Nova Ltd. stock declines amid broader market weakness

Nova Ltd. (NVMI) saw a significant decline of 5.80% as it crossed below its 5-day SMA, reflecting the overall negative sentiment in the market.

The stock's drop is attributed to broad market weakness, with the Nasdaq-100 down 0.99% and the S&P 500 down 0.58%, indicating a challenging environment for tech stocks. This sector-wide decline has led to a shift in investor sentiment, impacting stocks like Nova Ltd. negatively.

As the market opens, investors are cautious, and the downward movement in Nova Ltd.'s stock price may continue if the broader market trends persist.

Trade with 70% Backtested Accuracy

Analyst Views on NVMI

About NVMI

About the author

- Share Reduction: Harel Insurance disclosed on February 3, 2026, that it sold 4,177,000 shares of the Invesco KBW Bank ETF (KBWB), amounting to an estimated $330 million transaction, indicating a diminished confidence in this investment.

- Market Impact: The sale resulted in a $326.68 million decline in the value of its KBWB position, reflecting negative market movements and raising concerns about the future profitability of the banking sector amid changing interest rates.

- Strategic Shift: While reducing its KBWB holdings, Harel Insurance increased investments in healthcare (TEVA and XLV) and technology (GOOGL, NVMI, and SMH), suggesting a strategic pivot towards sectors expected to benefit from improving economic conditions and rising corporate spending on AI.

- ETF Performance Overview: As of February 2, 2026, KBWB was priced at $87.64, up 26.2% over the past year; however, in a declining interest rate environment, the potential for modest gains in bank ETFs like KBWB may necessitate cautious investor evaluation of future market performance.

- Share Sale Scale: Harel Insurance disclosed in its SEC filing on February 3, 2026, that it sold 4,177,000 shares of the Invesco KBW Bank ETF (KBWB), with an estimated transaction value of approximately $330 million, reflecting its sensitivity to market dynamics.

- Asset Management Changes: This transaction resulted in a decline of $326.68 million in Harel's quarter-end position value, indicating a 2.9% negative impact on its assets under management (AUM), suggesting a need for reevaluation of its investment strategy.

- Portfolio Adjustment Strategy: Following the sale of KBWB shares, Harel holds only 620 shares valued at about $52,000, indicating a potential shift towards increasing investments in healthcare and technology sectors to navigate economic uncertainties.

- Market Environment Impact: With two rate cuts by the Federal Reserve, investors are cautious about the future performance of bank ETFs like KBWB, anticipating that lower interest rates will pressure banks' net interest margins and profits, potentially leading to slower growth in ETF returns.

Market Opening: U.S. stock markets are set to open in two hours.

Nextpower Inc. Performance: Nextpower Inc. Cl A (NXT) saw a 12.4% increase in pre-market trading.

Seagate Technology Performance: Seagate Technology Holdings PLC (STX) experienced a 9.1% rise in pre-market trading.

Overall Market Sentiment: The pre-market gains indicate positive sentiment among investors ahead of the market opening.

- Conference Participation: Nova's CFO Guy Kizner will present at the 28th Annual Needham Growth Conference on January 14, 2026, where he is expected to discuss the company's future growth opportunities and strategic direction.

- Live Webcast: The event will be available via a live webcast on Nova's Investor Relations website, enhancing real-time investor access to company updates and increasing transparency and investor confidence.

- One-on-One Meetings: Management will be available for in-person meetings on January 13 and 14, aimed at strengthening investor relations and fostering potential investment opportunities.

- Industry Position: As a leading innovator in semiconductor manufacturing, Nova provides high-performance metrology solutions that help customers improve product yields and market responsiveness, further solidifying its competitive advantage in the industry.

- Earnings Release Schedule: Nova expects to release its Q4 and full-year 2025 financial results before the Nasdaq opens on February 12, 2026, highlighting the company's commitment to transparency and investor communication.

- Conference Call Details: CEO Gaby Waisman and CFO Guy Kizner will host a conference call at 8:30 a.m. Eastern Time on the same day to analyze financial performance and engage with investors, enhancing stakeholder relations.

- Replay Availability: The conference call will be available for replay from February 12 to 19, 2026, ensuring that investors who cannot attend live can access critical information, thereby strengthening investor relations.

- Global Business Context: As a leading innovator in semiconductor manufacturing, Nova's financial results will provide important insights into its performance in high-precision metrology and process control solutions, as well as its future growth potential.

- AI-Driven Demand Surge: Nova, as a supplier of semiconductor manufacturing equipment, is experiencing strong business growth driven by the AI megatrend, highlighting the company's significant position in a rapidly evolving market.

- Increased Market Recognition: The widespread application of AI technologies has led to a notable increase in demand for Nova's products, further solidifying its leadership in the semiconductor industry.

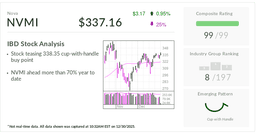

- Rising Investor Interest: Being named IBD Stock Of The Day reflects heightened investor recognition of Nova's future growth potential, which could drive stock price appreciation.

- Strategic Market Positioning: The company's robust performance in AI-related sectors indicates a strategic alignment with market trends, likely attracting more investor attention moving forward.