Midday Stock Highlights: Notable Movements from Exxon, SLM, CVS, AutoZone, Ares, Campbell's, and Others

Campbell's Sales Decline: Campbell's reported a 3% decrease in net sales to $2.68 billion and a 13% drop in adjusted earnings, leading to a nearly 6% stock decline, despite exceeding Wall Street expectations.

Exxon Mobil's Growth Forecast: Exxon Mobil's stock rose 2.7% after announcing an updated corporate plan projecting $25 billion in earnings growth and $35 billion in cash flow growth from 2024 to 2030.

Staar Surgical's Takeover Bid: Staar Surgical's shares surged over 12% after Alcon increased its takeover bid to $30.75 per share, representing a 30.6% premium from the previous closing price.

Teleflex Divestment Strategy: Teleflex's stock rose more than 9% after announcing the sale of three business units for $2.03 billion, with plans to use the proceeds for stock buybacks and debt reduction.

Trade with 70% Backtested Accuracy

Analyst Views on ARES

About ARES

About the author

- Oil Price Surge: Despite the International Energy Agency's unprecedented release of 400 million barrels from emergency reserves, crude prices surged, with WTI rising 6.1% to $88.56 per barrel and Brent up 6.0% to $93.06, indicating persistent market concerns over rising energy costs.

- Broad Market Decline: The Dow Jones Industrial Average fell 1.1% to 47,190 for the second consecutive day, while the S&P 500 dropped 0.5% to 6,750 and the Nasdaq 100 slipped 0.3% to 24,890, reflecting a waning investor confidence in risk assets amid rising oil prices.

- Inflation Concerns Intensify: The 10-year Treasury yield rose to 4.22% despite February's CPI meeting expectations, suggesting heightened market anxiety over potential inflationary pressures in the coming months, which could influence monetary policy decisions.

- Private Credit Market Turmoil: Reports of JPMorgan Chase tightening lending to private credit funds and marking down loan values triggered a sharp selloff in alternative asset managers, highlighting increasing concerns over credit risk in the financial sector.

- Risk Management Measures: JPMorgan is proactively reducing its exposure to the private credit industry by marking down the value of loans collateralized by software companies, indicating a forward-looking approach to potential market turbulence.

- Market Reaction: Concerns over software firms due to model updates from OpenAI and Anthropic have led to retail investors pulling funds, creating high redemption rates in the private credit sector, prompting JPMorgan's preemptive actions to address this trend.

- Leverage Risk Control: By reducing the borrowing capacity of private credit firms, JPMorgan not only mitigates its own risk exposure but may also compel these firms to post additional collateral, thereby enhancing overall financial stability.

- Historical Lessons: JPMorgan's previous pullback on leverage during the early days of the COVID pandemic underscores its commitment to maintaining financial discipline in the face of market uncertainties to avoid potential future crises.

- Tightened Lending: JPMorgan Chase has reduced lending to private credit funds, indicating a more cautious approach in the current financial climate.

- Loan Valuation Adjustments: The bank has also marked down the value of certain loans in its portfolios, reflecting challenges faced by the private credit industry.

- Tightened Lending: JPMorgan Chase has reduced lending to private credit funds, indicating a more cautious approach in the current financial climate.

- Loan Valuation Adjustments: The bank has also marked down the value of certain loans in its portfolios, reflecting challenges within the private credit industry.

- Impact on Private Credit Industry: These actions contribute to the ongoing difficulties faced by the beleaguered private credit sector.

- Market Response: The tightening of credit and valuation adjustments may signal broader concerns about the stability and future of private credit markets.

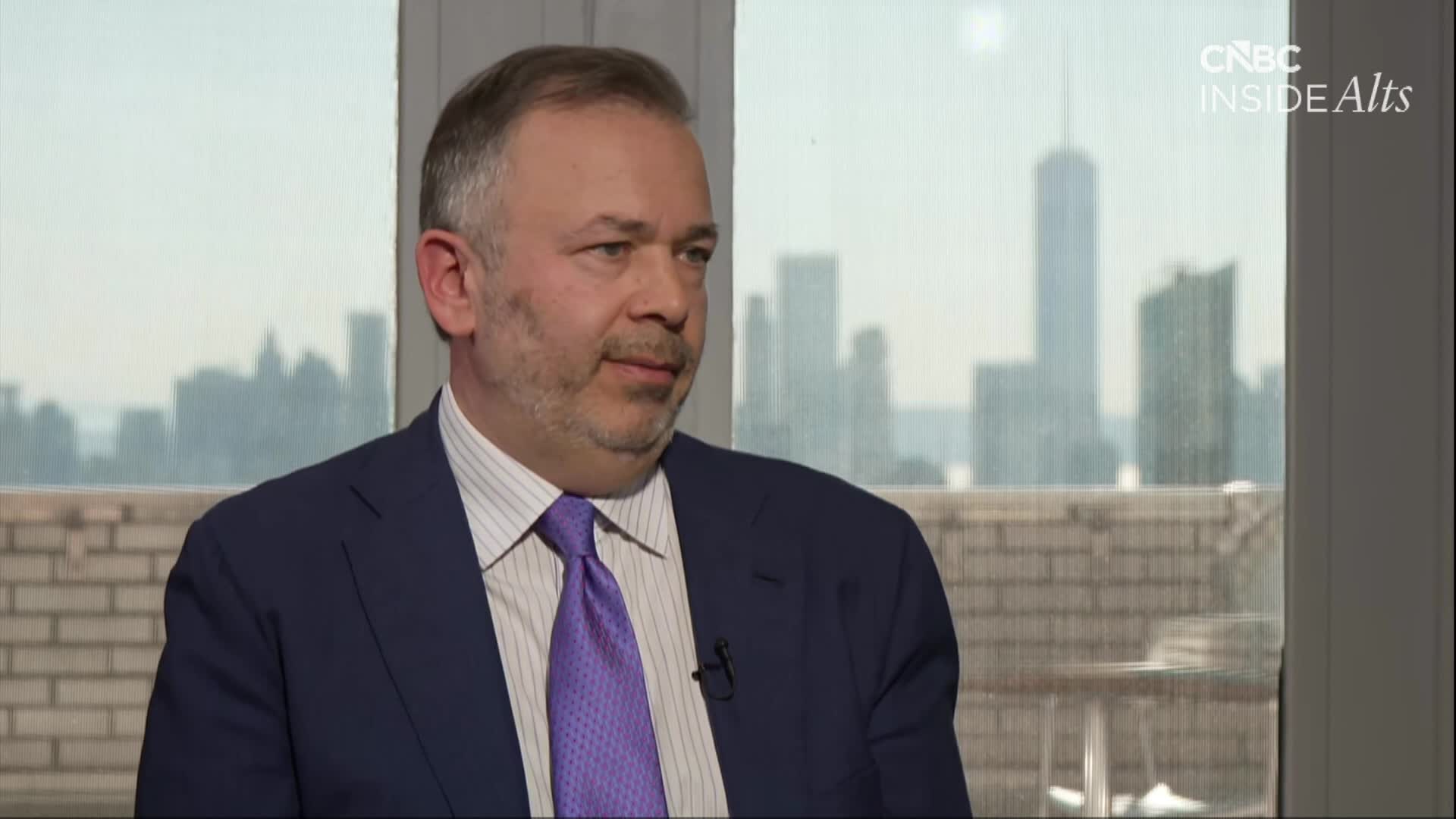

- Liquidity Issues Escalate: Boaz Weinstein of Saba Capital highlights that liquidity problems in private credit are worsening during the bull market, leading to dividend cuts for investors and increasing market focus on redemption requests, reflecting potential risks and uncertainties within the industry.

- Surge in Redemption Requests: Blue Owl Capital Corp. II halted quarterly redemptions and sold $1.4 billion in direct lending investments to provide liquidity, becoming one of the first non-traded private credit funds affected by redemption requests, indicating urgent market demand for liquidity.

- Investment Opportunities Arise: Despite market challenges, Weinstein remains optimistic about major private credit managers like Ares, Apollo, and Blackstone, believing these firms will emerge as winners after market fluctuations, demonstrating confidence in the industry's future.

- Cliffwater Monitoring: Weinstein is closely watching Cliffwater's redemption rate, expected to be between 10% and 20%, indicating potential difficulties in meeting redemption requests, further reflecting the fragility of the private credit market.

- Oil Price Fluctuations: U.S. benchmark WTI crude prices have fallen below $90 a barrel, despite being up over 50% year-to-date, indicating market optimism regarding improved U.S.-Iran relations, yet geopolitical risks continue to loom over oil prices.

- Tech Stock Rating Changes: Intuit was upgraded to buy from hold by Rothschild & Co Redburn, with its stock rising over 30% since late February, although it remains down 28.5% for the year, reflecting a recovery in market confidence in its software products.

- Cybersecurity Stock Bounce: Morgan Stanley upgraded CrowdStrike from hold to buy, with its stock up over 20% from last month's low, highlighting the positive impact of AI technology on the cybersecurity sector and indicating optimistic market expectations for future growth.

- Hewlett Packard Enterprise's Positive Outlook: Despite memory cost pressures, the company raised its full-year earnings outlook, with reported quarterly revenues slightly below expectations but gross margins and adjusted EPS exceeding forecasts, demonstrating strong demand in the data center buildout.