Satellogic Secures $35 Million in Direct Offering

Satellogic's stock price increased by 5.09% as it reached a 52-week high.

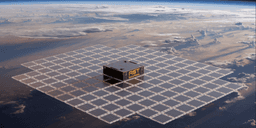

The company has signed a securities purchase agreement to sell 7.39 million shares at $4.73 each, expected to generate approximately $35 million in gross proceeds. This financing will support Satellogic's growth initiatives and satellite infrastructure, reflecting strategic planning for future development.

The positive market reaction to this offering indicates strong investor confidence in Satellogic's prospects, contributing to its recent stock performance.

Trade with 70% Backtested Accuracy

Analyst Views on SATL

About SATL

About the author

- Contract Extension: Satellogic has extended its 11-month high-frequency satellite monitoring agreement with the Albanian government, building on a previous three-year contract to ensure nationwide coverage with high-resolution (50 cm) imagery, enhancing national monitoring capabilities.

- Enhanced National Monitoring: With continuous satellite monitoring, Albania can detect changes in real-time and identify anomalies, improving its response capabilities in areas such as illegal construction, deforestation, and natural resource management, leading to more efficient decision-making.

- Economic Viability: Satellogic's vertically integrated satellite constellation makes national-scale monitoring not only operationally necessary but also economically viable, meeting government demands for continuous oversight and ensuring that critical changes do not go unnoticed.

- Market Outlook: The continuation of this agreement reflects a growing global demand for persistent Earth intelligence monitoring, signaling a shift in government and industry expectations regarding the availability, frequency, and continuity of geospatial data.

- Milestone Satellite Acquisition: HEO's acquisition of the in-orbit NewSat-34™ satellite makes it the first Australian entity to own and operate a sub-meter resolution satellite, marking a significant advancement in Australia's space sovereignty.

- Enhanced R&D Capabilities: Renamed Continuum-1, the satellite will serve as HEO's dedicated non-Earth imaging R&D testbed, enabling the testing of novel image acquisition modes and accelerating the development of autonomous imaging systems.

- Support for National Interests: As Australia's first sub-meter resolution remote sensing satellite under sovereign control, Continuum-1 extends the operational life of a legacy satellite while providing independent access to critical imaging capabilities for national interests.

- Strengthened Commercial Relationship: This acquisition deepens the collaboration between Satellogic and HEO, allowing HEO to fully control satellite operations and integrate the entire imaging service cycle, enhancing its competitiveness in the space sector.

- Durable Goods Orders Surge: U.S. durable goods orders rose 5.3% month-over-month in November, exceeding market expectations of 3.7%, indicating strong economic recovery that could boost future consumption and investment.

- Market Performance: The Nasdaq Composite gained over 150 points, closing at 23,682.70, reflecting investor confidence in tech stocks and further driving overall market gains.

- Stock Highlights: Battalion Oil Corp's shares skyrocketed 235% to $4.29 after switching gas processing partners and boosting production, demonstrating the positive impact of strategic adjustments.

- Market Volatility: CN Energy Group Inc's shares fell 43% to $0.46 after receiving a Nasdaq delisting notice, highlighting the financial pressures and declining market confidence faced by the company.

- Financing Agreement: Satellogic has signed a securities purchase agreement with a single institutional investment manager to sell 7.39 million shares of Class A common stock at $4.73 per share, expected to generate approximately $35 million in gross proceeds for the company.

- Clear Use of Funds: The net proceeds from this offering will be allocated towards Satellogic's growth initiatives, constellation and satellite infrastructure, working capital, and general corporate purposes, indicating the company's strategic planning for future development.

- Transaction Timeline: The offering is expected to close on January 27, 2026, highlighting the company's proactive approach in the capital markets and its focus on future liquidity.

- Positive Market Reaction: Following the announcement, Satellogic's stock price rose 2.85% in pre-market trading to $5.10 per share, reflecting investor optimism regarding the company's prospects.

- Earnings Beat: Neogen Corp reported adjusted earnings of $0.10 per share for Q2, surpassing market expectations of $0.06, which significantly boosts investor confidence in the company's profitability.

- Sales Growth: The company achieved quarterly sales of $224.691 million, exceeding the forecast of $207.846 million, indicating strong market demand and promising future growth potential.

- Stock Surge: Following the earnings report, Neogen's stock price surged 28% to $9.44 on Thursday, reflecting a positive market sentiment and potentially attracting more investor interest.

- Guidance Upgrade: Neogen raised its FY26 sales guidance above market estimates, demonstrating confidence in future performance, which may further drive stock price appreciation and enhance competitive positioning in the market.

AST SpaceMobile Stock Surge: AST SpaceMobile's stock experienced a significant increase as investors anticipate the launch of the company's next-generation satellites.

Broader Space Sector Gains: The positive momentum in the space sector continues, with multiple stocks benefiting from a recent rally.

Political Endorsement Impact: The surge in space stocks follows an implicit endorsement from President Donald Trump, contributing to investor confidence.

Market Sentiment: The overall sentiment in the market remains optimistic as the space industry gains traction and attention from investors.