Nasdaq Rises 1%; ON Semiconductor Reports Positive Q3 Earnings

U.S. Stock Market Performance: U.S. stocks opened higher, with the Nasdaq Composite gaining 1%, while the Dow and S&P 500 also saw modest increases. Consumer discretionary shares rose by 1.8%, but utilities stocks fell by 0.8%.

ON Semiconductor Earnings Report: ON Semiconductor Corporation reported better-than-expected Q3 earnings of 63 cents per share, surpassing the analyst estimate of 59 cents, along with sales of $1.551 billion.

Significant Stock Movements: MSP Recovery, Inc. shares surged 255%, while Resolute Holdings Management, Inc. and Tharimmune, Inc. also saw significant gains. Conversely, uniQure N.V. shares dropped 59% following FDA feedback on its investigational gene therapy.

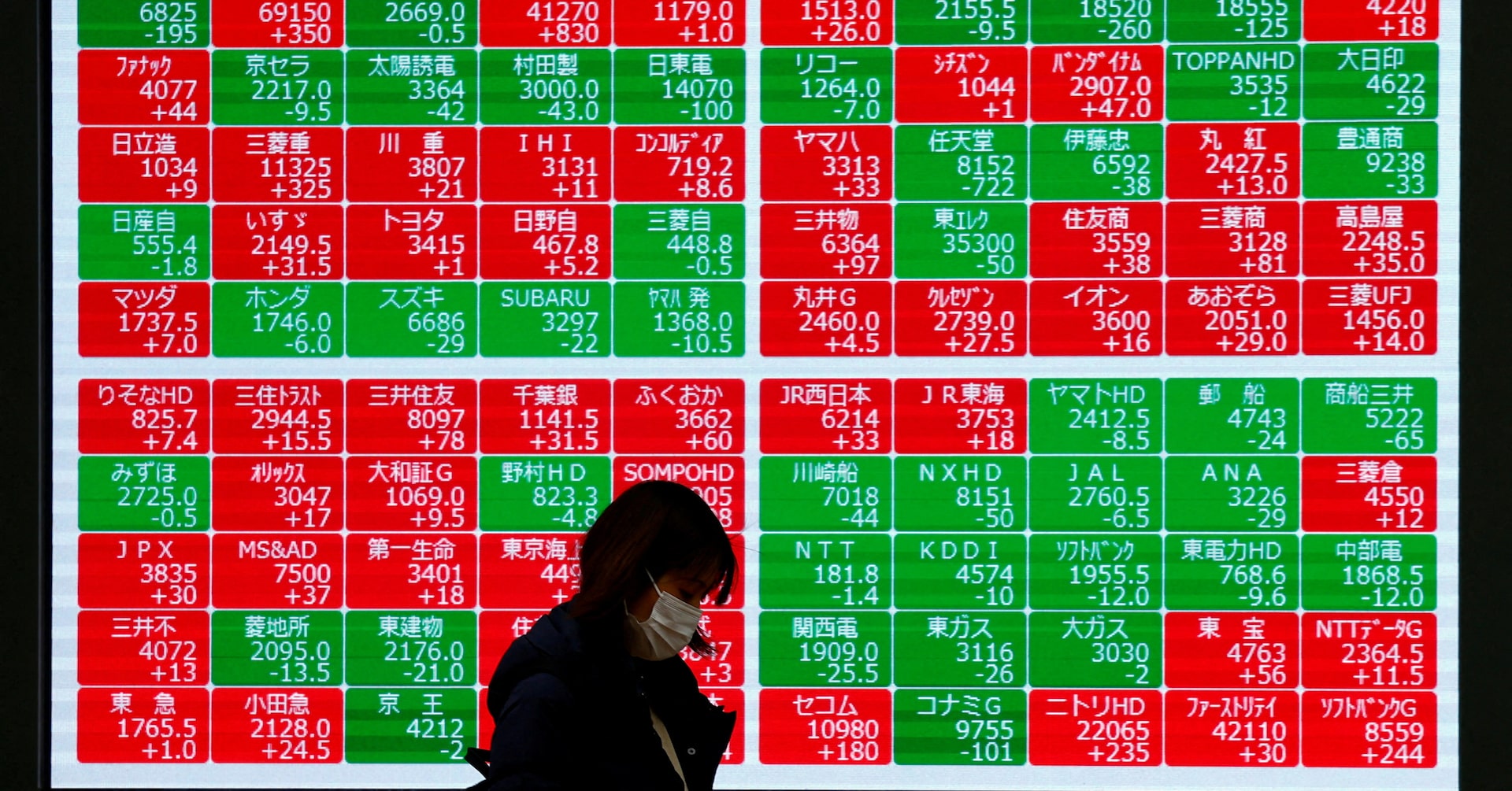

Global Market Trends: European shares were mostly higher, with the eurozone's STOXX 600 gaining 0.2%, while Asian markets also closed higher, led by Hong Kong's Hang Seng and China's Shanghai Composite.

Trade with 70% Backtested Accuracy

Analyst Views on ON

About ON

About the author

- Market Rebound: Semiconductor stocks rebounded on Wednesday after several days of steep losses, as investors reassessed geopolitical risks and tech-sector volatility, indicating a subtle shift in market sentiment.

- Earnings Report Impact: Despite Nvidia reporting strong earnings, investor focus remained on AI profitability, heavy capital spending, and macroeconomic pressures, reflecting ongoing caution about future uncertainties in the sector.

- Investor Advice: CNBC's Jim Cramer advised investors to remain calm amid sharp market swings and avoid panic selling, emphasizing that there are no fundamental issues in the memory sector and urging patience for potential market rebounds.

- Billionaire Buy-In: Billionaire Leo KoGuan purchased 1 million shares of Nvidia on Tuesday, signaling strong confidence in the future of artificial intelligence, and plans to buy more, demonstrating support for the market and optimism about the AI industry.

- Nvidia Earnings Reaction: Nvidia reported fourth-quarter revenue of $68.13 billion, a 73% year-over-year increase that surpassed the Street's estimate of $66 billion, yet failed to excite investors, leading to a decline in semiconductor stocks.

- Strong Data Center Performance: The data center segment generated a record $62.3 billion in revenue, rising 75% year-over-year, indicating robust market demand, but concerns about AI profitability persist among investors.

- Increased Market Volatility: Rising oil prices and bond yields have heightened market volatility, with Nvidia shares dropping 5.5%, negatively impacting the entire semiconductor index and causing declines in other chipmakers like Broadcom and AMD.

- Cautious Future Outlook: Although Nvidia expects first-quarter revenue between $76.44 billion and $79.56 billion, exceeding the Street estimate of $71.96 billion, supply constraints may affect the gaming segment, raising investor concerns about future performance.

- onsemi Performance Decline: onsemi (NASDAQ:ON), a global analog chip supplier, has seen a 14.8% drop in sales over the past two years, with projected sales growth of only 4.9% for the next 12 months, indicating weak demand and a 17.7 percentage point decline in operating margin, prompting caution among investors.

- Hyatt Hotel Challenges: Hyatt Hotels (NYSE:H) has faced weak revenue per room over the past two years, with an operating margin of just 5.3%, limiting its ability to respond to new competitive threats, while a 4.5% free cash flow margin restricts its capacity for growth investments or stock buybacks.

- Columbia Financial Profitability Issues: Columbia Financial (NASDAQ:CLBK) has experienced flat net interest income over the past five years, with a net interest margin of only 2.1%, indicating insufficient profitability; despite revenue growth, earnings per share have declined by 1.9% annually, reflecting lower profitability from incremental sales.

- Market Volatility Risks: As these stocks approach their 52-week highs, market sentiment may lead to short-term volatility, necessitating investor awareness of potential market correction risks, particularly regarding investments in these overvalued companies that require careful evaluation.

Market Dynamics: Industrial semiconductor makers are experiencing significant demand shifts, driven by inventory normalization in critical markets such as automotive, communications, and consumer electronics, alongside the growth of AI infrastructure.

Company Performance: Companies like Analog Devices and Onsemi are crucial players in the semiconductor industry, showing strong revenue growth and positive market sentiment, with expectations for continued performance improvements into 2026.

Stock Analysis: Analysts are bullish on semiconductor stocks, with many recommending purchases as market conditions improve, leading to increased price targets and a favorable outlook for growth in the sector.

Investment Recommendations: The article highlights five stocks that analysts believe are strong buys, suggesting that investors should act before broader market trends catch up, indicating a potential for significant returns.

- Growth Forecast: ON Semiconductor anticipates first-quarter 2026 revenue between $1.435 billion and $1.535 billion, marking the first year-over-year growth since the downturn began over three years ago, indicating recovery signs in automotive, industrial, and AI infrastructure sectors.

- Strong Cash Flow: In 2025, ON Semiconductor generated $1.4 billion in free cash flow, roughly 4.9% of its current market cap, with projections for 2026 indicating at least 25% of revenue converting into free cash flow, showcasing the company's financial health and growth potential.

- Share Buyback Program: The company initiated a three-year $6 billion share repurchase program aimed at enhancing shareholder value, and despite the significant price increase, there remains substantial upside potential, reflecting market confidence in its future growth.

- Market Opportunities and Risks: While concerns exist regarding exposure to the Chinese EV market, ON Semiconductor has significant growth opportunities in AI data centers, which contributed $250 million to its $6 billion revenue in 2025, highlighting the company's potential in emerging markets.

- Stock Performance: ON Semiconductor's stock has risen 53% since being highlighted for 2026 and 31% year-to-date, indicating strong market confidence in its future growth potential despite the recent price surge.

- Financial Performance: The company generated $1.4 billion in free cash flow in 2025, roughly 4.9% of its current market cap, with projections for 2026 indicating at least 25% of revenue will convert to free cash flow, showcasing robust cash generation capabilities.

- Market Outlook: Management's guidance for Q1 2026 anticipates revenue between $1.435 billion and $1.535 billion, marking the first year-over-year growth since the downturn began three years ago, reflecting signs of recovery in automotive, industrial, and AI infrastructure sectors.

- Buyback Program: ON Semiconductor has initiated a three-year $6 billion share repurchase program, which, in conjunction with its $28.4 billion market cap, demonstrates the company's confidence in its stock and aims to create long-term value for shareholders.