Monday's ETF Movers: SPXL, APIE

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Mar 24 2025

0mins

Should l Buy AMD?

Source: NASDAQ.COM

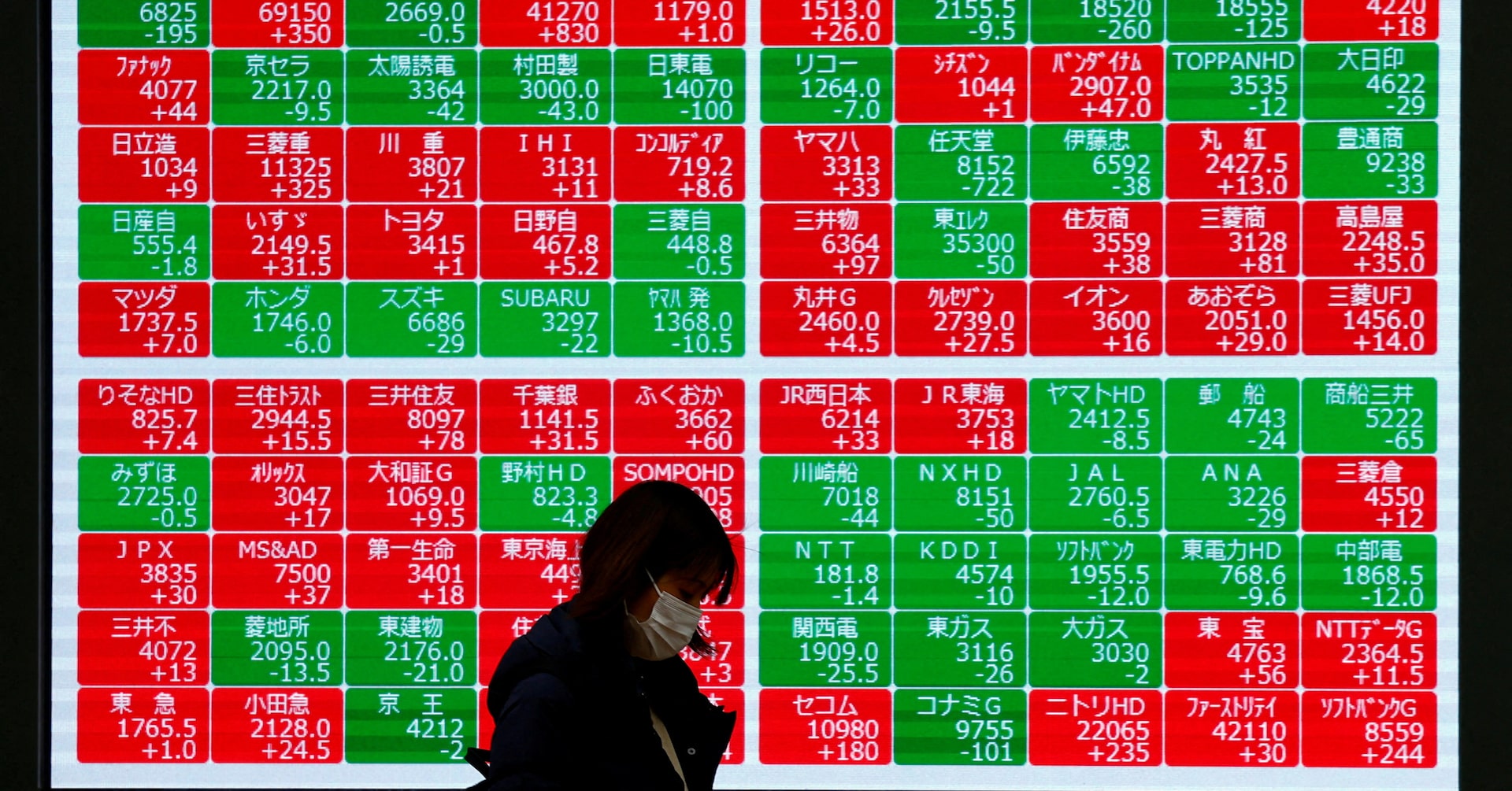

ETF Performance: The ActivePassive International Equity ETF is down approximately 1.5%, with notable declines in shares of James Hardie Industries (down 18.7%) and Jinkosolar Holding (down 5.6%).

Author's Perspective: The opinions expressed in the article are those of the author and do not necessarily represent Nasdaq, Inc.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy AMD?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on AMD

Wall Street analysts forecast AMD stock price to rise

33 Analyst Rating

25 Buy

8 Hold

0 Sell

Strong Buy

Current: 202.070

Low

210.00

Averages

289.13

High

377.00

Current: 202.070

Low

210.00

Averages

289.13

High

377.00

About AMD

Advanced Micro Devices, Inc. is a global semiconductor company. The Company is focused on high-performance computing, graphics and visualization technologies. Its segments include Data Center, Client and Gaming, and Embedded. Data Center segment includes artificial intelligence (AI) accelerators, microprocessors (CPUs) for servers, graphics processing units (GPUs), accelerated processing units (APUs), data processing units (DPUs), Field Programmable Gate Arrays (FPGAs), smart network interface Cards (SmartNICs) and Adaptive system-on-Chip (SoC) products for data centers. Client and Gaming segment includes CPUs, APUs, chipsets for desktops and notebooks, discrete GPUs, and semi-custom SoC products and development services. Embedded segment includes embedded CPUs, GPUs, APUs, FPGAs, system on modules (SOMs), and Adaptive SoC products. It markets and sells its products under the AMD trademark. Its products include AMD EPYC, AMD Ryzen, AMD Ryzen PRO, Virtex UltraScale+, and others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Valuation Pullback: Following earnings, AMD experienced a pullback, with its current valuation being 42% lower than the model, indicating market skepticism about its future growth potential, which may present a buying opportunity for investors.

- MI350 Catalyst: The launch of the MI350 is seen as a key driver for AMD's development in the AI sector, and if successfully executed, it could significantly enhance the company's market competitiveness and profitability.

- Profitability Outlook: Should AMD effectively convert AI demand into sustained profitability, it is expected to bring long-term earnings growth, thereby altering market perceptions of its future performance.

- Market Price Reference: Market prices as of February 27, 2026, were used as the basis for analysis, with the video published on March 4, 2026, reflecting market expectations for AMD's future performance.

See More

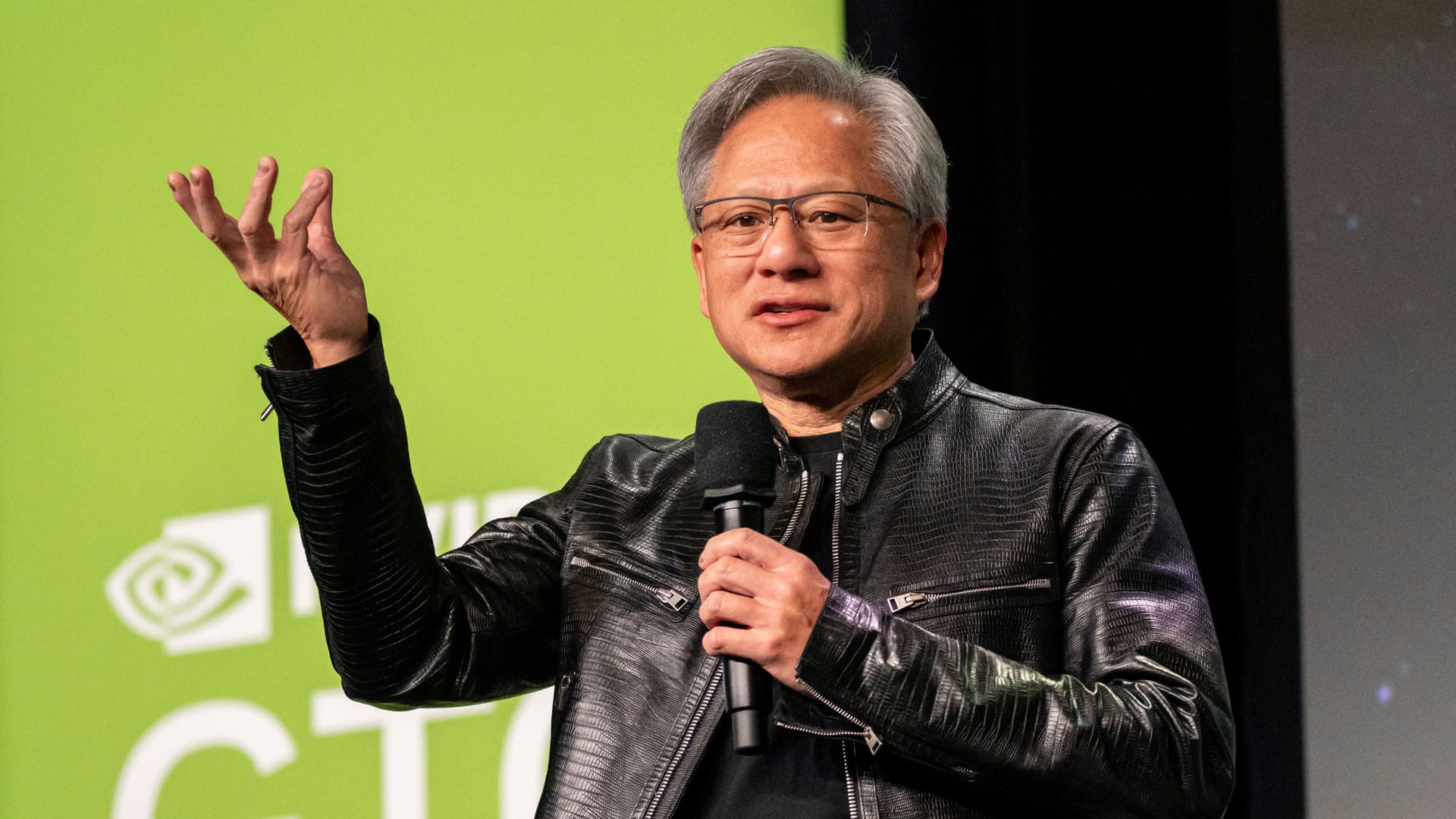

- Global Sales Restrictions: U.S. officials have drafted regulations requiring companies to obtain U.S. approval for nearly all exports of AI accelerators developed by Nvidia and AMD, expanding existing restrictions to about 40 countries, which could disrupt global AI chip supply chains.

- Complex Approval Process: The proposed rules mandate that companies seek permission from the U.S. Commerce Department to purchase AI chips, with the approval process varying based on the required computing power; exports of over 200,000 Nvidia GB300 chips will necessitate host government involvement, increasing compliance costs for businesses.

- Impact on China: This initiative aims to curb China's capabilities in AI chip manufacturing; while the Trump administration previously allowed Nvidia to sell certain chips to China, the new regulations may further restrict Chinese firms' access to AI chips, potentially hindering their technological advancements.

- Policy Uncertainty: The framework proposed by the Trump team is not finalized, and input from federal agencies may lead to modifications or shelving of the draft, creating uncertainty that could affect investor confidence in related companies, particularly Nvidia and AMD.

See More

- Oil Price Surge: West Texas Intermediate crude oil prices have surged past $80 per barrel, reaching their highest level since July 2024, primarily due to concerns over supply disruptions and ongoing conflict, which could lead to increased living costs for consumers.

- Inflationary Pressures: The rise in oil prices, coupled with higher benchmark 10-year Treasury yields, creates a negative impact on the stock market, undermining investor confidence in future economic growth and potentially leading to increased market volatility.

- Trump Administration Intervention: The Trump administration is drafting a plan that may tighten control over AI chip exports; while this does not constitute an export ban, it could still affect companies like Nvidia, adding uncertainty to the industry.

- Job Data Expectations: Economic data will be in focus, with economists forecasting a 55,000 increase in non-farm payrolls for February, a 3.7% rise in average hourly earnings, and an unemployment rate steady at 4.3%, which will significantly influence market sentiment.

See More

- New Export Regulations: Washington officials are reportedly drafting regulations that would require all semiconductor companies to obtain U.S. government approval before exporting AI accelerators to other countries, a move that could significantly impact Nvidia and AMD.

- Approval Process Based on Computing Power: The export approval process is likely to depend on the volume of computing power required, with large clusters potentially needing pre-clearance from the government before applying for export licenses, thereby increasing compliance costs and timelines for companies.

- Global Market Impact: This policy could limit the international competitiveness of U.S. semiconductor companies, particularly in the rapidly growing AI market, potentially leading other countries to seek alternative suppliers and affecting U.S. firms' market share.

- Anticipated Industry Response: As the policy progresses, industry reactions may intensify, prompting companies to adjust their export strategies to comply with the new regulatory environment, which could subsequently impact their future revenue and growth outlook.

See More

- Market Share Advantage: Synopsys holds a 41% share in the electronic design automation (EDA) market, and despite a more than 32% drop in stock price due to the software sector sell-off, its strong contract backlog and undervaluation maintain its competitive edge.

- AI-Driven Growth: CEO Ghazi stated that AI will transform the engineering software industry, with clients like Nvidia and Tesla increasing demand for complex chip designs, positioning Synopsys to benefit from the multitrillion-dollar AI infrastructure buildout.

- Upgraded Financial Outlook: Synopsys raised its full-year earnings guidance to a range of $14.38 to $14.46 per share, indicating robust financial health amid subdued demand from consumer, automotive, and industrial markets, while still capitalizing on AI growth opportunities.

- Repurchase Plan Boosts Confidence: The board approved a stock repurchase program of up to $2 billion, reflecting confidence in its value, while Nvidia's increased stake further solidifies market optimism surrounding Synopsys.

See More

- Government and Corporate Relations: OpenAI CEO Sam Altman stated at the Morgan Stanley conference that the government should be more powerful than private companies, emphasizing the responsibility of businesses in the democratic process, which could impact corporate-government collaborations.

- Anthropic's Challenges: Anthropic CEO Dario Amodei criticized Altman's relationship with the Trump administration, noting that the company has not given 'dictator-style praise' to Trump, which may affect its reputation and partnership opportunities in the industry.

- Tensions with the Department of Defense: The Defense Secretary labeled Anthropic as a 'Supply-Chain Risk to National Security' and directed all federal agencies to cease using its technology, potentially leading to a decline in its market share.

- Rapid Growth of OpenAI: OpenAI recently announced a $110 billion funding round at a $730 billion valuation, with an annual revenue run rate of $25 billion, showcasing its ability to expand rapidly in a highly competitive market.

See More