Can Category Trends Sustain DICK'S Sporting Goods' Competitive Momentum?

DICK'S Sporting Goods Performance: DICK'S Sporting Goods reported a 5.7% increase in comparable sales for Q3 fiscal 2025, driven by strong demand in footwear, apparel, and hardlines, alongside strategic store expansions and a robust e-commerce presence.

Store Expansion and Innovation: The company opened 13 House of Sport locations and six Field House stores, enhancing customer engagement and partnerships with national brands, while also introducing new product categories like trading cards through Fanatics.

Financial Outlook: DICK'S raised its full-year guidance, expecting comps growth of 3.5–4% and EPS of $14.25–$14.55, reflecting confidence in its product assortment and holiday execution despite a fluid macro environment.

Market Position and Valuation: DICK'S shares have outperformed industry averages, trading at a forward P/E of 14.43X, which is lower than the industry average, presenting a compelling investment opportunity in the retail sector.

Trade with 70% Backtested Accuracy

Analyst Views on SFIX

About SFIX

About the author

- Earnings Release Date: Stitch Fix is set to announce its Q2 earnings on March 11 after market close, with consensus EPS estimate at -$0.04 and revenue expected at $332.79 million, reflecting a 6.6% year-over-year growth, which could significantly impact the company's market performance.

- Historical Performance Review: Over the past year, Stitch Fix has beaten EPS estimates 50% of the time and revenue estimates 75% of the time, indicating a certain level of capability in managing market expectations.

- Estimate Revision Dynamics: In the last three months, there has been one upward revision for EPS estimates and two downward revisions for revenue estimates, reflecting a cautious market sentiment regarding the company's future performance, which may affect investor confidence.

- Market Focus: Despite challenges in profitability, analysts remain attentive to the company's turnaround momentum, emphasizing the need for fundamental improvements to attract more investor interest.

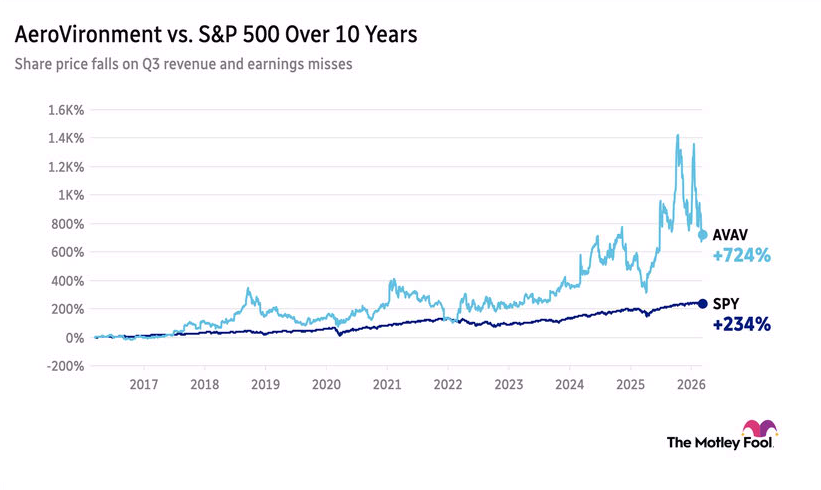

- Earnings Decline: AeroVironment (AVAV) saw a 10% drop in stock price after its Q3 results, despite a 143% year-over-year revenue increase to $408 million, which fell short of Wall Street's $484 million expectations, undermining market confidence.

- Guidance Adjustment: Following the pause of a key U.S. Space Force contract, the company revised its fiscal 2026 revenue guidance down to $1.85-1.95 billion from the previous $1.95-2.0 billion, anticipating a $151 million goodwill impairment as a result.

- Core Business Resilience: CEO Wahid Nawabi emphasized strong demand for the company's Autonomous Systems despite challenges, indicating that the core business remains robust in a competitive landscape.

- Market Uncertainty: The uncertainty surrounding government contracts poses a significant risk to the company's future growth, potentially impacting its competitiveness in a rapidly evolving market environment.

- Earnings Reports: Next week will see earnings results from Hewlett Packard Enterprise (HPE), Kohl's (KSS), Oracle (ORCL), and Adobe (ADBE), which are expected to significantly impact market sentiment, particularly as investors closely monitor performance in the tech and retail sectors amid the current economic climate.

- CPI Data Release: The Consumer Price Index (CPI) results for February will be released, with the market keenly observing changes in inflation trends that will provide crucial insights for the Federal Reserve's monetary policy decisions, potentially influencing interest rate expectations and stock market performance.

- NFIB Optimism Index: The latest readings on the NFIB Optimism Index will be published, reflecting small business owners' confidence in the economic outlook; strong data could boost market sentiment and affect related stock performance.

- Existing Home Sales Data: The latest data on existing home sales in the U.S. will also be released, with the market closely watching the health of the real estate sector, especially against a backdrop of rising interest rates, which could impact consumer confidence and spending.

- Market Underperformance: Textile shares collectively fell by approximately 4.6% on Monday, indicating a weak trend in the sector that could undermine investor confidence and lead to capital outflows.

- Stock Drag: Steven Madden's stock dropped by about 8.7%, while VFC fell by approximately 7.7%, with these two companies significantly impacting the overall industry performance, potentially raising concerns about their future earnings.

- Uncertain Industry Outlook: The overall decline in the textile sector may reflect weakening consumer demand or supply chain issues, further affecting the profitability and competitiveness of related companies.

- Investor Attention: As textile stocks continue to languish, investors may reassess their portfolios in search of sectors with greater growth potential to navigate market uncertainties.

Consumer Discretionary Sector Performance: The Consumer Discretionary Select Sector SPDR ETF rose by 1%, making it the top-performing sector among the 11 S&P groups last week.

Weakness in Major Holdings: Despite the sector's overall gain, major holdings like Home Depot and Nike saw declines of 4% and 13%, respectively.

Nike's Notable Decline: Nike's 13% drop represents its worst weekly performance since late June 2024, indicating ongoing challenges in the athletic apparel market.

Adidas Struggles: Adidas is also facing difficulties, currently trading 30% below its most recent 52-week high.

AOV Growth: Stitch Fix reported a 9.6% year-over-year increase in Average Order Value (AOV) for fiscal Q1 2026, marking nine consecutive quarters of growth, driven by larger basket sizes and a focus on high-demand categories like footwear and denim.

Revenue per Active Client: Revenue per active client (RPAC) rose 5.3% year-over-year to $559, reflecting increased client engagement and deeper wallet share rather than just customer acquisition.

AI and Personalization: The company's AI-powered tools, such as Stitch Fix Vision and the AI Style Assistant, enhance customer experience and decision-making, contributing to higher transaction values and loyalty.

Stock Performance and Valuation: Stitch Fix shares have increased by 30.4% year-to-date, while trading at a forward price-to-sales ratio of 0.56X, significantly lower than the industry average, and currently holds a Zacks Rank of #2 (Buy).