that tailored hardware will better meet its unique needs.

- AI Training Chip Testing: Testing for Meta's first in-house AI training chip is expected to begin in early 2025, and despite setbacks with advanced designs like Olympus in February, the company aims for a 2026 rollout for generative AI.

- Alignment with Industry Trends: This initiative aligns with broader industry trends to optimize AI infrastructure costs and performance, signaling Meta's pursuit of a competitive edge in the rapidly evolving AI landscape.