SEC's Action Against Leveraged ETFs Creates Power Shift — Who Benefits When 5X Trading is Halted?

Regulatory Challenges for Ultra-Leveraged ETFs: The SEC has issued warning letters to nine issuers, including ProShares and Direxion, halting plans for new ultra-leveraged ETFs that promise up to five times the daily return on various assets, including stocks and cryptocurrencies.

Impact on Existing 2× ETFs: The regulatory freeze creates a scarcity advantage for already-approved 2× ETFs, which have performed well this year, as they become the only viable options for traders seeking leveraged exposure.

Uncertain Future for Ultra-Leveraged Funds: The SEC's discomfort with the risk profiles of ultra-leveraged products raises questions about whether this regulatory pause is temporary or indicative of a more fundamental shift in the market.

Shift in the Leveraged ETF Landscape: The current freeze on new product launches signals a new phase of disruption in the leveraged ETF market, potentially leading issuers to explore buffered or thematic ETFs instead.

Trade with 70% Backtested Accuracy

Analyst Views on META

About META

About the author

- Meta's Investment Potential: Analyst Barton Crockett believes Meta's current share price of $653 is undervalued, with a target price of $1,144 implying a 75% upside; this reflects market skepticism about its AI investments, yet the company reported a 24% revenue increase in Q4, driven by an 18% rise in ad impressions, indicating improved ad performance.

- AI-Driven Ad Growth: By investing in AI products and capabilities, Meta has developed machine learning models to optimize ad placements, and despite its stock being 17% below its record high, the company has managed to increase ad pricing by 6%, showcasing its strong position in the ad tech market.

- Atlassian's Market Opportunities: Morgan Stanley analyst Keith Weiss sees Atlassian's current share price of $76 as undervalued, with a target price of $290 suggesting a 280% upside; while concerns exist about AI tools replacing developers, analysts argue that AI will actually expand the developer pool, boosting demand for DevOps tools.

- Rovo's User Growth: Atlassian's AI capabilities suite, Rovo, recently surpassed 5 million monthly active users, growing over 40% from the previous quarter, demonstrating the company's proactive stance in the AI space, with adjusted earnings expected to grow at a 19% annual rate, making its current stock price relatively cheap and attractive for long-term investment.

- Meta's Stock Potential: Analyst Barton Crockett believes Meta's current share price of $653 has a target of $1,144, indicating a 75% upside, reflecting market confidence in its AI investments.

- Ad Performance Improvement: Meta's use of AI has led to a 24% revenue increase in Q4, with an 18% rise in ad impressions and a 6% increase in ad pricing, demonstrating the effectiveness of its market strategy.

- Atlassian's Market Position: Atlassian's Jira software is highly popular among developers, and Morgan Stanley analysts argue that AI will expand the developer pool, driving demand for DevOps tools, with a projected 280% upside in stock price.

- Growing AI Demand: Atlassian's AI tool Rovo has surpassed 5 million monthly active users, a 40% increase from the previous quarter, indicating strong demand and market potential, with expectations to benefit from the widespread adoption of AI technologies.

- Strong Performance: Broadcom reported Q1 fiscal 2026 revenue of $19.3 billion, a 29% year-over-year increase, surpassing analyst expectations of $19.14 billion, demonstrating robust performance amid ongoing demand for AI hardware, which solidifies its market position.

- Surge in AI Revenue: The company's AI-related revenue soared 106% year-over-year to $8.4 billion, marking the 12th consecutive quarter of growth in AI business, indicating that the widespread adoption of AI technology is driving sustained performance improvements.

- Optimistic Outlook: Broadcom projects Q2 revenue to reach $22 billion, a 47% increase year-over-year, well above Wall Street's forecast of $20.4 billion, reflecting strong confidence in future growth, particularly with AI semiconductor revenue expected to surge 140% to $10.7 billion.

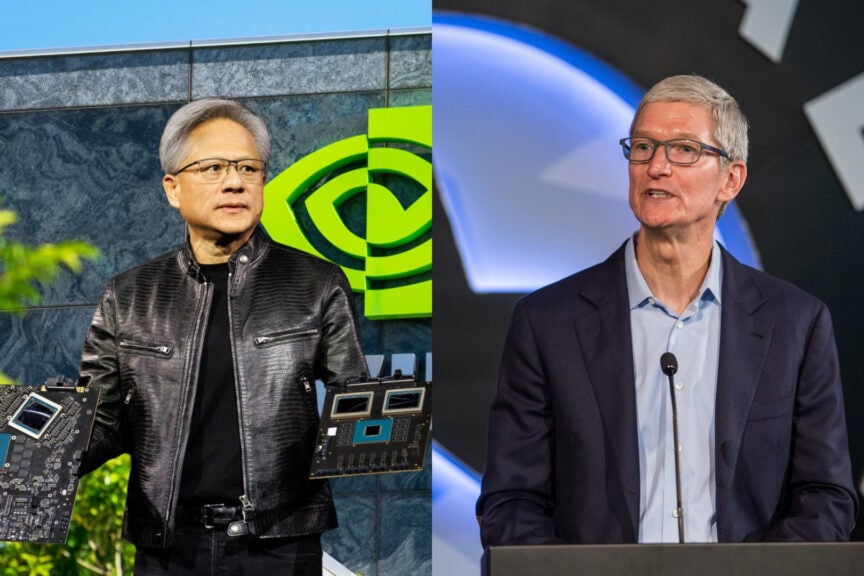

- Broader Market Implications: The strong results and positive outlook from Broadcom further corroborate Nvidia CEO's assertion that AI technology has reached an inflection point, suggesting that accelerating demand for AI will create significant opportunities across the industry.

- Significant Market Potential: With a market cap of $1.6 trillion, Meta could see an 81% potential return if it joins the $3 trillion club, indicating strong growth prospects in the coming years.

- Ad Impression Growth: Meta reported an 18% increase in ad impressions in Q4, driven by AI-enhanced user engagement, showcasing the company's strengthening position in the digital advertising market.

- Revenue Continues to Rise: Meta is expected to generate $251 billion in revenue by 2026, a 22% increase from 2025, further solidifying its global market position, particularly with significant expansion potential in international markets.

- Increased Capital Expenditure: Meta plans to raise capital expenditures to $125 billion in 2026, a 73% increase from last year, reflecting the company's commitment to AI technology and its strategic importance for future growth.

- Massive Market Potential: With a current market cap of approximately $1.6 trillion, Meta could join the $3 trillion club with an 81% stock price increase, highlighting its strong growth potential in the social media sector.

- Ad Revenue Growth: Meta reported an 18% increase in ad impressions in Q4, driven by AI-enhanced user engagement, which not only boosted ad revenue but also increased the amount charged per ad, reflecting the effectiveness of its business model.

- International Market Expansion: Meta's revenue growth in Europe and Asia-Pacific continues, with these markets still trailing the U.S., indicating significant future growth opportunities and further solidifying its global market position.

- Capital Expenditure Plans: Meta plans to increase capital expenditures to $125 billion by 2026, a 73% increase from last year, demonstrating the company's commitment to AI technology and confidence in future revenue growth.

- Broadcom's Strong Earnings: Broadcom reported record revenue of $19.3 billion for Q1 2026, a 29% year-over-year increase, surpassing analyst expectations of $19.14 billion, highlighting robust demand for AI hardware and reinforcing its market position.

- Surge in AI Revenue: The company's AI-related revenue soared 106% year-over-year to $8.4 billion, marking the 12th consecutive quarter of AI growth, indicating a significant share in the rapidly expanding AI market.

- Optimistic Future Outlook: Broadcom anticipates Q2 revenue of $22 billion, a 47% increase year-over-year, well above Wall Street's forecast of $20.4 billion, reflecting strong confidence in future AI chip demand.

- Bright Prospects for Nvidia: Nvidia controls 92% of the data center GPU market, and as AI adoption expands downstream, demand for its GPUs is expected to rise, presenting a favorable entry point for investors despite market uncertainties.