SPDR Consumer Discretionary Sector: Key Pivot Points

Pivot Points for Consumer Discretionary Sector: The pivot high is set at $230.04 and the pivot low at $227.24, calculated using the DeMark method.

Market Sentiment Indicators: A breakout above the pivot high is considered bullish, while a breakdown below the pivot low is seen as bearish.

Technical Analysis Tool: The DeMark method is utilized to determine these pivot points, which are important for traders in making decisions.

Data Relevance: The information is based on data available up to October 2023.

Trade with 70% Backtested Accuracy

Analyst Views on XLY

About the author

Morgan Stanley's Price Target Update: Morgan Stanley raised its price target on Dutch Bros to $85 from $82, maintaining an overweight rating, while RBC Capital lowered its target to $75 from $80 but kept an outperform rating.

Strong Q4 Performance: Dutch Bros reported Q4 revenues of $443.6 million, exceeding expectations of $424.9 million, and demonstrated a 29.4% increase in revenue year-over-year.

Analyst Ratings and Market Sentiment: Analysts have varied ratings on Dutch Bros, with some maintaining buy ratings and others lowering price targets, reflecting a mix of optimism and caution in the market.

Future Projections: Dutch Bros announced plans for significant capital expenditures in 2026, projecting revenues between $2 billion and $2.03 billion, with same-store sales growth estimated at 3% to 5%.

Consumer Discretionary Performance: Consumer discretionary stocks have seen minimal growth, with only a 2% increase over the past year as indicated by the Consumer Discretionary Select Sector SPDR ETF.

Comparison with Other S&P Sectors: Among the 11 major S&P sectors, consumer discretionary stocks performed poorly, with only financials showing worse performance, remaining unchanged over the same period.

S&P 500 Growth: In contrast, the S&P 500 has experienced a more robust gain of 12% over the past year, highlighting the underperformance of consumer discretionary and financial sectors.

Market Trends: The overall market trends suggest a challenging environment for consumer discretionary stocks, reflecting broader economic conditions affecting consumer spending.

- Market Dynamics: The stock market is characterized by rapid changes, where previously popular stocks can quickly lose favor.

- Investor Strategy: Investors are increasingly looking back at former stock picks to identify potential opportunities for profit.

- Stock Price Prediction: Predicting stock prices is inherently challenging due to market volatility and numerous influencing factors.

- Weather Pattern Prediction: Forecasting weather patterns proves to be even more complex, highlighting the difficulties in making accurate predictions in both fields.

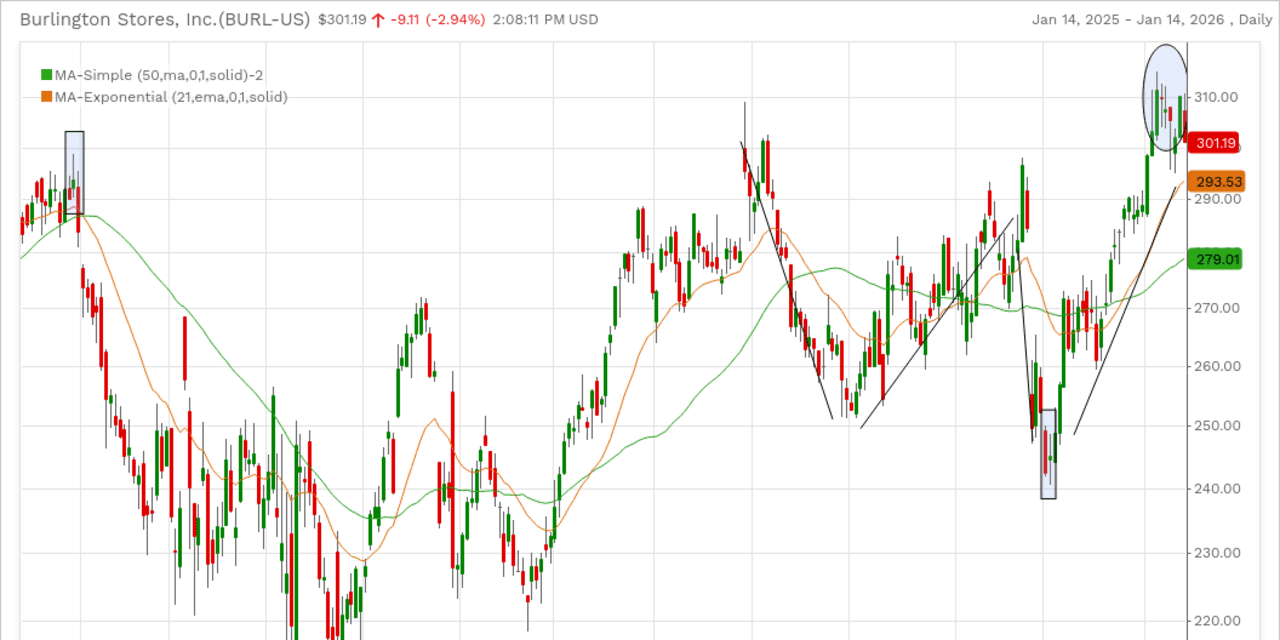

Market Dynamics: Stock markets are continuously changing, with past stock picks potentially becoming new investment opportunities as trends evolve.

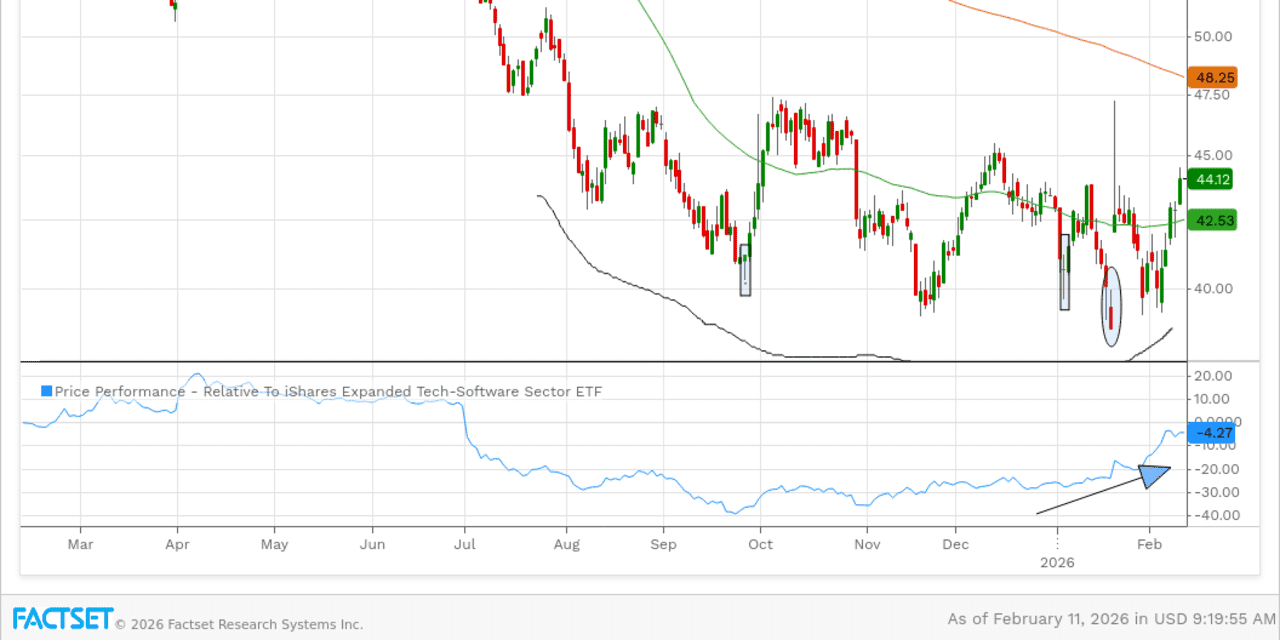

Technical Reset: Many previously strong stocks are undergoing technical resets after consolidations or pullbacks, indicating potential for renewed growth.

Investor Patience: Investors who are patient may find rewarding setups in stocks that are beginning to show signs of recovery.

Revisiting Stocks: It is beneficial to revisit earlier stock selections that may now present fresh opportunities due to recent market adjustments.