Charts Indicate This Communication Services ETF May Be Poised for a Breakout

XLC's Bullish Formation: The State Street Communication Services Select Sector SPDR ETF (XLC) is showing a bullish setup with a potential breakout above a key level, which could lead to new all-time highs.

Sector Composition: The communication services sector, comprising about 10.5% of the S&P 500, is heavily influenced by a few mega-cap stocks, particularly Alphabet, Meta, Netflix, and Disney, which together account for nearly 40% of XLC.

Recent Performance Drivers: Recent strength in XLC has been attributed to stocks like TKO Group, Fox Corp., Warner Bros. Discovery, and Comcast, which have been making higher highs and lows, contributing to the ETF's upward movement.

Breakout Potential: For XLC to achieve a significant breakout, it must surpass the 118 level, which would enhance the likelihood of a sustained upward trend across the sector.

Trade with 70% Backtested Accuracy

Analyst Views on META

About META

About the author

- Surge in AI Revenue: Broadcom reported a more than 100% year-over-year increase in AI revenue for Q1, reaching $8.4 billion, demonstrating the company's robust performance amid the AI boom, which is expected to drive sustained future growth.

- Strong Earnings Guidance: The company achieved a 29% increase in total sales to $19.3 billion in Q1, surpassing analyst expectations, with CEO Hock Tan projecting AI semiconductor revenue of $10.2 billion for the current quarter, further solidifying its market leadership.

- Rising Customer Demand: As large customers increasingly require custom silicon, Broadcom has secured the supply chain necessary to meet its 2027 sales targets, indicating strategic readiness to fulfill market demands.

- Key Customer Collaborations: Broadcom is assisting six major clients, including Google, Meta, Anthropic, and OpenAI, in chip design, which is expected to accelerate the next phase of custom AI deployment and further drive company growth.

- Policy Initiative: President Trump has called on major tech and AI companies to secure the energy needed for data center construction, requiring them to bear the full costs of energy and infrastructure, thereby creating a favorable environment for the cryptocurrency market and likely attracting more investor interest.

- Market Reaction: Following Trump's announcement, Shiba Inu (SHIB) saw a 2.84% price increase, reaching a market cap of $3.3 billion, indicating a rebound in market confidence towards cryptocurrencies, particularly in light of supportive policies.

- Industry Impact: The implementation of this new policy will block anti-crypto mining legislation, alleviating potential impacts on ordinary consumers and further solidifying the Trump administration's image as crypto-friendly.

- Future Outlook: With more major tech companies signing the pledge, we can expect additional top-down policy support for digital currencies, benefiting not only meme coins like Shiba Inu but also other more 'serious' cryptocurrencies.

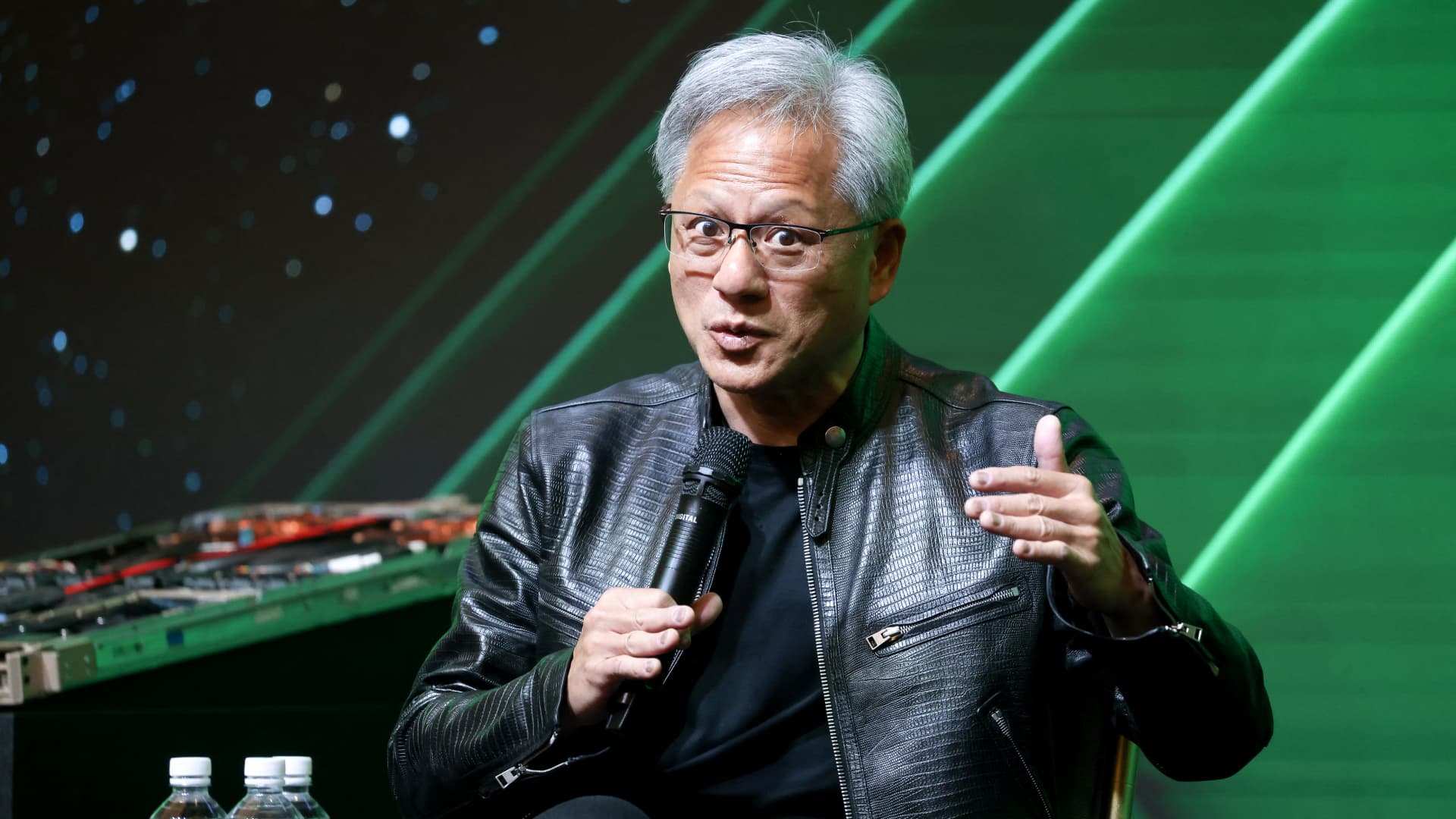

- Market Share Comparison: Nvidia commands an impressive 86% market share in AI data center revenue, compared to AMD's mere 7%, highlighting Nvidia's dominant position in the data center processor market, which is likely to attract more customers in the future.

- Major Deal Impact: AMD's agreement with Meta to supply up to 6 gigawatts of AI data center processing, valued at over $100 billion, represents a significant win for AMD; however, its high stock valuation raises concerns among investors.

- Financial Performance Divergence: Nvidia's recent Q4 fiscal 2026 results revealed a 65% increase in sales to nearly $216 billion, with adjusted earnings rising 60% to $4.77 per share, indicating strong growth momentum in the AI sector.

- Valuation Comparison: Nvidia's P/E ratio stands at 53, which, while above the tech sector average, is significantly lower than AMD's 101, making Nvidia a more attractive investment in the AI stock landscape given its robust financial performance.

- Policy Initiative: President Trump has called on major tech and AI companies to secure energy for data center operations without passing costs to consumers, creating a favorable environment for cryptocurrencies and reducing the risk of anti-crypto mining legislation.

- Market Reaction: Following Trump's announcement, the cryptocurrency market experienced a general rally, particularly benefiting meme coins like Shiba Inu, indicating a positive market response to policy support that could attract more investors to this sector.

- Corporate Participation: No fewer than seven major tech companies, including Alphabet, Microsoft, and Meta Platforms, have signed the pledge, demonstrating industry support for cryptocurrencies and reinforcing the Trump administration's image as crypto-friendly.

- Long-term Impact: This policy not only helps stabilize the cryptocurrency market but may also promote broader adoption of digital currencies, especially meme coins, enhancing their acceptance and utility among investors.

- Surge in AI Revenue: Broadcom's AI revenue more than doubled year-over-year to $8.4 billion in Q1, contributing to a 29% increase in total sales to $19.3 billion, indicating strong demand and market potential in the AI sector.

- Strong Future Outlook: The company expects AI semiconductor revenue to reach $10.2 billion this quarter, with CEO Hock Tan projecting that AI chip revenue will significantly exceed $100 billion by 2027, reflecting confidence in future market growth.

- Rising Customer Demand: Broadcom is assisting six key customers, including Google, Meta, Anthropic, and OpenAI, in designing custom chips, showcasing the company's capability to meet the increasing demand for custom silicon from large clients.

- Supply Chain Assurance: Tan noted that the company has secured the supply chain necessary to achieve its 2027 sales targets, maintaining competitiveness in the AI accelerator market despite challenges such as high bandwidth memory shortages and manufacturing capacity constraints.

- Stock Performance: Since going public in May 2024 through a SPAC merger, Oklo's stock has surged 645%, yet it has fallen 64% from its all-time high, indicating significant market uncertainty regarding its future.

- Market Demand: With power demand soaring due to AI data centers, Oklo's innovative energy solutions, particularly its small modular reactor (SMR) technology, have attracted investor interest for their potential.

- Partnership Development: Oklo has partnered with Meta Platforms to develop a nuclear reactor in Ohio, expected to generate at least 1.2 gigawatts of power by 2030, reflecting confidence from a major player in the tech sector.

- Commercialization Challenges: Despite a market cap of approximately $9.8 billion, Oklo has yet to record any revenue from power generation, and the likelihood of paying dividends in the next five years is very low, urging investors to approach with caution regarding dividend expectations.