Most Active Stocks After Hours on November 28, 2025: HBI, NVDA, SNAP, NEOG, MOS, INTC, AAPL, PFE, QQQ, CCL, AVTR, MSFT

NASDAQ 100 After Hours Performance: The NASDAQ 100 After Hours Indicator is down -1.79 to 25,433.1, with a total after-hours volume of 95,876,785 shares traded.

Active Stocks Overview: Hanesbrands Inc. (HBI) is up slightly, while NVIDIA Corporation (NVDA) and Snap Inc. (SNAP) are down, with NVDA having positive earnings forecast revisions and SNAP's current price at 80.74% of its target.

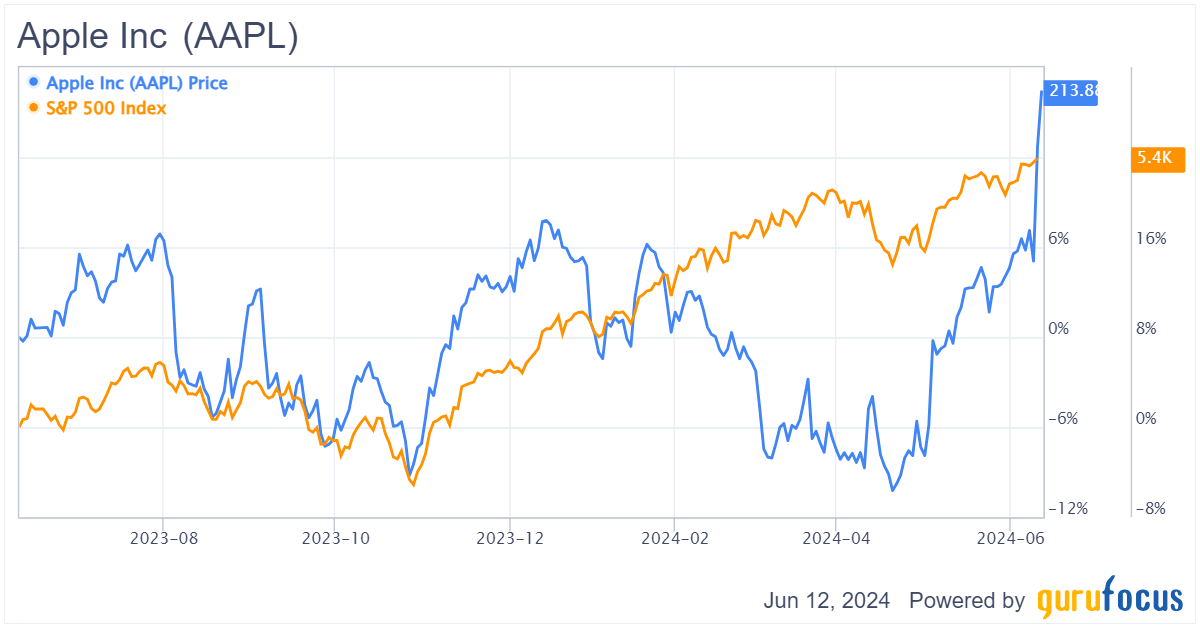

Stock Price Movements: Other notable stocks include Intel Corporation (INTC) and Apple Inc. (AAPL), with INTC exceeding its target price and AAPL experiencing a slight decline despite positive earnings forecast revisions.

Market Recommendations: Several companies, including Microsoft Corporation (MSFT) and Carnival Corporation (CCL), are in the "buy range" according to current market recommendations, with MSFT also showing multiple earnings forecast revisions.

Trade with 70% Backtested Accuracy

Analyst Views on AAPL

About AAPL

About the author

- Market Share Battle: In 2025, the iPhone became the top-selling smartphone, capturing 20% of the market share, and despite facing competitive pressures, Apple maintained high profits, demonstrating its strong competitive edge in the premium market.

- New Product Launch: At the spring event, Apple introduced the iPhone 17e with a starting price of $599, maintaining this price despite rising memory and storage chip costs, thereby attracting more consumers and enhancing market competitiveness.

- Supply Chain Advantage: Apple's strategy of securing multi-year agreements with suppliers allows it to manage price fluctuations effectively, ensuring production capacity and maintaining stable product pricing in a high-cost environment, further solidifying its market position.

- Long-term Shareholder Benefits: The pricing strategy of the iPhone 17e will enhance Apple's competitiveness in price-sensitive markets, likely attracting more users into the Apple ecosystem, which will promote sales of subsequent products and services, ultimately benefiting shareholders in the long run.

- AI Stock Selection Experiment: A Reddit user utilized Anthropic's Claude Opus 4.6 large language model to create a stock-picking system based on Warren Buffett's investment philosophy, aiming to test AI's effectiveness in stock selection to provide individual investors with a market edge.

- Portfolio Performance: The AI model's portfolio featured Alphabet Inc. as its largest holding, with a 71% increase in stock price over the past year, while Berkshire Hathaway's stake in the company is valued at $5.59 billion, showcasing the potential of AI-driven stock selection.

- Holding Analysis: Although Berkshire previously owned Procter & Gamble, the stock is currently not part of its portfolio and has declined by 4.3% over the past 12 months, reflecting the limitations of the AI model in selecting holdings.

- Market Reaction: Moody's shares fell by 13% due to concerns about AI's potential disruption of the financial data industry, with Berkshire holding a $12.6 billion stake in the company, indicating that market apprehensions regarding AI technology could impact traditional investment strategies.

- New Product Launch: Apple unveiled a range of new hardware this week, including the updated MacBook Air and MacBook Pro featuring the M5 chips, which offer four times the GPU computing power of their predecessors, significantly enhancing AI-enabled workflows.

- Price Increase Strategy: The new MacBook Air starts at $1,099 (up from $999), while the MacBook Pro is priced at $2,199 (up from $1,999), reflecting Apple's strategy to pass on rising memory costs to consumers, thereby improving its margin profile.

- Market Reaction: Despite a 3.5% decline in Apple shares over the past five sessions, Wedbush analysts maintain an Outperform rating with a $350 price target, indicating confidence in Apple's future performance amidst market uncertainties.

- Product Portfolio Optimization: Apple also introduced the updated iPhone 17e and iPad Air, which are expected to drive sales growth further, particularly as the company navigates memory price fluctuations while enhancing the average selling price (ASP) across its product lineup.

- Semiconductor Opportunities: Loop initiates coverage of Astera Labs with a buy rating, highlighting the company's potential across all generative AI silicon solutions that address critical pain points in AI server and cluster experiences, which could enhance its market share.

- Auto Parts Investment Advice: Deutsche Bank upgrades Dauch Corporation from hold to buy, suggesting that investors should seize the opportunity amid recent stock weakness before an acquisition, with expectations that the company's margin targets will be supported going forward.

- Vacation Market Outlook: Mizuho upgrades Marriott Vacations from market perform to outperform, raising the price target from $58 to $104, indicating a 52% upside potential that reflects strong prospects in the vacation market.

- Insurance Sector Dynamics: Goldman Sachs upgrades AIG from neutral to buy, citing strong earnings growth potential, particularly as AIG's improving return on equity stands out amidst peers facing decelerating earnings growth due to cyclical pressures.

- Share Buyback Resumption: Berkshire Hathaway has resumed its share buyback program for the first time since 2024, with CEO Abel committing to use his full salary for stock purchases annually, demonstrating confidence in the company's intrinsic value.

- Personal Investment Demonstration: Abel's personal purchase of $15 million in stock increases his stake in the company, addressing investor concerns about his alignment with Buffett's legacy and enhancing market confidence.

- Leadership Transition Communication: Abel emphasized the importance of communication with Buffett to reassure shareholders during the leadership transition, thereby strengthening trust in the new management.

- Financial Performance Pressure: Despite reporting a nearly 30% decline in operating earnings for Q4, primarily due to weakness in the insurance sector, the stock rose 1% following the announcement, indicating a positive market reaction to the buyback news.

- Market Cap and Stock Performance: Apple has reached a market cap of $3.9 trillion, with its stock price soaring 953% over the past decade, indicating strong market performance and investor confidence, suggesting potential for continued price appreciation in the future.

- Sustained Competitive Advantage: Despite slow progress in AI investments, Apple's dominance is supported by its 2.5 billion active devices and strong brand loyalty, indicating that it is likely to maintain its competitive position in the long term.

- Profit Growth Expectations: Analysts project that Apple's earnings per share will grow at a compound annual rate of 11.5% between fiscal 2025 and fiscal 2028, suggesting that while growth may moderate, it will still drive stock price increases.

- Valuation and Price Target: With a current P/E ratio of 33.5, if maintained, Apple stock is expected to reach $1,000 in just over 12 years, reflecting its potential in terms of profitability and valuation.