Alphabet's Gemini to Surpass ChatGPT Market Share in 2026

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 20 2026

0mins

Should l Buy GOOGL?

Source: NASDAQ.COM

- Market Share Competition: In 2026, Alphabet's Gemini is expected to achieve market share parity with OpenAI's ChatGPT, which has seen a 19-point drop to 68% over the past year, while Gemini has gained 13 points to reach 18%.

- Technological Advantages: Gemini is not just a chatbot; it also supports technologies like video creation, and with Alphabet's distribution and cloud infrastructure, it is poised to accelerate market penetration and enhance its competitive edge in generative AI.

- Industry Predictions: Analysts believe that while Gemini's market share is growing rapidly, ChatGPT will still face pressure from smaller competitors, indicating potential shifts in the overall market landscape in the coming years.

- Investment Opportunities: As AI technology evolves quickly, investors are encouraged to focus on the potential returns of Gemini and its related technologies, especially given Alphabet's ability to sustain its generative AI business.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy GOOGL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on GOOGL

Wall Street analysts forecast GOOGL stock price to rise

33 Analyst Rating

26 Buy

7 Hold

0 Sell

Strong Buy

Current: 307.040

Low

305.00

Averages

374.25

High

400.00

Current: 307.040

Low

305.00

Averages

374.25

High

400.00

About GOOGL

Alphabet Inc. is a holding company. The Company's segments include Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment includes infrastructure and platform services, collaboration tools, and other services for enterprise customers. Its Other Bets segment is engaged in the sale of healthcare-related services and Internet services. Its Google Cloud provides enterprise-ready cloud services, including Google Cloud Platform and Google Workspace. Google Cloud Platform provides access to solutions such as artificial intelligence (AI) offerings, including its AI infrastructure, Vertex AI platform, and Gemini for Google Cloud; cybersecurity, and data and analytics. Google Workspace includes cloud-based communication and collaboration tools for enterprises, such as Calendar, Gmail, Docs, Drive, and Meet.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Acquisition Announcement: OpenAI has announced the acquisition of cybersecurity startup Promptfoo, with the team joining OpenAI to enhance security and governance capabilities within its Frontier platform, although deal terms remain undisclosed.

- Technology Integration: Promptfoo's security tools will be integrated into OpenAI's Frontier platform, addressing the security challenges posed by AI agents connecting to real data and systems, thereby improving the safety and reliability of AI systems.

- Funding Background: In July 2023, Promptfoo completed a Series A financing round of $18.4 million led by Insight Partners, with participation from Andreessen Horowitz, bringing its total funding to $22.68 million and a valuation of $85.50 million.

- Team Expansion: With 11 employees, Promptfoo's integration into OpenAI will accelerate the development of its open-source project, aiding developers in testing and comparing the performance of various AI-related prompts and agents, further promoting the secure application of AI technology.

See More

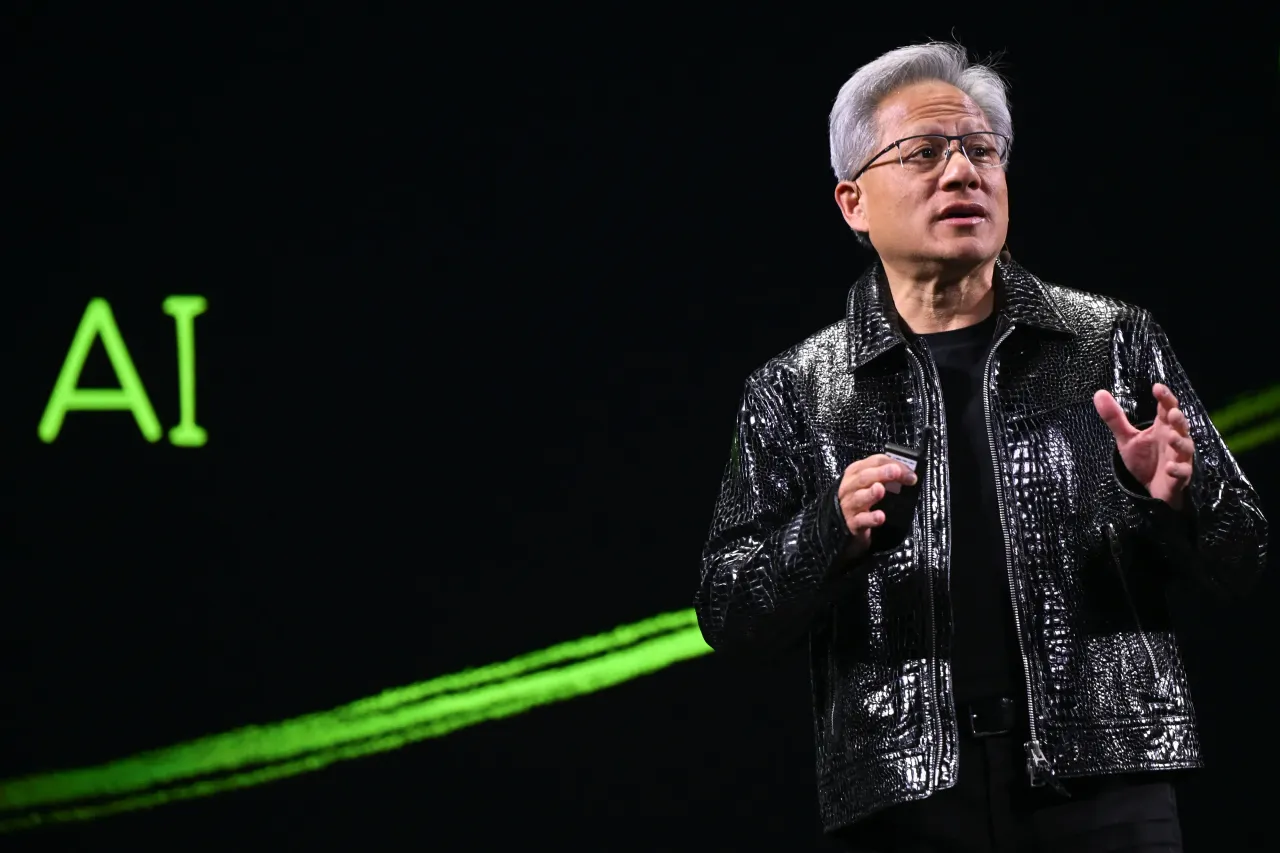

- Future Investment Plan: Nvidia plans to invest $26 billion over the next five years to develop open-source AI models, aiming to enhance its competitiveness in the AI sector and align with its industry-leading AI chips, thereby driving the development and testing of next-generation AI models.

- Market Leadership: With its performance during the AI revolution, Nvidia's market capitalization has reached $4.5 trillion, making it the world's most valuable publicly traded company, showcasing its strong influence and market share in the rapidly growing AI market.

- Strengthened Competitive Advantage: Nvidia's CUDA programming platform and over 400 libraries help developers optimize GPU performance, and if it launches open-source AI models compatible with its GPUs, it will further enhance its market barriers and user loyalty.

- Outstanding Financial Performance: Since the onset of the AI revolution in 2023, Nvidia's revenue has surged over 1,000%, from $6 billion to $68 billion, while net income skyrocketed 2,940%, from $1.4 billion to $43 billion, reflecting its robust financial health and future growth potential.

See More

- Merger Announcement: Google announced that its fiber internet unit, GFiber, will merge with Astound Broadband to form an independent internet provider, with Google retaining a minority stake; the transaction is expected to close in Q4, marking a strategic shift for Google in the fiber market.

- Management Continuity: The new company will be led by the existing GFiber executive team, leveraging their expertise in high-speed fiber innovation to manage the combined network footprint, aiming to enhance service quality and market competitiveness.

- Historical Context: Launched in 2010, GFiber has been focused on building ultra-fast fiber-optic broadband networks in the U.S., starting with a gigabit-speed rollout in Kansas City in 2012, showcasing Google's forward-looking approach in the broadband market.

- Investor Involvement: The merged entity will be majority-owned by investment firm Stonepeak, a structure that not only provides GFiber with financial backing but also potentially accelerates its expansion and technological innovation in the fiber market.

See More

- AI Investment Plan: Nvidia has earmarked $26 billion for AI model development over the next four years, positioning itself to compete more directly with enterprise AI offerings from OpenAI and Google.

- New Model Launch: The company unveiled Nemotron 3 Super, its most powerful open-weight AI model to date, designed to provide production-ready solutions for enterprises, optimizing applications on Nvidia's AI infrastructure.

- Developer Conference Preview: Ahead of the upcoming developer conference, Nvidia is expected to unveil new AI chips and software tools, with a strong focus on agentic AI platforms, further enhancing its influence in the enterprise market.

- Market Sentiment Shift: Despite Nvidia's stock rising 4.6% over the past three days, retail investor sentiment has turned bearish due to geopolitical risks, which may impact future market performance.

See More

- Strong Financial Performance: Uber's fourth-quarter gross bookings rose 22% year-over-year to $54.1 billion, with revenue climbing 20% to $14.4 billion, demonstrating robust market performance and sustained cash flow growth.

- User Growth: The company's monthly active platform consumers increased by 18% year-over-year to 202 million, reflecting growing global acceptance of its platform and further solidifying its market leadership.

- Autonomous Driving Threat: Despite strong core business performance, investor concerns about autonomous driving technology are rising, potentially impacting Uber's driver-reliant model, as competitors like Waymo and Tesla actively advance their robotaxi initiatives.

- Strategic Partnership Opportunity: Uber's partnership with Amazon's autonomous driving company Zoox aims to launch autonomous taxi services in Las Vegas and Los Angeles by mid-2027; if successful, this transition could significantly reduce costs and enhance profit margins.

See More

- Surging Cash Flow: Uber's free cash flow reached $2.8 billion in Q4, up 65% year-over-year, with full-year cash flow at $9.8 billion, reflecting the company's robust financial resilience in a rapidly growing market.

- Revenue and Booking Growth: In Q4, Uber's gross bookings rose 22% year-over-year to $54.1 billion, while revenue climbed 20% to $14.4 billion, underscoring its market leadership and strong business performance.

- Autonomous Driving Risks and Opportunities: While the rise of autonomous driving poses a threat to Uber's driver-reliant model, the CEO noted that a successful transition could unlock a multi-trillion dollar market opportunity, highlighting the strategic importance of technological transformation.

- Intensifying Market Competition: With Alphabet's Waymo and Tesla advancing in autonomous driving, Uber faces increasing competition, which challenges market confidence in its future growth and has led to a 12% decline in stock price over the past three months.

See More