Qualcomm Declares Quarterly Dividend Amid Market Weakness

Qualcomm Inc (QCOM) is down 3.24% in pre-market trading, hitting a 20-day low as broader market indices, including the Nasdaq-100 and S&P 500, decline significantly.

The company has declared a quarterly dividend of $0.89 per share, consistent with previous payouts, reflecting its stable cash flow and shareholder return strategy. This announcement comes amid a challenging market environment, where Qualcomm's exclusion from the top investment stocks list has raised concerns about its growth potential. Despite these challenges, the dividend yield of 2.21% may bolster investor confidence in the long term.

The implications of this dividend announcement suggest that Qualcomm is committed to returning value to shareholders, even as it navigates market headwinds. Investors may view this as a sign of stability, but the company's recent performance and market sentiment could lead to cautious trading in the near term.

Trade with 70% Backtested Accuracy

Analyst Views on QCOM

About QCOM

About the author

- High Growth Potential: Qualcomm (QCOM) is positioned to lead the AI edge computing market, projected to grow at an annual rate of 32% through 2029, enhancing its competitive edge by applying AI technology to automotive and industrial automation.

- E-commerce Market Opportunity: MercadoLibre (MELI) continues to expand its share in the Latin American e-commerce market, with last year's revenue growth of 44% and 39% year-over-year, despite profit pressures from free shipping initiatives, indicating strong market demand.

- Gene Therapy Breakthrough: CRISPR Therapeutics (CRSP) received FDA approval for its gene therapy Casgevy, with expectations of generating over $500 million in revenue through its partnership with Vertex Pharmaceuticals by 2026, marking a significant recognition of gene therapies in the pharmaceutical industry.

- Long-term Investment Strategy: Despite recent stock performance challenges for all three companies due to short-term pressures, their long-term growth potential and market share expansion strategies are set to lay the groundwork for future investment returns.

- Policy Risk Impact: Semiconductor stocks, particularly Qualcomm, faced pressure as reports emerged of the White House planning stricter rules for foreign buyers of U.S. chips, raising concerns about Qualcomm's significant global revenue exposure to potential export policy tightening.

- Automotive Tech Collaboration: Despite regulatory concerns, Qualcomm unveiled a technical collaboration with autonomous driving developer Wayve, aiming to integrate Wayve's AI Driver software with Qualcomm's Snapdragon Ride platform to advance next-generation advanced driver assistance systems.

- Autonomy Technology Integration: Wayve's AI Driver learns driving behavior from large datasets collected in real-world conditions, while Qualcomm's Snapdragon Ride architecture provides the necessary computing power for vehicle-level AI processing, ensuring safety redundancy and real-time monitoring capabilities.

- Future Robotaxi Opportunities: The partners plan to explore future robotaxi systems built on Qualcomm processors, evaluating opportunities for Level 4 autonomous mobility platforms, which could significantly enhance their market positioning in the autonomous vehicle sector.

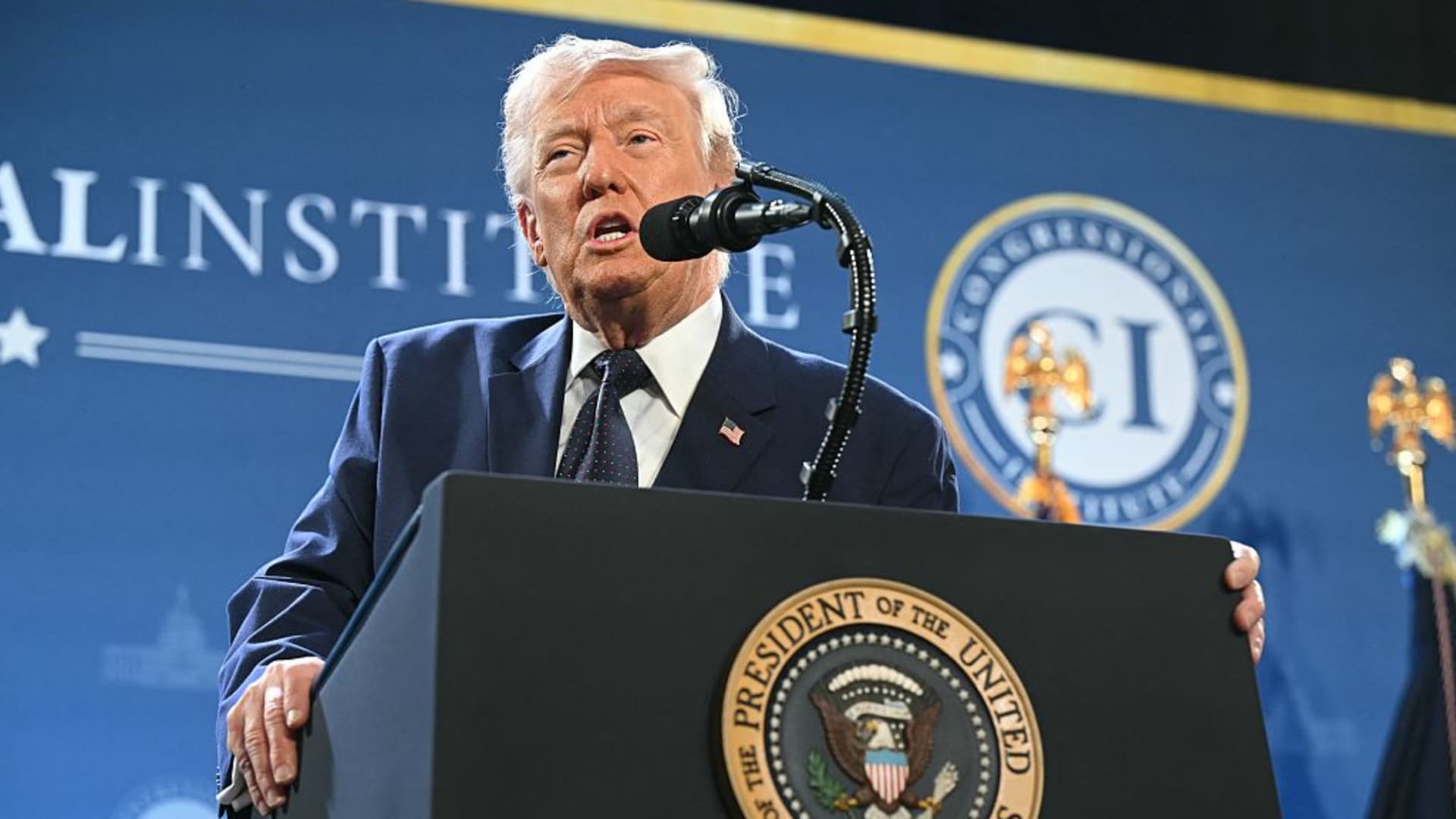

- Market Rebound: Stocks opened lower on Tuesday but quickly rebounded after President Trump's comments hinted at a potential end to the Iran conflict, with West Texas Intermediate crude falling 10.5% to around $85 per barrel, reflecting the market's sensitivity to geopolitical risks.

- Nvidia Hardware Launch Expectations: Ahead of its annual GPU Tech Conference, Nvidia shares rose 1.6%, with analysts anticipating the launch of new hardware, particularly a new chip for training AI models, which could serve as a positive catalyst for the stock.

- Corning Stock Surge: Corning's shares jumped 7.6% following AT&T's announcement of a $250 billion investment over the next five years to build high-speed networks, positioning Corning favorably due to its leadership in optical fiber and cable manufacturing.

- Investor Caution Advised: Jim Cramer cautioned investors to be aware of market volatility, particularly how presidential comments could significantly impact the market, suggesting a need for caution in the short term to navigate potential uncertainties.

- Qualcomm's Shareholder Sentiment: Qualcomm shareholders have been facing a lack of positive news recently.

- Analysts' Outlook: Analysts at BofA Securities predict that the negative sentiment surrounding Qualcomm is unlikely to improve in the near future.

- Oil Price Fluctuations: U.S. benchmark WTI crude prices have fallen below $90 a barrel, despite being up over 50% year-to-date, indicating market optimism regarding improved U.S.-Iran relations, yet geopolitical risks continue to loom over oil prices.

- Tech Stock Rating Changes: Intuit was upgraded to buy from hold by Rothschild & Co Redburn, with its stock rising over 30% since late February, although it remains down 28.5% for the year, reflecting a recovery in market confidence in its software products.

- Cybersecurity Stock Bounce: Morgan Stanley upgraded CrowdStrike from hold to buy, with its stock up over 20% from last month's low, highlighting the positive impact of AI technology on the cybersecurity sector and indicating optimistic market expectations for future growth.

- Hewlett Packard Enterprise's Positive Outlook: Despite memory cost pressures, the company raised its full-year earnings outlook, with reported quarterly revenues slightly below expectations but gross margins and adjusted EPS exceeding forecasts, demonstrating strong demand in the data center buildout.

- New Platform Launch: Qualcomm has partnered with British autonomous driving software company Wayve to introduce the Wayve AI Driver platform, aimed at providing automakers with ready-to-deploy autonomous driving solutions, enhancing market competitiveness.

- Integration Simplification: By combining the Wayve AI Driver with Qualcomm's Snapdragon Ride system-on-chips, the integration complexity is reduced, enabling automakers to implement advanced driver assistance systems (ADAS) more quickly and efficiently.

- Significant Market Potential: Qualcomm's automotive segment has generated over $1 billion in revenue in recent quarters, and this new solution is expected to become a long-term growth driver, supporting scalability from basic driver assistance to Level 4 automation.

- Strategic Diversification: This collaboration is part of Qualcomm's long-term strategy to diversify, aiming to help automakers reduce development cycles and risks while strengthening their market position in the autonomous driving sector.