Stock Futures Edge Up Ahead of Key Retail Sales Data

- Credo Stock Surge: Credo (CRDO) shares jumped 15% after the company raised its FQ3 revenue outlook to $404M–$408M, significantly above the previous guidance of $335M–$345M, indicating strong demand momentum, with management projecting mid-single-digit sequential revenue growth into FY2027, suggesting over 200% year-over-year growth for the current fiscal year.

- Clear Channel Acquisition Deal: Clear Channel Outdoor (CCO) shares rose 7% as the company agreed to be acquired by Mubadala Capital and TWG Global in an all-cash deal valued at $6.2B, with shareholders set to receive $2.43 per share, a 71% premium over the $1.42 closing price before speculation, and the transaction is expected to close by the end of Q3 this year.

- Upwork Stock Plunge: Upwork (UPWK) shares fell 24% after the company reported mixed Q4 results and issued weaker-than-expected near-term guidance, with Q1 revenue projected at $192M–$197M, below the $200.85M consensus, despite FY2026 revenue guidance of $835M–$850M being broadly above consensus.

- REGENXBIO Clinical Hold: REGENXBIO (RGNX) shares dropped 17% after the FDA placed a clinical hold on its gene therapies RGX-111 and RGX-121 due to a tumor detected in a patient during a Phase I/II study, with management expressing surprise at the hold and investigating whether the event is treatment-related.

Trade with 70% Backtested Accuracy

Analyst Views on ON

About ON

About the author

- Celestica Upgrade: Analyst Danil Sereda upgraded Celestica (CLS) from Hold to Buy following strong Q4 results and record hyperscaler bookings, projecting CCS segment revenue to reach $7 billion by 2027, indicating robust growth potential in the market.

- ON Semiconductor Rating Change: Tech Stock Pros upgraded ON Semiconductor (ON) from Sell to Hold, noting mixed Q4 results but signs of stabilization in automotive and industrial markets, suggesting the company is moving towards a healthier position post-inventory correction, although EV demand recovery remains critical.

- RTX Corporation Downgrade: The Value Portfolio downgraded RTX Corporation (RTX) from Buy to Sell, citing a high P/E ratio near 30x with only mid-single-digit growth projected, alongside political risks that could impact margins and future returns for defense contractors.

- Varonis Systems Downgrade: May Investing Ideas downgraded Varonis Systems (VRNS) from Buy to Hold, highlighting decelerating SaaS ARR growth and stagnant net retention rates, indicating that tangible improvements are necessary before the stock becomes attractive again.

Mixed Earnings Report: Onsemi's Q4 2025 earnings report showed mixed results, with revenue falling short of market expectations, but the company affirmed its return to growth and anticipated improvements in margins and cash flow.

Strong Cash Flow and Buybacks: The company reported a record free cash flow margin for 2025, enabling it to utilize 100% of this cash for share buybacks, which is expected to strengthen share prices.

Segment Performance: The Intelligent Sensing Group performed strongly with a 9% year-over-year growth, while other segments like Power Solutions and Analog & Mixed Signal faced challenges, leading to overall mixed performance.

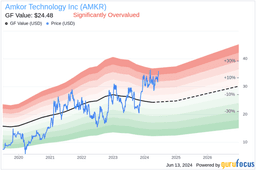

Analyst Sentiment: Analysts have mixed sentiments about Onsemi, with some price target reductions offset by upgrades, indicating a generally favorable outlook for the stock, which is considered fairly valued near its critical resistance point.

- Amentum Holdings Decline: Amentum Holdings' stock fell approximately 12% after fiscal Q1 revenue and adjusted EBITDA missed Wall Street analysts' consensus estimates, indicating market concerns over its financial performance and potential future financing capabilities.

- BP Suspends Buyback: BP Plc suspended its stock buyback program to strengthen its balance sheet, resulting in a 6% drop in its ADRs in the U.S., reflecting the company's cautious approach amid market volatility.

- ZoomInfo Downgrade: ZoomInfo Technologies forecasted first-quarter earnings per share between 25 to 27 cents, below analysts' expectations of 27 cents, leading to a 10% decline in its stock price, which may affect market confidence and investor sentiment.

- Ichor Holdings Surge: Ichor Holdings' shares soared 37% to a 52-week high due to strong demand driving a fourth-quarter earnings beat, highlighting the recovery potential in the semiconductor equipment market.

- Major Earnings Preview: After the market closes on Monday, key companies such as Prospect Capital Corporation (PSEC), ON Semiconductor Corporation (ON), PennantPark Floating Rate Capital Ltd. (PFLT), and The Goodyear Tire & Rubber Company (GT) are set to release their earnings, which could significantly impact market sentiment.

- Upwork Earnings Release: Upwork (UPWK) is another notable company reporting on Monday, and its performance will be closely watched by investors, potentially influencing its stock price and perceptions of the online labor market.

- Additional Earnings Reports: Other companies scheduled to report after Monday's close include ACGL, ACM, AMKR, BRX, CHGG, CINF, CRBG, DAC, GTM, ICHR, KRC, MEDP, MTW, NTB, PFG, PNNT, SSD, SVM, UDR, and VNO, which may trigger market volatility.

- Earnings Season Calendar: Investors can access the full earnings season calendar through Seeking Alpha to better navigate market dynamics and identify investment opportunities.

Morgan Stanley Raises Target Price: Morgan Stanley has increased its target price for a specific stock to $43.00 from $35.00.

Market Implications: This adjustment reflects a positive outlook on the stock's performance and potential growth in the market.

- Earnings Performance: On Semiconductor reported a fourth-quarter EPS of 64 cents, surpassing the Wall Street estimate of 62 cents, indicating stability in profitability despite mixed results.

- Revenue Results: The quarterly revenue of $1.53 billion fell short of the consensus estimate of $1.536 billion and decreased from $1.72 billion year-over-year, highlighting a softening market demand.

- Market Outlook: CEO Hassane El-Khoury noted signs of stabilization in key markets, with expectations for first-quarter adjusted EPS ranging from 56 to 66 cents, slightly above the analyst estimate of 61 cents, suggesting cautious optimism.

- Stock Reaction: On Semiconductor shares fell 3.5% to $62.85 in pre-market trading, reflecting a cautious market sentiment despite the earnings beat, indicating investor concerns over revenue shortfalls.