Projected 12-Month Target for FNDB by Analysts

ETF Analysis: The Schwab Fundamental U.S. Broad Market Index ETF (FNDB) has an implied analyst target price of $27.53, indicating a potential upside of 9.59% from its current trading price of $25.12.

Notable Holdings: Key underlying holdings with significant upside potential include Topgolf Callaway Brands Corp (MODG), Ladder Capital Corp (LADR), and AAR Corp (AIR), each showing expected price increases based on analyst targets.

Market Sentiment: The article raises questions about whether analysts' target prices are justified or overly optimistic, suggesting that high targets could lead to downgrades if they do not align with current market conditions.

Investor Considerations: Investors are encouraged to conduct further research to assess the validity of analyst targets in light of recent developments in the companies and their respective industries.

Trade with 70% Backtested Accuracy

Analyst Views on AIR

About AIR

About the author

Investor Behavior: Investors are moving away from struggling software companies and seeking stability in stocks less likely to be affected by the rise of artificial intelligence.

Market Insights: Goldman Sachs reports that this shift in investment strategy appears to be yielding positive results.

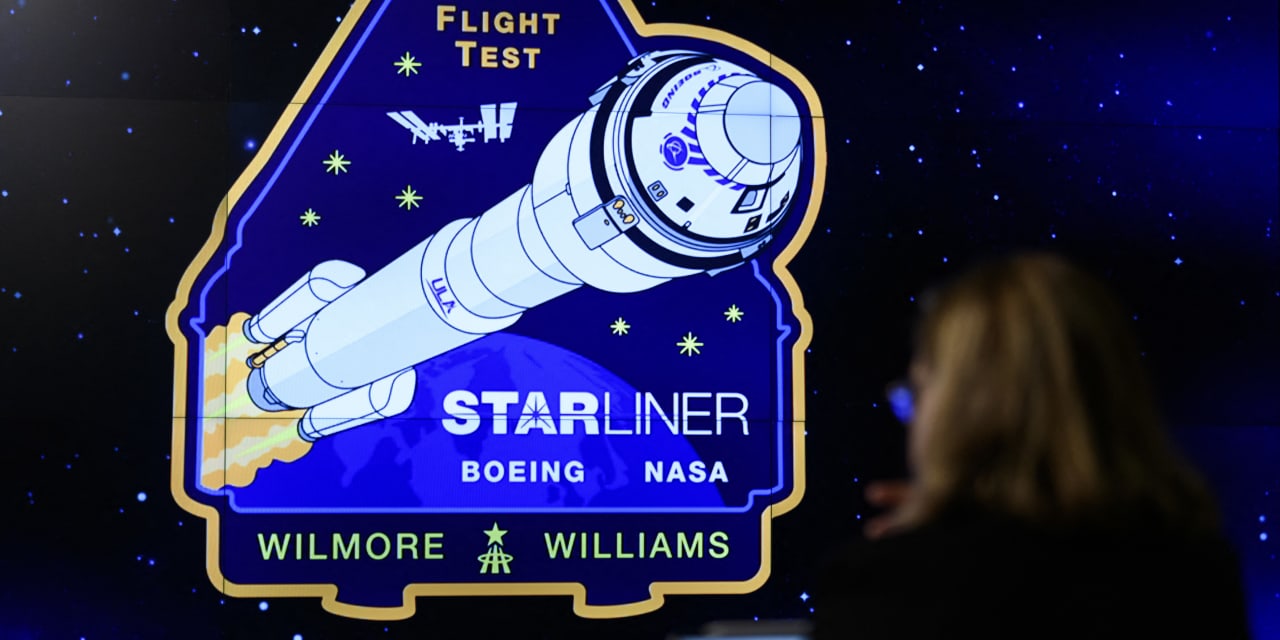

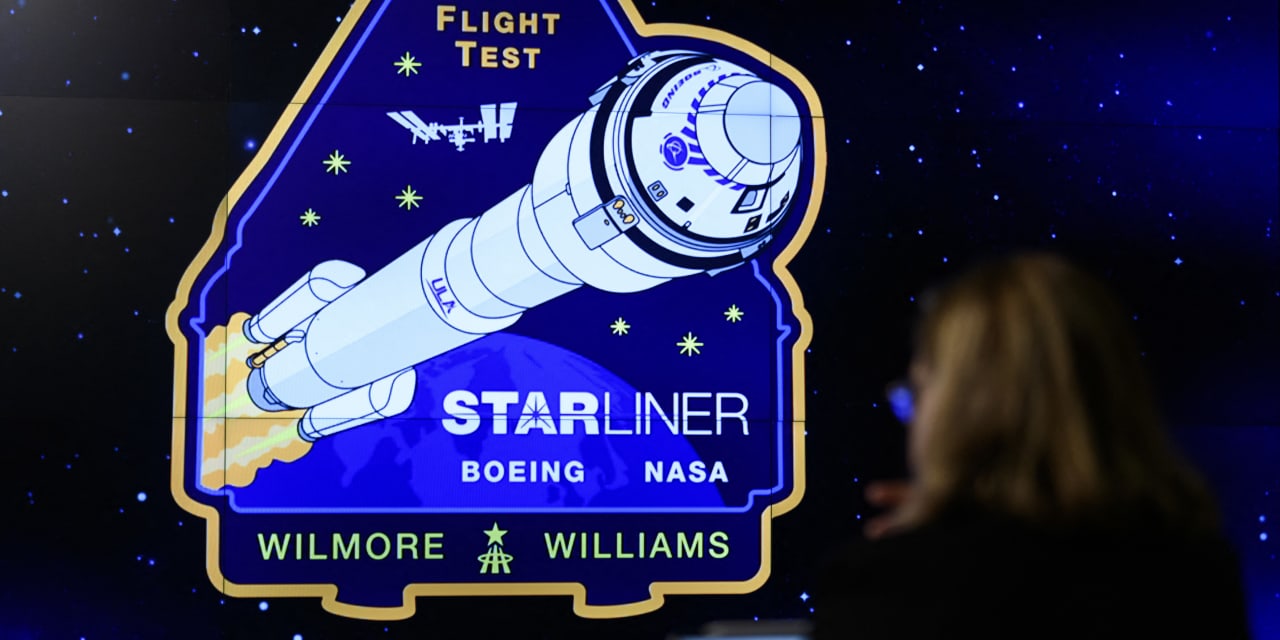

- Boeing's Starliner: The troubled space capsule Starliner has resurfaced in the news, highlighting ongoing issues within Boeing's space program.

- Investor Concerns: The situation serves as a reminder for investors about the necessary changes at Boeing and the implications for the company's stock performance.

- Boeing's Starliner Issues: Boeing's space capsule Starliner has faced ongoing challenges, drawing attention to the company's operational difficulties.

- Investor Concerns: The situation serves as a reminder for investors about the necessary changes at Boeing and the implications for its stock market performance.

Airbus Financial Guidance: Airbus has provided unexpected financial guidance for 2026, indicating a strong outlook for the company.

Impact on Aerospace Supply Chain: This guidance reflects not only Airbus's competition with Boeing but also its influence on the broader aerospace supply chain, particularly concerning jetliner engines.

Ongoing Challenges: Six years post-Covid-19 pandemic, the aviation industry continues to face significant difficulties in aircraft production.

Supply Chain Issues: Persistent supply chain disruptions and labor shortages are major factors hindering the manufacturing of planes.

Ongoing Challenges: Six years post-Covid-19 pandemic, the aviation industry continues to face significant difficulties in aircraft production.

Supply Chain Issues: Persistent supply chain disruptions and labor shortages are contributing to the challenges in manufacturing planes.

Economic Impact: The ongoing issues in plane production are affecting the broader economy and the recovery of the travel industry.

Future Outlook: Experts suggest that resolving these challenges will require time and strategic planning within the aviation sector.