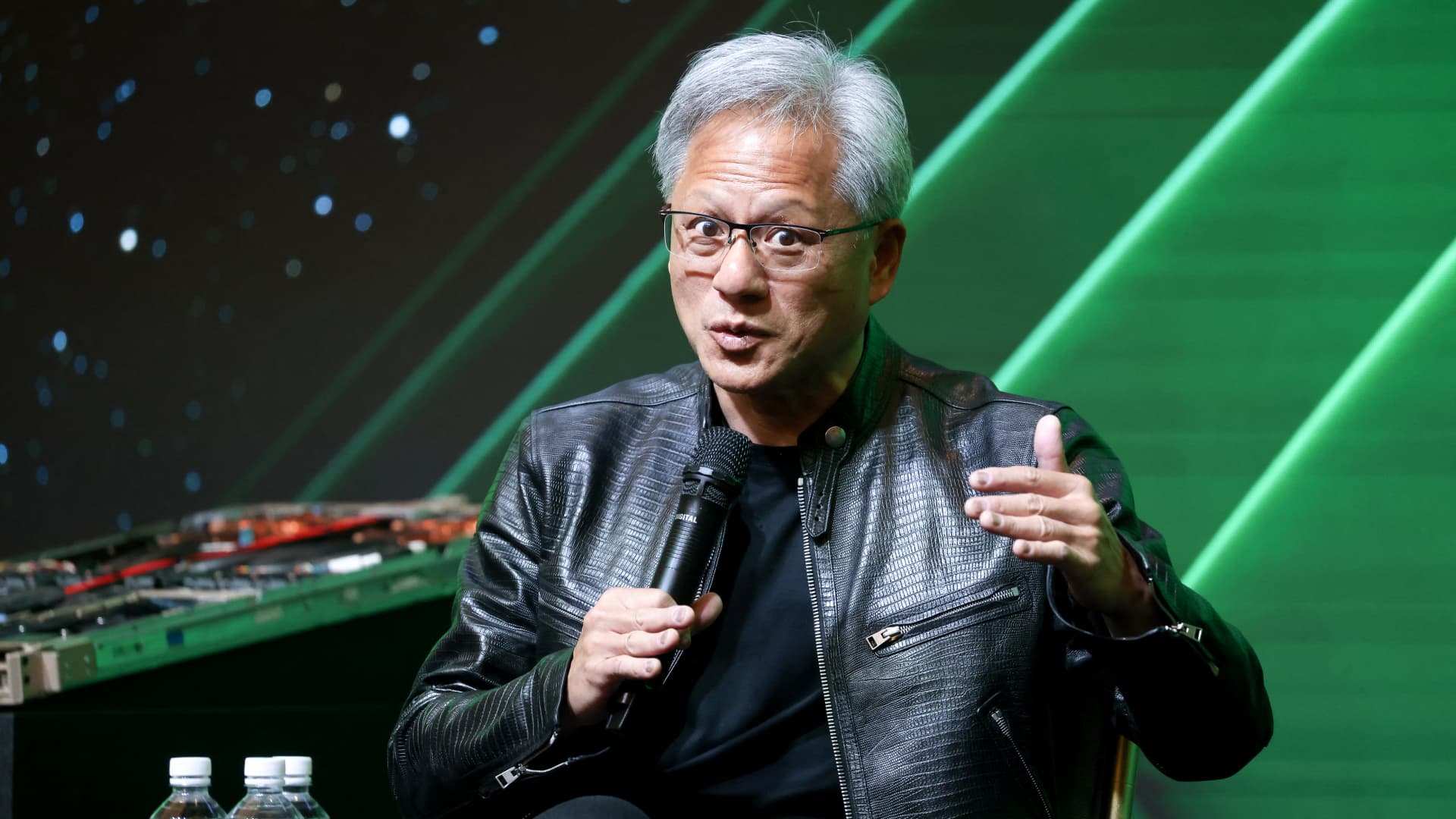

Reasons Behind the Significant Decline of Nvidia, Broadcom, and Other AI Stocks

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Dec 17 2025

0mins

Should l Buy AMD?

Source: MarketWatch

Concerns Over Debt Financing: Recent fears regarding debt financing for data-center buildouts have negatively impacted the artificial-intelligence sector, particularly with new worries surrounding Oracle.

Broadcom's Stock Performance: Broadcom's stock (AVGO) fell over 5% late in the trading day, marking a total decline of more than 21% over the past five sessions, the worst performance since March 2020.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy AMD?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on AMD

Wall Street analysts forecast AMD stock price to rise

33 Analyst Rating

25 Buy

8 Hold

0 Sell

Strong Buy

Current: 190.950

Low

210.00

Averages

289.13

High

377.00

Current: 190.950

Low

210.00

Averages

289.13

High

377.00

About AMD

Advanced Micro Devices, Inc. is a global semiconductor company. The Company is focused on high-performance computing, graphics and visualization technologies. Its segments include Data Center, Client and Gaming, and Embedded. Data Center segment includes artificial intelligence (AI) accelerators, microprocessors (CPUs) for servers, graphics processing units (GPUs), accelerated processing units (APUs), data processing units (DPUs), Field Programmable Gate Arrays (FPGAs), smart network interface Cards (SmartNICs) and Adaptive system-on-Chip (SoC) products for data centers. Client and Gaming segment includes CPUs, APUs, chipsets for desktops and notebooks, discrete GPUs, and semi-custom SoC products and development services. Embedded segment includes embedded CPUs, GPUs, APUs, FPGAs, system on modules (SOMs), and Adaptive SoC products. It markets and sells its products under the AMD trademark. Its products include AMD EPYC, AMD Ryzen, AMD Ryzen PRO, Virtex UltraScale+, and others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Iran Withdrawal Resolution Fails: The U.S. Senate's failure to pass a resolution demanding President Trump withdraw from military actions in Iran highlights significant congressional divisions over current military policy, despite the resolution's largely symbolic nature.

- Major Update to French Nuclear Policy: French President Macron's announcement to increase the number of nuclear warheads and enhance cooperation with European allies is viewed as the most significant update to France's nuclear deterrence policy in 30 years, potentially reshaping the European security landscape.

- Impact on Indian Remittance Flows: A Citi report indicates that the Indian diaspora in Gulf countries contributes nearly 38% of total remittance inflows, with a total of $135.4 billion in FY 2025, of which $51.4 billion comes from Gulf nations, suggesting that prolonged Middle Eastern conflict could negatively impact India's economy.

- China Sets Record Low GDP Growth Target: The Chinese government has set its GDP growth target for 2026 at 4.5% to 5%, marking the lowest target on record since the early 1990s, reflecting the challenges Beijing faces amid persistent deflationary pressures and trade tensions with the U.S.

See More

- Strong Earnings Report: Broadcom's fiscal Q1 2026 revenue reached $19.31 billion, surpassing the $19.18 billion consensus forecast with a 29% year-over-year increase, indicating robust growth potential in the AI chip sector.

- Improved Profitability: Adjusted earnings per share (EPS) rose 28% to $2.05, exceeding expectations of $2.03, while adjusted EBITDA grew 30% to $13.13 billion, further boosting investor confidence.

- Optimistic Future Outlook: Broadcom projects AI chip revenue to exceed $100 billion by 2027, having secured the necessary supply chain, reflecting strong confidence in future demand, particularly with a positive relationship with OpenAI.

- Shareholder Return Plan: The company announced a newly authorized $10 billion share repurchase program, which, combined with strong financial performance and an optimistic outlook, enhances market confidence in Broadcom's stock.

See More

- Market Share Comparison: Nvidia commands an impressive 86% market share in AI data center revenue, compared to AMD's mere 7%, highlighting Nvidia's dominant position in the data center processor market, which is likely to attract more customers in the future.

- Major Deal Impact: AMD's agreement with Meta to supply up to 6 gigawatts of AI data center processing, valued at over $100 billion, represents a significant win for AMD; however, its high stock valuation raises concerns among investors.

- Financial Performance Divergence: Nvidia's recent Q4 fiscal 2026 results revealed a 65% increase in sales to nearly $216 billion, with adjusted earnings rising 60% to $4.77 per share, indicating strong growth momentum in the AI sector.

- Valuation Comparison: Nvidia's P/E ratio stands at 53, which, while above the tech sector average, is significantly lower than AMD's 101, making Nvidia a more attractive investment in the AI stock landscape given its robust financial performance.

See More

- GDP Growth Target: China has set its GDP growth target for 2026 at 4.5% to 5%, marking the lowest target on record since the early 1990s, indicating significant challenges for economic recovery amid persistent deflationary pressures and trade tensions with the U.S.

- Defense Spending Increase: Defense spending is projected to rise by 7%, the slowest increase since 2021, although analysts believe the official figures may be understated, which could impact national security and military modernization efforts.

- Data Center Attack: Amazon's data center in Bahrain was targeted by Iran for supporting the U.S. military, with damage reported from a drone strike, potentially affecting Amazon's cloud computing operations in the Middle East in the short term.

- Global Tariff Increase: U.S. Treasury Secretary announced that global tariffs will rise from 10% to 15%, with expectations that tariff rates will return to pre-Supreme Court ruling levels by August, which will have profound implications for international trade and the cost structures of U.S. businesses.

See More

- Strong Economic Data: The February ADP employment report revealed an addition of 63,000 jobs, surpassing expectations of 50,000, indicating continued growth in the labor market and boosting investor confidence in economic recovery.

- Service Sector Expansion: The US ISM services index unexpectedly rose to 56.1 in February, significantly better than the anticipated 53.5, reflecting the fastest pace of expansion in 3.5 years and further supporting the stock market rally.

- Oil Price Volatility: Crude oil prices surged over 1% due to the closure of the Strait of Hormuz, despite reports suggesting Iran's willingness to discuss terms for ending the conflict, intensifying market concerns over energy supply.

- Market Performance: The S&P 500 index rose by 0.78%, the Dow Jones Industrial Average increased by 0.49%, and the Nasdaq 100 index climbed by 1.51%, reflecting optimistic expectations regarding economic resilience and corporate earnings.

See More

- Market Rebound: Asia-Pacific markets opened higher on Thursday after several days of steep losses, with Australia's S&P/ASX 200 rising by 0.63%, indicating improved investor sentiment.

- Strong Japanese Market: Japan's Nikkei 225 futures pointed to a strong open, with the Chicago contract at 56,360, significantly up from the last close of 54,245.54, reflecting optimistic expectations for economic recovery.

- Hong Kong Hang Seng Recovery: Hong Kong's Hang Seng index futures opened at 25,534, higher than the previous day's close of 25,249.48, suggesting a gradual restoration of investor confidence in market prospects.

- Support from U.S. Markets: U.S. stocks rose on Wednesday, with the Dow Jones Industrial Average adding 238.14 points to close at 48,739.41, ending a three-day losing streak, driven by strong performance in technology stocks, particularly in the chip sector.

See More