Cathie Wood Increases Stakes in Broadcom, Klarna, and Kodiak AI

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 15 2026

0mins

Should l Buy AVGO?

Source: Fool

- Broadcom's Strong Performance: Broadcom reported a 28% year-over-year revenue increase in its last quarter, driven by a 74% surge in AI semiconductor revenue, with analysts projecting a 51% revenue growth for the upcoming fiscal year, highlighting its critical position in global internet traffic and attracting Wood's investment.

- Klarna's Post-IPO Dip: Klarna's stock has fallen 22% since its IPO four months ago, despite a 28% revenue growth in its first quarter, with stronger performance in the U.S. and European markets, indicating Wood's interest in its future growth potential.

- Kodiak AI's Technological Promise: Kodiak AI focuses on autonomous driving technology for commercial trucking, currently operating 10 customer-owned trucks, but has logged over 3 million miles on its platform, showcasing significant market application potential that has caught analysts' attention.

- Investment Strategy Insight: Wood's decision to increase stakes in these stocks amid market fluctuations reflects her confidence in tech stocks, particularly in the AI and fintech sectors, which could yield substantial returns for Ark Invest.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy AVGO?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on AVGO

Wall Street analysts forecast AVGO stock price to rise

30 Analyst Rating

29 Buy

1 Hold

0 Sell

Strong Buy

Current: 313.840

Low

370.00

Averages

457.75

High

525.00

Current: 313.840

Low

370.00

Averages

457.75

High

525.00

About AVGO

Broadcom Inc. is a global technology firm that designs, develops, and supplies a range of semiconductors, enterprise software and security solutions. The Company operates through two segments: semiconductor solutions and infrastructure software. Its semiconductor solutions segment includes all of its product lines and intellectual property (IP) licensing. It provides a variety of radio frequency semiconductor devices, wireless connectivity solutions, custom touch controllers, and inductive charging solutions for mobile applications. Its infrastructure software segment includes its private and hybrid cloud, application development and delivery, software-defined edge, application networking and security, mainframe, distributed and cybersecurity solutions, and its FC SAN business. It provides a portfolio of software solutions that enable customers to plan, develop, automate, manage and secure applications across mainframe, distributed, mobile and cloud platforms.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Broadcom's Market Strategy: Broadcom is enhancing its competitive edge in the AI chip market by collaborating with Alphabet to develop Tensor Processing Units (TPUs) and signing a $21 billion deal with Anthropic to supply nearly 1 million AI chips, positioning itself as a key player in AI infrastructure.

- Lam Research's Growth Potential: Lam Research reported fourth-quarter revenue of $5.34 billion in 2025, a 22.3% increase year-over-year, with net income of $1.59 billion, indicating strong performance in semiconductor manufacturing equipment and expected benefits from the acceleration of AI technology.

- TSMC's Technological Advantage: TSMC achieved net revenue of $122.4 billion in 2025, a 35.9% increase, with 60% of its revenue coming from 3-nanometer and 5-nm chips, reinforcing its leadership position in the high-end chip market and driving profitability.

- Value of a Diversified Portfolio: By investing in Broadcom, Lam Research, and TSMC, investors can achieve diversification in the AI sector, leveraging the specialized capabilities of these companies to collectively drive stable growth in their investment portfolios.

See More

- Futures Market Movement: U.S. stock futures fell on Thursday, with major benchmark indices showing declines, reflecting market caution ahead of upcoming economic data, particularly following a positive close on Wednesday that may influence investor sentiment.

- Bond Yield Trends: The 10-year Treasury bond yielded 3.11%, while the two-year bond stood at 3.56%, indicating market expectations regarding interest rate policies; the CME Group's FedWatch tool shows a 97.3% likelihood of the Federal Reserve keeping rates unchanged in March.

- Stock Highlights: Broadcom Inc. (NASDAQ:AVGO) surged 6.66% in premarket trading after reporting better-than-expected financial results for Q1 FY2026, demonstrating a strong long-term trend despite a weaker price trend in the short term.

- Analyst Insights: BlackRock maintains a cautiously optimistic outlook on the U.S. economy and stock market, driven by “mega forces” like artificial intelligence, suggesting a scenario-based approach to navigate future uncertainties despite recent inflation concerns and volatility in the S&P 500.

See More

- Strong Performance: Broadcom reported Q1 fiscal 2026 revenue of $19.3 billion, a 29% year-over-year increase, surpassing analyst expectations of $19.14 billion, demonstrating robust performance amid ongoing demand for AI hardware, which solidifies its market position.

- Surge in AI Revenue: The company's AI-related revenue soared 106% year-over-year to $8.4 billion, marking the 12th consecutive quarter of growth in AI business, indicating that the widespread adoption of AI technology is driving sustained performance improvements.

- Optimistic Outlook: Broadcom projects Q2 revenue to reach $22 billion, a 47% increase year-over-year, well above Wall Street's forecast of $20.4 billion, reflecting strong confidence in future growth, particularly with AI semiconductor revenue expected to surge 140% to $10.7 billion.

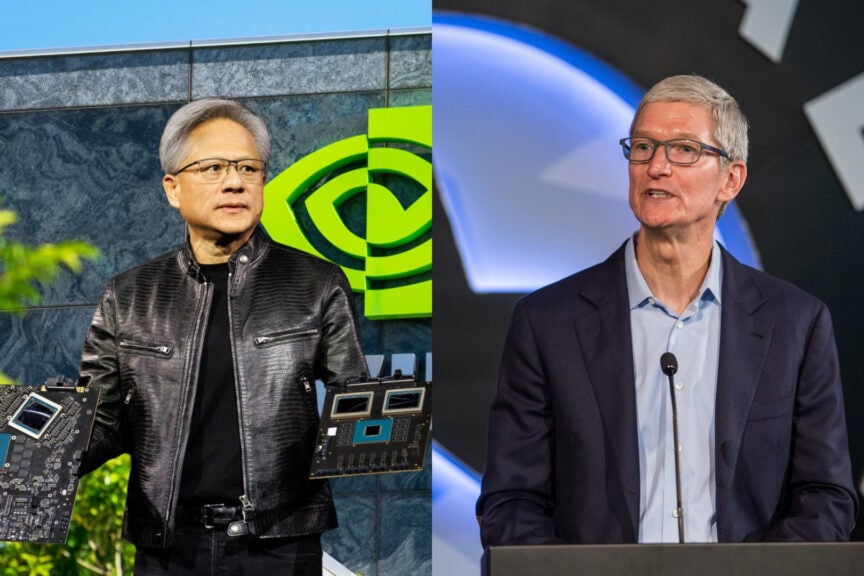

- Broader Market Implications: The strong results and positive outlook from Broadcom further corroborate Nvidia CEO's assertion that AI technology has reached an inflection point, suggesting that accelerating demand for AI will create significant opportunities across the industry.

See More

- Iran Withdrawal Resolution Fails: The U.S. Senate's failure to pass a resolution demanding President Trump withdraw from military actions in Iran highlights significant congressional divisions over current military policy, despite the resolution's largely symbolic nature.

- Major Update to French Nuclear Policy: French President Macron's announcement to increase the number of nuclear warheads and enhance cooperation with European allies is viewed as the most significant update to France's nuclear deterrence policy in 30 years, potentially reshaping the European security landscape.

- Impact on Indian Remittance Flows: A Citi report indicates that the Indian diaspora in Gulf countries contributes nearly 38% of total remittance inflows, with a total of $135.4 billion in FY 2025, of which $51.4 billion comes from Gulf nations, suggesting that prolonged Middle Eastern conflict could negatively impact India's economy.

- China Sets Record Low GDP Growth Target: The Chinese government has set its GDP growth target for 2026 at 4.5% to 5%, marking the lowest target on record since the early 1990s, reflecting the challenges Beijing faces amid persistent deflationary pressures and trade tensions with the U.S.

See More

- Nvidia's Market Position: Nvidia may not be as favored in the stock market currently, but it still retains a strong following among certain investors.

- Investment by Leo Koguan: Billionaire IT entrepreneur Leo Koguan has purchased one million shares of Nvidia and intends to increase his investment further.

See More

- Broadcom's Strong Earnings: Broadcom reported record revenue of $19.3 billion for Q1 2026, a 29% year-over-year increase, surpassing analyst expectations of $19.14 billion, highlighting robust demand for AI hardware and reinforcing its market position.

- Surge in AI Revenue: The company's AI-related revenue soared 106% year-over-year to $8.4 billion, marking the 12th consecutive quarter of AI growth, indicating a significant share in the rapidly expanding AI market.

- Optimistic Future Outlook: Broadcom anticipates Q2 revenue of $22 billion, a 47% increase year-over-year, well above Wall Street's forecast of $20.4 billion, reflecting strong confidence in future AI chip demand.

- Bright Prospects for Nvidia: Nvidia controls 92% of the data center GPU market, and as AI adoption expands downstream, demand for its GPUs is expected to rise, presenting a favorable entry point for investors despite market uncertainties.

See More