Critical Metals Corp's Stock Declines Despite Positive License Renewal News

Critical Metals Corp's stock fell 5.01% during regular trading, hitting a 5-day low, despite positive news regarding the renewal of its Wolfsberg mining license by the Austrian government for an additional two years. This renewal is expected to support the company's mining development plans and boost investor confidence. However, the stock's decline may be attributed to sector rotation, as the broader market, including the Nasdaq-100 and S&P 500, showed gains of 0.80% and 0.60%, respectively, indicating a shift in investor focus.

The Austrian government's decision to renew the mining license ensures that Critical Metals Corp can continue its operations without interruption, which is crucial as the company evaluates its future mining plans amid rising lithium prices. The license renewal, coupled with the significant increase in lithium carbonate prices in China, reflects a tightening supply dynamic that could facilitate project financing for the company. Nevertheless, the stock's performance suggests that investors may be reallocating their portfolios, leading to a decline in CRML shares despite the positive news.

This situation highlights the complexities of market dynamics, where positive developments for a company can be overshadowed by broader market trends. Investors will need to monitor the company's progress on its mining projects and the overall market sentiment to gauge future stock performance.

Trade with 70% Backtested Accuracy

Analyst Views on CRML

About CRML

About the author

- Rising Investment Interest: Greenland is experiencing a notable increase in mining investment interest, particularly from investors in the UK, Canada, and EU countries, indicating a growing appeal of its natural resources that could drive future capital inflows.

- Market Rebound: Critical Metals' stock surged over 6% on Monday after its worst trading session in three weeks, reflecting a recovery in market confidence regarding the company's rare earth projects in Greenland, which may attract more investor attention.

- Social Media Buzz: Retail message volume for CRML on Stocktwits jumped 186% in the last 24 hours, indicating renewed interest among retail investors, and the stock has seen a 2,378% increase in followers over the past year, showcasing market recognition of its potential.

- Policy Support: The Greenland government is easing permitting and tax regulations to attract more capital, while France has expressed willingness to take minority stakes in mining projects, further enhancing the investment climate and strengthening Critical Metals' market position.

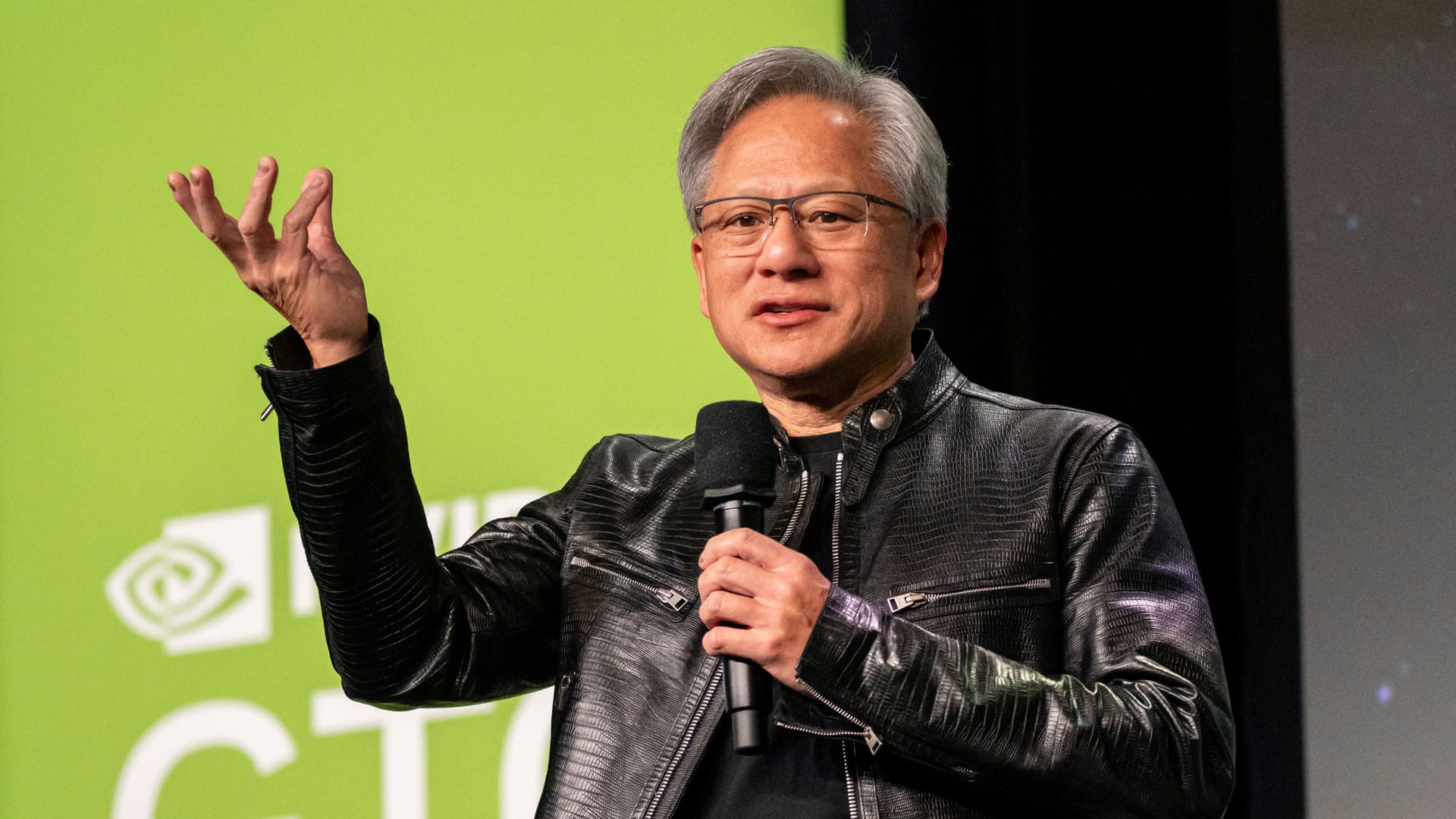

- Cautious Market Sentiment: Despite Nvidia's strong earnings report, Wall Street traders are cautious ahead of the open due to concerns over its revenue from China, with Nasdaq futures down 0.1% and Dow futures down 0.2%.

- Merger Developments in Focus: Investors are closely watching Warner Bros. Discovery's upcoming earnings report, while speculation arises that Netflix may abandon its bid for the company, with its co-CEO heading to the White House to discuss regulatory issues, highlighting the market's keen interest in merger dynamics.

- Software Giants' Guidance Miss: Salesforce's fiscal 2027 revenue guidance fell short of Wall Street expectations despite a strong Q4 earnings report, negatively impacting investor sentiment and leading to a decline in confidence in the software sector.

- Monitoring Economic Data: Investors will be attentive to the weekly jobless claims data set to be released at 8:30 a.m. ET, along with Federal Reserve Vice Chair Michelle Bowman's testimony before Congress, which could influence market perceptions of the economic outlook.

- Insider Selling Disclosure: Critical Metals revealed in an SEC F-3 filing that certain insiders plan to sell approximately 2.8 million shares, representing 2.4% of outstanding shares, and despite this typically negative news, the stock rose by 3.7% today.

- Market Reaction Analysis: Although insider selling is generally viewed as a bearish signal, the market's response indicates strong demand for the stock, possibly due to optimistic expectations regarding the company's future potential.

- Financial Impact: Since the sale involves insiders liquidating their holdings, Critical Metals will not receive any proceeds from these transactions and may incur costs related to the registration of the shares, which could exert pressure on the company's financials.

- Market Advice: Despite the short-term price increase, analysts advise caution regarding Critical Metals stock, especially in light of insider selling, which may pose greater market risks.

- Market Sentiment Shift: Retail sentiment towards the SPDR S&P 500 ETF (SPY) has flipped from 'bearish' to 'bullish' in just one day, indicating a growing confidence among investors that could lead to increased capital inflows in the near term.

- Nvidia Strategic Shift: Nvidia has exited Applied Digital and Arm Holdings while deepening its partnership with Meta by committing to millions of processors, signaling a strategic pivot towards AI and social media that may impact its market share and competitive positioning.

- Tesla Compliance Action: Tesla has avoided a 30-day sales suspension in California after taking 'corrective action' in the marketing of its Autopilot and Full Self-Driving features, which will help maintain its brand image and market position.

- Economic Data Focus: Investors are closely watching the release of housing starts at 8:30 AM ET and industrial production data at 9:15 AM, as these figures will provide crucial signals about economic health that could influence the Federal Reserve's monetary policy decisions.

- REE Exploration Results: Critical Metals Corp's 33 drill holes at the Hill Zone of the Tanbreez Heavy REE Project revealed exceptional grades, with a peak TREO of 0.94%, validating the project's status as a world-class asset and reinforcing the company's focused development strategy.

- Economic Enhancement: The assay results indicate a weighted average TREO+Y of 0.44% with a heavy rare earth oxide component of 24.1%, significantly improving project economics and paving the way for resource expansion to meet the growing global demand for heavy rare earths.

- Future Development Plans: The company plans priority infill drilling in 2026 to convert existing inferred and indicated mineral resource estimates into measured resources, thereby de-risking its resource base and enhancing negotiation capabilities with offtakers.

- Strategic Partnerships and Market Engagement: Critical Metals Corp will actively engage with strategic partners and capital markets to accelerate project development, ensuring competitiveness in sectors such as electric vehicles, defense, and advanced technologies.

- Stock Volatility: Critical Metals (CRML) has seen its stock price dip below $10 after trading above $10 for over a month, opening at $10.50 today but currently down 8.3%, reflecting market unease about its future prospects.

- Market Reaction: Despite no negative news explaining the decline, investor anxiety is heightened by President Trump's aggressive rhetoric regarding Greenland's acquisition and NATO's military actions in the region, leading to a bearish market sentiment.

- Project Valuation: The Tanbreez Rare Earth Project, currently under development by Critical Metals, was assessed in March 2025 to have a before-tax net present value between $2.7 billion and $3.4 billion, indicating significant project potential, though geopolitical tensions may undermine investor confidence.

- Investor Alternatives: With Operation Arctic Sentry set to commence, conservative investors may prefer lower-risk rare earth investment opportunities like MP Materials stock to avoid the volatility associated with Critical Metals shares.